What States Don't Have Property Tax

While it is true that many states in the United States have property taxes, it is worth noting that some jurisdictions have implemented unique tax structures that deviate from the traditional property tax model. In this article, we will explore the concept of property tax and delve into the specific states that have opted for alternative tax systems, essentially eliminating property taxes as we commonly understand them.

Understanding Property Tax

Property tax, also known as ad valorem tax, is a levy imposed on the value of real estate and personal property. It is a significant source of revenue for local governments, including cities, counties, and special taxing districts. These taxes are used to fund essential services such as public schools, emergency services, infrastructure development, and other municipal operations.

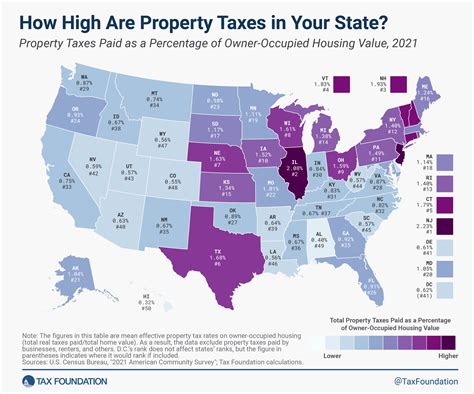

The tax rate for property taxes is typically expressed as a percentage of the property's assessed value. The assessed value is determined by local tax assessors, who evaluate the property's market value and apply any applicable exemptions or deductions. Property tax rates can vary widely across different jurisdictions, and they are often subject to frequent changes due to fluctuations in the local economy and budget requirements.

States with Alternative Tax Systems

While property taxes are a common feature of the American tax landscape, several states have adopted alternative tax systems that effectively eliminate or significantly reduce the burden of property taxes on their residents.

Alaska

Alaska is renowned for its unique tax system, which stands out from the traditional property tax model. Instead of imposing a property tax, Alaska relies on a comprehensive set of state taxes, including an income tax, corporate tax, and a unique tax on the extraction of natural resources known as the Alaska Permanent Fund Dividend (APFD). This fund, which is derived from oil revenues, provides an annual dividend to eligible Alaskans.

By forgoing property taxes, Alaska aims to attract residents and businesses with a more favorable tax environment. This approach has contributed to the state's reputation for being business-friendly and has made it an attractive destination for those seeking tax-efficient living and investment opportunities.

Florida

Florida is another state that has implemented a tax system that differs from the conventional property tax model. While Florida does have a property tax, it offers several significant exemptions and benefits that effectively reduce the tax burden for many residents.

One notable feature of Florida's tax system is the Homestead Exemption, which provides substantial property tax savings for homeowners who meet specific residency and ownership criteria. This exemption allows eligible homeowners to exclude a portion of their home's assessed value from taxation, resulting in lower property tax bills. Additionally, Florida offers portability for the Homestead Exemption, allowing residents who move within the state to transfer their exemption to their new property.

Florida's tax structure also includes a Save Our Homes cap, which limits the annual increase in assessed value for homesteaded properties to 3% or the Consumer Price Index (CPI), whichever is less. This cap ensures that property taxes do not skyrocket due to rapidly increasing property values, providing stability for homeowners.

Texas

Texas, known for its vibrant economy and diverse industries, has a tax system that stands out in the absence of a state-level income tax. While Texas does have property taxes, they are primarily levied by local governments, including counties, cities, school districts, and special taxing districts.

The property tax rates in Texas vary widely across different jurisdictions, and they are often among the highest in the nation. However, the state's tax system is designed to distribute the tax burden more evenly across various levels of government, with the state's constitutional requirements ensuring that property taxes are used to fund local services effectively.

Texas also offers several tax exemptions and benefits to reduce the property tax burden on certain groups. These include exemptions for homeowners over the age of 65, disabled veterans, and surviving spouses of disabled veterans. Additionally, the state provides a School Tax Relief (STAR) program, which provides property tax relief for homeowners based on their income and property value.

Louisiana

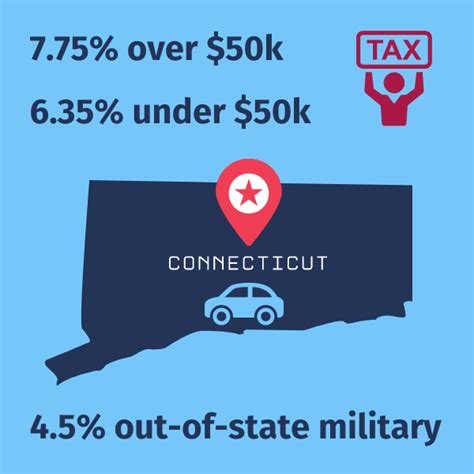

Louisiana has a tax system that includes property taxes, but it also relies heavily on other forms of taxation to fund its operations. One notable feature of Louisiana’s tax system is its sales tax, which is among the highest in the nation. The state imposes a sales tax on the purchase of goods and services, and these revenues contribute significantly to its overall tax revenue.

While Louisiana has property taxes, they are not a primary source of revenue for the state. Instead, the property tax system is largely controlled by local governments, with each parish (the equivalent of a county) setting its own tax rates. This decentralized approach to property taxation results in varying tax rates across the state.

Louisiana also offers a Homestead Exemption for homeowners, similar to Florida's system. This exemption reduces the assessed value of the homeowner's primary residence, leading to lower property tax bills. Additionally, Louisiana provides a Veterans Exemption, which offers property tax relief to qualifying veterans.

Nevada

Nevada, often associated with its vibrant entertainment industry and tax-friendly policies, has a tax system that differs from traditional property taxation. While Nevada does have property taxes, they are primarily levied by local governments, similar to Texas. However, the state’s tax structure is designed to minimize the reliance on property taxes as a primary revenue source.

Nevada's tax system is heavily reliant on sales and use taxes, which are imposed on the sale of goods and services within the state. These taxes are a significant source of revenue for Nevada, contributing to its overall tax revenue and funding various government services.

In addition to sales and use taxes, Nevada also imposes a Modified Business Tax on businesses operating within the state. This tax is based on the business's gross revenue and is a crucial component of Nevada's tax revenue. By diversifying its tax base, Nevada is able to maintain a competitive business environment while reducing the reliance on property taxes.

South Dakota

South Dakota has a tax system that focuses on a mix of different tax sources, including property taxes, sales taxes, and income taxes. However, the state’s property tax system is designed to be more equitable and less burdensome for its residents.

One notable feature of South Dakota's property tax system is its Classification System, which categorizes properties into different classes based on their use. This classification system ensures that properties with similar characteristics and uses are taxed at the same rate. As a result, residential properties, agricultural lands, and commercial properties are subject to different tax rates, promoting fairness in the tax system.

South Dakota also offers a Homestead Exemption, similar to other states, which provides property tax relief for homeowners who meet specific residency and ownership criteria. This exemption reduces the assessed value of the homeowner's primary residence, resulting in lower property tax bills.

Conclusion: The Complexity of Tax Systems

The absence of property taxes in certain states is not a straightforward phenomenon. While these states may not have a traditional property tax, they often have unique tax systems that achieve similar revenue-generating goals while providing tax relief to residents. These alternative tax systems demonstrate the complexity and diversity of tax structures across the United States.

It is important to note that tax systems are dynamic and subject to change over time. As economic conditions evolve and budgetary needs shift, states may adjust their tax policies to adapt to new circumstances. Therefore, it is crucial to stay informed about the latest tax developments in your state and understand how they impact your financial situation.

In conclusion, while the idea of states without property taxes may seem appealing, it is essential to recognize that alternative tax systems have their own complexities and trade-offs. Understanding the tax landscape in your state and seeking professional advice can help you make informed decisions about your financial planning and tax obligations.

How do property taxes impact homeowners in states with alternative tax systems?

+In states with alternative tax systems, the impact of property taxes can vary. While some states, like Alaska and Nevada, have effectively eliminated property taxes, others, like Florida and Texas, offer significant exemptions and benefits to reduce the tax burden. These exemptions and benefits can provide substantial savings for homeowners, making property ownership more affordable.

What are the advantages of states with alternative tax systems?

+States with alternative tax systems can offer several advantages. They may attract residents and businesses with a more favorable tax environment, promoting economic growth and investment. Additionally, alternative tax systems can provide stability for homeowners by limiting the increase in property taxes, ensuring that residents are not burdened with sudden and significant tax increases.

Are there any drawbacks to states without property taxes?

+While states without traditional property taxes may offer certain benefits, there can also be drawbacks. The lack of property taxes may result in reduced funding for local services, such as schools and infrastructure. This can impact the quality and availability of these services, potentially affecting the overall well-being of residents. Additionally, alternative tax systems may place a heavier burden on other forms of taxation, such as sales taxes, which can be regressive and impact lower-income individuals disproportionately.