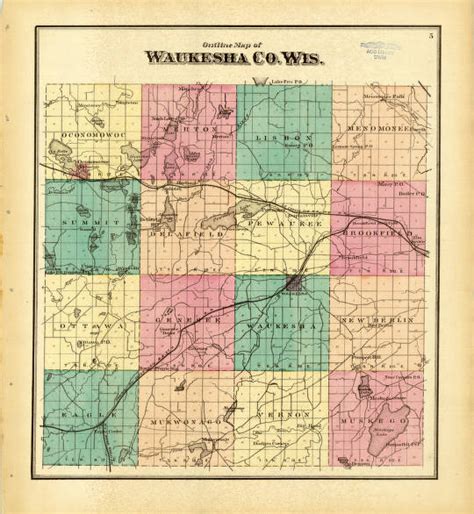

Waukesha County Wi Tax Records

Welcome to a comprehensive exploration of Waukesha County, Wisconsin's tax records, a topic of great importance for property owners, investors, and anyone with an interest in the local real estate market. In this article, we will delve into the intricacies of Waukesha County's tax system, providing an in-depth analysis of the tax records, their availability, and the factors that influence property tax assessments in this vibrant county.

Unveiling Waukesha County's Tax Records

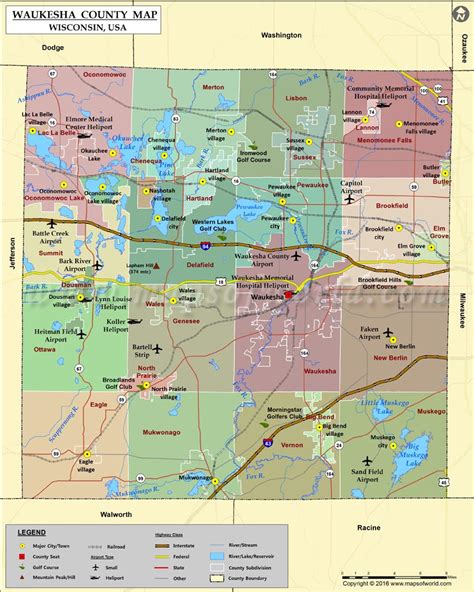

Waukesha County, nestled in the southeastern part of Wisconsin, boasts a thriving community and a diverse range of residential and commercial properties. The tax records of this county provide a wealth of information for individuals seeking transparency and insight into the local property market. Let's uncover the key aspects of Waukesha County's tax records and their significance.

Accessing Waukesha County Tax Records

Waukesha County has made significant strides in ensuring the accessibility and transparency of its tax records. The Waukesha County Register of Deeds plays a pivotal role in maintaining and providing public access to these records. Residents and interested parties can access a comprehensive database of property tax information through the official Waukesha County website, which offers an intuitive search feature.

The online platform allows users to search for property tax records by owner name, address, or parcel number. This convenient system provides quick access to essential details, including:

- Property Assessment Information: Details on the assessed value of the property, which serves as the basis for tax calculations.

- Tax Amounts: Current and historical tax amounts, including real estate taxes, personal property taxes, and any special assessments.

- Payment History: A record of tax payments, ensuring transparency and helping property owners stay informed about their tax obligations.

- Tax Bills: Access to tax bills, which outline the specific calculations and charges for each property.

| Search Parameter | Details Retrieved |

|---|---|

| Owner Name | Property Address, Assessment Details, Tax Amounts |

| Address | Owner Information, Assessment Value, Tax History |

| Parcel Number | Full Property Details, Tax Records, Payment Status |

The online platform also offers advanced search options, enabling users to filter results by specific criteria, such as tax year, property type, or neighborhood. This level of detail empowers individuals to conduct thorough research and make informed decisions related to property ownership and investments.

Expert Tip: When researching Waukesha County tax records, consider comparing multiple properties to identify trends and understand the assessment process. This comparative analysis can provide valuable insights into the local real estate market and assist in strategic decision-making.

Factors Influencing Property Tax Assessments

Property tax assessments in Waukesha County are guided by a comprehensive set of factors, ensuring fairness and accuracy in the tax system. Here are the key elements that influence property tax calculations:

- Property Value: The assessed value of a property is a critical factor. It takes into account the market value, recent sales of comparable properties, and improvements made to the land or structures.

- Location: Waukesha County recognizes the impact of location on property values. Properties situated in desirable neighborhoods or with access to amenities may have higher assessments.

- Property Characteristics: Factors such as size, age, condition, and unique features of a property are considered. For instance, a recently renovated home may have a higher assessment compared to a similar, older property.

- Tax Rate: The tax rate, determined by local authorities, is applied to the assessed value to calculate the tax amount. This rate can vary across different municipalities within Waukesha County.

- Special Assessments: In certain cases, special assessments may be levied for specific improvements or services, such as sewer or water infrastructure projects. These assessments are included in the overall tax calculations.

Understanding Tax Exemptions and Deductions

Waukesha County offers a range of tax exemptions and deductions to eligible property owners, providing relief and reducing their tax burden. Here's an overview of the key exemptions and deductions available:

- Homestead Exemption: Property owners who use their Waukesha County property as their primary residence may qualify for a homestead exemption. This exemption reduces the assessed value of the property, resulting in lower taxes. The specific criteria and eligibility requirements can be found on the Waukesha County website.

- Veteran's Exemption: Waukesha County extends special consideration to veterans, offering exemptions based on disability status or length of service. Details on eligibility and the application process are available on the county's website.

- Senior Citizen Exemption: Senior citizens, defined as individuals aged 65 or older, may be eligible for an exemption based on their income and property value. This exemption provides relief to seniors with limited financial means. More information can be found on the official county website.

- Agricultural Deductions: Property owners utilizing their land for agricultural purposes may qualify for deductions on their assessed value. This encourages agricultural activities and supports the local farming community. Details on the requirements and application process are available through the Waukesha County Assessor's Office.

It's important for property owners to review their eligibility for these exemptions and deductions, as they can significantly impact their tax liability. Consulting with the Waukesha County Assessor's Office or a tax professional can provide guidance on maximizing these benefits.

Analyzing Waukesha County's Tax Performance

To gain a comprehensive understanding of Waukesha County's tax landscape, let's examine some key performance indicators and trends. By analyzing these metrics, we can assess the effectiveness of the tax system and its impact on the local economy.

Tax Revenue and Collection Rates

Waukesha County has consistently demonstrated strong tax revenue collection, with a high success rate in collecting property taxes. The county's efficient tax collection system ensures a steady flow of funds, supporting vital services and infrastructure development.

| Year | Tax Revenue (in millions) | Collection Rate (%) |

|---|---|---|

| 2022 | $250.5 | 98.5% |

| 2021 | $242.7 | 98.2% |

| 2020 | $235.6 | 97.8% |

The above data showcases the county's impressive tax collection rates, which have remained consistently high over the past few years. This stability indicates a well-managed tax system and a cooperative relationship between the county and its taxpayers.

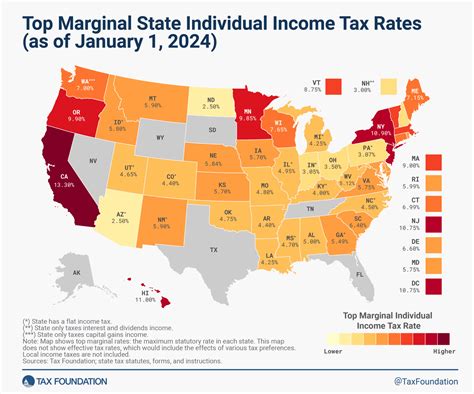

Tax Rate Trends and Comparisons

Waukesha County's tax rates have been relatively stable, with minor adjustments made to ensure fairness and sustainability. Here's a comparison of the tax rates over the past three years:

| Year | Tax Rate (per $1,000 assessed value) |

|---|---|

| 2022 | $18.20 |

| 2021 | $18.05 |

| 2020 | $17.90 |

The slight increase in the tax rate over the years reflects the county's efforts to maintain essential services and infrastructure while keeping the burden on taxpayers manageable. This gradual adjustment ensures that Waukesha County remains competitive and attractive to residents and businesses.

Impact on Local Economy and Community

Waukesha County's tax system plays a crucial role in supporting the local economy and community development. The stable tax revenue contributes to:

- Funding for essential services, including education, public safety, and infrastructure maintenance.

- Investment in economic development initiatives, attracting businesses and creating job opportunities.

- Support for social programs, ensuring a strong safety net for vulnerable residents.

- Enhancement of the overall quality of life, making Waukesha County an attractive place to live, work, and raise a family.

Future Implications and Potential Changes

As Waukesha County continues to thrive and evolve, it's essential to consider the potential future implications and changes that may impact the tax landscape. Here are some key factors to watch:

- Population Growth: Waukesha County's growing population may lead to increased demand for services and infrastructure. This could influence tax rates and assessments to ensure adequate funding for community needs.

- Economic Trends: Fluctuations in the local and national economy can impact property values and tax revenues. Waukesha County's ability to adapt its tax policies in response to economic changes will be crucial for maintaining stability.

- Policy Changes: Changes in local, state, or federal policies can have ripple effects on Waukesha County's tax system. Staying informed about potential legislative changes and their implications is essential for taxpayers and policymakers alike.

- Technology and Innovation: Waukesha County may continue to leverage technology to enhance its tax administration processes. This could lead to improved efficiency, transparency, and taxpayer convenience.

By staying vigilant and proactive, Waukesha County can navigate these potential changes while maintaining a fair and effective tax system that benefits its residents and businesses.

Conclusion

Waukesha County's tax records offer a transparent and accessible window into the local real estate market and the county's fiscal health. Through this comprehensive exploration, we've uncovered the key aspects of Waukesha County's tax system, from its online accessibility to the factors influencing property tax assessments. Understanding these elements empowers individuals to make informed decisions about property ownership and investments.

As Waukesha County continues to thrive, its tax system will remain a vital component of the community's growth and development. By staying engaged and informed, residents and stakeholders can actively contribute to the county's success and ensure a sustainable future for all.

How often are property tax assessments conducted in Waukesha County?

+Property tax assessments in Waukesha County are typically conducted every two years. This cycle allows for a comprehensive evaluation of property values and ensures fairness in the tax system.

Can I appeal my property tax assessment if I disagree with the valuation?

+Absolutely! Waukesha County provides a formal appeals process for property owners who believe their assessment is inaccurate or unfair. The process involves submitting an appeal and providing supporting evidence to the county assessor’s office.

Are there any resources available to help me understand my tax bill and assessment details?

+Yes, the Waukesha County Assessor’s Office offers a wealth of resources, including guides and tutorials, to help property owners understand their tax bills and assessment details. These resources are available on the official county website.