Maryland Tax Forms

Maryland's tax system is a crucial aspect of the state's financial landscape, impacting both individuals and businesses. Understanding the tax forms and processes is essential for compliance and effective financial management. In this comprehensive guide, we will delve into the intricacies of Maryland tax forms, providing a detailed analysis to assist taxpayers in navigating this complex system.

Navigating Maryland's Tax Forms: A Comprehensive Guide

Maryland, known as the Old Line State, boasts a rich history and a robust economy, which is reflected in its diverse tax structure. From personal income taxes to corporate and sales taxes, the state's revenue system is designed to support its public services and infrastructure. This guide aims to demystify the process, offering a step-by-step breakdown of the tax forms and their requirements.

Understanding Maryland's Tax Landscape

Maryland's tax system is characterized by its progressive nature, with tax rates varying based on income brackets. This ensures that those with higher incomes contribute a larger proportion of their earnings to the state's revenue. The state also imposes sales and use taxes on various goods and services, with specific exemptions and rules.

For businesses, Maryland offers a range of tax incentives and programs to encourage economic growth. From tax credits for research and development to reduced tax rates for specific industries, the state provides a supportive environment for entrepreneurship and innovation.

| Tax Type | Rate |

|---|---|

| Personal Income Tax | 2% to 5.75% (progressive) |

| Corporate Income Tax | 8.25% |

| Sales and Use Tax | 6% |

In addition to these taxes, Maryland also imposes property taxes, estate taxes, and various other fees and assessments. Each of these tax categories has its own set of forms and requirements, which we will explore in detail.

Personal Income Tax Forms: A Detailed Breakdown

Maryland's personal income tax forms are designed to calculate an individual's taxable income and determine the applicable tax rate. The process involves reporting various sources of income, including wages, salaries, investments, and business profits.

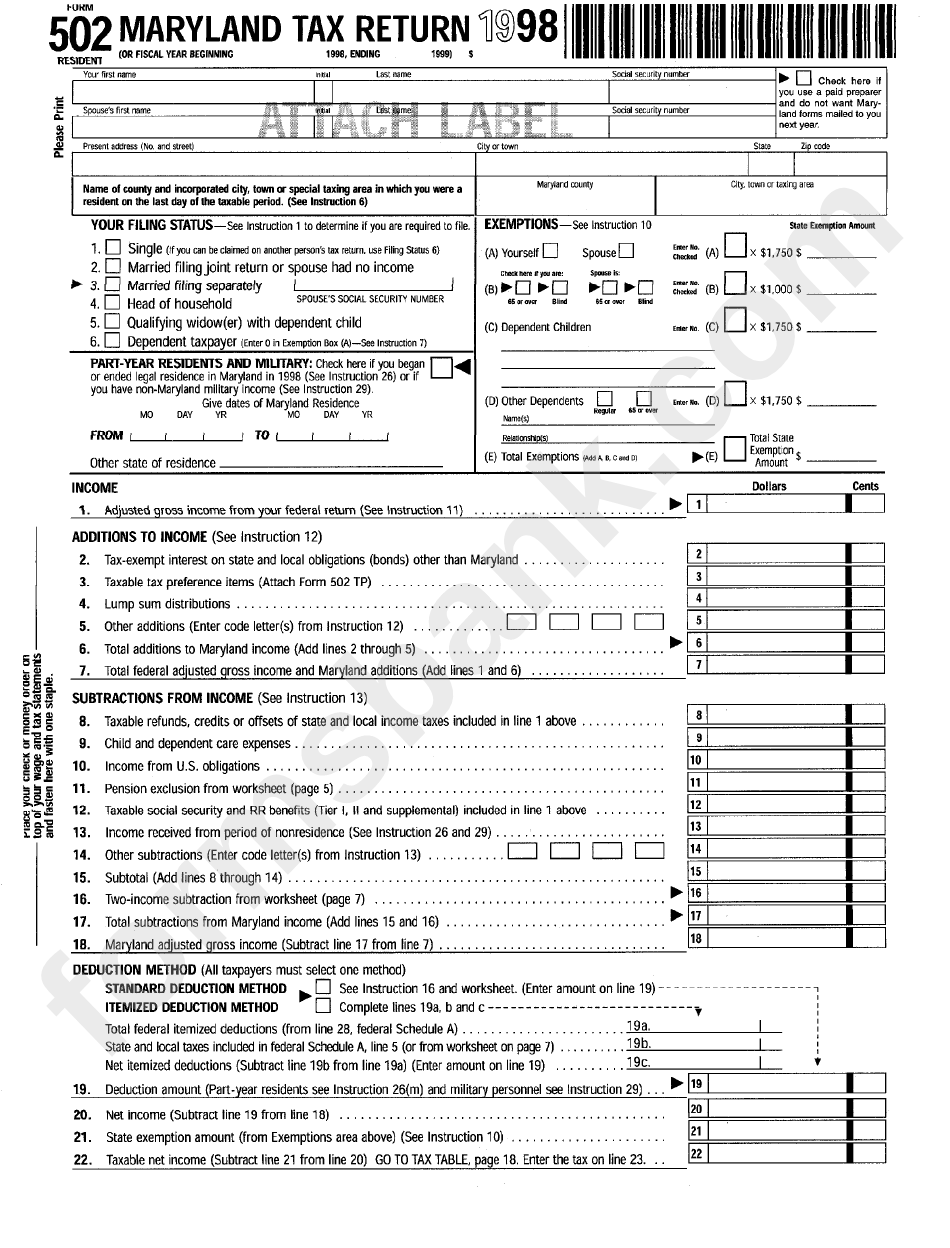

The most common form for individual taxpayers is the Form 502, which covers a range of income types and allows for deductions and credits. This form is accompanied by various schedules and worksheets to account for specific income sources, such as rental income (Schedule RI) or farm income (Schedule FI).

For taxpayers with more complex financial situations, Maryland offers additional forms. Form 502CR is designed for those with income from more than one state, allowing for the allocation of income and the calculation of taxes owed to Maryland.

Taxpayers with business income may need to file Form 505, which reports profits from sole proprietorships, partnerships, and S corporations. This form is accompanied by detailed instructions and worksheets to ensure accurate reporting.

| Form Name | Purpose |

|---|---|

| Form 502 | Standard personal income tax form |

| Form 502CR | For taxpayers with income from multiple states |

| Form 505 | Business and professional income tax form |

Maryland also provides specific forms for taxpayers with unique circumstances, such as Form 502B for blind individuals, Form 502R for retirees, and Form 502P for part-year residents. These forms offer tailored tax calculations and deductions for these specific groups.

Corporate and Business Tax Forms: A Comprehensive Overview

For businesses operating in Maryland, the tax landscape is equally intricate. The state imposes a corporate income tax on C corporations, with a standard rate of 8.25%. S corporations and partnerships are taxed at the individual level, with their profits passed through to the owners or partners.

The primary form for corporate tax filing is Form 500, which calculates the taxable income and tax liability for C corporations. This form is accompanied by various schedules and attachments, such as Schedule B for apportioning income and Schedule E for calculating the Maryland Corporate License Fee.

For S corporations and partnerships, the tax process involves reporting their profits on individual tax returns. These entities do not pay corporate income tax directly but pass through their income, deductions, and credits to their owners or partners, who report these on their personal tax returns.

| Entity Type | Form Name |

|---|---|

| C Corporation | Form 500 |

| S Corporation | Pass-through reporting on individual tax returns |

| Partnership | Pass-through reporting on individual tax returns |

In addition to the corporate income tax, businesses in Maryland may also be subject to other taxes, such as the Business Entity Tax and the Commercial and Industrial Property Tax Credit. These additional taxes and credits are designed to support the state's economic development and provide incentives for businesses to invest and grow.

Sales and Use Tax: A Comprehensive Guide

Maryland's sales and use tax is a significant source of revenue for the state, applying to the sale or lease of tangible personal property and certain services. The standard rate is 6%, but there are various exemptions and special rates for specific goods and services.

The primary form for sales and use tax filing is Form MW50, which calculates the tax liability for businesses based on their sales and purchases. This form is accompanied by detailed instructions and worksheets to account for various tax rates and exemptions.

For taxpayers who make online sales or use out-of-state vendors, the Maryland Sales and Use Tax Return for Noncollecting Sellers is required. This form ensures that the proper tax is collected and remitted to the state, even if the business does not directly collect the tax from the customer.

Maryland's sales and use tax system is designed to be fair and efficient, with a focus on ensuring that all businesses and consumers contribute their fair share to the state's revenue. The state provides resources and guidance to help taxpayers understand their obligations and comply with the law.

Property and Estate Taxes: Understanding the Requirements

Maryland imposes property taxes on real estate and tangible personal property. These taxes are a significant source of revenue for local governments and are used to fund public services such as schools, roads, and public safety.

The assessment and collection of property taxes are handled by local jurisdictions, with varying tax rates and assessment methods. Taxpayers can typically find information about their property taxes on their local government's website or by contacting the local tax assessor's office.

In addition to property taxes, Maryland also imposes an estate tax on the transfer of property at death. The Maryland Estate Tax Return is required for estates with a gross value exceeding a certain threshold. This form calculates the taxable value of the estate and determines the tax liability.

| Tax Type | Form Name |

|---|---|

| Property Tax | Varies by local jurisdiction |

| Estate Tax | Maryland Estate Tax Return |

Maryland's property and estate tax system is designed to be fair and transparent, with resources and guidance available to help taxpayers understand their obligations. The state aims to ensure that all taxpayers contribute their fair share to support the state's public services and infrastructure.

Additional Tax Forms and Considerations

In addition to the tax forms covered above, Maryland has a range of other tax obligations and considerations. These include:

- Withholding taxes for employers

- Unclaimed property reporting

- Excise taxes on specific goods and services

- Motor vehicle taxes

- Fuel taxes

- Tax incentives and credits for specific industries

Each of these tax categories has its own set of forms and requirements, and taxpayers should consult the Maryland Comptroller's website or seek professional advice to ensure compliance.

Conclusion: Navigating Maryland's Tax Landscape

Maryland's tax system is complex, with a range of taxes and forms to navigate. From personal income taxes to corporate and sales taxes, each tax category has its own set of rules and requirements. By understanding these forms and their specific requirements, taxpayers can ensure compliance and make the most of the available tax incentives and credits.

This comprehensive guide has provided an in-depth look at Maryland tax forms, offering a step-by-step breakdown of the process. By following the instructions and seeking professional advice when needed, taxpayers can navigate the tax landscape with confidence and contribute to the state's vibrant economy.

FAQ

When are Maryland tax forms due for individuals?

+

Maryland tax forms for individuals are typically due by April 15th each year, aligning with the federal tax deadline. However, in the event that the 15th falls on a weekend or holiday, the deadline is extended to the following business day.

What is the deadline for filing corporate tax returns in Maryland?

+

The deadline for filing corporate tax returns in Maryland is typically the 15th day of the third month after the corporation’s fiscal year ends. For example, if a corporation’s fiscal year ends on December 31st, the tax return is due by March 15th of the following year.

Are there any tax incentives for renewable energy projects in Maryland?

+

Yes, Maryland offers a range of tax incentives for renewable energy projects, including tax credits for the installation of solar, wind, and geothermal systems. These incentives are designed to encourage the adoption of clean energy technologies and support the state’s environmental goals.

How can I estimate my sales and use tax liability in Maryland?

+

To estimate your sales and use tax liability in Maryland, you can use the state’s online tax calculator. This tool allows you to input your sales data and calculate the estimated tax due, taking into account various tax rates and exemptions. It’s a helpful resource for businesses to manage their tax obligations effectively.

What is the process for claiming a tax refund in Maryland?

+

To claim a tax refund in Maryland, you need to file a tax return using the appropriate form for your tax situation. If you are due a refund, it will be calculated automatically based on your reported income and deductions. The state typically issues refunds within a few weeks to a few months, depending on the complexity of your return.