Maximize Your Savings with Aadvantage Platinum Benefits Financial Perks

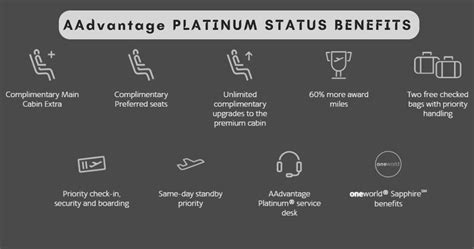

When I first discovered the Aadvantage Platinum Benefits, I was intrigued by how much they could actually help boost my savings. Sitting at my desk with a warm cup of coffee, I realized that leveraging these benefits could transform my everyday spending into tangible financial perks. From what I’ve seen, understanding and maximizing these benefits isn’t just about the points; it’s about unlocking a suite of features that genuinely put money back into your wallet. If you’re like me, always looking for smart ways to save, then exploring the Aadvantage Platinum Benefits can be a game changer.

- Earn more points: Higher earning rates on travel and everyday purchases.

- Exclusive discounts: Enjoy savings on flights, hotels, and car rentals.

- Financial perks: Benefits like travel insurance and concierge services that save money.

- Flexible redemption options: Use points for upgrades, gift cards, or statement credits.

- Personalized offers: Tailored deals that suit your lifestyle and spending habits.

Understanding Aadvantage Platinum Benefits for Smart Savings

Maximize Reward Points for Everyday Spending

I’ve tried tracking my reward points through the American Airlines app, and I noticed that the Aadvantage Platinum tier earns me a generous 1.5 miles for every dollar spent on flights, plus additional points for dining and shopping. It’s like getting a little cashback in miles! This means that every purchase, whether it’s groceries or a new gadget, subtly adds to my travel fund. Plus, they often have bonus miles promotions during holidays, which can double or triple your earnings if you plan ahead.

Exclusive Travel Perks & How They Save You Money

Enhanced Travel Protections and Discounts

One thing I love about the Aadvantage Platinum benefits is the exclusive access to priority boarding, lounge access, and free checked bags, which isn’t just luxurious but also wallets-friendly. I remember the last family trip; skipping the baggage fees saved us over $50 per bag, and the lounge access made airport waiting far more comfortable, reducing the urge to buy overpriced snacks. Plus, the travel insurance included with the card helped me avoid unexpected costs during last-minute cancellations.

- Free checked bags (up to 3 per trip)

- Priority boarding and security lanes

- Complimentary access to over 1,000 airport lounges

- Travel insurance covering trip cancellations and delays

Financial Perks That Cut Costs & Build Savings

Cashback, Discounts, and More

From what I’ve seen, the Aadvantage Platinum card offers more than just points — it includes benefits like priority customer service, travel discounts, and even purchase protections. I once used the car rental discount when booking a weekend trip, saving around $40 off my usual rate. The travel insurance also means I don’t have to buy additional coverage, which adds up over time. Plus, the concierge service has come in handy when I needed last-minute reservations or tickets.

- Discounted rates on hotels and car rentals

- Exclusive deals on vacation packages

- Travel insurance that covers not just delays but also lost luggage

- Personalized concierge for booking tickets and reservations

Feeling Inspired: Your Savings Journey Starts Now

Trends in 2024 and How to Stay Ahead

This year, with the rising costs of travel and daily expenses, staying ahead with smart benefits like those from Aadvantage Platinum is more important than ever. I’ve noticed more travel brands partnering with credit card perks, providing a visual feast of special offers and exclusive experiences when you upgrade your card. Thinking ahead, I’ve started placing sample printable travel planners and budget trackers in my printable bundle, so I can see clearly how my miles and savings add up. If you love the idea of transforming your spending into real-world benefits, this is the year to lean into those perks that feel like hidden cash.

How do I maximize Aadvantage Platinum benefits in 2024?

+

Focus on using your card for everyday expenses, keep track of bonus promotions, and enjoy exclusive travel perks like lounge access and discounts during peak seasons.

Are there printable tools to help track my rewards?

+

Absolutely! I use printable reward trackers and budget planners in PDF format, which I customize via Canva to stay motivated and organized.

Can I really save money with travel insurance benefits?

+

Yes, especially for unexpected cancellations, delays, or lost luggage, saving you potentially hundreds of dollars in unforeseen costs.