Hartford Taxes

Welcome to an in-depth exploration of Hartford's taxes, a crucial aspect of understanding the economic landscape of this vibrant city. Taxes are an essential component of any functioning society, and Hartford, being the capital of Connecticut, has its unique tax structure and considerations. This article aims to provide a comprehensive guide, shedding light on the various aspects of Hartford's tax system, from its history to its current implications and future prospects.

A Historical Perspective on Hartford’s Tax System

The story of Hartford’s taxes is deeply intertwined with the city’s rich history and economic evolution. Dating back to the colonial era, Hartford’s tax system has undergone significant transformations, adapting to the changing needs of its citizens and the evolving global economy. One of the earliest tax records in Hartford dates back to the 17th century, when the city levied taxes on property and personal estates to fund public works and defense.

As Hartford grew into a thriving commercial center, the tax system became more complex. In the 19th century, the city introduced taxes on businesses and industries, recognizing the need to distribute the tax burden more equitably. This era also saw the introduction of specialized taxes, such as those on real estate transfers and certain goods, which helped fund the city's rapid infrastructure development.

The 20th century brought about a shift towards more progressive taxation, with Hartford implementing income taxes and a graduated tax rate system. This period also witnessed the establishment of various tax incentives and relief programs aimed at supporting local businesses and encouraging economic growth.

Key Milestones in Hartford’s Tax History

Here’s a timeline of some significant events that shaped Hartford’s tax landscape:

- 1639: Hartford's first recorded tax, a property tax, was implemented to support the city's militia and public works.

- 1865: The city introduced a business tax to fund the expansion of its commercial district and infrastructure.

- 1919: Hartford adopted an income tax, one of the first cities in the nation to do so, to provide a more equitable revenue stream.

- 1933: During the Great Depression, the city introduced tax relief measures to support struggling businesses and homeowners.

- 1980s: Hartford offered tax incentives to attract and retain businesses, a strategy that continues to shape its economic development.

Understanding Hartford’s Current Tax Structure

Today, Hartford’s tax system is a sophisticated blend of various taxes designed to meet the city’s financial needs and support its economic goals. Let’s delve into the key components of this structure.

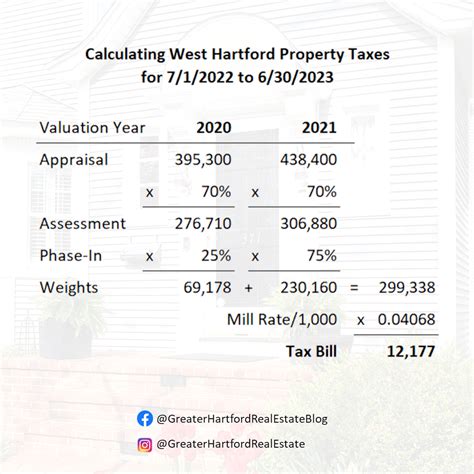

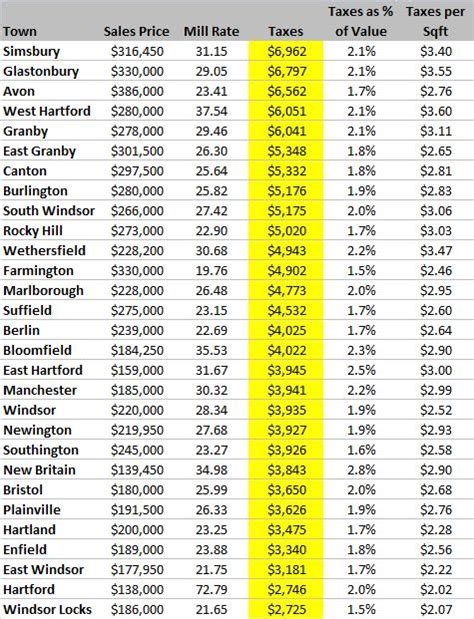

Property Taxes: A Significant Revenue Source

Property taxes remain a cornerstone of Hartford’s tax revenue. The city assesses properties annually, taking into account factors such as location, size, and use. The assessed value is then multiplied by the tax rate, which is set by the city council, to determine the property tax owed by each owner.

| Property Type | Average Assessed Value | Tax Rate (Mill Rate) |

|---|---|---|

| Residential | $150,000 | 72.50 |

| Commercial | $500,000 | 72.50 |

| Industrial | $1,000,000 | 72.50 |

Hartford's property tax system is notable for its stability, with the mill rate remaining relatively consistent over the past decade. This provides predictability for homeowners and businesses, which is crucial for long-term financial planning.

Income Taxes: Progressive Approach

Hartford levies income taxes on individuals and businesses. The city’s income tax system is progressive, meaning that higher incomes are taxed at a higher rate. This approach aims to ensure that those with greater financial means contribute proportionally more to the city’s revenue.

| Income Bracket | Tax Rate |

|---|---|

| Up to $10,000 | 1.5% |

| $10,001 - $50,000 | 2.5% |

| $50,001 - $100,000 | 3.0% |

| Over $100,000 | 3.5% |

The city's income tax is often seen as a fair and effective way to distribute the tax burden, ensuring that the benefits of living and working in Hartford are shared by all.

Sales and Use Taxes: Supporting City Services

Hartford, like many cities, relies on sales and use taxes to fund essential city services. These taxes are applied to the sale of goods and services within the city limits, as well as to the use of certain products and materials. The revenue generated helps maintain the city’s infrastructure, public safety, and social services.

Currently, Hartford's sales tax rate is 6.35%, which is applied to most retail transactions. Additionally, the city imposes a use tax on goods purchased outside of Hartford but used within the city limits, ensuring that all residents contribute to the maintenance of the city's resources.

The Impact of Hartford’s Taxes on its Economy and Residents

Hartford’s tax system plays a pivotal role in shaping the city’s economic landscape and the lives of its residents. Let’s explore some of the key impacts.

Economic Growth and Development

Hartford’s tax structure is designed to encourage economic growth and development. Tax incentives and relief programs, such as the Small Business Tax Relief Program and the Business Enterprise Zone Program, aim to attract and support businesses, creating jobs and stimulating the local economy. These initiatives have been particularly beneficial for the city’s small business community, fostering entrepreneurship and innovation.

Additionally, Hartford's tax system has been instrumental in funding major development projects, such as the revitalization of its downtown area and the expansion of its cultural institutions. These projects not only enhance the city's attractiveness but also boost its economic vitality, attracting visitors, investors, and new residents.

Social Equity and Community Support

Hartford’s progressive tax system ensures that the city’s resources are distributed fairly, benefiting all residents. The revenue generated from taxes is used to fund essential social services, including education, healthcare, and housing assistance. This support is particularly crucial for low-income families and individuals, helping to reduce economic disparities and promote social equity.

Moreover, Hartford's tax structure includes provisions for property tax relief for senior citizens and veterans, ensuring that these vulnerable populations can continue to call Hartford home without facing financial hardship.

Challenges and Opportunities

While Hartford’s tax system has been effective in supporting the city’s growth and social welfare, it also faces certain challenges. One of the primary concerns is the city’s budget deficit, which has led to discussions about potential tax increases or structural changes to the tax system.

However, these challenges also present opportunities. Hartford has the chance to innovate and adapt its tax system to meet the changing needs of its residents and businesses. By exploring new tax strategies and incentives, the city can continue to thrive economically while maintaining its commitment to social equity and community support.

Future Outlook: Shaping Hartford’s Tax Landscape

As Hartford looks to the future, its tax system will continue to evolve to meet the city’s evolving needs. Here are some key considerations and potential developments:

Technological Advancements

The integration of technology into tax administration is likely to streamline processes and improve efficiency. Hartford can explore the use of digital platforms for tax filing and payment, reducing administrative costs and enhancing transparency. Additionally, technological advancements can aid in tax compliance and enforcement, ensuring that all taxpayers meet their obligations.

Sustainable Taxation

Hartford has an opportunity to lead in sustainable taxation practices. By incentivizing green initiatives and sustainable businesses, the city can attract environmentally conscious investors and businesses. This approach not only supports the city’s environmental goals but also creates a more resilient and forward-thinking economic landscape.

Tax Reform and Simplification

Simplifying Hartford’s tax system could make it more accessible and understandable for residents and businesses. This could involve consolidating certain taxes or streamlining tax rates to reduce complexity. A more straightforward tax system can enhance compliance and make it easier for taxpayers to fulfill their obligations.

Community Engagement

Engaging the community in discussions about tax policy can lead to more informed and effective decisions. Hartford can organize town hall meetings, online forums, or other platforms to gather feedback and ideas from residents. This inclusive approach ensures that the tax system reflects the needs and aspirations of the community it serves.

Conclusion: Hartford’s Taxes - A Catalyst for Progress

Hartford’s tax system is a dynamic and evolving entity, shaped by the city’s history, economic realities, and the aspirations of its residents. From its colonial-era beginnings to its modern-day complexities, taxes have been a crucial component of Hartford’s growth and development.

As Hartford continues to thrive and adapt to the challenges and opportunities of the 21st century, its tax system will play a pivotal role in shaping its future. By embracing technological advancements, sustainable practices, and community engagement, Hartford can ensure that its tax system remains a catalyst for progress, supporting economic growth, social equity, and the overall well-being of its residents.

How can I estimate my property taxes in Hartford?

+You can use the city’s online property tax estimator tool, which takes into account your property’s assessed value and the current tax rate. This tool provides a quick and convenient way to estimate your property tax obligations.

Are there any tax incentives for renewable energy projects in Hartford?

+Yes, Hartford offers tax incentives for renewable energy projects. These incentives include tax abatements and exemptions for solar, wind, and other green energy installations. Contact the city’s tax department for more details and eligibility criteria.

What support does Hartford provide for low-income taxpayers?

+Hartford provides a range of support for low-income taxpayers, including tax credits, deductions, and relief programs. The city’s Taxpayer Assistance Program offers guidance and assistance to ensure that low-income residents can navigate the tax system effectively and take advantage of available benefits.