How To Get Tax Id For Llc

In the world of business, understanding the legal and financial landscape is crucial, especially when it comes to setting up a Limited Liability Company (LLC). One of the essential steps in the process is obtaining a Tax ID, which is a unique identifier assigned by the Internal Revenue Service (IRS) in the United States. This number is vital for tax reporting, financial transactions, and various legal requirements. In this comprehensive guide, we will delve into the process of acquiring a Tax ID for your LLC, covering everything from the initial steps to the benefits and implications.

Understanding the Importance of a Tax ID for Your LLC

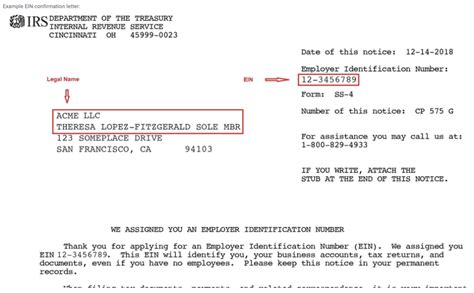

A Tax ID, also known as an Employer Identification Number (EIN), serves as a unique identifier for your LLC in the eyes of the IRS. It is a nine-digit number that allows the government to track your business's tax obligations and financial activities. Without a Tax ID, your LLC may face limitations in terms of banking, hiring employees, and complying with tax regulations.

Obtaining a Tax ID is a fundamental step for any LLC, as it provides several benefits and simplifies various administrative processes. Let's explore the significance of this crucial identification number in more detail.

Benefits of a Tax ID for Your LLC

- Banking and Financial Transactions: A Tax ID is often required when opening a business bank account. It allows you to separate your personal and business finances, which is essential for maintaining accurate records and ensuring compliance with tax laws.

- Employment and Payroll: If your LLC plans to hire employees, you'll need a Tax ID to manage payroll taxes, file employment tax returns, and report wages to the IRS. It streamlines the process of withholding and remitting taxes for your employees.

- Tax Compliance: With a Tax ID, your LLC can file tax returns, pay estimated taxes, and comply with various tax obligations. It simplifies the process of reporting income, deductions, and credits, ensuring your business remains in good standing with the IRS.

- Business Licenses and Permits: Many local, state, and federal agencies may require your LLC's Tax ID when applying for business licenses or permits. It serves as a reliable identifier for your business entity.

- Business Credit and Loans: When seeking business credit or loans, lenders often request a Tax ID as part of their due diligence. It helps them assess the financial health and credibility of your LLC.

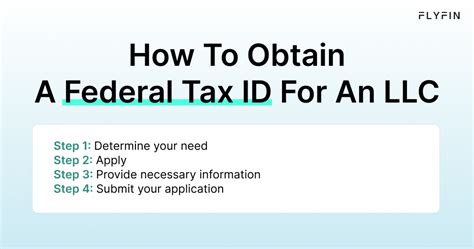

Step-by-Step Guide: How to Get a Tax ID for Your LLC

Acquiring a Tax ID for your LLC is a straightforward process, but it requires attention to detail and adherence to specific guidelines. Here's a comprehensive step-by-step guide to help you navigate the procedure efficiently.

Step 1: Determine Eligibility and Requirements

Before applying for a Tax ID, ensure that your LLC meets the eligibility criteria set by the IRS. Generally, any business entity, including LLCs, partnerships, corporations, and sole proprietorships, may need an EIN. However, the requirements may vary based on factors such as the number of members in your LLC and your business activities.

Additionally, consider whether your LLC has any specific requirements or regulations set by your state or local government. Some jurisdictions may have additional criteria or processes for obtaining a Tax ID. Familiarize yourself with these requirements to ensure a smooth application process.

Step 2: Gather Necessary Information and Documents

To complete the Tax ID application, you'll need to provide specific information and documents. Here's a checklist of what you'll typically need:

- Business Name and Address: Have your LLC's legal name and registered business address ready. If your LLC has a Doing Business As (DBA) name, you may need to provide that as well.

- Business Structure: Identify the business structure of your LLC. This information is crucial for determining the appropriate tax classification and reporting requirements.

- Business Activities: Be prepared to describe the primary activities and services your LLC provides. This information helps the IRS understand the nature of your business.

- Owner/Member Information: Gather the names, titles, and percentages of ownership for all members or owners of your LLC. This is essential for establishing the ownership structure.

- Business Contact Information: Have the contact details of the primary business contact ready. This person will be responsible for receiving important communications and updates from the IRS.

- Valid Identification Documents: Depending on your situation, you may need to provide valid identification documents, such as a driver's license, passport, or social security card.

Step 3: Choose the Application Method

The IRS offers multiple ways to apply for a Tax ID, allowing you to choose the method that best suits your preferences and circumstances. Here are the available options:

- Online Application: The IRS provides an online application form, which is the quickest and most convenient method. It allows you to receive your Tax ID immediately upon successful submission.

- Fax Application: If you prefer a fax-based application, the IRS provides a fax number for submitting your request. This method typically takes a few business days for processing.

- Mail Application: For those who prefer a traditional approach, you can print and mail the Form SS-4 to the IRS. This method may take several weeks for processing.

- Third-Party Authorized Representatives: You can authorize a third-party representative, such as an accountant or attorney, to apply for your Tax ID on your behalf. This option is useful if you require expert assistance or have complex business structures.

Step 4: Complete and Submit the Application

Once you've chosen your preferred application method, carefully complete the form or follow the instructions provided. Ensure that all the information you provide is accurate and up-to-date. Inaccurate or incomplete information may lead to delays or even rejection of your application.

When submitting your application, pay close attention to the specific instructions for each method. For online applications, double-check that you have entered all the required information correctly and provided valid contact details. For fax and mail applications, ensure that you are sending the form to the correct IRS location and including all necessary supporting documents.

Step 5: Receive and Verify Your Tax ID

After submitting your application, the IRS will process your request and issue your LLC's Tax ID. The time it takes to receive your Tax ID can vary depending on the application method you chose.

Once you receive your Tax ID, carefully verify the information to ensure accuracy. It's crucial to safeguard this unique identifier, as it will be used for various official purposes and tax-related activities. Keep a record of your Tax ID in a secure location, and ensure that all your business records and documentation reflect the correct Tax ID.

Tips and Best Practices for Managing Your LLC's Tax ID

Now that you have successfully obtained your LLC's Tax ID, it's essential to understand how to utilize and manage it effectively. Here are some tips and best practices to ensure you make the most of this crucial identification number:

Keep Your Tax ID Secure

Your Tax ID is a sensitive piece of information that should be protected like any other confidential data. Ensure that you store it in a secure location, such as a locked cabinet or a password-protected digital storage system. Share it only with authorized individuals or entities when necessary.

Update Your Records Regularly

As your LLC grows and evolves, it's crucial to keep your records up-to-date. If there are any changes to your business structure, ownership, or contact information, be sure to notify the IRS and update your records accordingly. This ensures that your Tax ID remains accurate and reflects the current state of your LLC.

Utilize Your Tax ID for Compliance

Your Tax ID is a powerful tool for ensuring compliance with tax laws and regulations. Use it to file your LLC's tax returns, pay estimated taxes, and report any financial transactions accurately. Staying on top of your tax obligations not only helps you avoid penalties but also establishes a positive relationship with the IRS.

Explore Tax Strategies and Benefits

With your Tax ID in hand, you can explore various tax strategies and benefits specific to LLCs. Consult with tax professionals or accountants who specialize in small businesses to understand how you can optimize your tax situation. They can provide valuable insights into deductions, credits, and tax-saving opportunities tailored to your LLC's structure and activities.

Maintain Good Communication with the IRS

Should you have any questions or concerns regarding your Tax ID or tax-related matters, don't hesitate to reach out to the IRS. They provide various resources and assistance channels to help businesses navigate the tax landscape. By maintaining open communication, you can ensure that your LLC remains compliant and stays on the right track.

Frequently Asked Questions (FAQ)

What is the difference between a Tax ID and an Employer Identification Number (EIN)?

+A Tax ID and an Employer Identification Number (EIN) are essentially the same. The IRS uses both terms interchangeably to refer to the unique nine-digit identifier assigned to businesses for tax purposes. Whether you call it a Tax ID or an EIN, it serves the same purpose of identifying your LLC in tax-related matters.

<div class="faq-item">

<div class="faq-question">

<h3>Can I obtain a Tax ID for my LLC if I am not a US citizen or resident?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, non-US citizens and residents can obtain a Tax ID for their LLCs. The IRS allows foreign entities to apply for a Tax ID as long as they meet the eligibility criteria and provide the necessary documentation. However, the process may involve additional steps and requirements, so it's advisable to consult with a tax professional for guidance.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How long does it take to receive a Tax ID for my LLC after submitting the application?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>The time it takes to receive your Tax ID can vary depending on the application method you choose. Online applications are processed immediately, and you'll receive your Tax ID right away. Fax applications typically take a few business days, while mail applications may take several weeks. Plan accordingly based on your preferred method and the urgency of your need.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can I use my personal Social Security Number (SSN) instead of a Tax ID for my LLC?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>It is generally not recommended to use your personal Social Security Number (SSN) for your LLC's tax purposes. Using a dedicated Tax ID for your LLC helps maintain a clear separation between your personal and business finances, which is crucial for tax compliance and liability protection. It's best to obtain a separate Tax ID for your LLC.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What happens if I lose or forget my LLC's Tax ID?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>If you lose or forget your LLC's Tax ID, you can retrieve it by contacting the IRS directly. You can call the IRS Business and Specialty Tax Line at 1-800-829-4933 and provide the necessary details to verify your identity. The IRS representative can assist you in obtaining your Tax ID or providing guidance on how to locate it.</p>

</div>

</div>

</div>

In conclusion, obtaining a Tax ID for your LLC is a crucial step in establishing your business’s legal and financial foundation. By following the outlined steps and best practices, you can navigate the process efficiently and ensure your LLC remains compliant and well-organized. Remember, a Tax ID is not just a number; it’s a vital tool for managing your business’s tax obligations and maintaining a positive relationship with the IRS.