What Is Sales Tax In New York State

Sales tax is an essential component of the tax system in New York State, impacting both residents and businesses. This tax, applied to various goods and services, is a crucial source of revenue for the state, supporting essential services and infrastructure. Understanding the intricacies of sales tax is vital for individuals and businesses alike, as it affects their financial planning and compliance with tax regulations.

Understanding Sales Tax in New York State

Sales tax in New York is a type of consumption tax, levied on the sale or lease of tangible personal property and certain services. It is an indirect tax, meaning the tax is typically collected from the consumer by the retailer, who then remits it to the state. The tax rate varies depending on the location of the sale and the nature of the goods or services being provided.

Statewide Sales Tax Rate

The statewide sales tax rate in New York is 4%. This rate applies uniformly across the state, making it a straightforward aspect of the tax system. However, it’s important to note that this is just the base rate, and additional local taxes can significantly increase the total sales tax burden.

Local Sales Tax Variations

New York State allows local governments, such as counties and cities, to impose additional sales taxes. These local taxes can vary significantly, leading to a complex landscape of sales tax rates. For instance, New York City has a local sales tax rate of 4.5%, bringing the total sales tax to 8.5% in the city. Other localities may have different rates, with some areas having lower or even no additional local sales tax.

| Location | State Sales Tax Rate | Local Sales Tax Rate | Total Sales Tax Rate |

|---|---|---|---|

| New York City | 4% | 4.5% | 8.5% |

| Albany | 4% | 3% | 7% |

| Rochester | 4% | 2% | 6% |

Sales Tax Exemptions

Not all goods and services are subject to sales tax in New York. Certain items, such as prescription medications, most groceries, and certain clothing items under a specific price threshold, are exempt from sales tax. Additionally, nonprofit organizations and government entities are often exempt from paying sales tax, but they must possess a valid exemption certificate.

Use Tax

New York State also imposes a use tax, which is similar to sales tax but applies to purchases made outside the state and brought into New York. This tax ensures that out-of-state purchases are taxed in a manner similar to in-state purchases. It’s particularly relevant for online purchases, where the sales tax might not have been collected by the retailer.

Impact of Sales Tax on Businesses and Consumers

Sales tax has a significant impact on both businesses and consumers in New York. For businesses, it affects pricing strategies, with the need to incorporate sales tax into retail prices. It also adds a layer of complexity to accounting and tax compliance, requiring businesses to remit sales tax regularly to the state.

Compliance and Penalties

Businesses are required to register for a sales tax permit with the New York State Department of Taxation and Finance. Failure to register or underreporting sales tax can result in significant penalties and interest charges. Regular compliance with sales tax regulations is essential to avoid these penalties and maintain a good standing with the state.

Consumer Perspective

For consumers, sales tax adds to the cost of goods and services. Understanding the sales tax rate in their area can help consumers make more informed purchasing decisions. Additionally, consumers should be aware of their rights and responsibilities regarding sales tax, particularly when making purchases online or out of state.

Future Implications and Changes

The sales tax landscape in New York State is subject to change, with potential revisions to rates or the inclusion of new services or goods under taxation. These changes can have a significant impact on both businesses and consumers, affecting pricing, tax revenue, and the overall economy of the state.

Potential Tax Reform

There have been ongoing discussions about tax reform in New York, including proposals to simplify the sales tax system. Some suggestions include reducing or eliminating local sales taxes, which could lead to a more uniform tax rate across the state. However, such reforms face challenges, particularly from localities reliant on the additional revenue generated by local sales taxes.

Online Sales and E-Commerce

The rise of e-commerce has led to a significant shift in sales tax collection, particularly with the increasing complexity of online sales. New York, like many other states, has been adapting its tax regulations to address this change, ensuring that online retailers collect and remit sales tax appropriately. This evolution in tax policy is crucial to maintaining a level playing field between brick-and-mortar and online retailers.

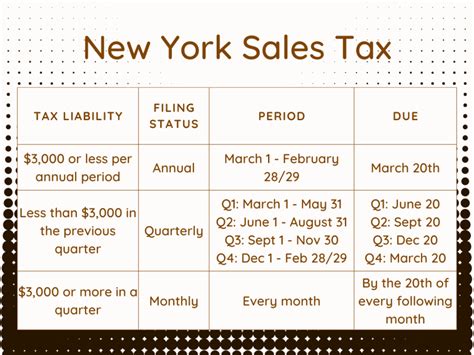

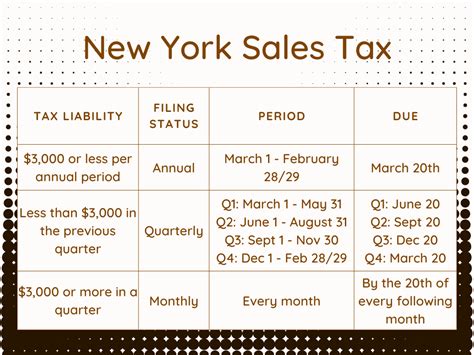

How often do businesses need to remit sales tax in New York State?

+The frequency of sales tax remittance depends on the volume of sales. Businesses with higher sales volumes may be required to remit sales tax monthly, while those with lower volumes might remit quarterly or semi-annually. The New York State Department of Taxation and Finance provides guidelines based on the business’s sales history and projected sales.

Are there any resources available to help businesses calculate and manage sales tax obligations in New York State?

+Yes, the New York State Department of Taxation and Finance offers a Sales Tax Calculator on its website, which can assist businesses in determining the sales tax for a transaction. Additionally, there are various tax software solutions available that can help businesses manage their sales tax obligations more efficiently.

What happens if a business makes a mistake in calculating or remitting sales tax in New York State?

+Mistakes can happen, and the New York State Department of Taxation and Finance understands this. If a business discovers a mistake in sales tax calculation or remittance, it should contact the department as soon as possible. The department will work with the business to rectify the error and may waive penalties if the business is cooperative and acts promptly.