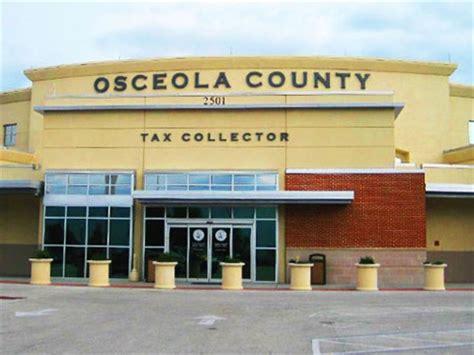

Tax Collector Osceola County

In Osceola County, Florida, the role of the Tax Collector is a crucial position that plays a vital role in the financial management and operations of the county. The Tax Collector's Office serves as a key hub for various essential services and is responsible for efficiently collecting and managing taxes and fees that fund numerous vital services and infrastructure projects within the community.

The Vital Role of the Tax Collector in Osceola County

The Tax Collector in Osceola County is an elected official, responsible for the fair and efficient collection of taxes and fees mandated by local, state, and federal governments. This role extends beyond mere revenue collection; it is a position of trust and accountability, ensuring that the financial obligations of residents and businesses are met accurately and in a timely manner. The office’s responsibilities encompass a wide range of services, including the collection of property taxes, motor vehicle registration fees, driver’s license-related fees, hunting and fishing licenses, and other related services.

The Tax Collector's Office in Osceola County is committed to providing exceptional service to the community. It aims to simplify the tax payment process, making it as convenient and accessible as possible for taxpayers. This includes offering various payment methods, such as online payment portals, walk-in services, and mobile apps, to cater to the diverse needs of the county's residents.

Furthermore, the office is dedicated to educating taxpayers about their financial obligations and providing resources to help them understand the tax system. This proactive approach fosters a culture of financial responsibility and ensures that taxpayers are well-informed about their rights and the importance of timely tax payments.

Key Responsibilities and Services Offered

- Property Tax Collection: The Tax Collector’s Office is responsible for collecting property taxes, which are a significant source of revenue for the county. This involves assessing property values, issuing tax bills, and ensuring timely payments. The office also provides resources to help property owners understand the assessment process and their tax obligations.

- Motor Vehicle Services: Osceola County’s Tax Collector’s Office handles motor vehicle registration and titling, including the issuance of vehicle registrations, titles, and license plates. They also process title transfers, issue replacement tags, and handle specialty plate requests. The office ensures that all motor vehicle-related fees are collected and processed efficiently.

- Driver’s License Services: In collaboration with the Florida Department of Highway Safety and Motor Vehicles (FLHSMV), the Tax Collector’s Office provides driver’s license-related services. This includes issuing and renewing driver’s licenses, processing identification cards, and conducting written and vision tests for new license applicants.

- Hunting and Fishing Licenses: The office also plays a role in conserving natural resources by issuing hunting and fishing licenses. These licenses are crucial for funding conservation efforts and ensuring sustainable use of the county’s natural environment. The Tax Collector’s Office ensures that hunters and anglers have the necessary licenses to engage in these activities responsibly.

- Other Services: In addition to the above, the Tax Collector’s Office offers a range of other services, such as tax certificate sales, tax deed applications, and the collection of various local government fees. They also provide assistance with tax exemptions and discounts for eligible individuals, ensuring that all residents have access to the benefits they are entitled to.

| Service | Description |

|---|---|

| Property Tax Collection | Assess and collect property taxes, provide tax bill payments, and offer resources for understanding assessments. |

| Motor Vehicle Services | Process vehicle registrations, titles, and license plates, handle transfers and replacements, and manage specialty plate requests. |

| Driver's License Services | Issue and renew driver's licenses, process ID cards, and conduct written and vision tests in collaboration with FLHSMV. |

| Hunting and Fishing Licenses | Issue hunting and fishing licenses to fund conservation efforts and ensure responsible outdoor activities. |

| Additional Services | Tax certificate sales, tax deed applications, local government fee collection, and assistance with tax exemptions and discounts. |

The Impact of the Tax Collector’s Office on the Community

The Tax Collector’s Office in Osceola County has a profound impact on the community’s overall well-being and development. The taxes and fees collected by the office are essential for funding a wide array of public services and infrastructure projects. These funds are vital for maintaining and improving the county’s roads, bridges, and other transportation infrastructure, ensuring safe and efficient travel for residents and visitors alike.

Furthermore, the revenue generated supports critical public safety initiatives, including law enforcement, fire protection, and emergency medical services. This ensures that the community remains safe and secure, with prompt and effective response to emergencies. The office's contributions also extend to funding for schools and education, helping to provide quality educational opportunities for the county's youth.

In addition to these essential services, the Tax Collector's Office plays a crucial role in economic development. By facilitating business registrations and licenses, the office supports local entrepreneurs and businesses, fostering a vibrant and thriving business environment. This, in turn, leads to job creation and economic growth, benefiting the entire community.

Community Engagement and Outreach

Beyond its core responsibilities, the Tax Collector’s Office actively engages with the community to promote financial literacy and awareness. They organize educational workshops and seminars to help residents understand their tax obligations and financial rights. These initiatives empower individuals to make informed financial decisions and actively participate in the county’s economic life.

The office also partners with local organizations and charities to support community initiatives. By participating in charity events and donating a portion of their proceeds, they demonstrate their commitment to giving back to the community. This fosters a sense of trust and goodwill, solidifying the office's role as a trusted partner in the community's development.

In conclusion, the Tax Collector's Office in Osceola County is a vital institution that goes beyond mere tax collection. It serves as a crucial link between the community and the government, ensuring that the county's financial obligations are met while also contributing to the growth and prosperity of the region. Through its commitment to efficient service, community engagement, and support for local initiatives, the Tax Collector's Office plays a pivotal role in shaping the future of Osceola County.

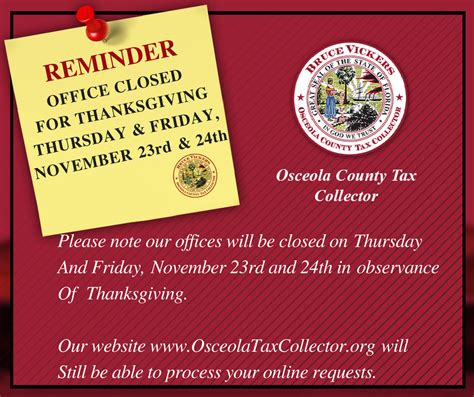

What are the office hours of the Tax Collector’s Office in Osceola County?

+

The Tax Collector’s Office in Osceola County is open from Monday to Friday, 8:30 AM to 4:30 PM. These hours are subject to change, so it is advisable to check the official website or contact the office directly for the most up-to-date information.

How can I pay my property taxes in Osceola County?

+

Osceola County offers several convenient methods to pay your property taxes. You can pay online through the official tax collector website, by phone, or in person at any of the Tax Collector’s Office locations. Additionally, you can set up automatic payments or pay by mail using the provided remittance slip.

What are the requirements for obtaining a hunting license in Osceola County?

+

To obtain a hunting license in Osceola County, you must be at least 16 years old and possess a valid Florida driver’s license or ID card. You will need to complete a hunter safety course and pass a written test. The Tax Collector’s Office can provide more detailed information and assist you with the application process.

Can I renew my driver’s license online in Osceola County?

+

Yes, Osceola County offers online renewal for driver’s licenses. You can visit the official FLHSMV website or the Tax Collector’s Office website to renew your license. However, certain restrictions apply, such as age limits and the need to provide valid identification documents. It is recommended to check the eligibility criteria before attempting an online renewal.

How often do I need to renew my vehicle registration in Osceola County?

+

Vehicle registrations in Osceola County typically need to be renewed annually. The exact renewal date is based on the month and year indicated on your registration card. It is important to renew your registration on time to avoid late fees and maintain valid registration status. The Tax Collector’s Office will send a renewal notice before the expiration date to remind you.