Denton County Property Tax Search

Denton County, located in the north-central region of Texas, is known for its vibrant communities, diverse economy, and thriving real estate market. One crucial aspect of homeownership in this region is understanding and managing property taxes. In this comprehensive guide, we will delve into the world of Denton County property taxes, providing you with expert insights, practical information, and resources to navigate the tax assessment and payment process with ease.

Understanding Property Taxes in Denton County

Property taxes are an essential revenue source for local governments and play a significant role in funding vital community services and infrastructure. In Denton County, these taxes contribute to the maintenance of roads, schools, public safety, and other essential services that enhance the quality of life for residents.

The property tax system in Denton County operates on a complex yet well-regulated framework. It involves several key players, including the Appraisal District, Appraisal Review Board, Taxing Units, and Tax Assessor-Collector, each with distinct roles and responsibilities.

The Appraisal District is responsible for determining the value of each property within the county. This value, known as the appraised value, serves as the basis for calculating property taxes. The Appraisal Review Board, an independent body, handles protests and appeals related to appraised values, ensuring fairness and accuracy in the assessment process.

Taxing Units and Assessment Process

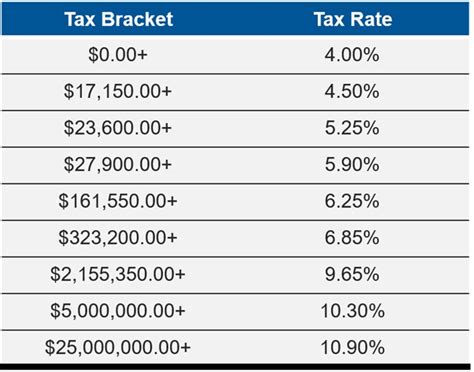

Denton County is divided into multiple taxing units, which include cities, school districts, counties, and other special districts. Each taxing unit has the authority to set its tax rate, which, when applied to the appraised value of a property, determines the property tax liability for that specific unit.

The assessment process begins with the Appraisal District sending out notice of appraised value to property owners. This notice provides information about the appraised value and the deadline for filing protests. Property owners have the right to review and challenge their appraised values if they believe they are inaccurate or excessive.

| Key Dates | Description |

|---|---|

| April 15 | Appraisal District sends notices of appraised value. |

| May 15 - June 15 | Protest period for property owners. |

| July 1 | Tax rates adopted by taxing units. |

| October 1 | Tax bills mailed to property owners. |

Online Resources for Property Tax Search

In today’s digital age, Denton County provides convenient online platforms to assist residents in accessing property tax information and managing their obligations. These resources offer a user-friendly interface and a wealth of data, making the tax search process efficient and accessible.

Denton County Appraisal District (DCAD)

The Denton County Appraisal District website serves as a valuable resource for property owners. It offers an online property search tool that allows users to look up properties by address, account number, or even by map location. This tool provides detailed information about a property’s characteristics, such as its size, improvements, and appraised value.

Additionally, the DCAD website provides a comprehensive tax calendar with important dates and deadlines related to property taxes. It also offers an online protest filing system, enabling property owners to initiate the protest process digitally.

Tax Assessor-Collector’s Office

The Denton County Tax Assessor-Collector’s Office plays a crucial role in collecting property taxes and issuing tax bills. Their website offers an online property tax lookup feature, allowing residents to search for their property tax account information and view their current tax bill.

This online tool provides a breakdown of the tax amount, including the specific taxing units and their respective rates. It also offers payment options, such as online payments, e-checks, or credit card payments, ensuring convenience and flexibility for taxpayers.

Interactive Mapping and Data Tools

Denton County also provides interactive mapping tools and data resources to explore property information and tax data. These tools allow users to visualize property boundaries, assess property values, and analyze tax data across different areas within the county.

One notable resource is the Denton County GIS (Geographic Information System), which offers an interactive map with layers that display property boundaries, tax rates, zoning information, and more. This tool empowers residents, businesses, and investors to make informed decisions related to property ownership and development.

Expert Tips for Property Tax Management

Navigating the property tax landscape can be complex, but with the right strategies and knowledge, homeowners can effectively manage their tax obligations and potentially reduce their tax burden.

Reviewing Appraised Values

It is essential to carefully review the appraised value of your property each year. Property values can fluctuate due to market conditions, improvements, or other factors. By staying informed about your property’s value, you can identify any discrepancies or potential overvaluations and take appropriate action.

Filing Protests

If you believe your property’s appraised value is inaccurate or excessive, you have the right to file a protest with the Appraisal Review Board. This process involves providing evidence and arguments to support your claim. The board will review your case and make a determination, potentially resulting in a reduction of your appraised value.

Tax Exemptions and Discounts

Denton County offers various tax exemptions and discounts to eligible property owners. These include homestead exemptions, which reduce the taxable value of your primary residence, and exemptions for elderly or disabled individuals. Understanding the eligibility criteria and applying for these benefits can significantly lower your property tax liability.

Payment Options and Discounts

Explore the different payment options available through the Tax Assessor-Collector’s Office. Timely payments may qualify you for discounts or interest-free periods. Consider setting up automatic payments or exploring payment plans to ensure you meet your tax obligations without incurring additional fees.

Future Implications and Trends

As Denton County continues to grow and develop, the property tax landscape is likely to evolve. Keeping up with local policies, initiatives, and market trends is essential for property owners to make informed decisions and plan their financial strategies accordingly.

The county's commitment to transparency and accessibility in the property tax process is evident through its online resources and initiatives. As technology advances, we can expect further enhancements in online property tax management, making it even more convenient for residents to access information and manage their obligations.

Conclusion

Understanding and managing property taxes in Denton County is a crucial aspect of homeownership. By utilizing the wealth of resources and expert advice available, residents can navigate the tax assessment and payment process with confidence. Stay informed, leverage the power of online tools, and explore the various options to optimize your property tax management strategy.

What is the average property tax rate in Denton County?

+

The average effective property tax rate in Denton County is approximately 2.31%, as of our latest data. However, it’s important to note that this rate can vary significantly depending on the specific taxing unit and the property’s location within the county.

How often are property values reassessed in Denton County?

+

Property values in Denton County are typically reassessed annually. The Appraisal District conducts a comprehensive review of properties to determine their market value and ensure fairness in the assessment process.

Can I pay my property taxes online in Denton County?

+

Yes, Denton County offers convenient online payment options. You can access your tax account information and make payments through the Tax Assessor-Collector’s Office website. Various payment methods, including credit cards, e-checks, and online transfers, are available.

Are there any tax exemptions available for seniors in Denton County?

+

Yes, Denton County provides tax exemptions for qualifying senior citizens. The Over 65 Homestead Exemption reduces the taxable value of a primary residence for homeowners aged 65 or older. Additionally, there are other exemptions and discounts available based on income and disability status.