Utah State Tax Refund

In the state of Utah, tax refunds are an essential aspect of the financial landscape, impacting residents and businesses alike. Understanding the Utah State Tax Refund process is crucial for individuals and businesses to ensure they receive their rightful returns and navigate the tax system effectively.

Understanding the Utah State Tax Refund System

Utah’s tax system is designed to generate revenue for the state while providing relief to taxpayers through refunds. The process of claiming and receiving tax refunds in Utah is straightforward and well-defined, ensuring that taxpayers can access their funds efficiently.

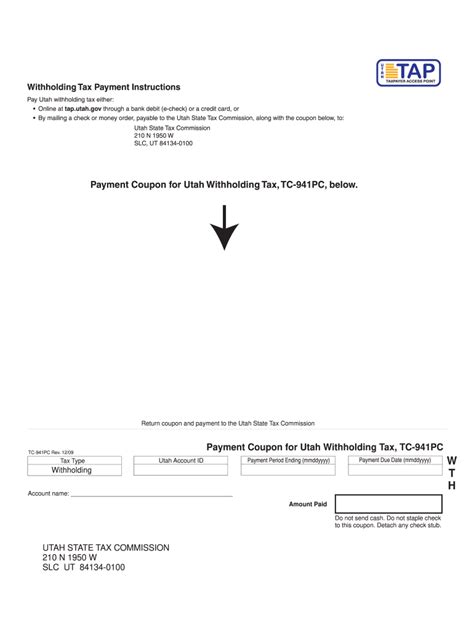

The Utah State Tax Commission is the primary authority responsible for managing tax refunds. They oversee the entire process, from tax filing to refund disbursement. The commission's website provides comprehensive information on tax laws, filing requirements, and refund status updates, making it a valuable resource for taxpayers.

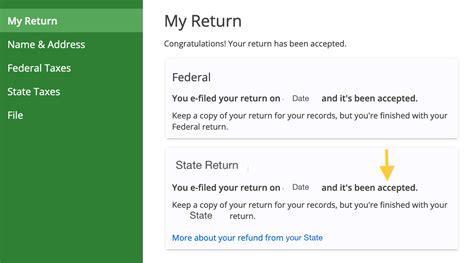

Taxpayers in Utah have the option to file their taxes electronically or through traditional paper methods. Electronic filing is encouraged as it simplifies the process and often results in faster refunds. The state offers a user-friendly online platform for e-filing, ensuring a smooth and secure experience.

Eligibility and Timing

To be eligible for a tax refund in Utah, individuals must have overpaid their taxes during the tax year. This overpayment can occur due to various reasons, including excess tax withholding, claiming certain deductions or credits, or simply having more income than expected. Businesses may also be eligible for refunds if they have overpaid their corporate taxes.

The timing of tax refunds in Utah is generally prompt, with the state aiming to process refunds within 45 days of receiving the tax return. However, the actual time it takes for a refund to reach the taxpayer can vary depending on several factors, including the method of filing and payment.

| Filing Method | Estimated Refund Time |

|---|---|

| Electronic Filing with Direct Deposit | 2-3 weeks |

| Electronic Filing with Paper Check | 3-4 weeks |

| Paper Filing | 6-8 weeks |

It's important to note that these are estimated timelines, and delays can occur due to various reasons, such as errors in the tax return, additional documentation requirements, or high volumes during peak tax seasons.

Refund Options and Preferences

Utah taxpayers have the flexibility to choose how they receive their tax refunds. The state offers multiple refund options to cater to different preferences and financial needs.

- Direct Deposit: This is the fastest and most convenient method, allowing taxpayers to have their refunds directly deposited into their bank accounts. It eliminates the wait for a paper check and reduces the risk of loss or theft.

- Paper Check: For those who prefer a traditional approach, a paper check can be mailed to the taxpayer's address. This option is suitable for individuals without direct deposit capabilities or those who prefer a physical record of their refund.

- Utah Savings: Utah has introduced a unique refund option called Utah Savings, which allows taxpayers to contribute all or a portion of their refund to a designated savings account. This encourages financial planning and provides an opportunity to build wealth over time.

The Utah Savings option is particularly beneficial for individuals who struggle with managing their finances and want to develop better savings habits. It offers a simple way to save without the need for complex budgeting strategies.

Maximizing Your Utah State Tax Refund

While the primary goal of filing taxes is to fulfill legal obligations, many taxpayers also view it as an opportunity to maximize their refunds. There are several strategies and considerations that Utah residents can employ to ensure they receive the largest possible refund.

Claiming All Eligible Deductions and Credits

Deductions and credits are powerful tools to reduce tax liabilities and increase refunds. Utah offers a range of deductions and credits that taxpayers may be eligible for, including:

- Standard Deduction: Utah allows taxpayers to deduct a standard amount from their taxable income, reducing the overall tax burden.

- Itemized Deductions: Individuals with significant expenses, such as medical costs, charitable donations, or mortgage interest, can itemize their deductions to lower their taxable income further.

- Child and Dependent Care Credit: Taxpayers who incur expenses for childcare or dependent care can claim a credit, providing relief for these costs.

- Education Credits: Utah residents pursuing higher education may be eligible for credits, such as the American Opportunity Credit or the Lifetime Learning Credit, which can significantly impact their tax refunds.

It's crucial to thoroughly review the available deductions and credits and ensure that all eligible expenses are accounted for. Consulting with a tax professional or using tax preparation software can help identify and maximize these opportunities.

Tax Planning and Strategies

Effective tax planning can make a significant difference in the size of your tax refund. Here are some strategies to consider:

- Adjusting Withholding: Review your W-4 form regularly to ensure that the correct amount of tax is being withheld from your paycheck. Adjusting your withholding allowances can help prevent overpaying during the year and maximize your refund.

- Retirement Contributions: Contributing to retirement accounts, such as a 401(k) or IRA, can provide tax benefits. These contributions are typically deducted from your taxable income, reducing your tax liability and potentially increasing your refund.

- Business Expenses: If you operate a business, carefully track and document all eligible expenses. These expenses can be deducted to reduce your business income and, consequently, your tax liability.

- Tax Software or Professional Assistance: Utilizing tax preparation software or seeking the expertise of a tax professional can help identify deductions and credits you may have overlooked. They can provide valuable insights and ensure your tax return is optimized for the highest refund.

Common Misconceptions and Challenges

Despite the relatively straightforward process, there are some common misconceptions and challenges that taxpayers may encounter when dealing with Utah State Tax Refunds.

Misconception: Refunds are Guaranteed

One common misconception is that taxpayers are always entitled to a refund. While overpayment of taxes often results in a refund, it’s not a guarantee. Taxpayers may owe additional taxes if their income or circumstances change, or if they fail to claim all eligible deductions and credits.

It's essential to carefully review your tax return and ensure accuracy to avoid any unexpected tax liabilities.

Challenges with Refund Delays

While Utah aims for prompt refund processing, delays can occur due to various reasons. Some common challenges include:

- Error Correction: If errors are detected in the tax return, the processing time may be extended as the tax authority works to rectify the issues.

- Identity Verification: In cases where there are concerns about identity theft or fraudulent activity, the tax authority may implement additional security measures, leading to delays in refund disbursement.

- High Volume During Peak Seasons: During the traditional tax filing season (January to April), the tax authority experiences a surge in tax returns. This increased workload can sometimes result in longer processing times.

To mitigate these challenges, it's advisable to file your tax return as early as possible and ensure accuracy to reduce the likelihood of errors or delays.

Future Implications and Developments

As technology advances and tax systems evolve, Utah is continuously exploring ways to improve its tax refund process. Here are some potential future developments and their implications:

Enhanced Electronic Filing

Utah is likely to further enhance its electronic filing system, making it even more user-friendly and accessible. This could include integrating new technologies, such as mobile apps, to simplify the filing process and provide real-time updates on refund status.

Expansion of Refund Options

The state may consider introducing additional refund options to cater to a wider range of taxpayer preferences. For instance, the option to contribute refunds to investment accounts or charity could be explored, providing taxpayers with more flexibility and opportunities for financial growth or charitable contributions.

Improved Taxpayer Education

To empower taxpayers and ensure they receive the maximum benefit from the tax system, Utah may invest in improving taxpayer education. This could involve developing comprehensive online resources, hosting workshops or webinars, and providing personalized tax planning guidance to help residents make informed decisions.

Frequently Asked Questions

How long does it typically take to receive a tax refund in Utah?

+

The typical processing time for tax refunds in Utah is 45 days. However, the actual time can vary based on filing method and other factors. Electronic filing with direct deposit is the fastest option, taking approximately 2-3 weeks.

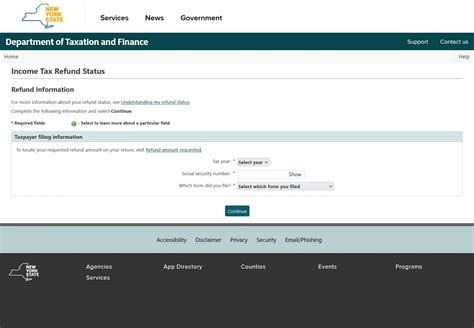

Can I check the status of my Utah State Tax Refund online?

+

Yes, you can check the status of your refund online through the Utah State Tax Commission’s website. Simply visit the website, navigate to the refund status page, and enter your personal information to track the progress of your refund.

What happens if I move to a different state during the tax year? Will it affect my Utah tax refund?

+

If you move to a different state during the tax year, it can indeed impact your Utah tax refund. You will need to file taxes in both states, reporting your income and deductions for the period you resided in each state. The tax authorities will determine your eligibility for refunds based on your specific circumstances.

Can I receive my Utah State Tax Refund through a prepaid debit card?

+

No, Utah does not offer the option to receive tax refunds through prepaid debit cards. The state provides refund options such as direct deposit or paper check, allowing taxpayers to choose the method that best suits their needs.

Are there any penalties for claiming incorrect information on my tax return, even if it results in a larger refund?

+

Yes, intentionally claiming incorrect information on your tax return can lead to serious penalties. The tax authorities have systems in place to detect errors and inconsistencies. If they identify any inaccuracies, they may impose fines, penalties, or even pursue legal action. It’s crucial to ensure the accuracy of your tax return to avoid any legal consequences.