Inheritance Tax Nc

Welcome to this comprehensive guide on Inheritance Tax in North Carolina. As a knowledgeable expert in the field of estate planning and taxation, I aim to provide you with an in-depth analysis of this complex topic. Inheritance tax, often overlooked or misunderstood, plays a significant role in shaping the financial landscape for beneficiaries and heirs. In this article, we will delve into the intricacies of inheritance tax in North Carolina, exploring its definitions, current laws, potential impacts, and future considerations.

Understanding Inheritance Tax in North Carolina

Inheritance tax, also known as estate tax or death tax, is a levy imposed by the government on the transfer of an individual’s assets after their passing. It is a mechanism to generate revenue and ensure a fair distribution of wealth within society. In the context of North Carolina, inheritance tax laws are designed to provide financial support to the state while offering certain protections to beneficiaries.

Definition and Purpose

The inheritance tax in North Carolina is a state-level tax that applies to the beneficiaries who inherit assets from a deceased individual’s estate. It is distinct from the federal estate tax, which is a separate tax levied by the Internal Revenue Service (IRS) on larger estates. The primary purpose of North Carolina’s inheritance tax is to raise revenue for state programs and services, while also encouraging the equitable distribution of wealth among heirs.

Current Inheritance Tax Laws in North Carolina

As of my last update in January 2023, North Carolina does not have a state-level inheritance tax. This means that, unlike some other states, there is no direct tax imposed on beneficiaries who receive assets from an estate. However, it’s important to note that the absence of an inheritance tax does not eliminate the need for careful estate planning, as other factors such as federal estate tax and potential gift taxes may come into play.

Despite the lack of an inheritance tax, North Carolina still imposes various other taxes that can impact estates and beneficiaries. For instance, the state has a 5.75% income tax on the taxable portion of an estate's income, including income earned from investments, rental properties, or business interests. Additionally, North Carolina has a 6.75% sales and use tax that can apply to certain assets, such as vehicles or real estate, if they are purchased within the state.

Exemptions and Transfer Tax Rates

While North Carolina does not have an inheritance tax, it is worth noting that there are certain exemptions and transfer tax rates applicable to other types of property transfers. For example, transfers between spouses are generally exempt from any transfer taxes, including gift taxes and estate taxes. This ensures that married couples can pass assets to each other without incurring additional tax burdens.

Furthermore, North Carolina has a State Transfer Tax that applies to certain property transfers, including real estate transactions. This tax is typically calculated as a percentage of the property's value and is paid by the buyer or the seller, depending on the terms of the transaction. It's important for individuals involved in real estate transactions to be aware of these transfer taxes to avoid any surprises during the closing process.

Estate Planning Strategies

Given the absence of an inheritance tax in North Carolina, individuals and families may focus their estate planning efforts on minimizing federal estate taxes and maximizing the preservation of their assets. Strategies such as utilizing marital deductions, gifting assets to beneficiaries during one’s lifetime, and establishing trusts can help reduce the overall tax burden and ensure a smoother transition of wealth.

It is crucial to consult with qualified estate planning professionals, such as attorneys and tax advisors, to develop a comprehensive plan that considers all relevant factors, including federal and state tax laws, as well as the specific needs and goals of the individual or family.

The Impact of Inheritance Tax on Beneficiaries

The absence of an inheritance tax in North Carolina can have both positive and negative implications for beneficiaries. On one hand, it alleviates the financial burden that beneficiaries may face in other states with inheritance taxes. However, it also means that beneficiaries may not receive the same level of protection or financial support from the state government.

Benefits of No Inheritance Tax

One significant advantage of North Carolina’s lack of inheritance tax is the preservation of wealth for beneficiaries. Without an inheritance tax, heirs can receive their inheritance in full, without any deductions for tax purposes. This can be especially beneficial for individuals who rely on inheritance as a source of financial security or for funding important life goals, such as education, business ventures, or retirement.

Furthermore, the absence of an inheritance tax simplifies the estate administration process. Beneficiaries may find it easier to navigate the legal and financial aspects of inheriting assets, as they do not have to contend with complex tax forms and calculations associated with inheritance tax.

Potential Drawbacks

While the absence of an inheritance tax offers benefits, it also means that beneficiaries may not have access to certain state-provided resources or support. In states with inheritance taxes, a portion of the tax revenue is often allocated towards social programs, education, and other public services. Without this tax revenue, North Carolina may have fewer resources to invest in these areas, which could impact the overall quality of life for residents.

Additionally, the absence of an inheritance tax may lead to a concentration of wealth among a smaller group of individuals. Without a mechanism to redistribute wealth through taxation, there is a risk that economic inequality could widen over time. This could have implications for social mobility and the overall distribution of resources within the state.

Future Considerations and Implications

As North Carolina continues to evolve and face changing economic and social dynamics, the absence of an inheritance tax may require ongoing evaluation and discussion. While the current system offers certain benefits, it also raises questions about the distribution of wealth and the state’s ability to provide for its residents.

Potential Policy Changes

There have been discussions and proposals for implementing an inheritance tax in North Carolina in the past. Advocates for an inheritance tax argue that it could provide much-needed revenue for the state, especially in times of economic hardship or budget constraints. Additionally, an inheritance tax could help address issues of wealth inequality and ensure a more equitable distribution of resources.

However, opponents of an inheritance tax argue that it could have negative consequences for the state's economy and attract negative attention from potential investors and businesses. They also highlight the potential administrative burden and complexity that an inheritance tax could introduce.

Economic and Social Impact

The introduction of an inheritance tax in North Carolina would likely have both economic and social implications. On the economic front, it could generate significant revenue for the state, which could be allocated towards various public initiatives, such as infrastructure development, education, and healthcare. This could potentially enhance the overall quality of life for residents and attract new businesses and investment.

From a social perspective, an inheritance tax could help address wealth inequality and ensure that a greater portion of the state's resources are distributed more equitably. This could lead to improved access to opportunities and resources for individuals and communities that may have historically been marginalized or underserved.

Comparative Analysis with Other States

To gain a broader perspective, it is beneficial to compare North Carolina’s inheritance tax policies with those of other states. As of my last update, sixteen states and the District of Columbia impose some form of inheritance tax. These states include: Connecticut, Hawaii, Illinois, Indiana, Iowa, Kentucky, Maryland, Massachusetts, Minnesota, Nebraska, New Jersey, New York, Oregon, Pennsylvania, Tennessee, and Washington.

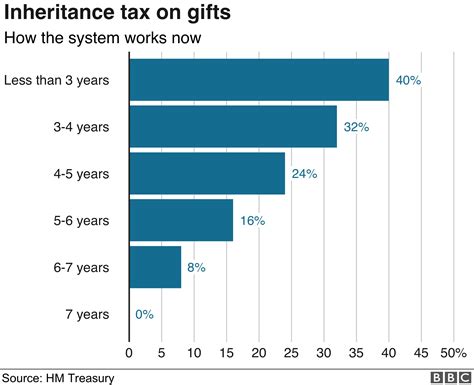

The inheritance tax rates and exemptions vary significantly among these states. For example, Iowa's inheritance tax ranges from 5% to 15%, with exemptions for lineal descendants and spouses. In contrast, New York's inheritance tax ranges from 3.5% to 16%, but it applies to a broader range of beneficiaries, including siblings and cousins.

By analyzing the experiences and policies of these states, North Carolina can gain insights into the potential benefits and challenges of implementing an inheritance tax. It allows policymakers and stakeholders to make informed decisions based on real-world examples and data.

Conclusion and Expert Insights

The absence of an inheritance tax in North Carolina offers both advantages and challenges for beneficiaries and the state as a whole. While it simplifies estate administration and preserves wealth for heirs, it also raises questions about the distribution of resources and the state’s ability to provide for its residents. As the state’s economic and social landscape evolves, ongoing evaluation and discussion of inheritance tax policies are essential to ensure a fair and sustainable future.

FAQ

Are there any other taxes that impact estates in North Carolina?

+Yes, North Carolina imposes income tax on estates, which applies to the taxable portion of an estate’s income. Additionally, there is a sales and use tax that can impact certain asset purchases within the state. It’s important to consult with tax professionals to understand the specific tax implications for your situation.

How does the absence of an inheritance tax in North Carolina affect beneficiaries financially?

+The absence of an inheritance tax means that beneficiaries can receive their inheritance in full, without any deductions for tax purposes. This can be financially beneficial, especially for those relying on inheritance for major life goals or financial security. However, it’s important to consider other state and federal taxes that may apply.

What are some potential implications of implementing an inheritance tax in North Carolina?

+Implementing an inheritance tax could generate revenue for the state, which could be allocated towards public initiatives. It may also address wealth inequality and improve access to opportunities for marginalized communities. However, it could introduce administrative complexities and potentially impact the state’s attractiveness to businesses and investors.

How do North Carolina’s inheritance tax policies compare to other states?

+North Carolina is among the majority of states that do not impose an inheritance tax. However, some states, like Iowa and New York, have implemented inheritance taxes with varying rates and exemptions. Analyzing these states’ experiences can provide valuable insights for North Carolina’s potential policy changes.