Tax Invoice

In the realm of business and commerce, a tax invoice serves as a vital document that plays a crucial role in the smooth functioning of financial transactions. This article delves into the intricacies of tax invoices, exploring their purpose, key components, and the impact they have on businesses and consumers alike. By understanding the ins and outs of tax invoices, we can navigate the complex world of taxation and ensure compliance with regulatory standards.

The Essence of a Tax Invoice

A tax invoice, often referred to as a “sales invoice” or simply an “invoice,” is a legally binding document issued by a seller or service provider to a buyer or customer. It serves as a formal record of the transaction, detailing the goods or services supplied, their quantities, prices, and any applicable taxes. The primary purpose of a tax invoice is to provide a clear and transparent overview of the transaction, ensuring that both parties have a comprehensive understanding of the financial obligations involved.

Key Components of a Tax Invoice

To be considered valid and compliant with tax regulations, a tax invoice must include specific information. Here are the essential components:

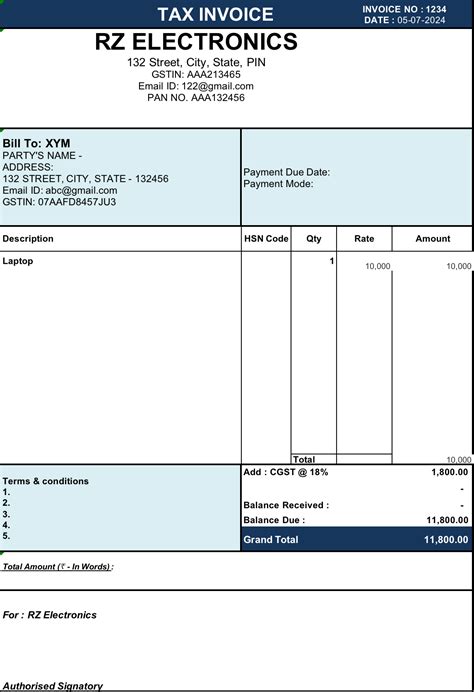

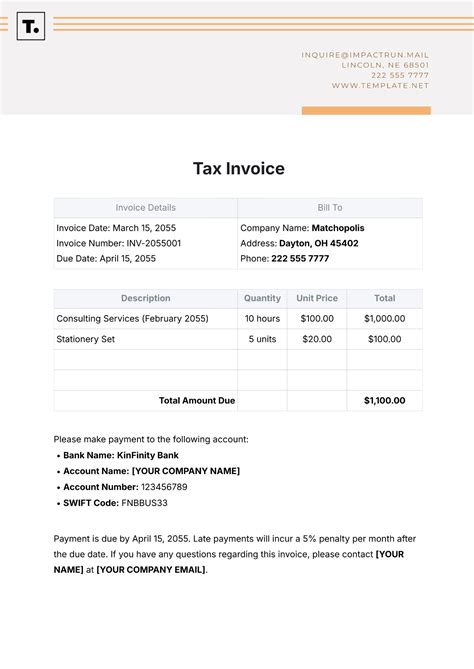

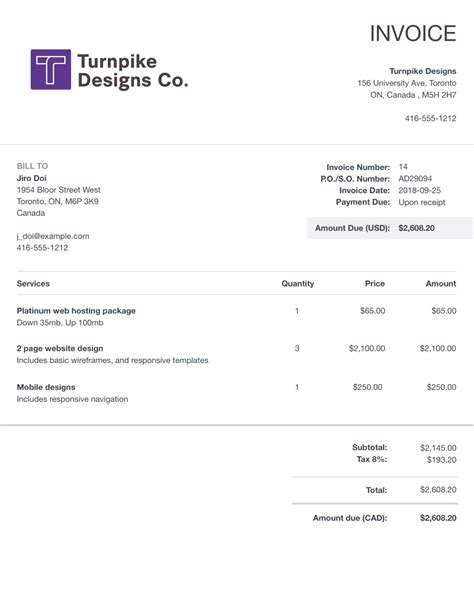

- Invoice Number and Date: Each tax invoice should have a unique identification number and the date of issue. This helps in tracking and referencing the invoice for future records.

- Seller's Details: The tax invoice must clearly display the seller's name, address, and tax registration details, such as the VAT or GST identification number.

- Buyer's Information: The buyer's name, address, and contact details should be included to identify the recipient of the goods or services.

- Itemized List of Goods/Services: A detailed list of the products or services provided, including their descriptions, quantities, unit prices, and any discounts or adjustments applied.

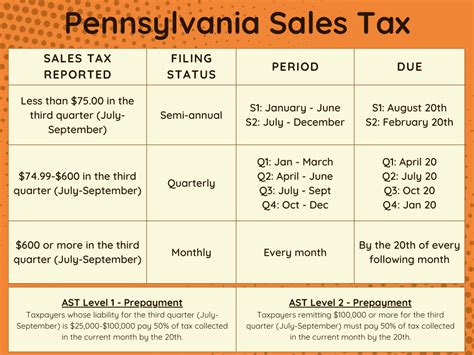

- Tax Information: This section outlines the applicable taxes, such as VAT, GST, or sales tax, along with the tax rates and the total tax amount. It is crucial to accurately calculate and present the tax details.

- Total Amount Due: The tax invoice should clearly state the grand total, including the cost of goods/services and any applicable taxes. This amount represents the final sum payable by the buyer.

- Payment Terms: The invoice should specify the payment due date, accepted payment methods, and any late payment penalties or early payment discounts.

- Terms and Conditions: A brief summary of the seller's terms, including return policies, warranty information, and any specific conditions related to the transaction.

By including these components, a tax invoice becomes a comprehensive document that serves as a legal proof of the transaction, aiding in tax compliance, accounting, and dispute resolution.

The Impact of Tax Invoices on Businesses

Tax invoices are an integral part of a business’s financial management and tax obligations. Here’s how they impact businesses:

Financial Management

Tax invoices provide a detailed record of sales and purchases, allowing businesses to accurately track their financial transactions. They help in maintaining proper accounting records, budgeting, and financial forecasting. Additionally, tax invoices serve as a reference for generating financial statements and tax returns, ensuring compliance with accounting standards.

Tax Compliance

Tax invoices are crucial for meeting tax obligations. They provide the necessary documentation for claiming input tax credits (ITC) or deductions, reducing the tax burden on businesses. By accurately recording the tax components, businesses can ensure they are not overpaying or underpaying taxes, thereby avoiding penalties and maintaining a good relationship with tax authorities.

Customer Relations

Issuing tax invoices in a timely and professional manner enhances the reputation of a business. It demonstrates transparency and accountability, building trust with customers. Well-structured tax invoices, with clear pricing and tax information, reduce the chances of disputes and misunderstandings, leading to better customer satisfaction and retention.

Business Analysis and Decision-Making

Tax invoices provide valuable data for business analysis. By analyzing sales trends, customer preferences, and pricing strategies, businesses can make informed decisions regarding product offerings, marketing campaigns, and pricing adjustments. This data-driven approach enables businesses to optimize their operations and stay competitive in the market.

The Role of Tax Invoices in Consumer Protection

Tax invoices not only benefit businesses but also play a significant role in protecting consumers. Here’s how they contribute to consumer rights:

Price Transparency

Tax invoices ensure that consumers are aware of the exact price they are paying for goods or services. By breaking down the cost into the product/service price and applicable taxes, consumers can understand the pricing structure and make informed purchasing decisions.

Dispute Resolution

In case of any disputes regarding the transaction, tax invoices serve as legal evidence. They provide a clear record of the agreed-upon terms, prices, and tax details, helping consumers resolve issues related to overcharging, incorrect pricing, or faulty products/services.

Warranty and Return Claims

Tax invoices often include warranty information and return policies. This enables consumers to claim warranties or initiate returns within the specified time frames, ensuring their rights are protected.

Input Tax Credit for Consumers

In certain cases, consumers may be eligible for input tax credits. By retaining the tax invoices, they can claim the credits, reducing their tax liabilities. This benefit is particularly relevant for businesses and individuals registered for VAT or GST.

Future Trends and Innovations in Tax Invoicing

As technology continues to advance, the world of tax invoicing is witnessing innovative changes. Here are some trends and developments to watch out for:

Electronic Invoicing

The shift towards electronic invoicing, or e-invoicing, is gaining momentum. This process involves creating and exchanging invoices digitally, eliminating the need for paper-based documentation. E-invoicing offers benefits such as reduced processing time, improved accuracy, and enhanced security. Many countries are implementing e-invoicing standards and regulations to streamline the process and reduce administrative burdens.

Blockchain Technology

Blockchain, the technology behind cryptocurrencies, is being explored for its potential in tax invoicing. By utilizing blockchain, tax invoices can be stored securely and immutably, ensuring data integrity and transparency. This technology can revolutionize tax compliance, making it easier to track and verify transactions, and reducing the risk of fraud.

Artificial Intelligence and Automation

AI-powered tools and automation are transforming the tax invoicing process. These technologies can automatically generate tax invoices based on transaction data, reducing manual errors and saving time. Additionally, AI can analyze tax invoices to identify patterns, detect anomalies, and provide insights for tax optimization.

Real-Time Tax Calculations

With the advancement of technology, tax invoicing systems are integrating real-time tax calculation features. This ensures that the applicable taxes are accurately calculated and displayed on the invoice, reducing the chances of errors and non-compliance.

Mobile Invoicing Apps

Mobile invoicing apps are gaining popularity, especially among small businesses and freelancers. These apps allow users to create and send tax invoices on the go, making the process more convenient and accessible.

Conclusion

Tax invoices are more than just pieces of paper; they are essential tools for businesses and consumers alike. By understanding the importance and intricacies of tax invoices, we can navigate the complex world of taxation with confidence. As technology advances, the future of tax invoicing looks promising, with innovative solutions set to revolutionize the way we manage financial transactions. Embracing these changes will be crucial for businesses to stay competitive and compliant in an ever-changing business landscape.

What is the difference between a tax invoice and a regular invoice?

+A tax invoice includes detailed tax information, such as VAT or GST rates and amounts, whereas a regular invoice may only state the total amount due without breaking down the tax components.

Can I issue a tax invoice without being registered for VAT or GST?

+In most jurisdictions, businesses are required to be registered for VAT or GST before issuing tax invoices. However, there may be exceptions for small businesses or specific industries, so it’s important to check the local regulations.

How long should I retain tax invoices for record-keeping purposes?

+The retention period for tax invoices varies depending on the jurisdiction and tax regulations. Generally, it is recommended to keep tax invoices for at least 6-7 years to comply with tax audit requirements.

Can I issue a tax invoice for partial payments or deposits?

+Yes, you can issue a tax invoice for partial payments or deposits, as long as it accurately reflects the transaction details and the amount paid. This helps in tracking payments and ensures compliance with tax regulations.