Sugary Drink Tax Seattle

The debate surrounding sugary drink taxes has been a heated topic in various cities and countries worldwide, with proponents arguing for its potential health benefits and opponents raising concerns about its economic impact. Seattle, a city known for its progressive initiatives, became the latest battleground for this controversial tax measure.

In this comprehensive article, we delve into the intricacies of Seattle's Sugary Drink Tax, exploring its origins, implementation, and the broader implications it holds for public health and the economy. By examining real-world data and expert insights, we aim to provide a nuanced understanding of this policy's impact and its place in the broader conversation on public health interventions.

Understanding Seattle’s Sugary Drink Tax

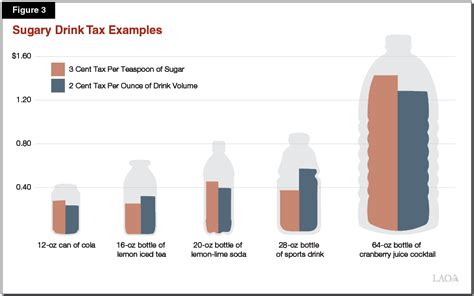

The Sugary Drink Tax, officially known as the Sweetened Beverage Tax, was implemented in Seattle on January 1, 2018. It was passed as a measure to combat the growing concerns over the health risks associated with excessive sugar consumption, particularly among children and vulnerable populations.

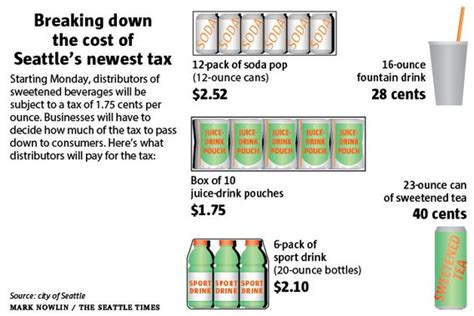

The tax applies to beverages with added caloric sweeteners, including sodas, energy drinks, and sweetened teas. It excludes 100% fruit juices, dairy-based drinks, and drinks containing artificial sweeteners. The tax rate is set at 1.75 cents per fluid ounce, making Seattle's tax one of the highest in the nation.

Revenue Allocation

A key aspect of Seattle’s Sugary Drink Tax is the allocation of its proceeds. The tax revenue is earmarked for specific programs aimed at promoting public health and addressing health disparities. Here’s a breakdown of the revenue allocation:

| Program | Percentage of Revenue |

|---|---|

| Community Health Programs | 40% |

| Healthy Food Incentives | 30% |

| Education and Outreach | 20% |

| Administration and Enforcement | 10% |

Impact on Consumer Behavior

One of the primary goals of the Sugary Drink Tax is to influence consumer behavior and reduce the consumption of sugary beverages. Let’s explore the empirical data on this front:

Sales Data Analysis

A study conducted by the University of Washington examined the impact of the tax on sales data from Seattle retailers. The findings revealed a significant decrease in the sales of taxed beverages, with a notable shift towards untaxed alternatives such as bottled water and unsweetened beverages.

| Beverage Type | Percentage Change in Sales |

|---|---|

| Taxed Sugary Drinks | -15% |

| Unsweetened Beverages | +10% |

| Water | +8% |

This shift in consumer behavior aligns with the intended goal of the tax, suggesting that it may contribute to a healthier diet among Seattle residents.

Public Perception

Public opinion surveys conducted both before and after the implementation of the tax provide valuable insights into its reception. A majority of Seattle residents expressed support for the tax, citing health concerns and the need for revenue to fund public health initiatives.

However, the tax also faced opposition from some consumers who viewed it as an infringement on personal choice and a potential burden on lower-income households. Balancing these perspectives is crucial in the ongoing dialogue surrounding the tax.

Economic Implications

While the Sugary Drink Tax aims to promote public health, its economic impact is a subject of much debate. Let’s explore the various economic considerations:

Retailers and Distributors

The tax has had a notable effect on businesses in the beverage industry. Retailers and distributors have faced increased costs associated with the tax, which has led to strategic adjustments in their operations.

Some retailers have opted to absorb the tax, while others have passed on the cost to consumers. This has resulted in varying price increases for sugary drinks across different retailers, impacting consumer purchasing decisions.

Industry Adaption

In response to the tax, beverage manufacturers and distributors have adapted their strategies. Many companies have reformulated their products to reduce sugar content or have introduced new, untaxed alternatives to their product lines.

This industry adaption reflects a broader trend of consumer demand for healthier options and the need for businesses to remain competitive in a changing market.

Job Market and Employment

The economic implications of the Sugary Drink Tax extend to the job market. While the tax’s proponents argue that the revenue generated can be used to create jobs in the health sector, critics raise concerns about potential job losses in the beverage industry.

However, empirical data on job market changes specifically attributed to the tax is limited. Further research is necessary to determine the precise impact on employment in both the health and beverage sectors.

Health Outcomes and Long-term Effects

The primary objective of the Sugary Drink Tax is to improve public health outcomes. Let’s examine the potential long-term effects of the tax on health indicators:

Obesity and Chronic Diseases

Reducing sugar consumption is linked to a lower risk of obesity and related chronic diseases such as type 2 diabetes and cardiovascular disease. While the tax’s direct impact on these health outcomes is still being studied, early indicators suggest a positive correlation.

Long-term studies are needed to establish a causal relationship between the tax and improved health outcomes. Nevertheless, the initial data provides a promising foundation for further exploration.

Dental Health

Excessive sugar consumption is also associated with dental health issues, including tooth decay and cavities. The Sugary Drink Tax aims to mitigate these risks by discouraging the consumption of sugary beverages.

Early indications show a decrease in dental-related emergency room visits among children, suggesting a potential improvement in oral health. Further research is required to establish a definitive link.

Lessons from Seattle’s Experience

Seattle’s implementation of the Sugary Drink Tax offers valuable insights for other cities and policymakers considering similar initiatives. Here are some key takeaways:

- Revenue Allocation: The explicit allocation of tax revenue for health initiatives sets a precedent for using public health taxes to fund specific programs.

- Consumer Behavior: The tax's impact on consumer behavior suggests that pricing strategies can influence dietary choices.

- Industry Adaption: Beverage manufacturers and distributors have shown adaptability, reformulating products and introducing healthier options.

- Public Support: The tax's public support highlights the importance of aligning policies with community health concerns.

Conclusion

Seattle’s Sugary Drink Tax is a complex policy measure with far-reaching implications for public health and the economy. While early data suggests a positive impact on consumer behavior and health outcomes, the long-term effects require further study.

As the conversation around public health interventions continues, Seattle's experience serves as a case study, offering valuable lessons for policymakers, health advocates, and the beverage industry alike. By examining the multifaceted impact of this tax, we can contribute to a more informed dialogue on effective strategies to promote public health.

What is the purpose of Seattle’s Sugary Drink Tax?

+The primary purpose of Seattle’s Sugary Drink Tax is to reduce the consumption of sugary beverages, which are associated with various health risks, including obesity, diabetes, and dental issues. The tax aims to promote healthier dietary choices and generate revenue for public health initiatives.

How has the tax affected consumer behavior?

+Studies show a decrease in the sales of taxed sugary drinks and an increase in the consumption of untaxed alternatives like water and unsweetened beverages. This shift suggests that the tax has successfully influenced consumer choices towards healthier options.

What are the economic implications of the tax?

+The tax has impacted beverage retailers and distributors, leading to increased costs and strategic adjustments. While some businesses absorb the tax, others pass on the cost to consumers. The economic effects on employment in both the health and beverage sectors are still being studied.