Sales Tax Florida

Welcome to the comprehensive guide on Sales Tax in Florida, a state known for its vibrant economy and unique tax landscape. This article will delve into the intricacies of Florida's sales tax system, offering an in-depth analysis and practical insights for businesses and consumers alike.

Understanding Sales Tax in the Sunshine State

Florida, with its diverse economy and tourism-driven industries, has a distinct approach to sales taxation. The state’s sales tax structure is a vital component of its revenue generation, influencing the prices consumers pay and the operations of businesses.

Florida's sales tax is governed by the Department of Revenue, which sets the rates and regulations. The state levies a base sales tax rate of 6% on most tangible goods and certain services. However, the real complexity arises with the additional local and discretionary sales surtaxes, which can significantly impact the final sales tax rate.

The Role of Local Sales Tax

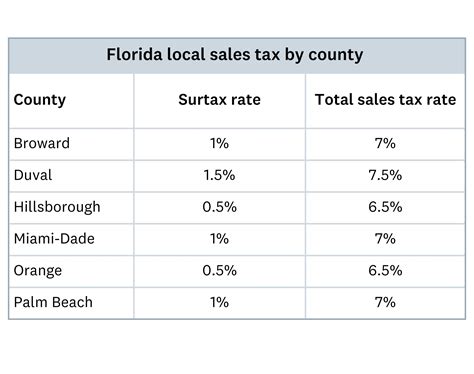

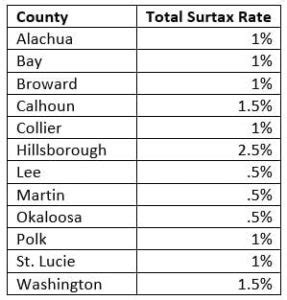

Florida allows local governments to impose county sales surtaxes, typically to fund specific projects or initiatives. These surtaxes can range from 0% to 1.5%, depending on the county. For instance, in Miami-Dade County, a 1% surtax is applied, while Hillsborough County has a 1.5% surtax.

| County | Surtax Rate |

|---|---|

| Miami-Dade | 1% |

| Hillsborough | 1.5% |

| Broward | 1.5% |

These local surtaxes can have a significant impact on the total sales tax burden. For example, a purchase in Miami-Dade County would incur a total sales tax of 7% (6% state + 1% county), while the same purchase in Hillsborough County would be taxed at 7.5% (6% state + 1.5% county).

Discretionary Sales Surtaxes

Beyond the county surtaxes, Florida also allows for discretionary sales surtaxes to be levied by local governments. These surtaxes are often used to fund specific projects, such as transportation initiatives or infrastructure development. The rates for these surtaxes can vary greatly, and they are usually in effect for a defined period, often several years.

For instance, Orange County currently has a 1% discretionary sales surtax in place to fund transportation projects. This surtax, when added to the state and county rates, results in a total sales tax of 8% (6% state + 1% county + 1% discretionary) in Orange County.

Sales Tax Exemptions and Special Considerations

Florida’s sales tax system is not without its exemptions and special provisions. Understanding these nuances is crucial for both businesses and consumers to navigate the tax landscape effectively.

Food and Beverage Exemptions

One notable exemption in Florida’s sales tax is for prepared foods and beverages. While the state sales tax generally applies to tangible personal property, food and beverages meant for immediate consumption are exempt. This exemption extends to items such as ready-to-eat meals, snacks, and beverages purchased from restaurants, delis, and food trucks.

However, it's important to note that the exemption does not apply to all food items. Non-prepared foods, such as raw produce, packaged snacks, and beverages, are subject to sales tax. Additionally, the exemption does not cover the sale of food containers, utensils, or other non-food items, which are taxed at the full rate.

Grocery Sales Tax Holiday

Florida periodically holds sales tax holidays, which are specific periods where certain items are exempt from sales tax. One notable sales tax holiday is the Grocery Sales Tax Holiday, which usually occurs in April. During this holiday, groceries, including non-prepared foods and beverages, are exempt from sales tax.

The Grocery Sales Tax Holiday provides a significant savings opportunity for Florida residents, especially those with large families or those who stock up on essentials during the tax-free period. It also boosts local economies, as consumers tend to increase their spending during these holidays.

Tangible Personal Property Tax

Florida imposes a Tangible Personal Property Tax on certain items, which is separate from the sales tax. This tax applies to tangible personal property used in a business, such as machinery, equipment, furniture, and fixtures. The tax is assessed annually by the local tax collector and is based on the property’s assessed value.

It's important for businesses to understand the distinction between sales tax and tangible personal property tax. While sales tax is collected at the point of sale, tangible personal property tax is an annual assessment and is a significant cost consideration for businesses operating in Florida.

Sales Tax Registration and Compliance

For businesses operating in Florida, understanding the sales tax registration process and compliance requirements is essential. The state’s Department of Revenue provides clear guidelines and resources to help businesses navigate the registration and compliance process.

Sales Tax Registration Process

Businesses are required to register with the Florida Department of Revenue to obtain a sales tax permit. The registration process involves providing detailed information about the business, including its legal structure, location, and the types of goods and services it offers. The Department of Revenue reviews the application and issues a unique sales tax permit number to the business.

The sales tax permit is valid for a specific period, usually a year, after which it must be renewed. Businesses must display their sales tax permit at their place of business and include their permit number on all sales tax filings and correspondence with the Department of Revenue.

Sales Tax Compliance and Filing

Once registered, businesses are responsible for collecting and remitting sales tax to the Department of Revenue. The frequency of sales tax filings depends on the business’s sales volume and can be monthly, quarterly, or annually. Businesses must file accurate sales tax returns and pay the collected tax by the due date to avoid penalties and interest.

The Department of Revenue offers various resources and tools to help businesses with sales tax compliance, including online filing and payment systems, tax rate lookup tools, and educational materials. Businesses can also seek assistance from tax professionals or consult with the Department of Revenue's taxpayer assistance offices for guidance on specific compliance issues.

Sales Tax Audits and Enforcement

The Florida Department of Revenue conducts sales tax audits to ensure compliance and to verify that businesses are correctly collecting and remitting sales tax. Audits can be random or targeted, and they may cover a specific period or the entire history of the business’s sales tax filings.

Audit Process and Consequences

During an audit, the Department of Revenue examines the business’s sales records, tax returns, and other relevant documents. The audit process can be complex and time-consuming, and businesses are required to cooperate fully with the auditors. Failure to cooperate or provide accurate records can result in penalties and additional tax assessments.

If an audit reveals that a business has underreported sales or undercollected sales tax, the Department of Revenue will issue a notice of deficiency, detailing the additional tax owed, along with any applicable penalties and interest. Businesses have the right to dispute the audit findings and can request a formal hearing to present their case.

Enforcement Actions

The Florida Department of Revenue has a range of enforcement actions it can take against businesses that fail to comply with sales tax laws. These actions can include imposing penalties, seizing assets, or even suspending the business’s sales tax permit. In severe cases of non-compliance or fraud, criminal charges may be pursued.

To avoid enforcement actions, businesses should ensure they understand and comply with all sales tax regulations. This includes accurately collecting and remitting sales tax, maintaining proper records, and staying informed about any changes to sales tax laws or regulations.

Future Implications and Trends

Florida’s sales tax landscape is subject to change and evolution, influenced by economic trends, political decisions, and technological advancements. Understanding these potential changes is crucial for businesses and consumers to stay ahead of the curve and adapt to the evolving tax environment.

Economic Impact and Policy Changes

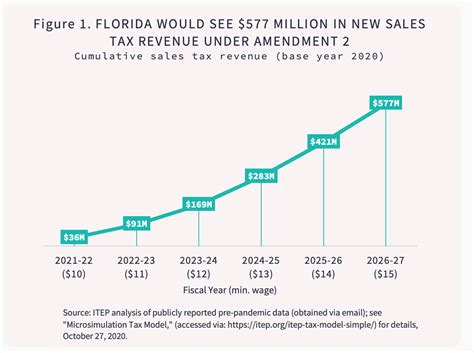

Florida’s economy is heavily reliant on tourism and consumer spending. As the state’s economy evolves, changes in consumer behavior and spending patterns can significantly impact sales tax revenue. For instance, the rise of e-commerce and online shopping has led to a shift in sales tax collection, with more focus on remote sellers and marketplace facilitators.

Additionally, political decisions, such as changes in tax rates or the introduction of new tax initiatives, can have a substantial impact on businesses and consumers. For example, proposals to increase or decrease sales tax rates, or to introduce new exemptions or surtaxes, can significantly affect the tax burden and the overall economic landscape.

Technological Advances and Sales Tax

Technological advancements are also shaping the future of sales tax in Florida. The increasing use of digital platforms and online marketplaces has led to a greater focus on sales tax compliance for remote sellers. The state has implemented measures, such as the Marketplace Facilitator Law, to ensure that sales tax is collected on online transactions, even when the seller is located out of state.

Furthermore, the use of technology in tax administration, such as automated tax filing and payment systems, is streamlining the sales tax process for businesses and tax authorities alike. These technological advances can lead to increased efficiency, reduced compliance costs, and improved accuracy in sales tax collection and remittance.

Conclusion

Florida’s sales tax system is a complex yet essential component of the state’s economy. From the base sales tax rate to the local surtaxes and discretionary sales surtaxes, understanding the nuances of Florida’s sales tax is crucial for businesses and consumers alike.

As we've explored in this guide, Florida's sales tax landscape is influenced by a variety of factors, including local government initiatives, economic trends, and technological advancements. By staying informed and adapting to these changes, businesses and consumers can navigate the sales tax system with confidence and ensure compliance with the state's regulations.

Frequently Asked Questions

What is the current base sales tax rate in Florida?

+

The base sales tax rate in Florida is 6%.

Are there any counties with no sales surtax in Florida?

+

Yes, there are a few counties in Florida that do not impose a county sales surtax, resulting in a total sales tax rate of 6%.

When is the next sales tax holiday in Florida?

+

The next sales tax holiday in Florida is typically announced by the state government a few months in advance. It’s recommended to check the official Florida Department of Revenue website for the latest information.

Do I need to register for sales tax if I only sell online in Florida?

+

Yes, if you are an out-of-state seller but have sales into Florida, you are required to register for sales tax and collect and remit the appropriate taxes.

What happens if I don’t comply with Florida’s sales tax regulations?

+

Failure to comply with Florida’s sales tax regulations can result in penalties, interest charges, and potential enforcement actions, including the suspension of your sales tax permit.