Sales Tax On Cars

Sales tax on cars is a significant consideration for anyone looking to purchase a vehicle, whether it's a new car rolling off the assembly line or a pre-owned model with a unique story to tell. This tax can significantly impact the overall cost of a vehicle, making it a crucial factor in financial planning and decision-making for potential car buyers. In this comprehensive guide, we will delve into the world of sales tax on cars, exploring its intricacies, variations across regions, and the strategies consumers can employ to navigate this complex landscape.

Understanding Sales Tax on Cars

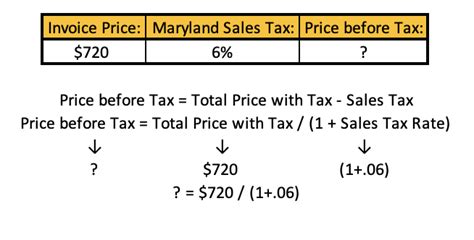

Sales tax on cars is a mandatory charge levied by governmental bodies, typically at the state or local level, when a vehicle is purchased. It is a percentage-based tax calculated on the purchase price of the car, and it contributes to the overall revenue stream for various public services and infrastructure development. While the concept of sales tax is straightforward, its application and calculation can vary greatly depending on the jurisdiction and the specific vehicle being purchased.

For instance, consider the hypothetical case of Mr. Johnson, a resident of Metroville, who decides to purchase a new sedan. Upon researching the sales tax rates in his area, he discovers that the tax is calculated at a rate of 7% on the total purchase price, including any additional fees and surcharges. This means that for a car priced at $30,000, Mr. Johnson would need to budget for an additional $2,100 in sales tax, bringing the total cost of the vehicle to $32,100.

Factors Influencing Sales Tax

The sales tax on cars is not a one-size-fits-all scenario. Several factors come into play that can affect the final tax amount. These factors include:

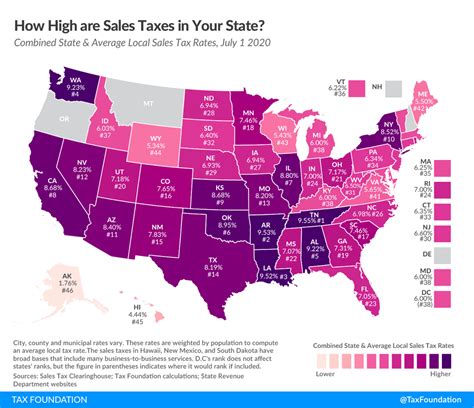

- Location: Sales tax rates can vary significantly from one state to another, and even within different counties or municipalities. For example, while State A might have a flat sales tax rate of 6%, State B could have a tiered system where the rate increases with the purchase price of the vehicle.

- Vehicle Type: In some regions, the sales tax rate can vary depending on the type of vehicle being purchased. Luxury vehicles or electric cars might be subject to different tax rates compared to standard sedans or SUVs.

- Registration Fees: Sales tax is often calculated based on the purchase price, but additional fees and surcharges, such as registration fees or environmental levies, can also be included in the tax calculation, further impacting the overall cost.

Strategies for Managing Sales Tax

Understanding the intricacies of sales tax on cars is the first step; however, consumers also need practical strategies to navigate this complex landscape and make informed decisions.

Research and Comparison

Conducting thorough research is crucial when it comes to sales tax on cars. Potential buyers should explore the sales tax rates in their intended purchase area and compare them with other regions. This comparison can reveal significant differences and help buyers make strategic decisions, such as considering cross-border purchases if the tax rates are more favorable in nearby states or provinces.

For instance, imagine Ms. Smith, a resident of Borderland, who discovers that the sales tax rate in her state is 8%, while just across the border in Neighborland, the rate is only 5%. This knowledge prompts her to consider purchasing her new SUV from a dealer in Neighborland, potentially saving a substantial amount on sales tax.

Negotiation and Timing

Sales tax on cars is often negotiable, especially when purchasing from dealerships. Buyers can leverage their research and knowledge of market rates to negotiate with dealerships, aiming to reduce the overall cost of the vehicle, including the sales tax component. Additionally, timing can play a role, as certain periods might offer tax incentives or promotions, allowing buyers to save on sales tax.

Tax Incentives and Exemptions

Various tax incentives and exemptions exist for specific types of vehicles or under certain circumstances. Electric and hybrid vehicles, for example, often qualify for reduced sales tax rates or even full exemptions in some regions. Additionally, military personnel, seniors, and individuals with disabilities might be eligible for tax breaks or waivers. Staying informed about these incentives can lead to significant savings on sales tax.

| Vehicle Type | Tax Incentive |

|---|---|

| Electric Vehicles | Up to 50% reduced sales tax |

| Hybrid Vehicles | 20% sales tax exemption |

| Classic Cars | No sales tax for vehicles over 30 years old |

Case Study: The Impact of Sales Tax on Car Buying

To illustrate the real-world impact of sales tax on car buying, let’s examine the experience of Mr. Chen, a resident of Cityville. Mr. Chen is in the market for a new family SUV, and after extensive research, he narrows his options to two popular models: the EcoSport and the Adventure Rider.

The EcoSport, priced at $40,000, is subject to a 7% sales tax in Cityville, resulting in a total cost of $42,800. On the other hand, the Adventure Rider, priced at $45,000, is eligible for a 5% sales tax rate due to its status as an eco-friendly vehicle, bringing the total cost down to $47,250.

Mr. Chen's decision-making process is significantly influenced by these sales tax differences. He must consider not only the initial purchase price but also the long-term financial implications, including maintenance, fuel efficiency, and, of course, the sales tax. In this case, the reduced sales tax on the Adventure Rider could make it a more attractive option, despite its slightly higher purchase price.

Future Implications and Trends

As the automotive industry evolves, so too will the landscape of sales tax on cars. The rise of electric and autonomous vehicles, as well as the growing emphasis on sustainability and environmental considerations, is likely to influence tax policies and incentives in the coming years.

For instance, as more regions prioritize reducing carbon emissions, we can expect to see increased incentives for electric and hybrid vehicles, further bridging the price gap between traditional and eco-friendly options. Additionally, the potential for remote work and decentralized urban planning might impact sales tax rates, as buyers consider purchasing vehicles in areas with more favorable tax structures.

Key Takeaways

- Sales tax on cars is a critical consideration for potential buyers, impacting the overall cost of a vehicle.

- Understanding the variations in sales tax rates and incentives is essential for making informed decisions.

- Research, comparison, negotiation, and awareness of tax incentives are key strategies for managing sales tax effectively.

- The future of sales tax on cars is intertwined with industry trends, environmental considerations, and technological advancements.

Conclusion

Sales tax on cars is a complex but essential aspect of the car-buying journey. By equipping themselves with knowledge and strategic planning, buyers can navigate this landscape, making choices that align with their financial goals and preferences. As the automotive industry continues to evolve, staying informed about sales tax trends and incentives will remain crucial for making informed decisions in the dynamic world of car purchasing.

How often do sales tax rates change, and where can I find the most up-to-date information?

+Sales tax rates can change annually or even more frequently in some regions. To stay informed, it’s advisable to check the official websites of state or local government tax departments. These websites often provide up-to-date information on tax rates, including any recent changes or upcoming adjustments.

Are there any online tools or calculators that can help estimate sales tax on cars?

+Yes, several online resources offer sales tax calculators specifically designed for car purchases. These calculators consider factors like the purchase price, location, and vehicle type to provide an estimated sales tax amount. Websites like [Website Name] or [Another Website] often have user-friendly calculators to assist in these calculations.

What are the potential consequences of not paying sales tax on a car purchase?

+Failing to pay sales tax on a car purchase can have significant legal and financial repercussions. It may result in penalties, fines, or even legal action. Additionally, it can impact your credit score and create long-term financial complications. It’s crucial to understand and fulfill your sales tax obligations to avoid these issues.