Dc Tax Percentage

The District of Columbia (DC), the vibrant heart of the United States, boasts a unique tax system that plays a crucial role in its economic landscape. This article delves into the intricacies of the DC tax structure, specifically focusing on the tax percentages, and provides an in-depth analysis of how these rates impact the city's residents and businesses.

Understanding DC’s Tax Structure

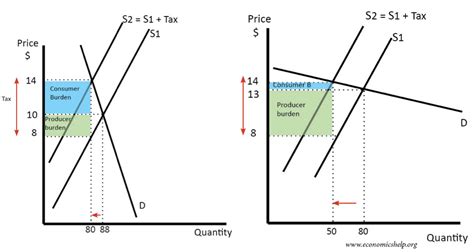

DC’s tax system is a complex framework designed to fund the city’s operations and services. It comprises a range of taxes, including income tax, sales tax, property tax, and various other levies. The tax rates are a key component of this system, determining the financial obligations of individuals and entities residing or operating within the district.

Income Tax Rates

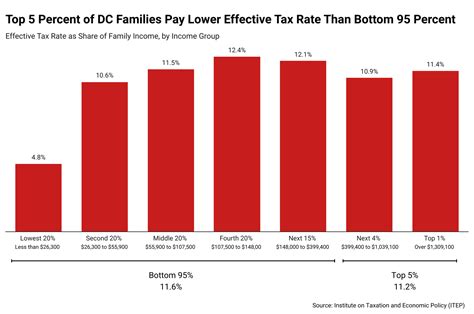

The income tax is a significant source of revenue for DC. The district employs a progressive tax system, meaning that higher incomes are taxed at higher rates. This structure ensures that those with greater financial means contribute proportionally more to the city’s budget. The income tax rates are categorized into brackets, and the applicable rate depends on an individual’s or household’s total taxable income.

| Tax Bracket | Tax Rate |

|---|---|

| Up to 10,000</td> <td>2.75%</td> </tr> <tr> <td>10,001 - 40,000</td> <td>4.00%</td> </tr> <tr> <td>40,001 - 60,000</td> <td>6.00%</td> </tr> <tr> <td>60,001 and above | 8.50% |

Sales and Use Tax

DC imposes a sales and use tax on most tangible personal property and certain services. This tax is typically paid by the purchaser at the point of sale and is included in the displayed price. The standard sales tax rate is 6%, which is applied to a wide range of goods and services.

However, certain items are exempt from sales tax, including most groceries, prescription drugs, and certain clothing items. Additionally, DC offers tax incentives for specific purchases, such as the Retailer Energy Efficiency Tax Credit, which provides a credit for the purchase of energy-efficient appliances.

Property Tax

The property tax in DC is levied on real estate properties, including residential, commercial, and industrial properties. The tax rate is determined by the assessed value of the property and can vary significantly depending on the neighborhood and type of property.

DC’s property tax system aims to encourage homeownership by offering various exemptions and tax relief programs. For instance, the Homestead Deduction reduces the taxable value of a homeowner’s primary residence, providing a financial benefit to those who live in the district.

Impact on Residents and Businesses

DC’s tax structure significantly influences the financial landscape for both residents and businesses. The progressive income tax, for instance, ensures that higher-income individuals contribute more to the city’s revenue, fostering a sense of shared responsibility. This system can also encourage businesses to offer competitive salaries, as the tax structure may impact an employee’s take-home pay.

Attracting and Retaining Talent

DC’s tax rates, particularly the income tax, can be a consideration for individuals when choosing where to live and work. While the city offers a vibrant cultural and professional environment, the tax rates might factor into an individual’s decision-making process. Businesses, therefore, may need to offer attractive compensation packages to attract and retain top talent.

Economic Growth and Development

The tax revenue generated by DC’s progressive tax structure funds a wide range of public services and infrastructure projects. This includes education, transportation, public safety, and other essential services. The tax system, therefore, plays a pivotal role in shaping the city’s economic growth and development trajectory.

Moreover, the tax incentives and credits offered by DC can attract new businesses and encourage existing ones to expand. For instance, the DC Business Tax Relief Program provides tax credits to eligible businesses, helping to offset their tax liability and promote economic growth.

Comparative Analysis: DC vs. Neighboring Jurisdictions

When examining DC’s tax structure, it’s beneficial to compare it to those of neighboring jurisdictions, such as Maryland and Virginia. This analysis provides context for understanding the uniqueness of DC’s tax rates and their potential impact on residents and businesses.

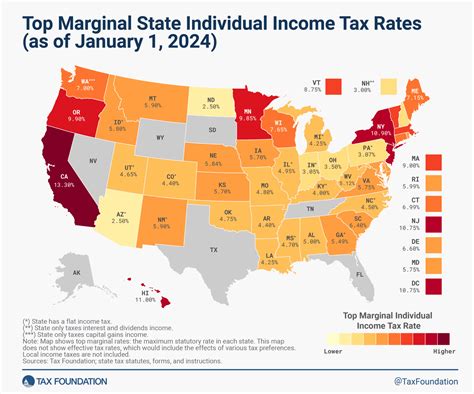

Income Tax Comparison

DC’s income tax rates are generally higher than those in Maryland and Virginia. While DC has a flat rate of 8.50% for incomes above $60,000, Maryland’s top rate is 5.75%, and Virginia’s is 5.75% as well. This can make DC less attractive to high-income earners who might consider moving to neighboring states to reduce their tax burden.

Sales Tax Comparison

DC’s sales tax rate of 6% is relatively competitive when compared to its neighbors. Maryland’s sales tax rate is 6%, while Virginia has a lower rate of 4.3%. However, it’s important to note that DC offers more tax exemptions and incentives, which can offset the higher rate for certain purchases.

Property Tax Comparison

DC’s property tax rates can be quite high compared to those in Maryland and Virginia, especially for commercial and industrial properties. This can make DC a less desirable location for businesses looking to establish or expand operations. However, the city’s tax incentives and relief programs can help mitigate these high rates for certain property types.

Conclusion: Navigating DC’s Tax Landscape

DC’s tax structure is a multifaceted system that plays a crucial role in the city’s economic health and growth. The tax rates, particularly the progressive income tax, sales tax, and property tax, have a significant impact on residents and businesses. Understanding these rates and their implications is essential for individuals and entities operating within the district.

While DC’s tax rates can be higher than those in neighboring jurisdictions, the city offers a unique blend of urban culture, professional opportunities, and public services. The tax revenue generated funds essential services and infrastructure, contributing to the overall well-being and development of the district. For those navigating DC’s tax landscape, it’s important to stay informed about the latest tax rates, incentives, and exemptions to make informed financial decisions.

What is the DC income tax rate for 2023?

+For the tax year 2023, DC’s income tax rates range from 2.75% for incomes up to 10,000 to 8.50% for incomes above 60,000. These rates are subject to change, so it’s advisable to check the official DC government website for the most current information.

Are there any tax incentives for businesses in DC?

+Yes, DC offers various tax incentives to attract and support businesses. These include the DC Business Tax Relief Program, which provides tax credits to eligible businesses, and the Retailer Energy Efficiency Tax Credit, which offers a credit for the purchase of energy-efficient appliances. There are also tax incentives for certain industries, such as the biotechnology sector.

How does DC’s sales tax compare to other states?

+DC’s sales tax rate of 6% is relatively competitive compared to some other states. For instance, Maryland also has a 6% rate, while Virginia has a lower rate of 4.3%. However, DC offers more tax exemptions and incentives, which can make it more favorable for certain purchases.