Dc Tax Refund Status

In the bustling world of tax refunds, knowing the status of your reimbursement is crucial, especially when it comes to the District of Columbia (DC). This comprehensive guide will walk you through the process of checking the DC Tax Refund Status, ensuring you stay informed and in control of your financial affairs. From understanding the factors that influence refund timelines to exploring the various methods to check your refund status, we've got you covered.

Understanding the DC Tax Refund Process

The DC Office of Tax and Revenue (OTR) manages the tax refund process, and several factors influence the speed and efficiency of refunds. Firstly, the timeliness of your tax return filing is critical. Submitting your return promptly, especially if you’re due a refund, can expedite the process. Secondly, the complexity of your tax situation plays a role. Returns with straightforward deductions and credits tend to be processed faster than those with more intricate financial details.

Additionally, the volume of tax returns the OTR receives during a given period can impact processing times. For instance, refunds during the peak tax season (typically late March to mid-April) might take longer due to the high volume of returns. Lastly, any errors or discrepancies on your tax return can lead to delays, as the OTR might need to reach out for clarification or additional information.

Checking Your DC Tax Refund Status

The DC Office of Tax and Revenue offers several convenient methods to check the status of your tax refund. These methods cater to different preferences and needs, ensuring accessibility for all taxpayers.

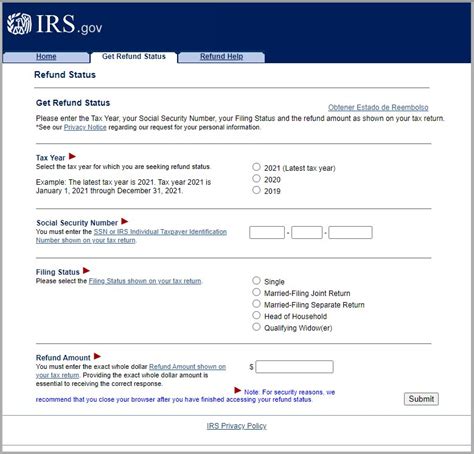

Online Refund Status Check

The most popular and efficient way to check your DC tax refund status is through the OTR’s online refund status tool. This tool provides real-time updates on the processing of your refund and is accessible 24⁄7. To use this service, you’ll need to provide certain personal information for verification, such as your Social Security Number, date of birth, and the amount of your refund.

Once you've entered this information, the tool will display the current status of your refund. This could include details such as whether your return has been received, is being processed, or if there are any issues that need to be resolved. The online tool also provides estimated refund dates, helping you plan your finances effectively.

| Refund Status | Description |

|---|---|

| Received | Your tax return has been successfully submitted. |

| Processed | The OTR has processed your return and approved your refund. |

| Issued | Your refund has been issued and is on its way to you. |

Note: It's essential to ensure the accuracy of the information you provide, as any errors could lead to delays or incorrect status updates.

Phone Inquiry

If you prefer a more personal approach, you can check your DC tax refund status by calling the OTR’s toll-free refund status line. This option is particularly useful for taxpayers who may not have easy access to the internet or prefer speaking to a representative directly. The phone line is typically available during regular business hours.

When calling, you'll be guided through a series of prompts to verify your identity. This process usually involves providing your Social Security Number, date of birth, and other personal details. Once verified, a representative will provide you with the status of your refund and answer any questions you might have.

Email or Postal Inquiry

For those who prefer written communication, the OTR offers the option to email or mail an inquiry about your DC tax refund status. This method is ideal for taxpayers who need a detailed response or have complex refund issues that require a more thorough explanation.

When emailing or mailing your inquiry, ensure you include your full name, Social Security Number, and any relevant details about your tax return. The OTR will then respond to your inquiry, providing an update on your refund status and any additional information they deem necessary.

DC Tax Refund Timelines

Understanding the typical timelines for DC tax refunds can help manage expectations and plan your finances effectively. On average, the OTR aims to process simple tax returns within 4 to 6 weeks of receipt. However, several factors can influence this timeline, as discussed earlier.

If your refund is more complex or involves errors or discrepancies, it might take longer to process. In such cases, the OTR will typically contact you to resolve the issue, which could further delay the refund process. It's crucial to respond promptly to any such communication to avoid unnecessary delays.

For e-filed returns, the processing time is usually faster, with refunds often issued within 2 to 3 weeks. This is because e-filing reduces the risk of errors and allows for a more streamlined processing system.

Speeding Up Your DC Tax Refund

While the OTR works diligently to process tax refunds promptly, there are a few steps you can take to potentially speed up the process and receive your refund sooner.

- E-file Your Return: As mentioned earlier, e-filing your tax return can significantly reduce processing times.

- Avoid Errors: Double-check your tax return for accuracy before submitting it. This includes ensuring all your personal information, deductions, and credits are correct.

- Direct Deposit: Opting for direct deposit of your refund instead of a paper check can also speed up the process, as it eliminates the time needed for mailing and potential delays in delivery.

By following these steps, you can potentially expedite your DC tax refund and receive your money faster.

Common DC Tax Refund Issues

While most taxpayers receive their refunds without any issues, there are a few common problems that can arise. Being aware of these issues can help you identify and resolve them quickly.

Refund Not Received

If you haven’t received your DC tax refund after the estimated date, there could be a few reasons for the delay.

- Processing Delays: As mentioned, various factors can lead to processing delays, including complex returns or errors on your tax form.

- Mailing Issues: If you opted for a paper check, it's possible the check was lost in the mail or delivered to the wrong address. In such cases, you should contact the OTR to request a replacement check.

- Bank Issues: If you chose direct deposit, there might be an issue with your bank account details, causing the refund to be rejected or delayed. Ensure your account information is accurate and up-to-date.

Refund Amount Discrepancy

Sometimes, taxpayers notice that the amount of their DC tax refund is different from what they expected. This could be due to a few reasons.

- Mathematical Errors: Simple errors in calculating your deductions or credits can lead to discrepancies in the refund amount. Double-check your calculations and ensure they align with the OTR's records.

- Additional Withholdings: If you've had additional taxes withheld from your paycheck or made estimated tax payments, these could impact the refund amount.

- Tax Law Changes: Changes in tax laws can affect the amount of tax you owe or the size of your refund. Stay updated with the latest tax laws to understand any potential impacts on your refund.

Resolving DC Tax Refund Issues

If you encounter any issues with your DC tax refund, there are several steps you can take to resolve them.

Contact the OTR

The first step is to contact the OTR to discuss the issue. They can provide you with specific information about your refund, including any errors or discrepancies they’ve identified. They’ll also guide you on the next steps to resolve the issue.

Review Your Tax Return

It’s essential to review your tax return carefully to identify any potential errors or discrepancies. This includes checking your personal information, deductions, credits, and the amount of tax you owe or are due as a refund.

Provide Additional Information

If the OTR identifies an issue with your tax return, they might request additional information to resolve it. This could include proof of deductions, changes to your personal information, or other relevant documents. Provide this information promptly to expedite the resolution process.

Future Outlook for DC Tax Refunds

The OTR is continuously working to improve the tax refund process, aiming to make it more efficient and taxpayer-friendly. Some of the initiatives they’re exploring include enhanced online services, which could provide even more detailed refund status updates and allow for quicker resolution of common issues.

Additionally, the OTR is considering implementing real-time processing for certain types of tax returns, which could significantly reduce refund processing times. While these initiatives are still in the planning stages, they showcase the OTR's commitment to modernizing the tax refund process and improving the taxpayer experience.

Frequently Asked Questions

How long does it usually take to receive a DC tax refund?

+The typical processing time for a DC tax refund is 4 to 6 weeks from the date the return is received. However, various factors can influence this timeline, such as the complexity of the return, errors, or the volume of returns being processed.

Can I check my DC tax refund status online?

+Yes, the OTR provides an online refund status tool that allows you to check the status of your DC tax refund. You’ll need to provide certain personal information for verification, such as your Social Security Number, date of birth, and the amount of your refund.

What should I do if my DC tax refund is delayed or I haven’t received it?

+If your DC tax refund is delayed or you haven’t received it, there are a few steps you can take. First, check the status of your refund online or by calling the OTR’s refund status line. If the status indicates a delay or issue, you should contact the OTR to discuss the specific problem and receive guidance on resolving it.

How can I speed up my DC tax refund process?

+To speed up your DC tax refund process, consider e-filing your return, as this typically leads to faster processing times. Ensure your return is accurate and free of errors, as this can also delay the refund. Opting for direct deposit instead of a paper check can further expedite the process.

What if I have issues with my DC tax refund amount or it’s incorrect?

+If you notice issues with your DC tax refund amount, such as it being incorrect or different from what you expected, you should first review your tax return for any errors or discrepancies. If you find an error, correct it and resubmit your return. If the issue persists, contact the OTR for guidance and resolution.