Georgia Tax Deadline 2025

The Georgia tax deadline is an important date for residents and businesses in the state to be aware of. It marks the last day to file tax returns and pay any outstanding tax liabilities for the previous year. In this comprehensive guide, we will delve into the details of the Georgia tax deadline for 2025, providing you with all the essential information and insights to navigate the tax landscape effectively.

Understanding the Georgia Tax Deadline

The tax deadline in Georgia, like in many other states, is an annual event that serves as a crucial reminder for taxpayers to fulfill their financial obligations to the state government. While the specific date may vary slightly from year to year, it typically falls within a predetermined timeframe, offering taxpayers a window of opportunity to ensure compliance with the state’s tax regulations.

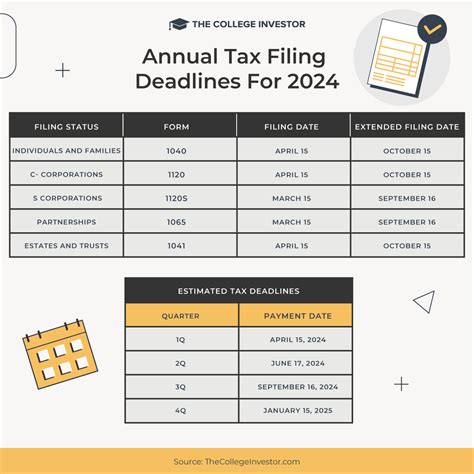

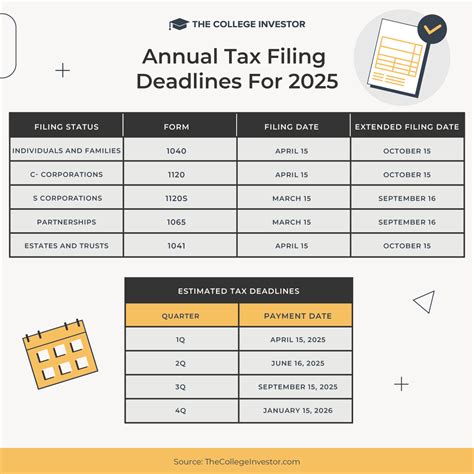

For the year 2025, the Georgia tax deadline is projected to be April 15th. This date aligns with the traditional federal tax deadline, creating a synchronized approach to tax filing across the state and federal levels. However, it's important to note that certain circumstances may warrant extensions or adjustments to this deadline, which we will explore further in this article.

Key Considerations for the 2025 Tax Season

As we approach the 2025 tax season in Georgia, it’s beneficial to familiarize yourself with the key considerations and potential changes that may impact your tax obligations. Here are some crucial aspects to keep in mind:

1. Tax Rate Adjustments

The state of Georgia periodically reviews and adjusts its tax rates to reflect economic conditions and policy objectives. While the exact tax rates for 2025 have not yet been finalized, it’s essential to stay informed about any changes that may occur. Monitoring the official tax rate announcements will ensure you’re prepared for any adjustments that might impact your tax liability.

| Tax Category | 2024 Rate | Potential 2025 Rate |

|---|---|---|

| Income Tax | 6% (for taxable income above $7,500) | To be determined |

| Sales and Use Tax | 4% | Subject to change |

| Corporate Income Tax | 6% | Pending legislative decisions |

2. Tax Reform Initiatives

The Georgia legislature is known for its ongoing efforts to streamline and improve the state’s tax system. As a result, taxpayers should anticipate potential tax reform initiatives that could influence the tax landscape in 2025. These reforms may include changes to tax credits, deductions, or the implementation of new tax incentives to promote economic growth.

3. Online Filing and Payment Options

Georgia offers a user-friendly online platform for taxpayers to file their returns and make payments electronically. For the 2025 tax season, it’s expected that the state will continue to enhance its digital services, making the filing process more efficient and accessible. Taxpayers can benefit from the convenience of online filing, which often includes features like real-time updates and secure data transmission.

4. Tax Preparation Resources

To assist taxpayers in navigating the complexities of tax filing, the Georgia Department of Revenue provides a wealth of resources and tools. These resources include comprehensive guides, calculators, and instructional videos. By leveraging these official resources, taxpayers can gain a deeper understanding of their tax obligations and ensure accurate filing.

Extension Requests and Payment Options

In certain circumstances, taxpayers may require additional time beyond the official tax deadline to complete their tax returns. Georgia offers an extension request process to accommodate such situations. To request an extension, taxpayers can utilize Form 505-EXT, which grants an automatic six-month extension for filing individual income tax returns.

It's important to note that while an extension provides more time for filing, it does not extend the deadline for making tax payments. Taxpayers are still expected to estimate their tax liability and make timely payments to avoid penalties and interest. Georgia offers various payment options, including online payments, direct bank transfers, and traditional mail-in methods.

Penalties and Interest for Late Filing and Payment

Failing to meet the Georgia tax deadline or making late payments can result in penalties and interest charges. The state imposes penalties for late filing, which can vary based on the specific circumstances and the amount of time elapsed since the original deadline. Additionally, interest accrues on any unpaid tax liabilities, further emphasizing the importance of timely filing and payment.

| Late Filing Penalty | Late Payment Interest |

|---|---|

| 5% of the unpaid tax liability per month, up to a maximum of 25% | Interest rate varies based on federal short-term rate plus 3% |

Preparing for the 2025 Tax Deadline

To ensure a smooth and stress-free tax season, it’s advisable to start preparing well in advance of the 2025 tax deadline. Here are some practical steps to consider:

- Gather all relevant tax documents, such as W-2 forms, 1099s, and receipts.

- Review your financial records and identify any potential deductions or credits you may be eligible for.

- Consider seeking professional tax advice or using tax preparation software to ensure accurate and optimized tax returns.

- Set aside time to thoroughly review your tax situation and plan your strategy for the upcoming tax season.

Future Implications and Tax Planning

Looking beyond the 2025 tax deadline, it’s essential to adopt a proactive approach to tax planning. By understanding the state’s tax landscape and staying informed about potential changes, taxpayers can make informed decisions that align with their financial goals.

Tax planning strategies can include maximizing deductions and credits, exploring investment opportunities with favorable tax implications, and considering the impact of tax laws on business operations or personal financial planning. By incorporating tax considerations into long-term financial strategies, individuals and businesses can optimize their tax positions and achieve greater financial stability.

Conclusion

The Georgia tax deadline for 2025 is an important milestone for taxpayers to mark on their calendars. By staying informed about tax rate adjustments, potential reforms, and the resources available for tax preparation, individuals and businesses can navigate the tax landscape with confidence. Remember, timely filing and payment are crucial to avoid penalties and ensure compliance with the state’s tax regulations.

As we approach the 2025 tax season, stay tuned for official announcements and updates from the Georgia Department of Revenue. By staying informed and taking a proactive approach to tax planning, you can ensure a smooth and successful tax filing experience.

What happens if I miss the Georgia tax deadline?

+Missing the tax deadline can result in penalties and interest charges. The state imposes late filing penalties and interest accrues on unpaid tax liabilities. It’s important to take prompt action by filing your return and making any necessary payments to minimize the impact of late fees.

Are there any tax credits or deductions available in Georgia?

+Yes, Georgia offers various tax credits and deductions to help reduce tax liabilities. These include credits for education expenses, certain business expenses, and even energy-efficient home improvements. It’s advisable to explore these options to maximize your tax savings.

Can I file my taxes electronically in Georgia?

+Absolutely! Georgia provides a convenient online filing system for taxpayers. By filing electronically, you can enjoy the benefits of real-time updates, secure data transmission, and faster processing times. It’s a user-friendly option that streamlines the tax filing process.