What Is New York State Sales Tax

In the vast and diverse landscape of the United States, each state has its unique set of laws and regulations, including tax systems. New York, a bustling hub of commerce and industry, has its own intricate sales tax structure. This article aims to delve into the intricacies of New York State Sales Tax, offering a comprehensive guide for businesses and individuals alike.

Understanding New York State Sales Tax

New York State Sales Tax is a consumption tax levied on the sale of goods and certain services within the state. It is an essential revenue source for the state government, contributing to the funding of public services and infrastructure. The tax is typically added to the purchase price of goods and services at the point of sale, with the seller collecting it from the buyer.

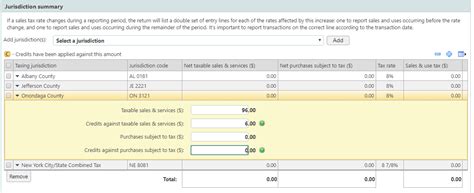

The state sales tax rate in New York is not a uniform figure but varies depending on the location of the transaction. While the statewide sales tax rate stands at 4%, there are additional local taxes that can be applied, pushing the total sales tax rate higher. These local taxes, known as "local sales taxes," are levied by counties and cities and can range from 0% to 4.75%, creating a complex web of tax rates across the state.

Taxable Goods and Services

The scope of taxable goods and services in New York is broad. Generally, all retail sales of tangible personal property are subject to sales tax. This includes items like clothing, electronics, furniture, and appliances. Additionally, certain services, such as repair and installation services, are also taxable. However, there are exemptions and exceptions to the sales tax, which can be based on the type of item, the intended use, or the purchaser’s status.

For instance, certain groceries, prescription drugs, and non-preparatory school supplies are exempt from sales tax. Similarly, sales to certain entities like governmental bodies, non-profit organizations, and religious institutions are often exempt, provided they have the necessary documentation.

Registration and Compliance

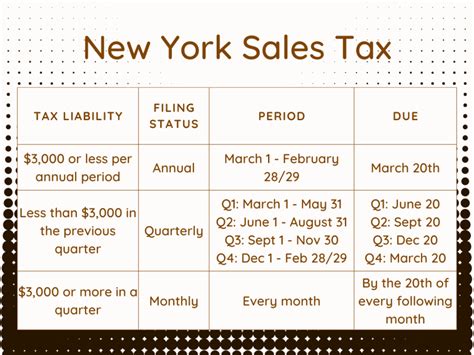

Businesses selling taxable goods or services in New York are required to register with the state’s Department of Taxation and Finance. This registration process involves obtaining a Certificate of Authority, which authorizes the business to collect and remit sales tax. Registered businesses must then collect the appropriate sales tax from customers and remit it to the state on a regular basis, typically monthly or quarterly.

Compliance with sales tax regulations is crucial. Businesses must maintain accurate records of taxable sales, ensuring proper tax collection and reporting. Failure to comply can result in penalties and interest charges, which can be substantial. It's worth noting that New York's tax authorities have robust audit processes in place to ensure tax compliance.

Online Sales and Sales Tax

With the rise of e-commerce, the issue of sales tax for online sales has become increasingly complex. New York, like many other states, has laws in place to ensure that online retailers collect and remit sales tax. This is particularly relevant for out-of-state retailers who make sales to New York residents. The state has implemented laws to ensure that these retailers collect and remit the appropriate sales tax, even if they do not have a physical presence in the state.

| Taxable Item | Sales Tax Rate |

|---|---|

| General Merchandise | 4% - 8.875% |

| Clothing (Below $110) | 0% |

| Prescription Drugs | 0% |

| Prepared Food | 8.875% |

The Impact of Sales Tax on Businesses and Consumers

Sales tax has significant implications for both businesses and consumers in New York. For businesses, the sales tax is an additional cost that must be managed and accounted for. It affects pricing strategies, as businesses must factor in the tax when setting their prices. Additionally, the administrative burden of sales tax compliance can be substantial, requiring dedicated resources for record-keeping and reporting.

From a consumer perspective, sales tax adds to the cost of goods and services. It can influence purchasing decisions, with consumers potentially seeking out tax-free alternatives or shopping in areas with lower tax rates. However, sales tax also funds essential public services, so it is a necessary part of the economic ecosystem.

Strategies for Businesses

Businesses operating in New York can employ various strategies to navigate the sales tax landscape effectively. One key strategy is to ensure accurate and timely compliance with sales tax regulations. This involves maintaining a robust sales tax registration and remittance process, as well as staying abreast of any changes to sales tax laws and rates.

Another strategy is to build sales tax into pricing models. By incorporating sales tax into the overall pricing strategy, businesses can ensure that their prices are competitive while also accounting for the tax. This approach can help businesses avoid the need to adjust prices frequently due to sales tax rate changes.

Consumer Awareness

For consumers, understanding sales tax is crucial for making informed purchasing decisions. Being aware of the sales tax rates in different areas of the state can influence where and when purchases are made. Additionally, consumers can take advantage of tax-free periods or exemptions, such as the tax-free weekend for certain items, to save on their purchases.

The Future of Sales Tax in New York

As with any tax system, New York’s sales tax structure is subject to change. The state’s tax authorities regularly review and update sales tax laws to ensure they remain fair and effective. This can lead to changes in tax rates, the scope of taxable items, and compliance requirements.

One trend that is likely to continue is the focus on online sales and the associated sales tax. With the ongoing growth of e-commerce, states are increasingly looking to ensure that online retailers, particularly those without a physical presence in the state, contribute to the tax base. This could lead to further developments in the laws governing online sales tax.

Additionally, there may be ongoing discussions around the fairness and equity of the sales tax system. Some argue for a simplification of the tax rates and structures, particularly with regard to the varying local tax rates. However, any changes would need to balance the state's revenue needs with the interests of businesses and consumers.

How often do sales tax rates change in New York?

+Sales tax rates can change annually, typically effective from April 1st each year. However, changes can also occur at other times due to legislative actions or budget adjustments.

Are there any sales tax holidays in New York?

+Yes, New York has tax-free weekends for certain items, such as clothing and school supplies. These weekends usually occur in late summer or early fall.

How can businesses stay updated on sales tax changes in New York?

+Businesses can subscribe to updates from the New York Department of Taxation and Finance, which provides notifications on any changes to tax laws and rates. Additionally, tax compliance software can help businesses stay informed and compliant.