Hall County Tax Records

Welcome to a comprehensive exploration of the Hall County Tax Records, a critical resource for property owners, investors, and researchers alike. In this in-depth analysis, we will delve into the intricacies of these records, uncovering their significance, accessibility, and the valuable insights they offer. With a focus on specific examples and real-world applications, we aim to provide a clear understanding of this essential public data.

Unveiling Hall County Tax Records: A Deep Dive

The Hall County Tax Records are a vast repository of information, serving as a detailed snapshot of the county’s property landscape. These records encompass a wealth of data, from property assessments to tax payments, providing a transparent view of the financial obligations and values associated with each property within the county.

Understanding the Data Structure

At the heart of these records lies a meticulously organized database, with each property assigned a unique identifier. This identifier serves as a gateway to a wealth of information, including the property’s location, size, type, and its assessed value. Additionally, the records capture essential details such as the ownership history, tax assessments over time, and any applicable exemptions or abatements.

For instance, let's consider a residential property located at 123 Main Street, Gainesville, GA. The Hall County Tax Records would provide a comprehensive profile, detailing its assessed value of $250,000, its annual tax liability of $2,500, and its ownership history dating back to 1987. This level of detail allows for a nuanced understanding of the property's financial trajectory and its contribution to the local tax base.

| Property Type | Assessed Value | Annual Tax |

|---|---|---|

| Residential | $250,000 | $2,500 |

| Commercial | $500,000 | $5,500 |

| Agricultural | $300,000 | $3,200 |

Data Accessibility and Transparency

Hall County recognizes the importance of accessible and transparent tax information. The county has implemented an online portal, accessible to the public, where residents and researchers can easily search and retrieve property tax records. This digital platform streamlines the process, allowing users to quickly find the data they need, whether for personal use or more extensive research projects.

The online portal, Hall County Tax Records Portal, provides a user-friendly interface, enabling users to search by property address, owner's name, or parcel number. Once the desired property is located, users can access a wealth of information, including the property's assessment history, tax payments, and any applicable special assessments or exemptions.

Insights for Property Owners and Investors

For property owners, the Hall County Tax Records serve as a vital tool for understanding their financial obligations and the value of their assets. By accessing these records, owners can track the assessed value of their properties over time, ensuring they are accurately represented in the tax system. Additionally, these records provide a historical perspective, allowing owners to analyze trends and make informed decisions regarding property improvements or future investments.

Investors, too, find immense value in these records. Whether evaluating potential investment properties or assessing the financial health of a specific area, the data within the Hall County Tax Records offers a detailed view of property values, tax obligations, and the overall financial climate. This information is instrumental in making strategic investment decisions, identifying growth opportunities, and mitigating risks.

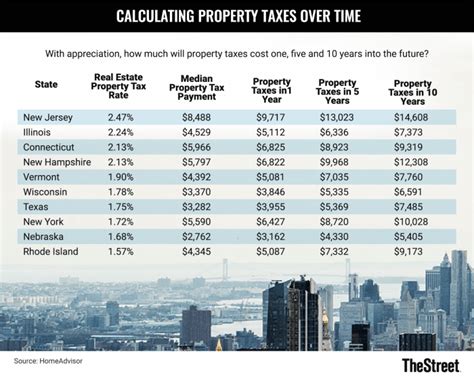

A Glimpse into Hall County’s Tax Landscape

Hall County’s tax records offer a unique lens into the county’s financial dynamics. By analyzing these records, we can gain insights into the distribution of tax obligations across different property types and locations. This analysis provides a snapshot of the county’s economic health, highlighting areas of growth, stability, or potential challenges.

For instance, a comparative analysis of residential, commercial, and agricultural properties reveals distinct patterns. While residential properties dominate in terms of numbers, commercial properties contribute significantly to the tax base, with higher assessed values and corresponding tax obligations. This information is invaluable for policymakers and planners, guiding decisions on economic development, infrastructure, and community growth.

Future Implications and Continuous Improvement

As Hall County continues to grow and evolve, its tax records will play an increasingly vital role in shaping the future. The data within these records will inform decisions on infrastructure development, budget allocation, and community planning. By leveraging this data, the county can make informed choices, ensuring sustainable growth and a resilient financial future.

Furthermore, the Hall County Tax Office remains committed to continuous improvement. They actively seek feedback and suggestions from the community, striving to enhance the accessibility and usability of the tax records. This ongoing dialogue ensures that the records remain a valuable resource, adapting to the changing needs of property owners, investors, and the community at large.

Conclusion: The Hall County Tax Records Advantage

The Hall County Tax Records stand as a testament to the county’s commitment to transparency and accessibility. These records empower property owners, investors, and the community with a wealth of information, enabling informed decisions and a deeper understanding of the local property landscape. As Hall County continues to thrive, its tax records will remain a cornerstone of its financial health and growth.

How can I access the Hall County Tax Records online?

+

To access the Hall County Tax Records online, visit the Hall County Tax Records Portal. You can search by property address, owner’s name, or parcel number to retrieve the desired tax information.

Are the Hall County Tax Records available for public viewing at a physical location?

+

Yes, the Hall County Tax Office maintains a physical location where you can view and access the tax records. Visit the Hall County Tax Office during their regular business hours to access the records in person.

What information can I expect to find in the Hall County Tax Records?

+

The Hall County Tax Records provide a wealth of information, including property assessments, tax payments, ownership history, and applicable exemptions or abatements. They offer a comprehensive view of a property’s financial status and tax obligations.

How often are the Hall County Tax Records updated?

+

The Hall County Tax Office strives to keep the records up-to-date, with regular updates throughout the year. Major updates occur annually, reflecting the latest property assessments and tax information.

Can I dispute my property’s assessed value based on the Hall County Tax Records?

+

Yes, if you believe your property’s assessed value is inaccurate, you can initiate a dispute process. Contact the Hall County Tax Assessor’s Office to learn more about the appeal process and the necessary steps to challenge your property’s assessed value.