Gofundme Taxes

Gofundme is a popular crowdfunding platform that has revolutionized the way people raise funds for various causes, be it personal emergencies, medical expenses, educational pursuits, or community projects. While the platform has facilitated countless successful campaigns, it's essential to understand the potential tax implications that may arise when using Gofundme.

As with any financial transaction, crowdfunding through Gofundme may have tax consequences depending on the nature and purpose of the campaign. It's crucial for campaign creators and donors alike to be aware of these implications to ensure compliance with tax regulations and make informed decisions.

Understanding Gofundme and Taxes

Gofundme operates as a platform that connects individuals or organizations seeking financial support with a community of donors willing to contribute to their cause. The platform provides a user-friendly interface for creating and sharing fundraising campaigns, allowing creators to set goals, share their stories, and receive donations from a global audience.

However, when it comes to taxes, the situation can become more complex. The tax treatment of Gofundme funds depends on several factors, including the campaign's purpose, the recipient's location, and the amount raised. It's important to note that tax regulations can vary significantly between countries and regions, so it's essential to seek professional advice tailored to your specific circumstances.

Tax Treatment for Personal Campaigns

Personal campaigns on Gofundme are often created to address individual financial needs, such as medical bills, debt relief, or personal emergencies. In such cases, the tax treatment can vary depending on the jurisdiction and the specific circumstances of the campaign.

In the United States, for example, the IRS considers personal Gofundme campaigns as gifts. Gifts received are generally not taxable, but there are exceptions and limitations. If the donor and recipient are not related, and the gift exceeds the annual exclusion amount ($15,000 as of 2021), the donor may need to report the gift on Form 709. However, the recipient is typically not required to report the gift as income.

It's worth noting that if the funds received through a personal campaign are used for non-qualified expenses, such as luxury purchases or personal investments, the IRS may consider it taxable income. It's crucial for campaign creators to maintain proper records and documentation to support the intended use of the funds.

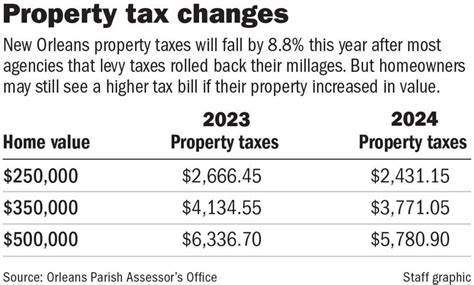

| Country | Tax Treatment |

|---|---|

| United States | Personal campaigns are generally considered gifts. Gifts over $15,000 may require reporting by the donor. |

| Canada | Funds received for personal reasons may be taxable if they exceed a certain threshold. Consult with a Canadian tax professional. |

| United Kingdom | Personal gifts are usually tax-free, but donations to individuals may be subject to Inheritance Tax. |

Tax Implications for Business and Non-Profit Campaigns

When Gofundme campaigns are launched for business or non-profit purposes, the tax treatment becomes more complex. The funds received through these campaigns are often considered income and may be subject to income tax, payroll tax, or other applicable business taxes.

For business campaigns, the funds received should be reported as revenue and included in the business's tax return. The business may also need to pay payroll taxes if the funds are used to compensate employees or contractors. It's crucial for businesses to maintain accurate records and consult with an accountant or tax advisor to ensure compliance with tax regulations.

Non-profit organizations also need to be mindful of tax implications. Funds raised through Gofundme campaigns for non-profit purposes may be subject to different tax treatments depending on the organization's tax-exempt status and the nature of the campaign. Non-profits should consult with their legal and tax advisors to understand their specific obligations.

Reporting and Compliance

Campaign creators on Gofundme have a responsibility to report and comply with tax regulations. While Gofundme itself does not issue tax forms or provide tax advice, it does offer resources and guidelines to help creators understand their tax obligations.

Gofundme recommends that campaign creators consult with a tax professional to ensure they are meeting their tax responsibilities. This is especially important for campaigns that receive significant amounts of funds or have complex tax situations.

Donors also have reporting obligations, particularly for larger donations. Donors should keep records of their contributions and consult with their tax advisors to ensure compliance with gift or donation reporting requirements in their jurisdiction.

Record-Keeping and Documentation

Maintaining proper records and documentation is crucial for both campaign creators and donors. Campaign creators should keep records of their campaign expenses, receipts, and any supporting documentation related to the use of the funds. This documentation can help demonstrate the intended purpose of the funds and provide evidence for tax reporting.

Donors, especially those making larger contributions, should also maintain records of their donations. This may include screenshots of the donation transaction, campaign details, and any communication with the campaign creator. These records can be crucial for gift or donation reporting and may also provide evidence for potential tax deductions.

Tax Benefits and Deductions

While Gofundme campaigns may have tax implications, they can also offer tax benefits and deductions for both campaign creators and donors, depending on the campaign's purpose and the applicable tax regulations.

Tax Deductions for Donors

Donors to Gofundme campaigns may be eligible for tax deductions, particularly if the campaign is for a qualified charitable organization or a personal campaign with a legitimate purpose. In many countries, donations to registered charities are tax-deductible, and donors can claim these deductions when filing their tax returns.

For example, in the United States, donations to qualified charitable organizations are generally tax-deductible. Donors can claim these deductions on their federal income tax returns using Form 1040, Schedule A. However, it's important to note that there are limitations and requirements for claiming charitable deductions, so donors should consult with a tax professional to ensure they meet the necessary criteria.

Tax Benefits for Campaign Creators

Campaign creators may also be able to take advantage of tax benefits, especially if their campaign is for a charitable cause or a business venture. For charitable campaigns, the funds raised may be considered tax-deductible donations, which can reduce the creator's taxable income.

Additionally, for business campaigns, the funds received can be used to offset business expenses, potentially reducing the creator's taxable income. Campaign creators should work closely with their tax advisors to understand the specific tax benefits and deductions available to them based on their campaign's purpose and structure.

Gofundme and International Tax Considerations

When it comes to international Gofundme campaigns, the tax landscape becomes even more intricate. The tax treatment of funds raised through Gofundme can vary significantly depending on the country of the campaign creator, the location of the donors, and the jurisdiction where the funds are received.

Campaign creators operating internationally should be aware of the tax regulations in their home country as well as the tax implications in the countries where their donors reside. It's crucial to consult with tax professionals who specialize in international tax matters to ensure compliance with all applicable tax laws.

Donors from different countries may also have varying tax obligations. For instance, donors from the United States may need to report certain international gifts or donations on their tax returns, especially if the gift exceeds the annual exclusion amount. It's essential for donors to understand their tax obligations and seek professional advice if needed.

Future Implications and Industry Insights

The world of crowdfunding continues to evolve, and with it, the tax implications for platforms like Gofundme. As the industry grows and matures, it's likely that tax regulations will become more defined and standardized.

One potential future development is the integration of tax reporting and compliance features directly into crowdfunding platforms. This could streamline the tax reporting process for campaign creators and donors, making it more accessible and user-friendly. However, it's important to note that such changes would require collaboration between crowdfunding platforms, tax authorities, and industry stakeholders.

Additionally, the rise of blockchain-based crowdfunding platforms and cryptocurrency donations may present new tax challenges and opportunities. These innovative funding methods could introduce complexities in tax reporting, especially with the pseudonymous nature of blockchain transactions. Campaign creators and donors using these methods should stay informed about the evolving tax landscape in this space.

Industry Insights

- Gofundme has become a trusted platform for raising funds for various causes, with over $10 billion raised since its inception.

- The platform's user-friendly interface and global reach have made it a popular choice for individuals and organizations seeking financial support.

- While Gofundme provides valuable resources and guidelines for tax compliance, it's crucial for users to seek professional tax advice tailored to their specific circumstances.

- The tax treatment of Gofundme funds can vary significantly depending on the campaign's purpose, the recipient's location, and the amount raised.

- Campaign creators and donors should maintain proper records and documentation to support their tax reporting and ensure compliance with tax regulations.

Conclusion

Gofundme has revolutionized the way we raise funds for personal and charitable causes, but it's essential to navigate the potential tax implications associated with crowdfunding. By understanding the tax treatment of Gofundme funds, campaign creators and donors can make informed decisions and ensure compliance with tax regulations.

As the crowdfunding industry continues to evolve, it's crucial to stay informed about tax developments and seek professional advice when needed. Whether it's for personal emergencies, business ventures, or charitable endeavors, proper tax planning can help maximize the impact of Gofundme campaigns while minimizing potential tax liabilities.

How does Gofundme handle tax reporting for campaign creators and donors?

+

Gofundme does not provide tax advice or issue tax forms. It is the responsibility of campaign creators and donors to understand their tax obligations and consult with tax professionals. Gofundme recommends seeking professional advice to ensure compliance with tax regulations.

Are donations to personal Gofundme campaigns taxable for the recipient?

+

The tax treatment of personal Gofundme campaigns varies by jurisdiction. In the United States, gifts received through personal campaigns are generally not taxable, but there are exceptions for larger gifts. It’s essential to consult with a tax professional for accurate guidance.

Can donors claim tax deductions for their Gofundme contributions?

+

Donors may be eligible for tax deductions if they contribute to qualified charitable organizations or personal campaigns with a legitimate purpose. The availability of deductions depends on the donor’s location and the campaign’s nature. Consulting with a tax advisor is recommended to understand specific deductions.

How should campaign creators report Gofundme funds on their tax returns?

+

Campaign creators should consult with tax professionals to determine the appropriate reporting method for their Gofundme funds. The tax treatment depends on factors such as the campaign’s purpose, the recipient’s location, and the amount raised. Proper record-keeping is crucial for accurate reporting.

Are there any tax implications for international Gofundme campaigns?

+

International Gofundme campaigns may have complex tax implications due to varying regulations across countries. Campaign creators and donors should be aware of the tax obligations in their home country and the countries where the donors reside. Consulting with tax professionals who specialize in international tax matters is recommended.