Is Overtime Taxed

Taxation of overtime pay is a complex matter that varies across jurisdictions and depends on several factors. Understanding how overtime wages are treated by tax authorities is crucial for both employees and employers, as it can significantly impact their financial planning and compliance obligations.

The Dynamics of Overtime Taxation

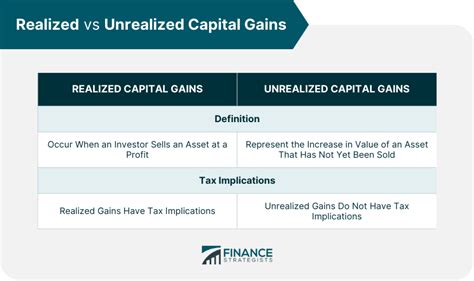

Overtime pay, which is typically earned when an employee works beyond their standard working hours, is subject to a unique set of tax regulations. These regulations can differ based on the country, state, or province, leading to a diverse range of tax implications for overtime earnings.

Overtime Tax Treatment Worldwide

In most countries, overtime pay is treated as regular income for tax purposes. This means that the tax rate applicable to regular wages also applies to overtime earnings. However, some jurisdictions have implemented specific rules that can make overtime pay more or less taxable.

| Jurisdiction | Overtime Tax Treatment |

|---|---|

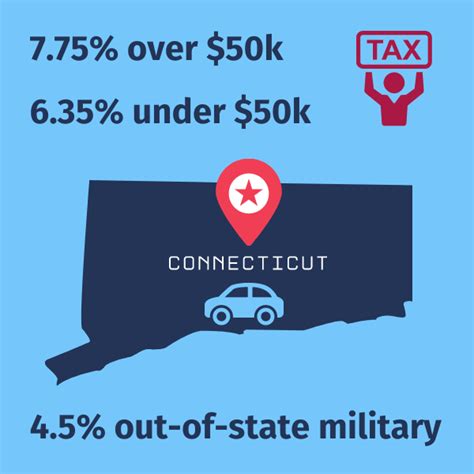

| United States | Overtime pay is taxed at the same rate as regular income. However, some states offer tax credits or deductions for overtime hours worked. |

| United Kingdom | Overtime pay is generally subject to income tax and National Insurance contributions. Special rules apply for certain industries, such as aviation. |

| Canada | Overtime pay is taxed at the regular federal and provincial tax rates. Some provinces offer tax credits for overtime hours, especially in specific industries. |

| Australia | Overtime pay is taxed as part of an employee's total income. The tax rate depends on the employee's total earnings, including overtime. |

| European Union | Overtime pay is taxed in line with each member state's income tax laws. Some countries, like France, have specific tax rates for overtime earnings. |

Impact on Employee Take-Home Pay

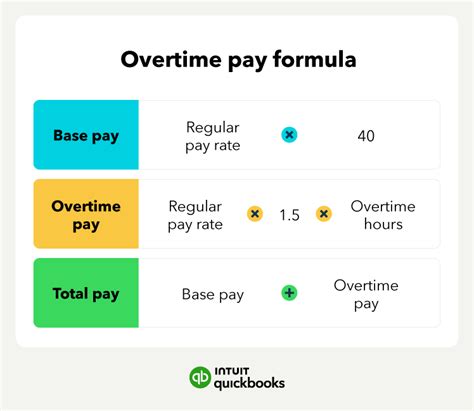

The taxation of overtime pay directly affects an employee’s take-home earnings. For instance, if an employee works 10 hours of overtime at a rate of 20 per hour, and their regular tax rate is 25%, they would pay 50 in taxes on their overtime earnings. This means their take-home pay for those overtime hours would be $150.

Employer Considerations

From an employer’s perspective, understanding overtime tax regulations is vital for payroll management and compliance. It’s essential to correctly calculate and deduct taxes from overtime pay to avoid legal issues and maintain a positive relationship with employees.

The Role of Tax Authorities

Tax authorities play a crucial role in overseeing the taxation of overtime pay. They provide guidelines and resources to help employees and employers understand their tax obligations. In some cases, tax authorities may offer support or clarifications on complex tax scenarios involving overtime pay.

Strategies for Managing Overtime Tax

For employees, managing overtime tax effectively involves understanding their tax brackets and exploring potential tax credits or deductions related to overtime work. They can consult tax professionals or use online tax calculators to estimate their tax liability for overtime earnings.

Employers, on the other hand, should ensure they are compliant with all tax regulations regarding overtime pay. This includes accurately calculating and deducting taxes, as well as providing employees with clear information about their overtime earnings and associated taxes.

Conclusion

In summary, the taxation of overtime pay is a nuanced and diverse topic, influenced by various factors. While overtime pay is generally taxed at the same rate as regular income, there are exceptions and incentives offered by different jurisdictions. Both employees and employers should stay informed about these regulations to make the most of their overtime earnings and maintain compliance.

FAQ

Are there any tax benefits for working overtime?

+

Some jurisdictions offer tax credits or deductions for overtime hours worked. For example, certain states in the U.S. provide tax credits for overtime work, which can reduce the tax liability for those earnings.

How does overtime pay impact my tax bracket?

+

Overtime pay is included in your total income for the year, which can push you into a higher tax bracket. This means you might pay a higher tax rate on your overtime earnings. It’s important to understand your tax bracket to estimate your tax liability accurately.

Can employers offer tax-free overtime pay?

+

In most cases, overtime pay is subject to tax. However, some employers may offer tax-advantaged compensation packages that can include flexible spending accounts or other benefits that can reduce the tax burden on overtime earnings. It’s important to consult a tax professional for advice on specific situations.