Capital Gain Tax For California

Capital Gain Tax, a crucial aspect of financial planning and investment strategies, is a topic that warrants in-depth exploration, especially within the context of California's unique tax landscape. This comprehensive guide aims to unravel the intricacies of Capital Gain Tax in California, providing an expert analysis that will benefit investors, financial advisors, and individuals seeking a thorough understanding of this complex tax domain.

Understanding Capital Gain Tax in California

Capital Gain Tax refers to the levy imposed on the profits made from selling assets or investments that have increased in value over time. In California, this tax plays a significant role in shaping investment decisions and financial planning, given the state’s diverse tax system and its impact on long-term wealth accumulation.

The Basics of Capital Gain Tax

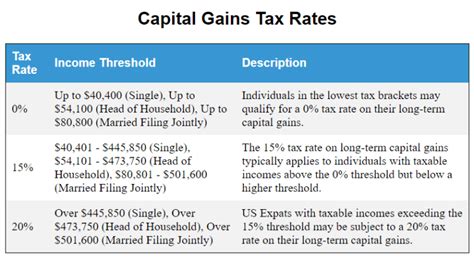

Capital gains can be classified into two primary categories: short-term and long-term. Short-term capital gains arise from the sale of assets held for a year or less, while long-term capital gains pertain to assets held for more than a year. The tax implications differ based on this classification, with long-term gains typically benefiting from more favorable tax rates.

The tax rate applicable to capital gains depends on the taxpayer's income bracket and the type of asset sold. For instance, gains from the sale of collectibles or precious metals are subject to a different tax rate than those from the sale of stocks or real estate.

| Asset Type | Tax Rate |

|---|---|

| Stocks and Mutual Funds | 0%, 15%, or 20% based on income |

| Real Estate | 15% to 28% |

| Collectibles and Precious Metals | 28% or 28% + 3.8% Net Investment Income Tax |

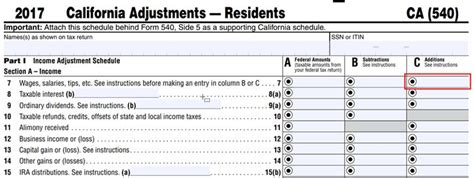

California’s Unique Tax Structure

California’s tax system operates on a progressive scale, meaning tax rates increase as income rises. The state imposes both income tax and capital gain tax on residents, with the latter playing a significant role in overall tax obligations. Understanding this progressive tax structure is essential for effective financial planning and tax optimization.

The California Franchise Tax Board (FTB) is responsible for administering and collecting capital gain taxes. The FTB's website provides detailed guidelines and resources for taxpayers, including information on filing requirements, tax rates, and payment options.

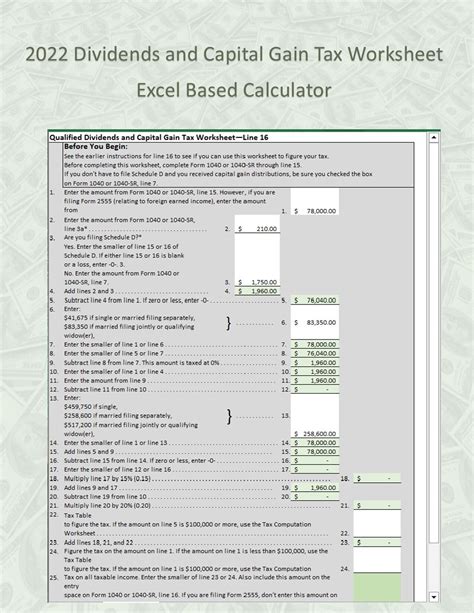

Calculating Capital Gain Tax in California

Calculating capital gain tax involves a series of steps, each crucial in determining the accurate tax liability. This section will provide a comprehensive guide to calculating capital gain tax, complete with real-world examples to illustrate the process.

Step 1: Determine the Asset Type

The first step in calculating capital gain tax is to identify the type of asset sold. As mentioned earlier, different asset types are subject to different tax rates. For instance, selling stocks or mutual funds typically results in a lower tax rate compared to selling collectibles or precious metals.

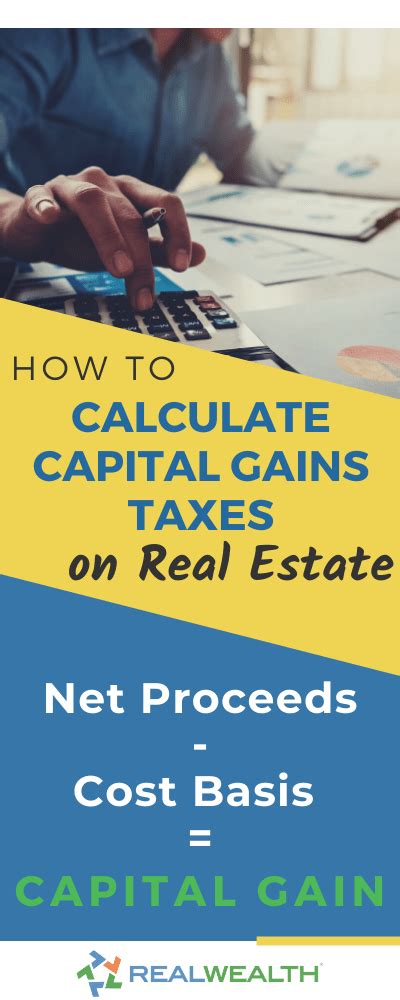

Step 2: Calculate the Capital Gain

The capital gain is the difference between the selling price and the purchase price of the asset. It is important to account for any additional costs associated with the purchase or sale, such as brokerage fees or transaction costs.

Example: Let's say you purchased 100 shares of a stock at $50 per share and sold them for $70 per share. The capital gain would be calculated as follows:

Capital Gain = (Selling Price - Purchase Price) * Number of Shares

Capital Gain = ($70 - $50) * 100 shares = $2,000

Step 3: Determine the Holding Period

The holding period refers to the duration for which the asset was held before its sale. As mentioned earlier, capital gains are classified as short-term (held for a year or less) or long-term (held for more than a year). The holding period determines the applicable tax rate.

Step 4: Apply the Tax Rate

Once the capital gain and holding period are determined, the appropriate tax rate can be applied. As mentioned earlier, the tax rate depends on the taxpayer’s income bracket and the type of asset sold. The following table provides an overview of the tax rates for different asset types:

| Asset Type | Tax Rate |

|---|---|

| Stocks and Mutual Funds | 0%, 15%, or 20% based on income |

| Real Estate | 15% to 28% |

| Collectibles and Precious Metals | 28% or 28% + 3.8% Net Investment Income Tax |

Step 5: Calculate the Tax Liability

After determining the applicable tax rate, the tax liability can be calculated by multiplying the capital gain by the tax rate. This amount represents the tax owed to the state of California on the capital gain.

Example: If the capital gain from the stock sale in the previous example is $2,000, and the applicable tax rate is 15%, the tax liability would be calculated as follows:

Tax Liability = Capital Gain * Tax Rate

Tax Liability = $2,000 * 0.15 = $300

Step 6: Adjust for Other Income and Deductions

The tax liability calculated in Step 5 is not the final amount owed. It is important to consider other sources of income and potential deductions that may impact the overall tax obligation. Consulting with a tax professional or using tax software can help individuals navigate these complexities and ensure accurate tax calculations.

Strategies for Minimizing Capital Gain Tax

Minimizing capital gain tax is a strategic approach that can significantly impact an individual’s financial health and long-term wealth accumulation. This section explores effective strategies for reducing capital gain tax obligations, backed by real-world examples and expert insights.

Long-Term Holding Period

Holding assets for a longer period, ideally more than a year, can lead to more favorable tax rates. Long-term capital gains are taxed at a lower rate than short-term gains, making this strategy an effective way to reduce tax obligations. However, it is important to consider the opportunity cost and potential risks associated with long-term holdings.

Tax-Loss Harvesting

Tax-loss harvesting is a strategy where investors sell assets at a loss to offset capital gains. By realizing losses on certain investments, individuals can reduce their overall tax liability. This strategy is particularly effective when combined with a long-term investment strategy, allowing investors to balance their portfolios while minimizing tax obligations.

Retirement Accounts and Tax-Advantaged Plans

Contributing to retirement accounts, such as 401(k)s or IRAs, can provide significant tax advantages. These accounts offer tax-deferred or tax-free growth, allowing individuals to accumulate wealth while deferring tax obligations until retirement. Additionally, certain retirement plans, like Roth IRAs, offer tax-free withdrawals, further reducing tax burdens.

Strategic Asset Allocation

Allocating assets strategically can help minimize capital gain tax obligations. For instance, holding a mix of short-term and long-term assets can provide flexibility in tax planning. Additionally, investing in assets that offer tax-efficient growth, such as index funds or real estate investment trusts (REITs), can reduce the impact of capital gain taxes.

Utilizing Tax Credits and Deductions

Taking advantage of tax credits and deductions can further reduce capital gain tax obligations. For example, individuals who qualify for the California Earned Income Tax Credit (CalEITC) can receive a refund or a reduction in their tax liability. Other deductions, such as the mortgage interest deduction or charitable contribution deductions, can also lower taxable income and, consequently, capital gain tax obligations.

The Impact of Capital Gain Tax on Investment Decisions

Capital Gain Tax is a significant factor influencing investment decisions, particularly for long-term investors and those seeking tax-efficient strategies. This section explores the impact of capital gain tax on investment choices, highlighting real-world scenarios and expert insights.

Short-Term vs. Long-Term Investments

The tax implications of short-term and long-term investments differ significantly. Short-term investments, held for a year or less, are subject to higher tax rates, while long-term investments, held for more than a year, benefit from more favorable tax rates. This distinction influences investors’ decisions on holding periods and asset allocation.

For instance, an investor considering the sale of a stock may opt to hold the asset for an additional year to qualify for long-term capital gain tax rates, especially if the asset has significant appreciation potential. This decision is influenced by the investor's tax bracket and the potential tax savings.

Tax-Efficient Investment Strategies

Investors often seek tax-efficient strategies to optimize their investment portfolios. This involves a careful consideration of asset types, holding periods, and tax regulations. For example, investing in tax-efficient funds, such as index funds or ETFs, can reduce the impact of capital gain taxes by minimizing turnover and capital gains distributions.

Real Estate Investments

Real estate investments present unique tax considerations. The sale of real estate properties is subject to capital gain tax, with rates varying based on the holding period and the type of property. Investors often engage in strategies such as 1031 exchanges, which allow them to defer capital gain taxes by reinvesting the proceeds into a similar property.

Tax Planning and Financial Goals

Effective tax planning is integral to achieving financial goals. Investors must consider their tax obligations alongside their investment objectives. For instance, an investor aiming for long-term wealth accumulation may prioritize tax-efficient investments and long-term holding periods to minimize tax burdens and maximize returns.

Tax-Advantaged Retirement Accounts

Retirement accounts, such as 401(k)s and IRAs, offer significant tax advantages. These accounts provide tax-deferred or tax-free growth, allowing investors to accumulate wealth while deferring tax obligations until retirement. Additionally, certain retirement plans, like Roth IRAs, offer tax-free withdrawals, further enhancing tax-efficient retirement planning.

Future Implications and Potential Changes

The landscape of Capital Gain Tax is dynamic, influenced by economic trends, policy changes, and technological advancements. This section explores the potential future implications and changes in Capital Gain Tax, providing a forward-looking perspective for investors and financial planners.

Economic Factors and Market Volatility

Economic conditions and market volatility can significantly impact capital gain tax obligations. During periods of economic growth and rising asset values, capital gains may increase, leading to higher tax obligations. Conversely, economic downturns or market corrections can result in lower capital gains or even losses, impacting tax liabilities.

Policy Changes and Tax Reform

Policy changes and tax reforms can bring about significant shifts in capital gain tax regulations. For instance, changes in tax rates, deductions, or the treatment of certain asset types can impact investors’ tax obligations and investment strategies. Staying informed about potential policy changes is crucial for effective tax planning.

Technological Advancements and Tax Software

Technological advancements have revolutionized tax planning and compliance. Tax software and online tools offer efficient and accurate tax calculations, helping individuals and businesses navigate complex tax regulations. These tools can streamline the process of calculating capital gain tax and ensure compliance with changing tax laws.

Global Tax Considerations

In an increasingly globalized economy, international tax considerations become crucial. Investors with global assets or cross-border transactions must navigate complex tax regulations, including the potential for double taxation. Understanding international tax treaties and seeking expert advice can help individuals optimize their tax obligations across borders.

Sustainable Investing and Impact Investing

The rise of sustainable and impact investing has brought about new considerations in tax planning. These investment strategies, focused on environmental, social, and governance (ESG) factors, may impact tax obligations and require specialized tax planning. As sustainable investing gains traction, understanding the tax implications becomes increasingly important.

What is the difference between short-term and long-term capital gains in California?

+

Short-term capital gains refer to profits made from selling assets held for a year or less, while long-term capital gains pertain to assets held for more than a year. The tax rates for short-term gains are typically higher, while long-term gains benefit from more favorable tax rates.

How can I calculate my capital gain tax liability in California?

+

To calculate your capital gain tax liability, you need to determine the asset type, calculate the capital gain, determine the holding period, apply the appropriate tax rate, and then adjust for other income and deductions. Online tax calculators or consulting with a tax professional can assist in this process.

What are some strategies to minimize capital gain tax in California?

+

Strategies to minimize capital gain tax include holding assets for a long-term period, engaging in tax-loss harvesting, utilizing tax-advantaged retirement accounts, strategic asset allocation, and taking advantage of tax credits and deductions.

How does capital gain tax impact investment decisions in California?

+

Capital gain tax influences investment decisions by shaping investors’ choices between short-term and long-term investments, guiding tax-efficient investment strategies, and impacting the tax obligations associated with real estate investments. It also influences tax planning and financial goal achievement.

What are some potential future changes to capital gain tax in California?

+

Potential future changes to capital gain tax in California could include economic factors impacting capital gains, policy changes or tax reforms, advancements in tax software and compliance, global tax considerations, and the rise of sustainable and impact investing with its unique tax implications.