Tax Abatement Definition

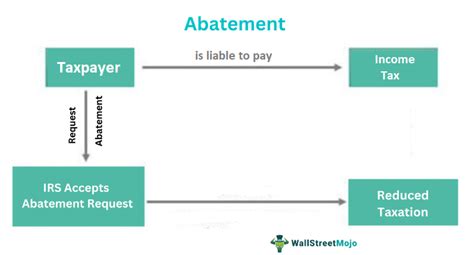

Tax abatement is a powerful tool used by governments and municipalities to stimulate economic growth, attract investments, and promote development within their jurisdictions. It involves reducing or eliminating certain taxes for a specified period, often as an incentive for businesses or individuals to locate, expand, or undertake specific activities within a particular area. This strategy has become increasingly popular and has proven to be an effective way to drive economic activity, create jobs, and boost local economies.

Understanding Tax Abatement: The Basics

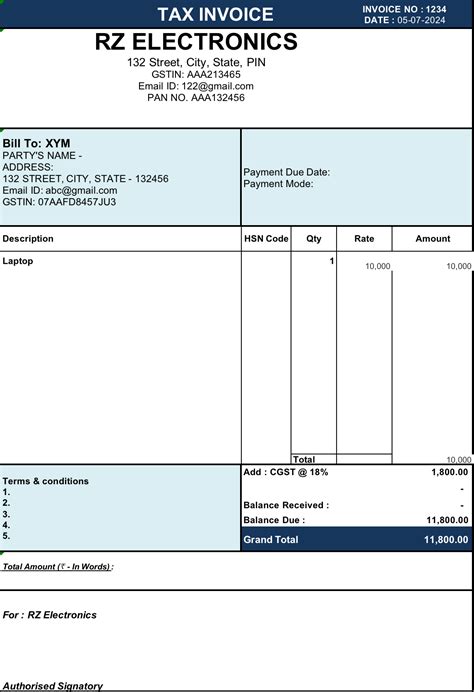

At its core, tax abatement is a strategic reduction in taxes, typically granted by a local government or municipality. It is a temporary measure, designed to encourage economic activity and development by making a specific area more attractive for businesses and investors. The abatement can apply to various taxes, including property taxes, income taxes, sales taxes, or even specialized taxes like those levied on machinery and equipment.

The abatement period can vary significantly, from a few years to over a decade, depending on the local government's objectives and the type of development they aim to encourage. During this period, the recipient of the abatement benefits from reduced tax obligations, allowing them to reinvest those savings into their operations, create jobs, or undertake expansion projects.

Eligibility and Criteria

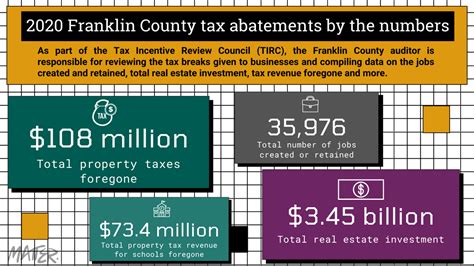

Eligibility for tax abatement programs is typically determined by local authorities and can be quite specific. Common criteria include the type of business, the location of the business within the jurisdiction, the number of jobs created or retained, and the investment amount. For instance, a city might offer tax abatement to attract new manufacturing facilities, with the criteria including a minimum investment of $10 million and the creation of at least 200 jobs.

In some cases, tax abatement programs are tailored to support specific industries or sectors that are deemed vital to the local economy. This could include technology startups, renewable energy projects, or traditional industries like manufacturing or agriculture.

| Tax Type | Description |

|---|---|

| Property Tax Abatement | Reduces or eliminates property taxes for a set period, often for new developments or renovations. |

| Income Tax Abatement | Offers reduced income tax rates for businesses or individuals under certain conditions. |

| Sales Tax Abatement | Waives or reduces sales taxes for specific goods or services, often to stimulate consumer spending. |

| Equipment Tax Abatement | Provides relief on taxes levied on machinery and equipment, encouraging businesses to invest in new technology. |

The Impact and Benefits of Tax Abatement

Tax abatement programs have far-reaching benefits for both the local economy and the businesses or individuals that take advantage of them. Here’s a closer look at some of the key impacts:

Economic Growth and Job Creation

One of the primary goals of tax abatement is to stimulate economic growth. By offering tax incentives, local governments can attract new businesses and industries, leading to increased economic activity. This influx of new businesses often translates into more job opportunities for local residents, contributing to a healthier job market and a more robust local economy.

For instance, a large technology company relocating to a city due to a tax abatement program could bring hundreds of high-paying jobs, which not only benefit the employees but also stimulate spending in the local economy, from retail to real estate.

Investment and Infrastructure Development

Tax abatement programs often require businesses to make significant investments in the local area, whether it’s constructing new facilities, renovating existing ones, or purchasing specialized equipment. These investments can lead to improved infrastructure, better access to resources, and an overall enhancement of the business environment.

Consider a scenario where a city offers tax abatement to a renewable energy company planning to build a solar farm. This not only attracts investment but also contributes to the city's renewable energy goals, reducing its carbon footprint and potentially providing a new source of revenue through energy sales.

Community Development and Revitalization

Tax abatement can play a crucial role in revitalizing struggling communities or underdeveloped areas. By offering incentives, local governments can encourage businesses to locate in these areas, leading to increased foot traffic, new business opportunities, and a potential boost in property values.

For example, a tax abatement program targeting downtown revitalization could attract restaurants, shops, and cultural centers, transforming a previously underutilized area into a bustling hub of activity.

Competitive Advantage

In today’s competitive business landscape, tax abatement can give a city or region a significant edge in attracting investment. It allows them to offer a more favorable business environment, which can be particularly appealing to companies looking to expand or relocate.

A city offering a generous tax abatement package might become the preferred choice for a multinational corporation, bringing with it not only economic benefits but also increased global visibility and prestige for the region.

Challenges and Considerations

While tax abatement programs offer numerous benefits, they also come with certain challenges and considerations that local governments must address:

Revenue Loss

One of the most significant concerns with tax abatement is the potential loss of revenue for the local government. The reduction or elimination of taxes, even for a limited period, can result in a substantial decrease in the tax base, which could impact the government’s ability to provide essential services and infrastructure.

To mitigate this, local governments often set specific criteria and limits for abatement programs, ensuring that the benefits are granted strategically and don't cause undue financial strain.

Equity and Fairness

Another challenge is ensuring that tax abatement programs are fair and equitable. Some critics argue that these programs can disproportionately benefit large corporations or high-income individuals, potentially exacerbating wealth inequality within a community.

To address this, many governments implement measures to ensure that the benefits are shared more broadly, such as by including community benefits agreements or targeting specific areas or industries that can provide opportunities for a wider range of residents.

Long-Term Sustainability

Tax abatement programs are often designed with specific goals in mind, such as attracting a particular industry or developing a certain area. However, ensuring the long-term sustainability of these initiatives is crucial. Once the abatement period ends, the business or individual must be able to continue thriving in the local economy without the incentive.

Local governments can address this by offering additional support, such as access to business resources, streamlined regulatory processes, or further investment opportunities, to ensure that the benefits of the abatement program are lasting.

Conclusion: A Strategic Tool for Economic Development

Tax abatement programs are a powerful tool in the hands of local governments, offering a strategic way to shape economic development and growth. By offering temporary tax incentives, governments can attract investment, create jobs, and stimulate economic activity in targeted areas or industries.

While challenges exist, such as revenue loss and ensuring fairness, the benefits of tax abatement are clear. These programs have the potential to transform communities, revitalize struggling areas, and provide a competitive advantage in attracting businesses and investors. As such, tax abatement continues to be a crucial strategy in the economic development toolkit of many governments and municipalities worldwide.

How do tax abatement programs benefit local communities?

+

Tax abatement programs bring a host of benefits to local communities. They can attract new businesses, leading to increased job opportunities and economic growth. Additionally, these programs often target specific areas or industries, helping to revitalize struggling communities and improve the overall quality of life for residents.

What are the potential drawbacks of tax abatement programs?

+

One of the main concerns with tax abatement programs is the potential loss of revenue for the local government. This can impact the government’s ability to provide essential services and maintain infrastructure. There are also concerns about fairness, as these programs may disproportionately benefit larger corporations or high-income individuals.

How can local governments ensure the long-term success of tax abatement programs?

+

To ensure long-term success, local governments should implement comprehensive strategies beyond just tax abatement. This includes offering additional support to businesses, such as access to resources and streamlined processes, as well as ensuring that the benefits of the program are shared equitably among the community.