Puerto Rico Taxes

Puerto Rico, an island territory of the United States, offers a unique tax system that has garnered significant attention from individuals and businesses seeking tax advantages. The tax structure in Puerto Rico is distinct from that of the mainland United States, and understanding its intricacies is crucial for anyone considering relocation or investment on the island.

The Puerto Rico Tax System: A Comprehensive Overview

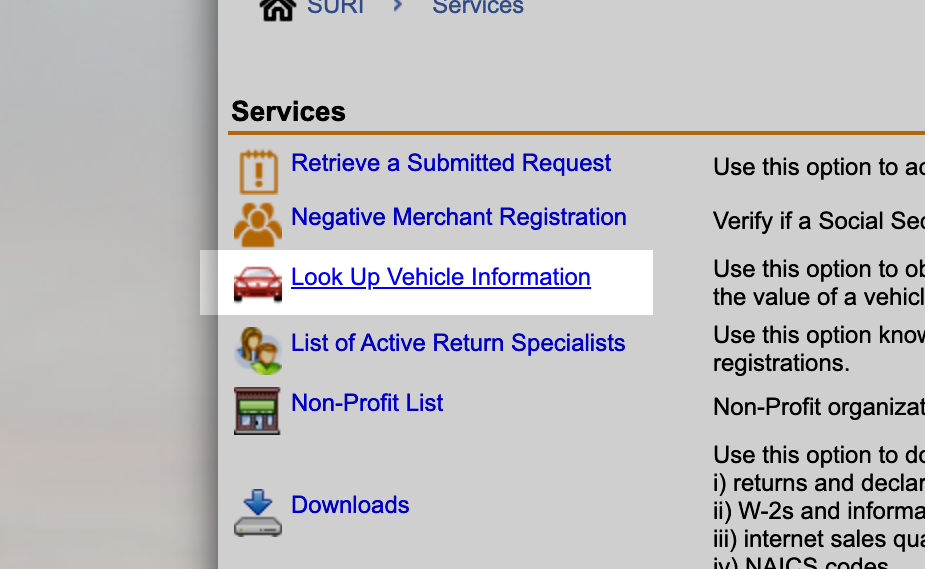

The tax system in Puerto Rico is governed by the Puerto Rico Internal Revenue Code, which is a comprehensive set of laws and regulations. While the island is subject to U.S. federal laws, it also has its own internal revenue service, the Puerto Rico Treasury Department (Hacienda). This department is responsible for collecting taxes and administering the tax system.

One of the most notable aspects of Puerto Rico's tax system is its attractive tax incentives, particularly for businesses. These incentives have been designed to encourage economic growth and investment on the island, making it an appealing destination for entrepreneurs and corporations.

Individual Income Taxes

For individuals, Puerto Rico offers a progressive tax system with marginal tax rates ranging from 1.5% to 33%. The tax brackets are based on taxable income, and there are additional deductions and credits available to reduce the tax liability. Residents of Puerto Rico are required to file their tax returns annually, typically by April 15th, using the appropriate forms provided by the Puerto Rico Treasury Department.

| Tax Rate | Taxable Income Range (USD) |

|---|---|

| 1.5% | Up to $6,000 |

| 3% | $6,001 - $12,000 |

| 6% | $12,001 - $20,000 |

| 10% | $20,001 - $35,000 |

| 17% | $35,001 - $60,000 |

| 26% | $60,001 - $150,000 |

| 31% | $150,001 - $250,000 |

| 33% | Over $250,000 |

💡 It's important to note that Puerto Rico residents are exempt from federal income taxes, a significant advantage compared to other U.S. jurisdictions. However, they are still subject to other federal taxes, such as Social Security and Medicare taxes.

Business Taxes

Puerto Rico has implemented various tax incentives to attract businesses, particularly those in the manufacturing and service sectors. The most notable incentive is Act 20, which offers a 4% corporate tax rate for certain types of businesses. This act aims to encourage the development of export services, international headquarters, and research and development centers on the island.

Additionally, Act 22 provides a 0% tax rate on long-term capital gains and passive income for individuals who become bona fide residents of Puerto Rico. This act has attracted many high-net-worth individuals seeking tax-efficient investment opportunities.

| Tax Incentive | Benefits |

|---|---|

| Act 20 | 4% corporate tax rate for qualifying businesses |

| Act 22 | 0% tax rate on long-term capital gains and passive income for individuals |

| Act 273 | 10-year tax exemption on corporate income tax for new manufacturing businesses |

| Act 73 | Tax incentives for the film and media industry |

These tax incentives have had a significant impact on the economy of Puerto Rico, attracting a diverse range of businesses and fostering economic growth. However, it's crucial for businesses to thoroughly understand the eligibility criteria and requirements associated with these incentives to ensure compliance and maximize their benefits.

Sales and Use Taxes

Puerto Rico has a value-added tax (VAT) system known as the Sales and Use Tax (Impuesto sobre Ventas y Uso, IVU). The standard IVU rate is 11.5%, but there are certain exemptions and reduced rates for specific goods and services. Businesses operating in Puerto Rico are responsible for collecting and remitting the IVU to the Puerto Rico Treasury Department.

| Product/Service | IVU Rate |

|---|---|

| General Goods and Services | 11.5% |

| Prepared Foods | 7% |

| Pharmaceuticals | 7% |

| Medical Devices | Exempt |

| Educational Services | Exempt |

💡 The IVU system in Puerto Rico is complex, with various exemptions and special rules. Businesses should stay informed about the latest regulations to ensure accurate tax collection and reporting.

Property Taxes

Property taxes in Puerto Rico are determined at the municipal level, and rates can vary significantly depending on the location. The tax is calculated based on the assessed value of the property and is typically due annually. It’s essential for property owners to understand the specific tax rates and assessment processes in their respective municipalities.

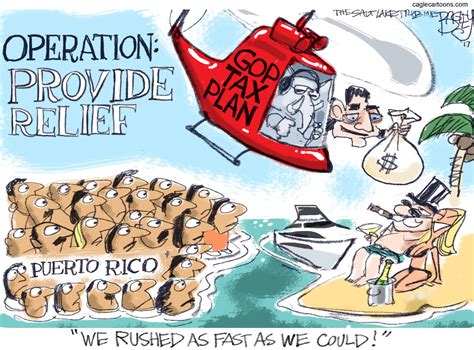

The Impact of Puerto Rico’s Tax System

The unique tax system in Puerto Rico has had a profound impact on the island’s economy. The tax incentives, particularly for businesses, have attracted significant foreign investment, leading to job creation and economic development. Additionally, the exemption from federal income taxes has made Puerto Rico an attractive destination for individuals seeking tax efficiency.

However, the tax system has also faced criticism and scrutiny. Some argue that the generous tax incentives have led to a lack of diversity in the economy, with certain sectors benefiting disproportionately. There have also been concerns about the potential impact on government revenues and the ability to provide essential public services.

Despite these challenges, Puerto Rico's tax system remains a key factor in its economic strategy. The island continues to refine and adapt its tax policies to attract investment and promote sustainable growth, while also addressing the concerns and needs of its residents.

How does Puerto Rico’s tax system differ from that of the mainland United States?

+Puerto Rico’s tax system differs significantly from that of the mainland United States. While it is subject to certain federal laws, it has its own internal revenue service and tax code. The most notable difference is the exemption from federal income taxes for Puerto Rico residents, which sets it apart from other U.S. jurisdictions.

What are the key tax incentives available in Puerto Rico for businesses?

+Puerto Rico offers several tax incentives for businesses, including Act 20, which provides a 4% corporate tax rate for qualifying businesses, and Act 22, which offers a 0% tax rate on long-term capital gains and passive income for individuals. These incentives aim to attract businesses and promote economic growth on the island.

Are there any disadvantages to Puerto Rico’s tax system for individuals?

+While Puerto Rico’s tax system offers significant advantages for individuals, particularly in terms of income taxes, there are some potential disadvantages. For instance, the sales and use tax (IVU) can be higher compared to some U.S. states, and property taxes can vary significantly depending on the municipality. Additionally, the limited access to certain federal programs and benefits can be a consideration for some individuals.