Will Trump Reduce Capital Gains Tax

The topic of capital gains tax and its potential reduction has been a subject of interest and speculation since Donald Trump's presidency. With his focus on tax reforms and his aim to boost the economy, there were discussions and proposals regarding the capital gains tax rate. Let's delve into the details and explore the implications of this potential change.

Understanding Capital Gains Tax

Before we delve into the potential reduction, it’s essential to grasp the concept of capital gains tax. Capital gains tax is levied on the profit or gain made from the sale of an asset, such as stocks, bonds, real estate, or other investments. When an investor sells an asset for a higher price than they initially paid for it, the difference is considered a capital gain, and it becomes taxable. The tax rate applied to these gains can vary depending on factors like the type of asset, the holding period, and the taxpayer’s income bracket.

Trump’s Tax Reform Agenda

During his presidency, Donald Trump made tax reform a key component of his economic policy. The Tax Cuts and Jobs Act (TCJA), signed into law in 2017, was a significant step towards achieving this goal. The TCJA brought about various changes to the tax system, including adjustments to tax brackets, standard deductions, and, notably, capital gains tax rates.

Capital Gains Tax Rate Changes under Trump

One of the critical aspects of the TCJA was its impact on capital gains tax rates. The reform introduced a flat tax rate of 20% for capital gains and qualified dividends for taxpayers in the top income bracket. This represented a reduction from the previous rate of 39.6%. For taxpayers in lower income brackets, the capital gains tax rate remained at 0% or 15%, depending on their taxable income.

| Income Bracket | Capital Gains Tax Rate |

|---|---|

| Top Bracket (over $400,000 for individuals) | 20% |

| Lower Brackets (up to $400,000 for individuals) | 0% or 15% |

The TCJA also introduced a new provision known as the Qualified Business Income (QBI) deduction. This deduction allows pass-through entities, such as sole proprietorships, partnerships, and S-corporations, to deduct up to 20% of their qualified business income from their taxable income. This move was aimed at encouraging entrepreneurship and small business growth.

Potential Impact and Criticisms

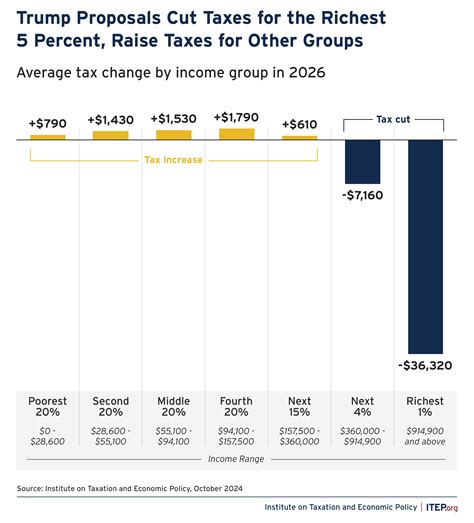

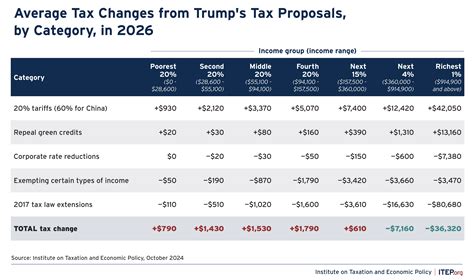

Trump’s proposed reduction in capital gains tax rates has sparked debates and divided opinions. While some argue that lower tax rates encourage investment and economic growth, others criticize it as favoring the wealthy and potentially widening income inequality.

Pros of Reduced Capital Gains Tax

- Encourages Long-Term Investments: Lower tax rates on capital gains can incentivize investors to hold onto their assets for longer periods, promoting long-term investment strategies.

- Boosts Economic Growth: By reducing the tax burden on investment profits, investors may be more inclined to reinvest their gains, leading to increased economic activity and job creation.

- Simplifies Tax Code: A flat tax rate simplifies the tax code, making it easier for taxpayers to understand and comply with their tax obligations.

Cons and Criticisms

- Income Inequality: Critics argue that lowering capital gains tax rates disproportionately benefits high-income earners, as capital gains are often a significant source of income for the wealthy.

- Revenue Loss: Reduced tax rates on capital gains could lead to a decrease in tax revenue for the government, potentially impacting public services and infrastructure projects.

- Short-Term Focus: Some argue that lower capital gains tax rates may encourage short-term investment strategies, as investors aim to maximize profits in the short run rather than focusing on long-term growth.

Analysis and Future Implications

The potential reduction in capital gains tax rates under Trump’s administration has sparked a lively debate among economists, policymakers, and investors. While the TCJA brought about significant changes, the long-term implications are still being studied and analyzed.

Economic Impact

Proponents of the reduced capital gains tax rate argue that it can stimulate economic growth by encouraging investment and entrepreneurship. By lowering the tax burden on investment profits, investors may feel more inclined to take risks and invest in new ventures, leading to job creation and innovation. Additionally, a simplified tax code could reduce compliance costs and increase overall tax efficiency.

Social and Political Considerations

However, the social and political aspects of this tax reform cannot be overlooked. Critics argue that the benefits of lower capital gains tax rates are skewed towards the wealthy, exacerbating income inequality. This inequality can lead to social and political tensions, impacting the overall stability of the society and the democratic process.

Long-Term Sustainability

Another crucial aspect to consider is the long-term sustainability of reduced capital gains tax rates. While it may provide a short-term boost to the economy, the potential loss of tax revenue could impact government spending and public services. Balancing economic growth with fiscal responsibility is a delicate task, and policymakers must carefully consider the trade-offs involved.

Conclusion

Trump’s proposal to reduce capital gains tax rates was a significant component of his tax reform agenda. While it aimed to boost investment and economic growth, it also sparked debates on income inequality and the role of taxation in society. The TCJA’s impact on capital gains tax rates is a crucial aspect of the broader tax reform, and its long-term effects are still being studied and evaluated.

As with any tax policy, the reduction in capital gains tax rates has both supporters and critics. It is essential to carefully analyze the potential benefits and drawbacks, considering the economic, social, and political implications. The future of capital gains tax rates remains a topic of discussion and debate, with policymakers and economists striving to find a balance that promotes economic growth while ensuring social and fiscal sustainability.

What is the current capital gains tax rate under Trump’s administration?

+The capital gains tax rate under Trump’s administration is a flat 20% for taxpayers in the top income bracket. Lower income brackets have a 0% or 15% rate, depending on their taxable income.

How does the Qualified Business Income (QBI) deduction impact capital gains tax?

+The QBI deduction allows pass-through entities to deduct up to 20% of their qualified business income from their taxable income. This deduction can effectively reduce the tax rate on capital gains for these entities, making it a significant incentive for small business owners.

What are the potential long-term implications of reduced capital gains tax rates?

+Reduced capital gains tax rates may stimulate economic growth by encouraging investment and entrepreneurship. However, it also raises concerns about income inequality and the potential loss of tax revenue, which could impact government spending and public services.