Wv Tax Return Status

In the intricate world of state taxation, understanding the status of your tax return is crucial, especially when it comes to West Virginia. This comprehensive guide aims to shed light on the process, providing valuable insights for taxpayers and ensuring a seamless experience. Let's delve into the world of WV Tax Return Status and uncover the key aspects that matter.

Understanding the WV Tax Return Process

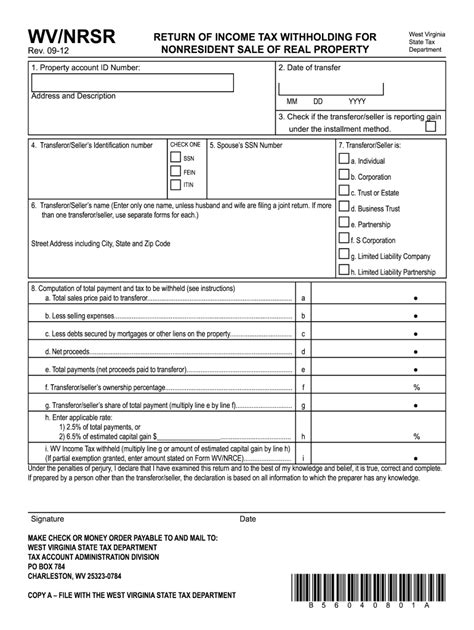

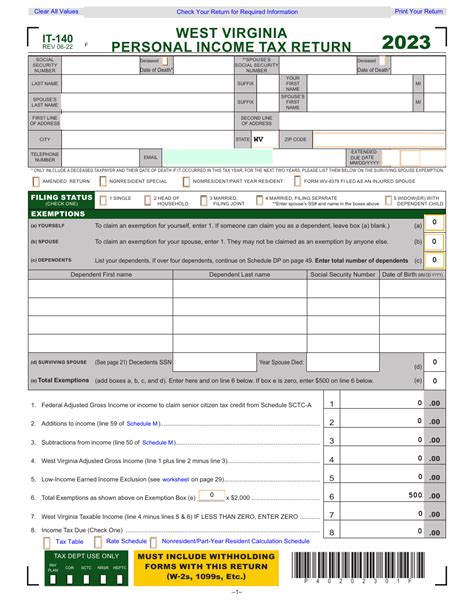

The West Virginia State Tax Department handles income tax returns for individuals and businesses. It’s essential to grasp the steps involved in the tax return process to navigate it efficiently.

The process typically begins with taxpayers filing their returns, either online through the WV Tax Department's official website or by mail. The state offers various options for payment methods, including direct debit, credit/debit cards, and electronic funds transfer. Taxpayers can also opt for a payment plan if they're unable to pay the full amount due.

Once the return is filed, the WV Tax Department processes it, reviewing the information provided and verifying its accuracy. This stage can take some time, especially during peak tax seasons. After processing, the department issues a notice of assessment, detailing the taxpayer's liability and any applicable refunds or credits.

Understanding the WV tax return process is the first step toward ensuring a smooth experience. Let's now explore how to check the status of your WV tax return.

Checking Your WV Tax Return Status

The WV Tax Department offers multiple methods for taxpayers to check the status of their returns. Here’s a detailed breakdown of each method:

Online Status Check

The most convenient way to check your WV tax return status is through the WV Tax Department’s online portal. This portal provides a secure and efficient way to access your tax information. To use this method, you’ll need to create an account and log in.

Once logged in, you'll be able to view the status of your return, including any processing updates, refund amounts (if applicable), and the estimated date of refund issuance. The portal also offers the option to track your refund status in real-time, providing a transparent and user-friendly experience.

To create an account, you'll need to provide your personal information, including your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), as well as some basic tax-related details. Once your account is set up, you can access your tax information anytime, from anywhere.

Telephone Inquiry

For those who prefer a more traditional approach, the WV Tax Department provides a telephone inquiry service. Taxpayers can call the department’s toll-free number and speak with a representative to inquire about their return status.

When calling, be prepared to provide your personal identification details, such as your SSN or ITIN, as well as specific information about your tax return. The representative will then be able to access your account and provide you with an update on the status of your return.

While this method may not offer the real-time updates of the online portal, it provides a direct line of communication with the WV Tax Department, allowing for more personalized assistance.

Mail Inquiry

Taxpayers can also check their WV tax return status by sending a written inquiry to the WV Tax Department. This method is ideal for those who prefer a more formal approach or who may not have access to online services.

To use this method, you'll need to send a letter to the department, requesting an update on your return status. Include your personal details, such as your name, address, and SSN or ITIN, as well as specific information about your tax return. Be sure to provide a self-addressed, stamped envelope for the department's response.

While this method may take longer than the online or telephone options, it provides a written record of your inquiry and the department's response, which can be useful for future reference.

Common Issues and Resolutions

Despite the WV Tax Department’s efforts to streamline the process, taxpayers may encounter issues or delays. Here are some common issues and their potential resolutions:

Return Processing Delays

During peak tax seasons, the WV Tax Department may experience delays in processing returns. This is especially true for returns with complex issues or those requiring additional verification. If your return is taking longer than expected, it’s best to remain patient and allow the department sufficient time to process your information.

However, if the delay is causing financial hardship or you have an urgent need for your refund, you can contact the WV Tax Department to inquire about the status of your return. They may be able to provide an estimated timeline or offer alternative solutions.

Missing Information or Errors

Sometimes, the WV Tax Department may identify missing information or errors on your tax return. In such cases, they will send you a notice of deficiency, detailing the issue and requesting additional information or corrections.

It's crucial to respond to these notices promptly. Provide the requested information or make the necessary corrections, and submit them to the department as soon as possible. This will help expedite the processing of your return and prevent further delays.

Refund Issues

If you’re expecting a refund and it hasn’t arrived, there could be several reasons for the delay. Common issues include mismatched personal information, such as an incorrect SSN or address, or bank account errors if you opted for direct deposit.

In such cases, contact the WV Tax Department to resolve the issue. They can help update your personal information, correct bank account details, or provide guidance on other potential issues causing the refund delay.

Future Implications and Updates

The WV Tax Department is continuously working to improve its services and streamline the tax return process. Here are some future implications and updates to be aware of:

Enhanced Online Services

The department is investing in improving its online portal, adding new features and enhancements to make it even more user-friendly and efficient. This includes real-time status updates, interactive tax calculators, and expanded self-service options.

By leveraging technology, the WV Tax Department aims to reduce processing times and provide taxpayers with more control over their tax information.

Expanded Payment Options

To cater to a wider range of taxpayers, the WV Tax Department is expanding its payment options. This includes adding more credit/debit card providers, offering mobile payment options, and potentially introducing cryptocurrency payments in the future.

These initiatives aim to make paying taxes more accessible and convenient for all West Virginia taxpayers.

Enhanced Security Measures

With the rise of cyber threats, the WV Tax Department is committed to strengthening its security measures to protect taxpayer information. This includes implementing advanced encryption protocols, two-factor authentication, and other security enhancements to safeguard sensitive data.

By prioritizing security, the department aims to ensure that taxpayer information remains confidential and secure.

Additional Tax Resources

The WV Tax Department is dedicated to providing taxpayers with the resources they need to navigate the tax system effectively. This includes expanding its website with comprehensive tax guides, interactive tools, and educational materials.

By investing in taxpayer education, the department aims to reduce errors and improve overall tax compliance.

How long does it typically take for the WV Tax Department to process a tax return?

+Processing times can vary depending on various factors, including the complexity of the return and the time of year. During peak tax seasons, processing times may be longer. On average, simple returns are processed within 4-6 weeks, while more complex returns may take up to 12 weeks.

What should I do if I haven’t received my refund after the estimated date of issuance?

+If your refund hasn’t arrived by the estimated date, first verify that your banking information is correct (if you opted for direct deposit). If the information is accurate, contact the WV Tax Department to inquire about the status of your refund. They can provide you with an update and help resolve any issues.

Can I check my WV tax return status without creating an online account?

+Yes, you can check your WV tax return status without an online account. You can use the telephone inquiry service or send a written inquiry by mail. However, having an online account provides more convenience and real-time updates.