North Dakota State Tax Commissioner

Welcome to an in-depth exploration of the role and responsibilities of the North Dakota State Tax Commissioner. This position plays a pivotal role in shaping the state's fiscal landscape and ensuring compliance with tax regulations. We'll delve into the specifics of the role, its impact on the state's economy, and the strategic initiatives being undertaken to enhance tax administration in North Dakota.

The North Dakota State Tax Commissioner: A Key Custodian of Fiscal Policy

The State Tax Commissioner is an appointed official who serves as a vital cog in North Dakota’s governmental machinery. With a term of four years, the Commissioner’s role is multifaceted, encompassing a range of critical responsibilities that significantly influence the state’s economic trajectory.

Responsibilities and Powers

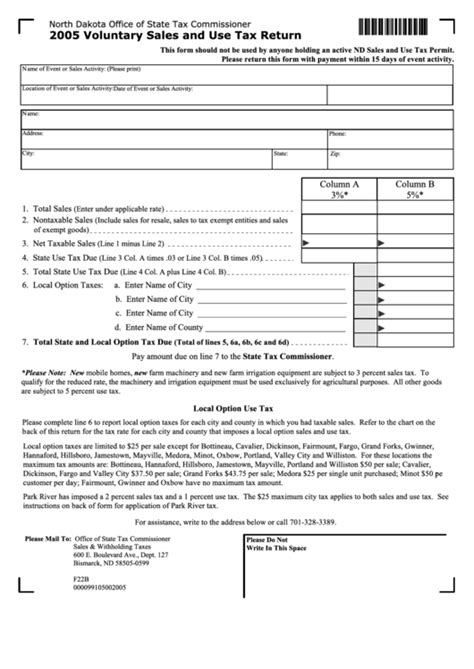

The North Dakota State Tax Commissioner wields substantial authority in matters of taxation, overseeing the collection, administration, and enforcement of various state taxes. These taxes encompass the state’s income tax, sales and use tax, property tax, and a host of other excise taxes. The Commissioner’s purview extends to the interpretation and application of these tax laws, ensuring compliance across the state.

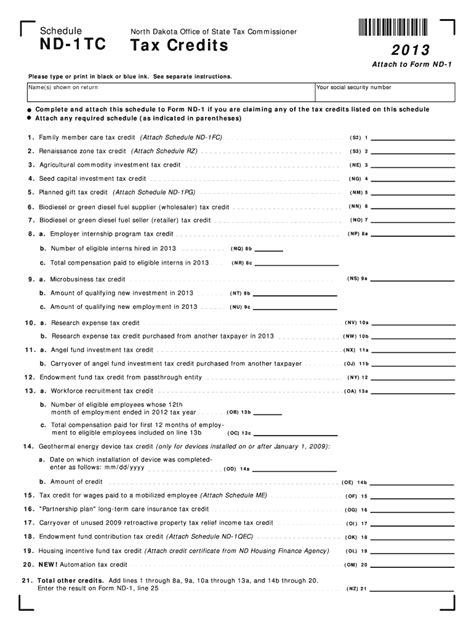

In addition to tax collection and administration, the Commissioner is charged with the crucial task of monitoring the state's tax expenditures. These expenditures, in the form of tax credits, exemptions, and deductions, play a significant role in shaping the state's economic policies and can have a profound impact on its revenue stream. The Commissioner's role in this domain involves ensuring that these expenditures are both fiscally responsible and aligned with the state's economic objectives.

Furthermore, the Commissioner is vested with the power to assess penalties and pursue legal action against entities or individuals found to be in violation of tax laws. This enforcement authority is critical in maintaining the integrity of the state's tax system and ensuring equitable compliance across all taxpayers.

| Tax Type | Key Responsibilities |

|---|---|

| Income Tax | Collection, filing assistance, and enforcement |

| Sales and Use Tax | Oversight of sales transactions, use tax collection, and registration |

| Property Tax | Assessment and administration, ensuring equitable valuation |

| Excise Taxes | Administration and collection of various excise taxes, including fuel and tobacco taxes |

Strategic Initiatives for Enhanced Tax Administration

The North Dakota State Tax Commissioner’s office is actively engaged in a series of strategic initiatives aimed at modernizing and streamlining tax administration. These initiatives are geared towards enhancing taxpayer services, improving compliance, and ensuring the efficient collection of state revenues.

One of the key areas of focus is the modernization of the state's tax systems. This involves the implementation of advanced technologies and digital platforms to facilitate online filing, payment, and record-keeping. By embracing digital transformation, the Commissioner's office aims to improve taxpayer convenience, reduce administrative burdens, and enhance the accuracy and efficiency of tax processes.

Furthermore, the Commissioner is committed to enhancing taxpayer education and outreach. This involves proactive communication and engagement with taxpayers, businesses, and community organizations to ensure a better understanding of tax obligations and incentives. By fostering a culture of tax literacy, the Commissioner's office aims to promote voluntary compliance and reduce instances of non-compliance.

The office is also dedicated to continuous improvement in tax enforcement. This includes the implementation of data analytics and advanced audit techniques to identify potential instances of tax evasion or fraud. By leveraging technology and expertise, the Commissioner's team aims to strengthen tax enforcement, ensuring a level playing field for all taxpayers and protecting the state's revenue stream.

Impact on the State’s Economy and Fiscal Policy

The role of the North Dakota State Tax Commissioner is of paramount importance in shaping the state’s economic landscape and fiscal policy. The Commissioner’s decisions and policies have a direct impact on the state’s revenue stream, influencing its ability to fund critical public services and infrastructure projects.

By effectively administering and enforcing tax laws, the Commissioner ensures a steady flow of revenue into the state's coffers. This revenue is vital for supporting essential services such as education, healthcare, and public safety, as well as for funding infrastructure development and economic initiatives. A well-managed tax system not only ensures the state's fiscal health but also contributes to its overall economic growth and prosperity.

Moreover, the Commissioner's role in tax policy extends beyond revenue collection. The office's strategic initiatives and policy recommendations play a pivotal role in shaping the state's fiscal policy. By analyzing economic trends, evaluating the impact of tax measures, and proposing evidence-based policies, the Commissioner's office provides valuable insights that inform the state's economic planning and decision-making.

A Look at the Current State Tax Commissioner

The current North Dakota State Tax Commissioner is Ian Duncan, who assumed office in 2021. Commissioner Duncan brings a wealth of experience and expertise to the role, having served in various tax-related capacities within the state government. His appointment reflects the importance and complexity of the Commissioner’s role in North Dakota’s governance.

During his tenure, Commissioner Duncan has focused on several key initiatives. These include the implementation of a new online tax filing system, aimed at improving efficiency and convenience for taxpayers. Additionally, he has prioritized outreach and education programs, particularly for small businesses, to ensure a better understanding of tax obligations and available resources.

Moreover, Commissioner Duncan has emphasized the importance of data-driven decision-making in tax administration. His office has invested in advanced analytics and data management systems to enhance tax enforcement and improve the accuracy of tax assessments. This approach not only strengthens compliance but also ensures a fair and equitable tax system for all North Dakotans.

Conclusion: A Commitment to Fiscal Responsibility and Economic Growth

The North Dakota State Tax Commissioner’s office plays a critical role in maintaining the state’s fiscal health and promoting economic growth. Through effective tax administration, strategic initiatives, and evidence-based policy recommendations, the Commissioner ensures that North Dakota’s tax system remains robust, efficient, and equitable.

As the state continues to evolve and adapt to changing economic landscapes, the Commissioner's office remains committed to its core mission: ensuring that North Dakota's tax system remains a vital tool for economic development, while simultaneously upholding the principles of fairness and compliance. With a focus on modernization, education, and enforcement, the Commissioner's office is poised to navigate the complexities of tax administration and contribute to the state's continued prosperity.

What is the role of the North Dakota State Tax Commissioner?

+The State Tax Commissioner is responsible for the collection, administration, and enforcement of state taxes, including income tax, sales and use tax, property tax, and various excise taxes. They also oversee tax expenditures and ensure compliance with tax laws.

How long is the term of the North Dakota State Tax Commissioner?

+The State Tax Commissioner serves a four-year term.

What are some strategic initiatives undertaken by the Commissioner’s office?

+The Commissioner’s office is focused on modernizing tax systems, enhancing taxpayer education and outreach, and improving tax enforcement through data analytics and advanced audit techniques.

How does the State Tax Commissioner impact the state’s economy and fiscal policy?

+The Commissioner’s effective tax administration ensures a steady revenue stream for the state, supporting essential services and infrastructure projects. Additionally, their strategic initiatives and policy recommendations shape the state’s fiscal policy, contributing to economic growth and development.

Who is the current North Dakota State Tax Commissioner?

+The current State Tax Commissioner is Ian Duncan, who took office in 2021.