Big Beautiful Bill Child Tax Credit

The Child Tax Credit (CTC) has been a cornerstone of the United States' social safety net, offering financial support to families with children. Among the various forms of government assistance, the CTC has gained prominence, particularly with the introduction of the Big Beautiful Bill, which aims to make a significant impact on the lives of American families.

This comprehensive guide delves into the Big Beautiful Bill Child Tax Credit, exploring its origins, key features, and the transformative effects it could have on the financial well-being of families across the nation. By understanding the intricacies of this bill, we can gain insights into its potential to shape the future of child benefits and its role in supporting the next generation.

The Evolution of the Child Tax Credit

The concept of the Child Tax Credit traces its roots back to the late 20th century, with the initial intent of providing tax relief to families with dependent children. Over the years, this credit has undergone significant transformations, evolving from a simple tax deduction to a powerful tool for reducing child poverty and promoting economic stability.

One of the most notable developments was the introduction of the refundable Child Tax Credit, which allows eligible families to receive a refund even if their tax liability is zero. This enhancement ensures that low-income families, who often have little to no tax liability, can still benefit from the credit, providing a much-needed financial boost.

Furthermore, the CTC has been a subject of intense debate and legislative action, with various proposals seeking to expand its reach and effectiveness. These efforts have aimed to increase the credit amount, broaden eligibility criteria, and ensure that more families can access this vital support.

Key Milestones in the CTC's History

The journey of the Child Tax Credit has been marked by several pivotal moments that have shaped its current form and impact:

- 1997: Introduction of the CTC - The CTC was first introduced as a tax credit for families with children, offering a maximum credit of $400 per child.

- 2001: Expansion and Refundability - The Economic Growth and Tax Relief Reconciliation Act expanded the CTC and made it partially refundable, benefiting more low-income families.

- 2017: Tax Cuts and Jobs Act - This act doubled the CTC to $2,000 per child and made significant changes to its structure, including adjustments to the income thresholds.

- 2021: American Rescue Plan - The American Rescue Plan Act temporarily increased the CTC to $3,600 for children under 6 and $3,000 for children aged 6 to 17. It also made the CTC fully refundable and introduced advance payments.

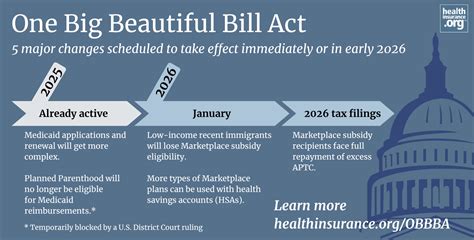

Unveiling the Big Beautiful Bill

The Big Beautiful Bill, officially known as the American Family Act, is a comprehensive piece of legislation that aims to enhance and expand the Child Tax Credit, making it a more effective tool for reducing child poverty and supporting families.

This ambitious bill, if enacted, would bring about several significant changes to the existing CTC, transforming it into a more robust and accessible benefit for millions of American families.

Key Features of the Big Beautiful Bill

The Big Beautiful Bill introduces a range of enhancements to the Child Tax Credit, including:

- Increased Credit Amount - The bill proposes raising the CTC to $3,000 per child for children aged 6 to 17 and $3,600 per child for children under 6. This increase aims to provide a more substantial financial cushion for families.

- Full Refundability - One of the bill's key provisions is making the CTC fully refundable. This means that even families with no tax liability can receive the full credit amount, ensuring that low-income households are not left behind.

- Advance Monthly Payments - The legislation proposes monthly advance payments of the CTC, providing families with regular and predictable financial support throughout the year. This feature can significantly alleviate financial strains and improve household stability.

- Expanded Eligibility - The Big Beautiful Bill seeks to broaden the CTC's reach by increasing the income threshold for eligibility. This change would allow more families, including those with lower incomes, to qualify for the credit, reducing the risk of financial hardship.

The Impact and Benefits

The potential impact of the Big Beautiful Bill on American families is profound and far-reaching. By increasing the CTC amount, making it fully refundable, and offering advance payments, the bill has the power to lift millions of children out of poverty and improve the financial security of families across the nation.

Reducing Child Poverty

One of the most significant outcomes of the Big Beautiful Bill is its potential to reduce child poverty rates. Research suggests that the enhanced CTC could lift approximately 4.1 million children out of poverty, a substantial decrease from the current rates.

By providing a more generous credit and ensuring its availability to low-income families, the bill aims to address one of the most pressing social issues in the United States. This reduction in child poverty can have long-lasting effects on children's health, education, and overall well-being, creating a brighter future for the next generation.

Financial Stability for Families

The monthly advance payments proposed in the Big Beautiful Bill can offer families a much-needed sense of financial stability. With regular and predictable income, families can better manage their budgets, pay for essential expenses, and plan for the future.

This stability can have a ripple effect, improving access to healthcare, education, and nutritious food. Additionally, it can reduce the stress and anxiety associated with financial uncertainty, leading to improved mental health and overall family well-being.

Economic Stimulus

Beyond its direct impact on families, the Big Beautiful Bill has the potential to stimulate the economy. The increased spending power of families receiving the enhanced CTC can lead to a boost in consumer spending, benefiting local businesses and contributing to economic growth.

Moreover, the bill's focus on supporting families with lower incomes can help reduce income inequality, fostering a more equitable society and promoting long-term economic sustainability.

| CTC Enhancement | Potential Impact |

|---|---|

| Increased Credit Amount | Reduces child poverty and provides financial relief to families. |

| Full Refundability | Ensures low-income families receive the full credit, promoting economic inclusion. |

| Advance Monthly Payments | Improves financial stability, reduces stress, and boosts household budgets. |

Frequently Asked Questions

How does the Big Beautiful Bill differ from previous CTC expansions?

+The Big Beautiful Bill builds upon previous CTC expansions by increasing the credit amount, making it fully refundable, and introducing advance monthly payments. It aims to provide more substantial financial support to families and reduce child poverty more effectively.

<div class="faq-item">

<div class="faq-question">

<h3>Who is eligible for the enhanced Child Tax Credit under the Big Beautiful Bill?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>The bill proposes to expand eligibility by increasing the income threshold. Families with lower incomes, including those with no tax liability, would qualify for the full credit amount, ensuring that more children receive the benefits.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How will the advance monthly payments work?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Families eligible for the enhanced CTC would receive advance payments on a monthly basis, providing regular financial support throughout the year. These payments would be based on the family's previous tax filings and income information.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What are the long-term effects of the Big Beautiful Bill on child poverty?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>The bill has the potential to significantly reduce child poverty rates in the United States. By providing a larger and more accessible credit, it aims to create a long-lasting impact on children's lives, improving their access to education, healthcare, and overall opportunities.</p>

</div>

</div>