New Mexico Sales Tax

Sales tax in New Mexico is a crucial aspect of the state's economy and revenue system, impacting both businesses and consumers alike. With a unique set of rules and regulations, understanding New Mexico's sales tax is essential for anyone conducting business within its borders. This comprehensive guide will delve into the intricacies of New Mexico sales tax, covering its rates, applicability, collection, and more, providing valuable insights for businesses and individuals navigating this complex landscape.

The Fundamentals of New Mexico Sales Tax

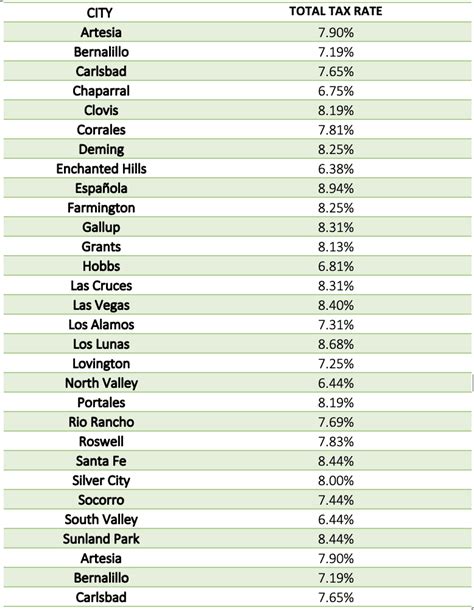

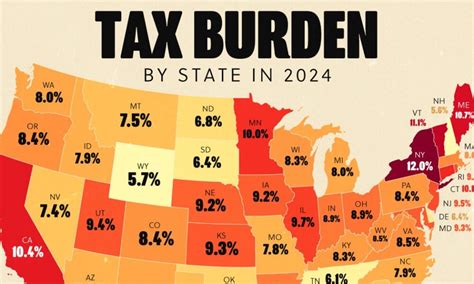

New Mexico imposes a sales tax on the sale of tangible personal property, certain services, and certain types of leases or rentals. The state sales tax rate is a flat 5.125%, but when combined with local rates, the total sales tax rate can vary depending on the location of the transaction. As of our last update, there are 49 local taxing jurisdictions in New Mexico, each with the ability to levy additional taxes on top of the state rate.

State Sales Tax Rate and Its Impact

The state sales tax rate of 5.125% is applicable across New Mexico. This rate is imposed on the sale of most goods and certain services. However, it’s important to note that certain items are exempt from sales tax, such as most groceries, prescription drugs, and non-prescription medicines. These exemptions can significantly impact the total sales tax burden for consumers.

For businesses, the state sales tax rate is a crucial factor in pricing strategies and cost calculations. Understanding the impact of the sales tax rate on their products or services is essential for accurate financial planning and budgeting.

| State Sales Tax Rate | 5.125% |

|---|---|

| Exempt Items | Groceries, Prescription Drugs, Non-Prescription Medicines |

Local Sales Tax Rates and Variations

In addition to the state sales tax rate, local governments in New Mexico have the authority to impose additional sales taxes. These local taxes can vary significantly, with rates ranging from 0% to 3.875%. As a result, the total sales tax rate can differ greatly depending on the location of the transaction.

For instance, in the city of Albuquerque, the total sales tax rate is 7.875%, consisting of the state rate plus a local rate of 2.75%. On the other hand, in the city of Santa Fe, the total sales tax rate is 6.125%, with a local rate of 1%. These variations can have a substantial impact on the prices consumers pay and the tax obligations of businesses.

| Local Sales Tax Rates | Varies (0% to 3.875%) |

|---|---|

| Example: Albuquerque | Total Rate: 7.875% (State: 5.125%, Local: 2.75%) |

| Example: Santa Fe | Total Rate: 6.125% (State: 5.125%, Local: 1%) |

Sales Tax Exemptions and Special Considerations

New Mexico sales tax also includes various exemptions and special considerations that can impact the total tax burden. These exemptions are designed to alleviate the tax burden on specific industries, promote economic growth, or support specific initiatives.

Exemptions and Special Rates for Industries

Certain industries and sectors in New Mexico benefit from sales tax exemptions or special rates. For instance, manufacturers and wholesalers are generally exempt from sales tax on purchases of machinery and equipment used directly in manufacturing processes. This exemption is a significant incentive for businesses to invest in New Mexico’s manufacturing sector.

Additionally, there are special sales tax rates for certain industries, such as the 2.5% rate applicable to retail sales of food and beverages for consumption on the premises. This rate is designed to support the hospitality and tourism industries, making New Mexico an attractive destination for travelers.

| Industry Exemptions and Special Rates | Varies |

|---|---|

| Manufacturing | Exemption for machinery and equipment |

| Hospitality and Tourism | 2.5% rate for food and beverage sales |

Sales Tax Holidays and Special Events

New Mexico occasionally offers sales tax holidays, during which certain items are exempt from sales tax for a limited period. These holidays are typically designed to boost economic activity and provide relief to consumers. For example, New Mexico may offer a back-to-school sales tax holiday, where clothing and school supplies are exempt from sales tax for a few days.

Additionally, the state may waive sales tax for specific events or initiatives, such as the New Mexico True Certification program, which promotes tourism and cultural events by offering a sales tax exemption to qualifying businesses.

| Sales Tax Holidays and Special Events | Varies |

|---|---|

| Back-to-School Sales Tax Holiday | Exemption for clothing and school supplies |

| New Mexico True Certification | Sales tax waiver for qualifying businesses |

Sales Tax Collection and Remittance

For businesses operating in New Mexico, collecting and remitting sales tax is a critical responsibility. The process involves several key steps, from registering with the state to calculating and remitting the tax on a regular basis.

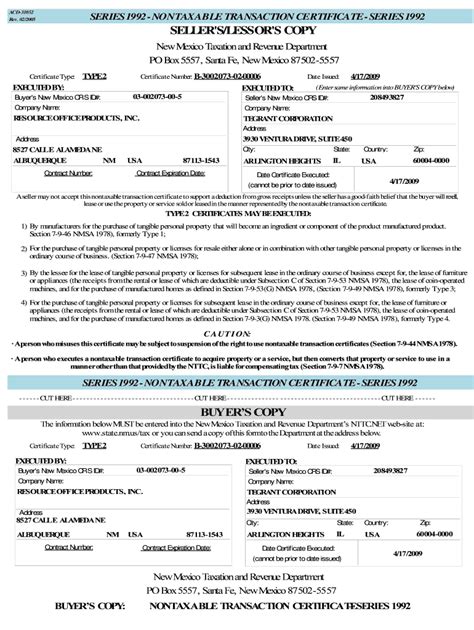

Registering for Sales Tax and Obtaining a Permit

Businesses must register with the New Mexico Taxation and Revenue Department to obtain a Sales and Use Tax Permit. This permit is required for any business making taxable sales, leases, or rentals in the state. The application process involves providing detailed information about the business, including its legal name, physical location, and the types of products or services offered.

Once registered, businesses receive a unique permit number, which must be displayed at all business locations. This number is essential for identifying the business when filing sales tax returns and communicating with the state.

Calculating Sales Tax and Filing Requirements

Calculating sales tax involves determining the total sales tax due based on the state and local rates applicable to the transaction. Businesses must keep accurate records of taxable sales, including the amount of sales tax collected from customers. These records are essential for preparing sales tax returns and ensuring compliance with state regulations.

Sales tax returns must be filed on a regular basis, typically quarterly or monthly, depending on the business's sales volume and other factors. These returns detail the total sales tax collected and remitted to the state, along with any applicable local taxes. Late filings or non-compliance can result in penalties and interest charges.

Online Sales and Remote Sellers

With the rise of e-commerce, New Mexico has implemented regulations to ensure sales tax is collected on online sales. Remote sellers, those with no physical presence in the state, are required to collect and remit sales tax if they meet certain thresholds. These thresholds are based on the seller’s total sales or transactions in New Mexico.

Remote sellers must register with the state, obtain a sales tax permit, and collect sales tax on all taxable sales to New Mexico residents. This ensures that online shoppers in New Mexico pay the same sales tax as those shopping in brick-and-mortar stores.

Sales Tax Compliance and Enforcement

Ensuring compliance with New Mexico’s sales tax regulations is a critical aspect of doing business in the state. The New Mexico Taxation and Revenue Department has various tools and resources to assist businesses in understanding and meeting their sales tax obligations.

Sales Tax Resources and Support

The Taxation and Revenue Department offers a range of resources to help businesses understand and comply with sales tax regulations. These resources include guides, webinars, and workshops, providing practical guidance on topics such as registration, collection, and filing.

Additionally, the department offers a Sales and Use Tax Bulletin, which provides updates on changes to sales tax laws and regulations. This bulletin is an essential resource for businesses to stay informed and ensure they are meeting their tax obligations.

Penalties and Interest for Non-Compliance

Non-compliance with sales tax regulations can result in significant penalties and interest charges. These penalties can include fines, late fees, and additional assessments based on the severity of the violation. In some cases, non-compliance can also lead to criminal charges.

To avoid penalties, businesses should ensure they are registered, collecting the correct amount of sales tax, and filing their returns on time. Maintaining accurate records and staying informed about sales tax regulations is crucial for compliance.

Future Implications and Potential Changes

As with any tax system, New Mexico’s sales tax is subject to potential changes and reforms. These changes can be driven by various factors, including economic conditions, political priorities, and evolving consumer behaviors.

Potential Sales Tax Reforms and Initiatives

One potential reform being discussed is the idea of a simplified sales tax system. This could involve consolidating the various local tax rates into a single, state-wide rate, reducing the complexity of the current system. Such a reform could make it easier for businesses to comply with sales tax regulations and provide more consistency for consumers.

Another initiative being considered is the expansion of sales tax to include certain services. Currently, many services are exempt from sales tax, but there is a growing trend to include more services in the tax base to broaden the state's revenue stream.

Impact of Economic and Political Factors

Economic conditions can significantly impact the sales tax system. During periods of economic growth, sales tax revenue typically increases, providing a boost to the state’s budget. Conversely, during economic downturns, sales tax revenue may decline, leading to budget shortfalls and potential tax rate adjustments.

Political factors can also influence sales tax rates and regulations. For example, changes in state leadership or legislative priorities can lead to new tax initiatives or reforms. These changes can impact the tax burden on businesses and consumers, making it essential to stay informed about political developments.

Adapting to Changing Consumer Behaviors

The rise of e-commerce and online shopping has presented new challenges for sales tax systems. As more consumers shop online, states like New Mexico are adapting their regulations to ensure sales tax is collected on these transactions. This includes implementing laws to require remote sellers to collect sales tax and developing systems to enforce these requirements.

Additionally, the shift towards digital services and away from traditional goods has prompted discussions about expanding the sales tax base to include more services. This could significantly impact businesses and consumers, as the tax burden would shift towards a broader range of transactions.

Conclusion

Navigating New Mexico’s sales tax system requires a thorough understanding of the state’s unique regulations and considerations. From varying local tax rates to industry-specific exemptions, the sales tax landscape in New Mexico is complex but crucial for businesses and consumers alike.

By staying informed about sales tax rates, exemptions, and compliance requirements, businesses can ensure they are meeting their tax obligations and taking advantage of any available tax incentives. For consumers, understanding the sales tax rates and exemptions can help them budget effectively and make informed purchasing decisions.

As New Mexico continues to evolve and adapt to changing economic, political, and consumer behaviors, the sales tax system will likely undergo further changes. Staying informed and adaptable is key for businesses and individuals to thrive in this dynamic environment.

What is the current state sales tax rate in New Mexico?

+The current state sales tax rate in New Mexico is 5.125%.

Are there any local sales tax rates in New Mexico?

+Yes, there are 49 local taxing jurisdictions in New Mexico, each with the ability to levy additional sales taxes. These local rates can vary significantly, ranging from 0% to 3.875%.

What are some common sales tax exemptions in New Mexico?

+Common sales tax exemptions in New Mexico include groceries, prescription drugs, and non-prescription medicines. Additionally, certain industries may benefit from industry-specific exemptions or special rates.

How often do sales tax rates change in New Mexico?

+Sales tax rates can change periodically due to legislative actions or local initiatives. It’s essential to stay informed about any changes, as they can impact the total sales tax burden for businesses and consumers.