Taxes In Switzerland

Switzerland, with its diverse landscapes and renowned quality of life, is often associated with a unique tax system that offers both benefits and complexities. Understanding the tax landscape in this Alpine nation is essential for anyone considering residence, business ventures, or financial planning within its borders. This article delves into the intricacies of Swiss taxation, shedding light on the various aspects that make it a distinctive and often advantageous system.

The Swiss Tax System: A Comprehensive Overview

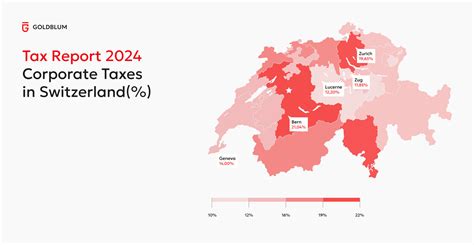

Switzerland’s tax system is known for its decentralization, with taxes being levied by both the federal and cantonal governments, as well as by the communes. This federal structure leads to significant variations in tax rates and regulations across the country’s 26 cantons and nearly 2,300 communes.

Federal Taxes

At the federal level, Switzerland imposes a value-added tax (VAT), known as Mehrwertsteuer or taxe sur la valeur ajoutée, on the consumption or use of goods and services. The standard VAT rate is set at 7.7%, with reduced rates for certain essential goods and services at 2.5% and 3.7%, respectively. Additionally, there are specific VAT rates for certain sectors, such as hospitality and accommodation, which are subject to an 3.7% rate.

Apart from VAT, the federal government levies taxes on certain products, such as tobacco, alcohol, and mineral oil. There are also federal duties on imports and exports, which vary depending on the type of goods and their origin.

Cantonal and Communal Taxes

Cantonal and communal taxes are a significant part of the Swiss tax system, and they primarily focus on income and wealth taxes. Each canton and commune has its own tax rates and regulations, leading to a wide range of tax burdens across the country. For instance, the impôt sur le revenu (income tax) and impôt sur la fortune (wealth tax) can vary significantly from one canton to another.

| Canton | Income Tax Rate | Wealth Tax Rate |

|---|---|---|

| Zurich | 11.8% - 43.3% | 0.1% - 0.8% |

| Geneva | 12.8% - 43.6% | 0.15% - 0.7% |

| Vaud | 11.7% - 42.2% | 0.1% - 0.8% |

| Zug | 6.6% - 35.4% | 0.1% - 0.6% |

| Schwyz | 10.6% - 35.6% | 0.2% - 0.9% |

It's important to note that these rates are subject to change, and they are often accompanied by various deductions and tax credits, which can significantly impact the effective tax rate. The tax system also differentiates between residents and non-residents, with the latter often subject to higher tax rates.

Taxation for Individuals and Businesses

For individuals, the Swiss tax system is largely based on their residence status. Residents are taxed on their worldwide income and wealth, while non-residents are taxed only on income and wealth sourced within Switzerland. The tax system follows a progressive structure, with higher income levels attracting higher tax rates.

Businesses in Switzerland are subject to corporate income tax, which is levied at both the federal and cantonal levels. The federal corporate tax rate is currently set at 7.83%, while cantonal rates vary significantly, ranging from around 6% to 18%. Additionally, businesses are subject to VAT, as mentioned earlier, and may also face cantonal and communal taxes on profits and capital.

Tax Benefits and Incentives

Switzerland’s tax system is renowned for its competitive rates and various tax incentives, making it an attractive destination for high-net-worth individuals and businesses. Some cantons, particularly those with lower tax rates, offer special tax regimes for expatriates and foreign companies, providing substantial tax savings.

For instance, the cantonal tax agreement allows certain expatriates to benefit from a flat tax rate, which is based on their spending rather than their income. This agreement is often advantageous for individuals with high expenses but relatively low taxable income.

Tax Compliance and Enforcement

The Swiss tax system is known for its robust compliance and enforcement mechanisms. Tax authorities at the federal, cantonal, and communal levels have extensive powers to investigate and audit taxpayers. Penalties for non-compliance can be severe, including fines, interest, and even criminal charges in cases of tax fraud.

Despite the stringent enforcement, Switzerland maintains a reputation for tax secrecy, particularly in the banking sector. However, in recent years, the country has taken steps to improve transparency and comply with international tax standards, including the automatic exchange of tax information with other countries.

The Impact of Swiss Taxation

The unique structure and rates of Swiss taxation have a significant impact on both the country’s economy and its residents and businesses. The competitive tax environment has been a key factor in attracting foreign investment and high-net-worth individuals, contributing to Switzerland’s status as a global financial hub.

For individuals, the diverse tax rates across cantons offer a range of options, allowing them to choose a canton that aligns with their financial goals and needs. Businesses, too, can benefit from the competitive tax rates, especially in certain cantons, which can significantly reduce their tax burden.

However, the complexity of the Swiss tax system can be a challenge, particularly for those unfamiliar with its nuances. Engaging with experienced tax advisors and legal professionals is crucial to ensure compliance and optimize one's tax position.

The Future of Swiss Taxation

Looking ahead, the Swiss tax system is likely to continue evolving to meet international standards and address emerging economic trends. The country has already made significant strides in enhancing tax transparency and cooperation with other nations, and it is expected to continue this path.

Furthermore, as the global economy becomes increasingly digital, Switzerland will need to adapt its tax regulations to accommodate the changing nature of business and income. This could lead to new tax policies and potentially a shift in the way certain types of income, particularly those derived from digital sources, are taxed.

In conclusion, Switzerland's tax system, with its decentralized structure and diverse rates, offers a unique and often advantageous tax environment. Understanding the intricacies of this system is essential for anyone considering a move to Switzerland or planning to do business within its borders. While the system provides opportunities for tax optimization, it also requires careful navigation and expert guidance to ensure compliance and take full advantage of its benefits.

What are the main differences in tax rates between cantons in Switzerland?

+The main differences in tax rates between cantons in Switzerland lie primarily in income and wealth taxes. For instance, the canton of Zurich has income tax rates ranging from 11.8% to 43.3%, while Geneva’s rates are slightly higher, ranging from 12.8% to 43.6%. Wealth tax rates also vary, with Zurich imposing rates between 0.1% and 0.8%, and Geneva charging between 0.15% and 0.7%.

How does Switzerland’s tax system impact foreign investment and businesses?

+Switzerland’s tax system, with its competitive rates and various incentives, has been a key factor in attracting foreign investment and businesses. Certain cantons, particularly those with lower tax rates, offer special tax regimes for foreign companies, providing substantial tax savings. This has contributed to Switzerland’s reputation as a global financial hub.

What are the main challenges in navigating the Swiss tax system for non-residents?

+The main challenges in navigating the Swiss tax system for non-residents include understanding the complex structure of federal, cantonal, and communal taxes, which can vary significantly across the country. Additionally, the language barrier can be a hurdle, as tax documents and regulations are often in the official language of the canton, which may be French, German, or Italian.

How has Switzerland adapted its tax system to international standards in recent years?

+In recent years, Switzerland has made significant strides in adapting its tax system to international standards. This includes implementing the automatic exchange of tax information with other countries and enhancing transparency in the banking sector. These measures have helped Switzerland comply with global tax standards and improve its reputation in the international arena.