Property Tax In San Antonio

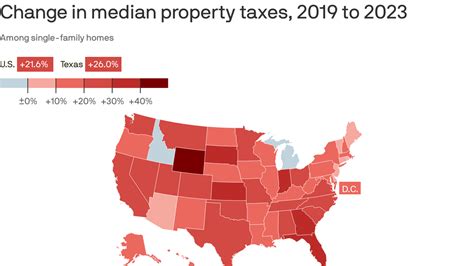

In the vibrant city of San Antonio, Texas, property taxes play a significant role in shaping the local economy and community development. Understanding the ins and outs of property taxes is crucial for homeowners, investors, and anyone interested in the real estate market. This comprehensive guide will delve into the specifics of property tax assessments, rates, and strategies to manage these financial obligations effectively.

Unraveling the San Antonio Property Tax Landscape

San Antonio, with its rich history and dynamic growth, presents a unique property tax environment. The city’s diverse neighborhoods, ranging from historic downtown areas to suburban developments, contribute to a varied tax landscape. Property taxes in San Antonio are determined by several factors, offering both opportunities and challenges for homeowners and investors.

Assessment Methods and Timelines

The appraisal process in San Antonio follows a systematic approach. The Chief Appraiser, appointed by the Appraisal District, oversees the annual assessment of properties. This process involves evaluating factors like property value, improvements, and any exemptions applicable. Notably, San Antonio operates on a January 1 assessment date, meaning property values are assessed as of this date each year.

| Assessment Timeline | Key Dates |

|---|---|

| Notice of Appraised Value | April 15th |

| Protest Deadline | May 15th |

| Value Determination | July 15th |

| Tax Bills Mailed | October |

Property Tax Rates and Calculations

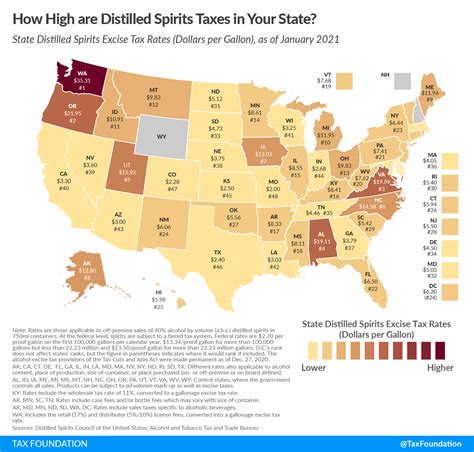

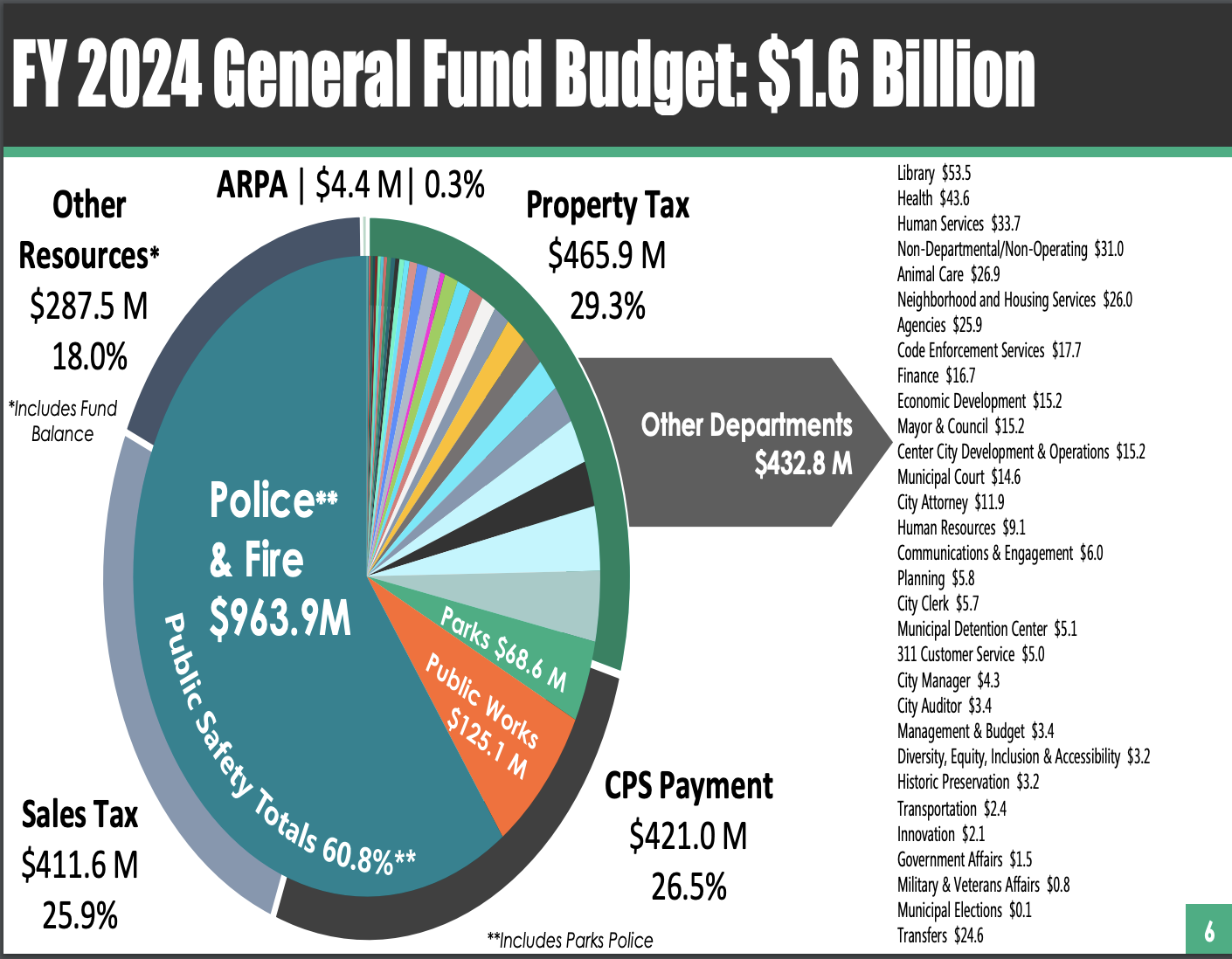

The property tax rate in San Antonio is determined by a combination of factors, primarily the tax rates set by various taxing entities. These entities include the city itself, the county, school districts, and special purpose districts. The effective tax rate is the total of these individual rates, and it’s this rate that determines the property tax burden for homeowners.

| Taxing Entity | Tax Rate (per $100 of valuation) |

|---|---|

| City of San Antonio | 0.4724 |

| Bexar County | 0.4157 |

| Northside ISD | 1.1923 |

| Special Districts | Varies |

For a property valued at $200,000, the estimated tax bill would be approximately $3,395, calculated as follows: ($200,000 x 0.004724) + ($200,000 x 0.004157) + ($200,000 x 0.011923) + (Special District Rates)

Exemptions and Reductions

San Antonio offers several exemptions to alleviate the property tax burden for eligible homeowners. These include the Homestead Exemption, which reduces the taxable value of a primary residence, and exemptions for seniors, veterans, and disabled individuals. Additionally, the city provides agricultural and wildlife management valuation for qualified properties, offering significant tax savings.

| Exemption Type | Description |

|---|---|

| Homestead Exemption | Reduces taxable value by up to $25,000 for homeowners with a primary residence. |

| Senior Citizen Exemption | Offers a reduction in taxes for homeowners aged 65 or older with limited income. |

| Disabled Veteran Exemption | Exempts up to 100% of the residence's value for qualifying disabled veterans. |

Strategies for Effective Property Tax Management

Navigating the property tax landscape in San Antonio requires a strategic approach. Here are some key strategies to consider:

Understanding Your Property’s Value

Regularly review your property’s appraised value and compare it to recent sales of similar properties in your neighborhood. This proactive approach can help identify potential discrepancies and guide your tax planning.

Exploring Exemptions and Incentives

Research and apply for applicable exemptions. San Antonio’s exemption programs can significantly reduce your tax liability. Stay informed about new initiatives and requirements to maximize your savings.

Engaging with the Appraisal District

If you disagree with your property’s appraised value, you have the right to protest. The Appraisal Review Board (ARB) provides a formal process for challenging assessments. Prepare your case with comparable sales data and be ready to present your arguments at the ARB hearing.

Long-Term Tax Planning

Consider the long-term tax implications when buying or selling property. Understanding the tax rates and potential exemptions in different areas can influence your real estate decisions and overall financial planning.

Seeking Professional Advice

Consulting with tax professionals or real estate experts can provide tailored guidance based on your specific circumstances. They can help navigate the complex tax landscape and ensure you’re taking advantage of all available benefits.

Conclusion: Empowering Homeowners and Investors

San Antonio’s property tax system, while comprehensive, can be navigated effectively with the right knowledge and strategies. By understanding the assessment process, tax rates, and available exemptions, homeowners and investors can make informed decisions and manage their property tax obligations efficiently. This guide aims to empower San Antonians to take control of their financial future, ensuring their real estate ventures are as rewarding as the city’s rich cultural offerings.

How often are property values reassessed in San Antonio?

+

Property values in San Antonio are reassessed annually as of January 1st. This means the appraised value for tax purposes is based on the property’s condition and market value as of this date each year.

Can I appeal my property’s appraised value?

+

Yes, if you disagree with your property’s appraised value, you have the right to protest. The Appraisal Review Board (ARB) provides a formal process for appealing assessments. It’s important to submit your protest within the specified deadline and prepare your case with comparable sales data to support your argument.

Are there any tax incentives for energy-efficient upgrades?

+

While San Antonio doesn’t offer specific tax incentives for energy-efficient upgrades, the state of Texas does provide some tax benefits for renewable energy systems. Check with the Texas Comptroller’s Office for more information on these programs.

What is the Homestead Exemption, and how do I apply for it?

+

The Homestead Exemption is a reduction in the taxable value of your primary residence. To apply, you must own and occupy the property as your principal residence on January 1st of the tax year. You can apply through the Bexar County Appraisal District website or by visiting their office. The exemption reduces the taxable value of your home by $25,000.

Are there any special tax considerations for investment properties?

+

Yes, investment properties in San Antonio are subject to different tax rates and considerations. It’s important to consult with a tax professional or real estate expert to understand the specific implications for your investment portfolio. They can guide you on strategies to optimize your tax obligations and maximize your returns.