Sales Tax For Cars In Ma

Sales tax is an essential aspect of vehicle purchases, and it is crucial to understand how it applies to car sales in the state of Massachusetts. The sales tax regulations in MA can impact the overall cost of a car, and being well-informed can help buyers make more financially savvy decisions. This comprehensive guide will delve into the specifics of sales tax for cars in MA, providing valuable insights for prospective car buyers in the state.

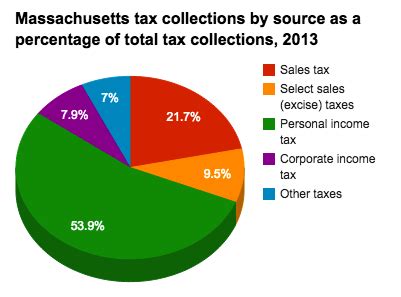

Understanding Sales Tax in Massachusetts

Massachusetts, like many other states, imposes a sales tax on various goods and services, including the purchase of motor vehicles. The sales tax rate in MA is relatively straightforward, but it’s essential to understand the nuances, especially when dealing with high-value items like cars.

The Basics of Sales Tax in MA

The state of Massachusetts has a flat sales tax rate of 6.25%, which is applied to most retail sales, including the purchase of vehicles. This rate is applicable across the state, making it consistent regardless of the county or city where the purchase is made.

However, it's important to note that local jurisdictions in MA may impose additional sales taxes, often referred to as local option taxes. These additional taxes can vary depending on the location, adding to the overall sales tax burden for car buyers.

How Sales Tax Applies to Car Purchases

When buying a car in Massachusetts, the sales tax is calculated based on the purchase price of the vehicle. This includes the base price of the car, any additional fees or charges, and the cost of any optional equipment or accessories.

For instance, if you purchase a car with a base price of $30,000 and add $2,000 worth of optional features, the sales tax will be calculated on the total amount of $32,000. This means you'll pay a sales tax of $2,000 (6.25% of $32,000) on top of the purchase price.

It's worth mentioning that Massachusetts also levies a title fee, which is a separate charge associated with registering your vehicle. This fee is $60 for most vehicles and is paid to the Massachusetts Registry of Motor Vehicles (RMV) at the time of registration.

| Component | Amount |

|---|---|

| Base Price | $30,000 |

| Optional Features | $2,000 |

| Sales Tax (6.25%) | $2,000 |

| Title Fee | $60 |

| Total Cost | $34,060 |

Sales Tax Exemptions and Special Considerations

While the general sales tax rate in Massachusetts applies to most car purchases, there are certain situations where buyers may be eligible for exemptions or reduced rates.

Tax Exemptions for Specific Vehicles

Massachusetts offers sales tax exemptions for the purchase of certain types of vehicles. These include:

- Hybrid and Electric Vehicles: Buyers of new hybrid and electric vehicles may be eligible for a sales tax exemption up to a certain purchase price threshold. This exemption is designed to encourage the adoption of environmentally friendly vehicles.

- Disabled Persons’ Vehicles: Vehicles that are specially equipped for persons with disabilities are eligible for a reduced sales tax rate of 3%. This applies to vehicles that have been modified to accommodate the needs of the disabled individual.

- Commercial Vehicles: Some commercial vehicles, such as heavy-duty trucks and certain types of trailers, may be subject to a lower sales tax rate or a use tax instead of sales tax.

Tax Considerations for Out-of-State Purchases

If you purchase a car out of state and bring it into Massachusetts, you may be subject to a use tax instead of sales tax. This is to ensure that all vehicle purchases are taxed, regardless of where they are made.

The use tax is calculated in a similar manner to sales tax, with a rate of 6.25% applied to the purchase price of the vehicle. However, you may be able to provide proof of tax paid in the state of purchase, which could reduce or eliminate the use tax liability in MA.

Sales Tax and Trade-Ins

When trading in your old vehicle as part of a new car purchase, the sales tax implications can be a bit more complex. The trade-in value of your old car is typically deducted from the purchase price of the new vehicle, but the sales tax calculation can vary depending on the dealership’s practices.

In some cases, the dealership may apply the sales tax to the difference between the trade-in value and the purchase price of the new car. For example, if your trade-in is valued at $10,000 and you're buying a new car for $30,000, the sales tax would be calculated on the $20,000 difference.

However, it's important to clarify the sales tax treatment with the dealership beforehand to ensure there are no surprises when it comes to the final cost.

Preparing for the Sales Tax Payment

Understanding the sales tax implications is just one aspect of the car-buying process. Here are some additional tips to help you prepare for the sales tax payment:

- Budgeting: Ensure you have allocated enough funds in your budget to cover the sales tax, especially for higher-priced vehicles. Unexpected tax costs can strain your finances.

- Negotiation: While the sales tax rate is set by the state, there may be room for negotiation on the overall price of the vehicle. This can indirectly impact the sales tax amount.

- Financing: Consider financing options that may offer more flexibility in managing the sales tax payment. Some dealerships offer financing plans that can help spread out the tax cost.

- Research: Before finalizing your purchase, research the sales tax rate in your specific location. Local option taxes can vary, so being informed can help you budget accurately.

Stay Informed, Save Money

Understanding the sales tax landscape in Massachusetts is a crucial step in making an informed car purchase. By knowing the applicable rates, exemptions, and considerations, you can navigate the process more effectively and potentially save money on your next vehicle acquisition.

Are there any online resources to estimate sales tax for car purchases in MA?

+Yes, there are several online tools and calculators available that can help estimate the sales tax for a car purchase in Massachusetts. These tools typically require you to input the purchase price and any applicable exemptions or deductions. Keep in mind that while these calculators can provide a good estimate, it’s always best to consult official sources or a tax professional for precise information.

Can I negotiate the sales tax with the dealership?

+The sales tax rate in Massachusetts is set by the state and is non-negotiable. However, you can negotiate the overall price of the vehicle, which indirectly affects the sales tax amount. By negotiating a lower purchase price, you can potentially reduce the sales tax liability.

Are there any ways to reduce the sales tax burden when buying a car in MA?

+Yes, there are a few strategies to reduce the sales tax burden. One approach is to consider buying a vehicle that qualifies for sales tax exemptions or reduced rates, such as hybrid or electric vehicles, or vehicles for persons with disabilities. Additionally, you can explore financing options that may offer flexible payment plans, helping you manage the tax cost more effectively.

What happens if I buy a car out of state and bring it to MA without paying sales tax there?

+If you purchase a car out of state and bring it into Massachusetts without paying sales tax in the original state, you may be subject to a use tax in MA. The use tax is calculated similarly to sales tax and is intended to ensure that all vehicle purchases are taxed. However, you may be able to provide proof of tax paid in the original state to reduce or eliminate the use tax liability in MA.