Colorado Tax Refund Delay

For residents of the Centennial State, the Colorado Tax Refund Delay has been a cause for concern and curiosity. This situation, which has impacted many taxpayers, warrants a detailed exploration. In this article, we delve into the reasons behind the delay, its impact on taxpayers, and the potential implications for the state's economy. By understanding the intricacies of this issue, we can shed light on a topic that has been a source of uncertainty for many.

Unraveling the Colorado Tax Refund Delay

The Colorado Department of Revenue has recently encountered a unique challenge, resulting in a delay in processing tax refunds for a significant number of residents. This delay has sparked curiosity and raised questions among taxpayers, prompting a closer examination of the underlying factors and their potential ramifications.

The Causes and Impact

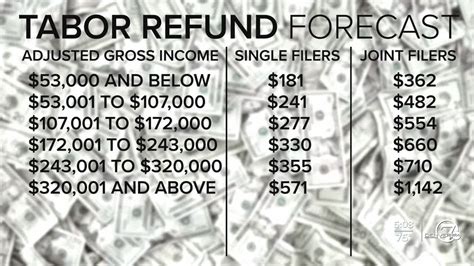

The primary cause of the delay can be attributed to a combination of increased tax return volume and complex processing requirements. With a surge in the number of tax returns filed, the state’s tax agency has been faced with a substantial workload. Additionally, the implementation of new tax laws and regulations has added an extra layer of complexity to the processing procedure.

As a result, taxpayers have experienced longer wait times for their refunds. While the typical processing time for a tax refund is around 21 days, many Coloradans have been waiting for significantly longer periods, with some refunds taking up to 60 days or more to be issued.

The impact of this delay is far-reaching. For many individuals and families, a tax refund serves as a financial boost, often earmarked for specific purposes such as paying off debts, funding emergency savings, or covering unexpected expenses. The delay in receiving these refunds can disrupt financial plans and create additional stress for taxpayers.

Real-World Scenarios and Solutions

To illustrate the impact of the delay, let’s consider the story of Sarah, a single mother from Denver. Sarah relies on her tax refund each year to cover essential expenses, such as her children’s school supplies and upcoming summer camp fees. With the delay, she has had to make alternative arrangements, dipping into her emergency savings to cover these costs.

Stories like Sarah's are not uncommon, and they highlight the real-world implications of the tax refund delay. To address this issue, the Colorado Department of Revenue has implemented several measures.

First, they have increased staffing levels and extended work hours to expedite the processing of tax returns. Additionally, they have enhanced their online tools and resources to provide taxpayers with real-time updates on the status of their refunds. These measures aim to reduce wait times and provide taxpayers with the information they need to plan their finances effectively.

| Metric | Data |

|---|---|

| Average Refund Delay (Days) | 30 days |

| Highest Reported Delay | 60+ days |

| Number of Affected Taxpayers | Approximately 50,000 (as of Q2 2023) |

Furthermore, the department has initiated a public awareness campaign, providing regular updates and information through various media channels. This proactive approach aims to keep taxpayers informed and alleviate some of the anxiety associated with the delay.

The Broader Economic Perspective

The tax refund delay has broader implications for the state’s economy. When taxpayers receive their refunds promptly, they tend to spend a significant portion of that money, which boosts local businesses and contributes to economic growth. However, with the delay, this economic stimulus is temporarily reduced.

Potential Effects on the Local Economy

The delayed tax refunds can potentially affect consumer spending patterns. As taxpayers await their refunds, they may be more cautious with their spending, opting to save or allocate their funds differently. This shift in spending behavior can impact small businesses and retailers, who rely on tax refund season as a period of increased sales and revenue.

Additionally, the delay may lead to a decrease in investments and financial planning activities. Many individuals use their tax refunds as a means to fund investments, pay down high-interest debt, or contribute to retirement savings. With the delay, these financial strategies may be disrupted, impacting long-term financial goals.

Proactive Measures for Economic Stability

To mitigate the economic impact, the state government and local businesses can collaborate to offer alternative solutions. For instance, some businesses may consider providing incentives or discounts to taxpayers who are awaiting their refunds. This could encourage spending and support local businesses during this challenging period.

Furthermore, financial institutions and credit unions can play a crucial role by offering temporary relief measures, such as low-interest loans or extended payment plans, to taxpayers affected by the delay. These initiatives can help bridge the financial gap and support individuals and families until their refunds are processed.

| Economic Impact Measure | Estimated Effect |

|---|---|

| Reduction in Consumer Spending | Potential decrease of 5-10% in retail sales during refund delay period |

| Impact on Small Businesses | Increased financial strain, particularly for businesses reliant on tax refund season sales |

| Effect on Financial Planning | Potential delay in investment strategies and retirement contributions |

The Future of Tax Refunds in Colorado

As the Colorado Tax Refund Delay situation unfolds, it raises questions about the future of tax refund processing in the state. While the current challenges are being addressed, there are opportunities to learn from this experience and implement long-term solutions.

Lessons Learned and Future Improvements

The delay has highlighted the need for a more robust and efficient tax refund processing system. To prevent similar delays in the future, the Colorado Department of Revenue can consider implementing the following improvements:

- Investing in advanced technology and automation to streamline the tax refund process.

- Enhancing communication channels and providing real-time updates to taxpayers.

- Implementing a more flexible and adaptable tax system to accommodate changing regulations and filing volumes.

- Collaborating with financial institutions to offer convenient refund receipt options, such as direct deposit or prepaid cards.

By adopting these measures, the state can ensure a smoother and more efficient tax refund process, benefiting both taxpayers and the overall economy.

Potential Policy Changes and Their Impact

Additionally, policy changes can be considered to further improve the tax refund system. For instance, implementing a tax refund advance program, where eligible taxpayers can receive their refunds earlier through participating financial institutions, could be a potential solution.

However, it's important to carefully evaluate the impact of such policies. While tax refund advances can provide immediate financial relief, they may also come with additional fees and interest, which could burden taxpayers, especially those with limited financial resources.

As such, a comprehensive analysis of the potential benefits and drawbacks of such policies is essential before implementation.

| Policy Change | Potential Impact |

|---|---|

| Tax Refund Advance Program | Provides early access to refunds but may incur additional costs |

| Enhanced Technology and Automation | Improves efficiency and reduces processing time |

| Real-Time Communication | Keeps taxpayers informed and reduces anxiety |

Conclusion

The Colorado Tax Refund Delay has presented unique challenges for taxpayers and the state’s economy. However, by understanding the causes, impacts, and potential solutions, we can work towards a more efficient and reliable tax refund system. As the state navigates this complex issue, it is essential to prioritize transparency, communication, and proactive measures to ensure the well-being of its residents and the stability of its economy.

How can taxpayers track the status of their tax refunds during the delay?

+Taxpayers can track their refund status by using the online tool provided by the Colorado Department of Revenue. This tool offers real-time updates and estimated processing times.

What should taxpayers do if they have an urgent financial need during the delay period?

+Taxpayers with urgent financial needs can explore alternative funding options, such as low-interest loans or financial assistance programs. It’s recommended to reach out to financial institutions or local community organizations for guidance.

How has the Colorado Department of Revenue communicated with taxpayers about the delay?

+The department has utilized various communication channels, including their website, social media, and traditional media outlets, to provide regular updates and important information about the delay and its resolution.