What Is The Sales Tax In Florida

In Florida, the sales tax landscape is an intricate web of varying rates and unique considerations. The state sales tax rate is a foundational piece of this puzzle, but it's the additional local taxes that truly diversify the tax structure across the Sunshine State. Let's delve into the specifics to understand the full picture.

The Foundation: Florida’s State Sales Tax

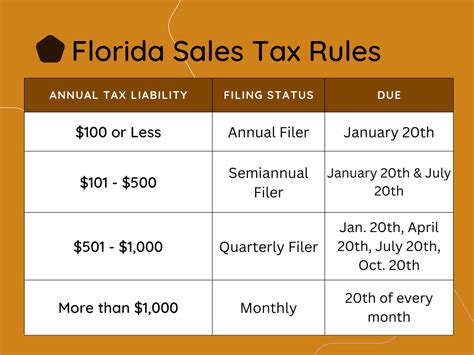

Florida imposes a state sales tax rate of 6% on most goods and services. This uniform rate applies statewide, providing a consistent baseline for understanding the tax environment. However, it’s important to note that this is just the beginning of the story.

Unveiling the Local Tax Landscape

Florida allows local governments, including counties and municipalities, to levy their own sales taxes, creating a dynamic and diverse tax structure. These additional taxes, often referred to as local option taxes, are where the real complexity lies.

County Sales Taxes

Many counties in Florida impose their own sales taxes, with rates varying from county to county. For instance, in Miami-Dade County, the total sales tax rate stands at 7%, with an additional 1% tax dedicated to transportation. Similarly, Broward County boasts a total sales tax rate of 7.5%, with a 1.5% county surcharge.

Municipal Sales Taxes

Beyond counties, individual cities and towns also have the authority to impose their own sales taxes. This results in a mosaic of tax rates across the state. Take, for example, the city of Miami, which levies a 1% municipal sales tax, bringing the total sales tax rate within the city limits to 8%.

Specialty Taxes and Exemptions

Florida’s sales tax structure is further nuanced by specialty taxes and exemptions. For instance, certain items like groceries and prescription drugs are subject to a reduced sales tax rate of 4%. Additionally, there are specific exemptions for items like non-prepared food items, certain agricultural products, and more.

| County | County Tax Rate | Total Tax Rate |

|---|---|---|

| Miami-Dade | 1% | 7% |

| Broward | 1.5% | 7.5% |

| Hillsborough | 1% | 7% |

| Orange | 1% | 7% |

| Palm Beach | 1.5% | 7.5% |

Navigating the Future of Sales Tax in Florida

As we look ahead, Florida’s sales tax structure is likely to continue evolving. With ongoing discussions around tax reform and the potential for new revenue streams, the state’s sales tax rates could see adjustments. Additionally, the rise of e-commerce and the challenge of taxing online sales present a unique opportunity for Florida to adapt its tax policies.

For businesses operating in Florida, staying informed about these potential changes is crucial. It ensures compliance with the ever-evolving tax landscape and allows for strategic planning. Whether it's adjusting pricing strategies or leveraging tax incentives, understanding the sales tax environment is key to success.

Conclusion

Florida’s sales tax landscape is a dynamic and complex environment, shaped by state policies and local initiatives. From the foundational state sales tax to the myriad of local option taxes, it’s a system that requires careful navigation. As we’ve explored, understanding these nuances is essential for both consumers and businesses alike. It’s a reminder of the intricate interplay between state and local governments in shaping the economic landscape.

What is the primary sales tax rate in Florida?

+The primary sales tax rate in Florida is 6%, applicable statewide.

Do counties and cities in Florida have the authority to impose their own sales taxes?

+Yes, many counties and cities in Florida have the authority to levy additional sales taxes, creating a diverse tax landscape across the state.

Are there any special considerations for certain items in Florida’s sales tax structure?

+Yes, Florida offers a reduced sales tax rate of 4% for items like groceries and prescription drugs, and there are specific exemptions for certain agricultural products and non-prepared food items.