Estimated Tax Payments California

In the vast landscape of financial obligations, estimated tax payments often emerge as a crucial yet often overlooked aspect of financial planning, particularly for individuals and businesses operating within the dynamic economy of California. These payments, serving as a means to fulfill tax liabilities throughout the year, are a vital component of the state's revenue system, ensuring a steady cash flow for various public services and initiatives.

The concept of estimated tax payments is especially relevant for those whose income is not subject to regular withholding, such as independent contractors, freelancers, and small business owners. For these individuals, understanding and managing estimated tax payments is essential to avoid penalties and ensure compliance with the California Franchise Tax Board (FTB). In this comprehensive guide, we will delve into the intricacies of estimated tax payments in California, exploring the who, what, when, and how of this critical financial obligation.

Understanding Estimated Tax Payments in California

Estimated tax payments in California are quarterly payments made by individuals and businesses to cover their expected state income tax liability for the current year. These payments are required when an individual's total expected tax for the year, including federal and state income taxes, exceeds $1,000 after applicable withholding and credits.

The California FTB mandates these payments to ensure a consistent stream of revenue throughout the year, rather than relying solely on annual tax returns. By spreading the tax burden over multiple payments, the state can better plan and allocate its resources, ensuring the smooth operation of essential public services.

For individuals and businesses, estimated tax payments offer a sense of financial control and planning. By making these payments throughout the year, taxpayers can avoid the burden of a large tax bill at the end of the year and reduce the risk of penalties for underpayment.

Who Needs to Make Estimated Tax Payments in California

Estimated tax payments are a requirement for certain individuals and entities in California. The following groups are generally obligated to make these payments:

- Self-Employed Individuals: Freelancers, independent contractors, and sole proprietors who earn income from their business activities fall into this category. As they are not subject to traditional payroll withholding, they must make estimated tax payments to cover their income tax liability.

- Business Owners: Owners of partnerships, LLCs, S corporations, and C corporations must make estimated tax payments on behalf of the business. This includes both federal and state income taxes, as well as any applicable payroll taxes.

- High-Income Employees: Employees whose income exceeds certain thresholds may also be required to make estimated tax payments. This is particularly relevant for those with significant investment income, bonuses, or other sources of income beyond their regular salary.

- Trusts and Estates: Trusts and estates that generate income must also make estimated tax payments. This includes income from investments, real estate, and other assets held by the trust or estate.

Key Considerations for Estimated Tax Payments

When navigating the world of estimated tax payments, there are several key considerations to keep in mind:

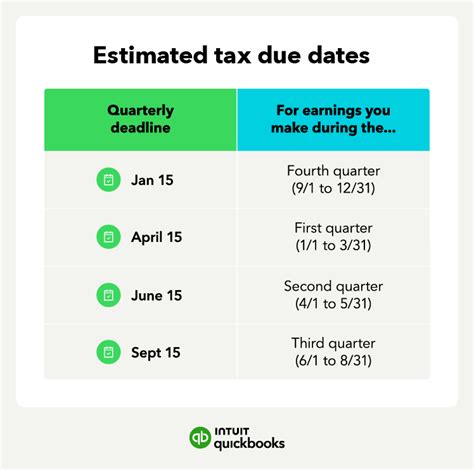

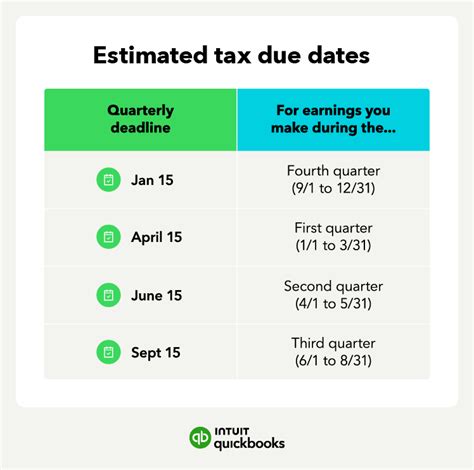

- Payment Due Dates: Estimated tax payments in California are due on specific dates throughout the year. The payment deadlines are typically: April 15th, June 15th, September 15th, and January 15th of the following year. Missing these deadlines can result in penalties and interest charges.

- Safe Harbor Rules: To avoid penalties for underpayment, taxpayers must either pay at least 90% of their current year's tax liability or 100% of their previous year's tax liability (adjusted for any tax law changes) through withholding and estimated tax payments. Understanding these safe harbor rules is crucial for proper tax planning.

- Payment Methods: The California FTB offers various methods for making estimated tax payments, including electronic funds transfer (EFT), credit card, and paper checks. Each method has its own advantages and considerations, and taxpayers should choose the one that best suits their needs and preferences.

- Filing Requirements: In addition to making payments, taxpayers must also file estimated tax vouchers with the FTB. These vouchers provide the FTB with essential information about the taxpayer's estimated income and tax liability. Failure to file these vouchers can result in penalties.

Calculating Estimated Tax Payments

Calculating estimated tax payments accurately is a critical aspect of financial planning. The process involves several steps and considerations to ensure that taxpayers are paying the correct amount and avoiding any potential penalties.

Estimating Income and Tax Liability

The first step in calculating estimated tax payments is to estimate your income for the current year. This includes all sources of income, such as business income, investment income, rental income, and any other taxable income. It's important to be as accurate as possible in this estimation, as underestimating income can lead to penalties for underpayment.

Once you have a good estimate of your income, the next step is to calculate your expected tax liability. This involves considering not only your state income tax but also any applicable federal income taxes, as well as any other state or local taxes that may be applicable. It's crucial to factor in any deductions, credits, and adjustments that may reduce your taxable income and, consequently, your tax liability.

Applying the Safe Harbor Rules

As mentioned earlier, the safe harbor rules play a critical role in determining the minimum amount of estimated tax payments you need to make to avoid penalties. These rules provide a threshold for taxpayers to ensure they are paying enough throughout the year.

There are two primary safe harbor options: paying 90% of your current year's tax liability or 100% of your previous year's tax liability. Taxpayers must choose the option that results in the higher estimated tax payments. This ensures that they are not underpaying and incurring penalties.

Quarterly Payment Calculation

Once you have estimated your income, tax liability, and applied the safe harbor rules, it's time to calculate the quarterly estimated tax payments. The FTB provides a Form 5805 for this purpose, which guides taxpayers through the calculation process.

The basic formula for calculating estimated tax payments is as follows:

| Estimated Tax Payment | = | Expected Tax Liability | x | Quarterly Percentage |

|---|---|---|---|---|

| For the current quarter | For the current year | 25% for the first three quarters, 50% for the fourth quarter |

This calculation ensures that taxpayers pay approximately 25% of their estimated tax liability in each of the first three quarters and 50% in the fourth quarter. By spreading the payments evenly, taxpayers can better manage their cash flow and avoid the burden of a large payment at the end of the year.

Making Estimated Tax Payments

Once you have calculated your estimated tax payments, it's time to make the actual payments to the California FTB. The FTB offers several convenient methods for making these payments, each with its own advantages and considerations.

Electronic Funds Transfer (EFT)

Electronic Funds Transfer (EFT) is a popular and efficient method for making estimated tax payments. With EFT, taxpayers can authorize the FTB to withdraw the payment directly from their bank account on the due date. This method is secure, convenient, and ensures timely payment, reducing the risk of penalties.

To use EFT, taxpayers must first register with the FTB's EFT program and provide their banking information. Once registered, they can make payments through the FTB's online system or by using the EFT-322 form. The FTB provides detailed instructions and guidelines for using EFT, ensuring a smooth and secure payment process.

Credit Card Payments

Another convenient option for making estimated tax payments is by using a credit card. The FTB has partnered with official payment processors that accept credit card payments for state taxes. This method offers the flexibility of paying with a credit card, allowing taxpayers to earn rewards or take advantage of credit card benefits.

However, it's important to note that credit card payments typically incur a convenience fee, which is a percentage of the payment amount. The fee is charged by the payment processor and is in addition to the tax payment. Taxpayers should carefully consider the convenience fee and weigh the benefits of using a credit card against the added cost.

Paper Check Payments

For those who prefer a more traditional method, paper check payments are also an option. Taxpayers can simply write a check payable to the "California Franchise Tax Board" and include the appropriate payment voucher with the check. The payment voucher provides essential information to the FTB, ensuring the payment is correctly applied to the taxpayer's account.

When sending a paper check, it's crucial to allow sufficient time for the check to reach the FTB by the due date. To ensure timely payment, taxpayers should mail their checks well in advance of the deadline. The FTB provides specific mailing addresses for different types of payments, so taxpayers should use the correct address to avoid processing delays.

Filing Estimated Tax Vouchers

In addition to making estimated tax payments, taxpayers must also file estimated tax vouchers with the FTB. These vouchers serve as a record of the taxpayer's estimated income, tax liability, and payments made for the year. They provide the FTB with important information for processing and auditing purposes.

Voucher Filing Requirements

Taxpayers are required to file estimated tax vouchers for each quarter in which they make payments. The vouchers must be filed even if the taxpayer has not made a payment for that quarter. This is because the vouchers provide important information about the taxpayer's estimated income and tax liability, which can be used to calculate any potential penalties for underpayment.

The FTB provides specific voucher forms for different types of taxpayers, such as individuals, businesses, and fiduciaries. Taxpayers should use the appropriate form for their situation and ensure that all required information is accurately reported.

Form 540-ES for Individuals

For individuals, the primary estimated tax voucher form is the Form 540-ES. This form guides taxpayers through the process of estimating their income, calculating their tax liability, and determining the amount of estimated tax payments they need to make. It also includes spaces for reporting actual payments made during the year.

The Form 540-ES is typically filed along with the taxpayer's annual state income tax return. However, if there are significant changes in income or tax liability during the year, taxpayers may need to file an updated Form 540-ES to reflect these changes and adjust their estimated tax payments accordingly.

Other Voucher Forms

In addition to the Form 540-ES, there are other voucher forms for specific types of taxpayers. For example, businesses use the Form 5805 to report their estimated tax payments and calculate their estimated tax liability. Fiduciaries, such as trustees and executors, use the Form 541-ES for the same purpose.

It's crucial for taxpayers to use the correct voucher form and provide accurate information. Incorrect or incomplete vouchers can lead to delays in processing, additional inquiries from the FTB, and potential penalties.

Penalties and Interest

While estimated tax payments are a critical part of financial planning, it's important to understand the potential consequences of not making these payments accurately or on time. The California FTB imposes penalties and interest charges for underpayment or late payment of estimated taxes, which can significantly increase a taxpayer's overall tax liability.

Underpayment Penalties

Underpayment penalties are assessed when a taxpayer does not pay enough estimated tax throughout the year. The FTB requires taxpayers to either pay 90% of their current year's tax liability or 100% of their previous year's tax liability through withholding and estimated tax payments. Failure to meet either of these thresholds can result in an underpayment penalty.

The underpayment penalty is calculated as a percentage of the amount of tax underpaid. The FTB uses a complex formula that takes into account the taxpayer's income, tax liability, and the timing of payments. In general, the penalty is higher for larger underpayments and when payments are made later in the year.

Late Payment Penalties

In addition to underpayment penalties, taxpayers may also incur late payment penalties if they fail to make their estimated tax payments on time. Late payment penalties are assessed on the amount of tax due for each quarter, with the penalty rate varying depending on the timing of the late payment.

For example, if a taxpayer misses the April 15th deadline for the first quarter payment, they may be subject to a penalty of 5% of the unpaid tax for that quarter. If the payment is made after the June 15th deadline, the penalty may increase to 10%. Late payments made after the September 15th deadline may result in a higher penalty, and payments made after the final deadline of January 15th of the following year may incur the highest penalty rate.

Interest Charges

Along with penalties, taxpayers may also be subject to interest charges on any unpaid tax balances. The FTB imposes interest on the unpaid tax amount from the original due date of the payment until the date the tax is paid in full. The interest rate is adjusted periodically and is typically based on the federal short-term interest rate.

Interest charges can quickly add up, especially for larger tax liabilities or when payments are significantly delayed. It's important for taxpayers to prioritize making their estimated tax payments on time to avoid these additional costs.

Common Questions and Scenarios

What happens if I don't make estimated tax payments in California?

+Failing to make estimated tax payments in California can result in penalties and interest charges. If you do not pay enough estimated tax throughout the year, you may be subject to an underpayment penalty. Additionally, late payments may incur late payment penalties and interest charges. It's important to plan and make timely payments to avoid these additional costs.

How can I avoid penalties for underpayment of estimated taxes in California?

+To avoid penalties for underpayment, taxpayers must pay at least 90% of their current year's tax liability or 100% of their previous year's tax liability through withholding and estimated tax payments. This is known as the safe harbor rule. It's crucial to accurately estimate your income and tax liability to ensure you are paying enough to avoid penalties.

Can I pay my estimated taxes in California in a lump sum at the end of the year instead of quarterly payments?

+While it is possible to make a lump sum payment at the end of the year to cover your estimated tax liability, it is generally not recommended. Spreading your payments throughout the year helps manage your cash flow and avoids the burden of a large payment at the end. Additionally, making quarterly payments ensures that you are not subject to underpayment penalties.

What happens if I overpay my estimated taxes in California?

+If you overpay your estimated taxes, the California FTB will apply the overpayment to your next estimated tax payment or your annual tax return. You can also request a refund of the overpayment by filing Form FTB 3519, Request for Refund or Credit of Overpayment. It's important to keep track of your payments to avoid overpaying.

In conclusion, estimated tax payments in California are a critical component of financial planning for individuals and businesses. By understanding the requirements, calculating estimated tax payments accurately, and making timely payments, taxpayers can ensure