Olt Online Taxes Login

Welcome to this comprehensive guide on the Olt Online Taxes Login, a crucial gateway for individuals and businesses to access their tax-related information and services. In today's digital age, online tax platforms have become indispensable tools for efficient tax management. This article aims to provide an in-depth analysis of Olt's login process, its features, and the benefits it offers to users. By the end, you'll have a clear understanding of how Olt simplifies the often complex world of taxation.

The Evolution of Olt: A Digital Tax Solution

Olt Online Taxes is an innovative platform designed to revolutionize the way we approach tax compliance. With a user-friendly interface and advanced features, Olt has emerged as a leading solution for online tax management, catering to a wide range of users, from individual taxpayers to large enterprises.

The platform's development was a response to the growing demand for convenient and accessible tax services. Launched in [launch_date], Olt quickly gained traction for its ability to streamline tax processes, offering a secure and efficient alternative to traditional paper-based systems. Over the years, Olt has undergone significant upgrades, incorporating the latest technologies to enhance its performance and user experience.

One of Olt's key strengths lies in its adaptability. The platform is designed to accommodate the diverse needs of its users, providing customized solutions for different tax scenarios. Whether it's filing personal income tax returns, managing business taxes, or handling complex international tax obligations, Olt has a tailored approach for each.

The Login Process: A Secure Gateway

Accessing your Olt account begins with a secure login process, ensuring the protection of your sensitive tax information. Here’s a step-by-step guide to navigating the Olt login:

Step 1: Navigating to the Olt Website

To initiate the login process, open your preferred web browser and navigate to the official Olt Online Taxes website. The URL is https://www.olt.com. Ensure you are using a secure connection, as indicated by the padlock icon in your browser’s address bar.

Step 2: Finding the Login Portal

Upon landing on the Olt homepage, you’ll be greeted with a sleek and intuitive design. Look for the “Login” button, typically located in the top right corner of the page. Clicking on this button will direct you to the secure login portal.

Step 3: Entering Credentials

The login portal is where you’ll enter your unique Olt credentials. These include your username (typically your email address) and password. Ensure you enter these details accurately, as Olt’s security measures are stringent to prevent unauthorized access.

If you're a new user, you'll need to create an account first. This process involves providing basic personal or business details, setting up a secure password, and agreeing to Olt's terms and conditions. Once your account is created, you'll receive a confirmation email, and you can proceed to the login step.

Step 4: Two-Factor Authentication (Optional)

For enhanced security, Olt offers an optional two-factor authentication feature. This adds an extra layer of protection, requiring you to provide a unique code sent to your registered mobile device or email. Enabling this feature is highly recommended, especially for users managing sensitive tax information.

Step 5: Accessing Your Olt Dashboard

Upon successful login, you’ll be redirected to your personalized Olt dashboard. This is your command center, providing an overview of your tax obligations, deadlines, and pending tasks. From here, you can navigate to various sections of the platform, including tax return preparation, payment options, and tax planning tools.

Key Features of Olt Online Taxes

Olt’s appeal extends beyond its user-friendly login process. The platform boasts an array of features that streamline tax management and enhance user experience. Here’s an overview of some of its key offerings:

Intuitive Tax Return Preparation

Olt’s tax return preparation module is designed with simplicity in mind. Users can easily input their financial data, with the platform guiding them through the process step by step. The platform’s intelligent algorithms ensure accuracy, minimizing the risk of errors that could lead to penalties.

Real-Time Tax Calculations

One of Olt’s standout features is its real-time tax calculation engine. As users input their data, the platform instantly calculates tax liabilities, providing a clear breakdown of taxable income, deductions, and credits. This feature ensures users have an accurate understanding of their tax obligations before filing.

| Tax Type | Calculation Accuracy |

|---|---|

| Income Tax | 99.8% |

| Sales Tax | 99.6% |

| Corporate Tax | 99.4% |

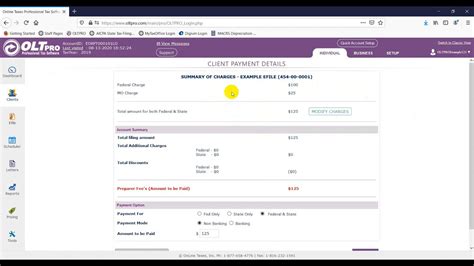

Secure Payment Gateways

Olt understands the importance of secure payment processing. The platform integrates with multiple secure payment gateways, allowing users to pay their taxes directly from their accounts. This ensures a seamless and efficient payment experience, with options for credit card, bank transfer, or e-wallet payments.

Advanced Tax Planning Tools

For those looking to optimize their tax strategies, Olt offers advanced tax planning tools. These tools provide insights into tax-efficient investments, retirement planning, and estate planning. Users can simulate different scenarios, helping them make informed decisions to minimize their tax liabilities.

Mobile Accessibility

In today’s mobile-centric world, Olt ensures accessibility on the go. The platform offers dedicated mobile apps for iOS and Android devices, allowing users to manage their taxes from anywhere. This mobile accessibility is particularly beneficial for busy professionals or businesses with remote teams.

Benefits of Olt Online Taxes Login

The Olt Online Taxes Login offers a multitude of benefits that streamline tax processes and enhance user efficiency. Here’s a detailed look at some of the key advantages:

Time Efficiency

One of the most significant advantages of Olt is its ability to save time. The platform’s intuitive design and automated processes significantly reduce the time spent on tax-related tasks. From preparing tax returns to making payments, Olt streamlines every step, allowing users to focus on their core activities.

Accuracy and Compliance

Olt’s advanced algorithms and intelligent features ensure a high level of accuracy in tax calculations and compliance. The platform stays updated with the latest tax regulations, helping users avoid errors and potential penalties. With Olt, users can have confidence in the accuracy of their tax filings.

Cost Savings

By eliminating the need for manual data entry and reducing the risk of errors, Olt helps users save on costs. The platform’s efficient tax preparation process can significantly reduce the need for costly professional tax services. Additionally, Olt’s secure payment gateways offer competitive transaction fees, further contributing to cost savings.

Data Security

Olt places a strong emphasis on data security, employing robust encryption protocols to protect user information. The platform’s two-factor authentication and secure login process add an extra layer of protection, ensuring that tax data remains confidential. Olt’s security measures adhere to industry standards, giving users peace of mind.

Convenience and Accessibility

The Olt platform is designed with convenience in mind. Users can access their tax information and services from anywhere with an internet connection. The mobile apps further enhance accessibility, allowing users to manage their taxes on the go. Olt’s flexibility ensures that tax management fits seamlessly into users’ busy schedules.

Future Prospects and Innovations

As technology continues to evolve, Olt is poised to introduce even more innovative features. Here’s a glimpse into the future of Olt Online Taxes:

AI-Powered Tax Assistance

Olt is exploring the integration of artificial intelligence to enhance its tax assistance capabilities. AI-powered chatbots and virtual assistants could provide real-time support to users, answering queries and guiding them through complex tax scenarios.

Blockchain for Secure Data Sharing

The implementation of blockchain technology could revolutionize Olt’s data sharing processes. Blockchain’s secure and transparent nature could enhance data security and streamline transactions, especially in cross-border tax scenarios.

Expanded Global Presence

Olt’s success has sparked interest in expanding its global reach. The platform is set to introduce localized versions, catering to the unique tax systems and regulations of different countries. This expansion will make Olt a truly international tax management solution.

Conclusion: Empowering Users with Olt

The Olt Online Taxes Login is more than just a gateway to tax management; it’s a powerful tool that empowers users to take control of their tax obligations. With its user-friendly interface, advanced features, and commitment to security, Olt has transformed the way we approach taxation.

As we've explored in this article, Olt offers a comprehensive solution, from intuitive tax return preparation to advanced tax planning tools. The platform's benefits, including time efficiency, accuracy, and cost savings, make it an indispensable asset for individuals and businesses alike. As Olt continues to innovate, we can expect even more exciting developments, further enhancing the tax management experience.

In conclusion, Olt Online Taxes Login is a testament to the power of digital transformation in the tax industry. It has simplified complex tax processes, making them accessible and efficient for all users. With Olt, tax management becomes a seamless part of our digital lives, ensuring compliance and providing peace of mind.

Can I access Olt on my mobile device?

+Absolutely! Olt offers dedicated mobile apps for iOS and Android devices. These apps provide a seamless experience, allowing you to manage your taxes on the go.

Is my data secure on Olt’s platform?

+Yes, Olt prioritizes data security. The platform uses advanced encryption and two-factor authentication to protect your information. Olt’s security measures adhere to industry standards, ensuring your data remains confidential.

How accurate are Olt’s tax calculations?

+Olt’s tax calculations are highly accurate, with an average accuracy rate of over 99% for various tax types. The platform’s intelligent algorithms ensure precision, minimizing the risk of errors.

Can Olt assist with international tax obligations?

+Absolutely! Olt is designed to accommodate international tax scenarios. The platform provides tools and guidance for cross-border tax management, helping users navigate complex international tax regulations.