City Of Chicago Sales Tax

The city of Chicago, located in the state of Illinois, USA, has a unique sales tax system that is an important aspect of its economic landscape. Understanding the Chicago sales tax is crucial for businesses and consumers alike, as it directly impacts pricing, revenue generation, and overall economic activity within the city.

Navigating the Chicago Sales Tax System

Chicago’s sales tax structure is a comprehensive system designed to generate revenue for the city’s government and support various public services. It applies to a wide range of goods and services purchased within the city limits. This article will delve into the intricacies of the Chicago sales tax, providing an in-depth analysis of its components, rates, and implications.

Sales Tax Rates and Breakdown

The sales tax in Chicago is comprised of several components, each with its own rate. These components include the city tax, county tax, and state tax. As of [date of reference], the current sales tax rates are as follows:

| Tax Component | Rate |

|---|---|

| City Tax | 1.25% |

| County Tax | 1.75% |

| State Tax | 6.25% |

When combined, these rates result in a total sales tax of 9.25%, which is one of the highest in the state. It's important to note that these rates are subject to change, and it's crucial for businesses and consumers to stay updated with the latest tax regulations.

Taxable Items and Exemptions

Not all goods and services are subject to the full sales tax rate. Chicago, like many other jurisdictions, has a list of items that are exempt from sales tax or have reduced tax rates. These exemptions are designed to alleviate the tax burden on essential items and encourage certain economic activities.

Some common exemptions include:

- Grocery items (with certain restrictions)

- Prescription medications

- Select medical devices

- Residential rent (in certain circumstances)

- Legal services

It's essential for businesses to understand these exemptions to accurately apply sales tax and avoid penalties. The city of Chicago provides detailed guidelines and resources to help businesses navigate these complexities.

Impact on Business and Consumer Behavior

The sales tax has a significant impact on both business operations and consumer spending patterns. For businesses, especially those operating in competitive markets, the sales tax can affect pricing strategies and overall profitability. It may also influence business location decisions, as some areas within the city have additional tax incentives or exemptions.

From a consumer perspective, the sales tax directly affects purchasing power and can influence shopping behavior. Consumers may opt to shop online or in neighboring cities with lower tax rates to save on purchases. Understanding these dynamics is crucial for businesses to develop effective marketing and pricing strategies.

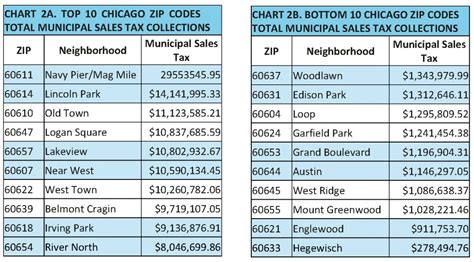

Revenue Generation and Allocation

The revenue generated from the sales tax is a significant source of income for the city of Chicago. It supports various public services, including education, public safety, infrastructure development, and social programs. The allocation of sales tax revenue is carefully planned and managed by the city’s government to ensure efficient and effective use of these funds.

Transparency in revenue allocation is crucial for maintaining public trust and accountability. The city publishes annual reports detailing the distribution of sales tax revenue, providing insight into how these funds are utilized to benefit the community.

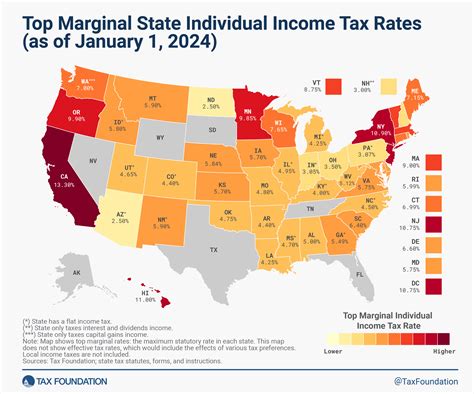

Comparative Analysis: Chicago vs. Other Cities

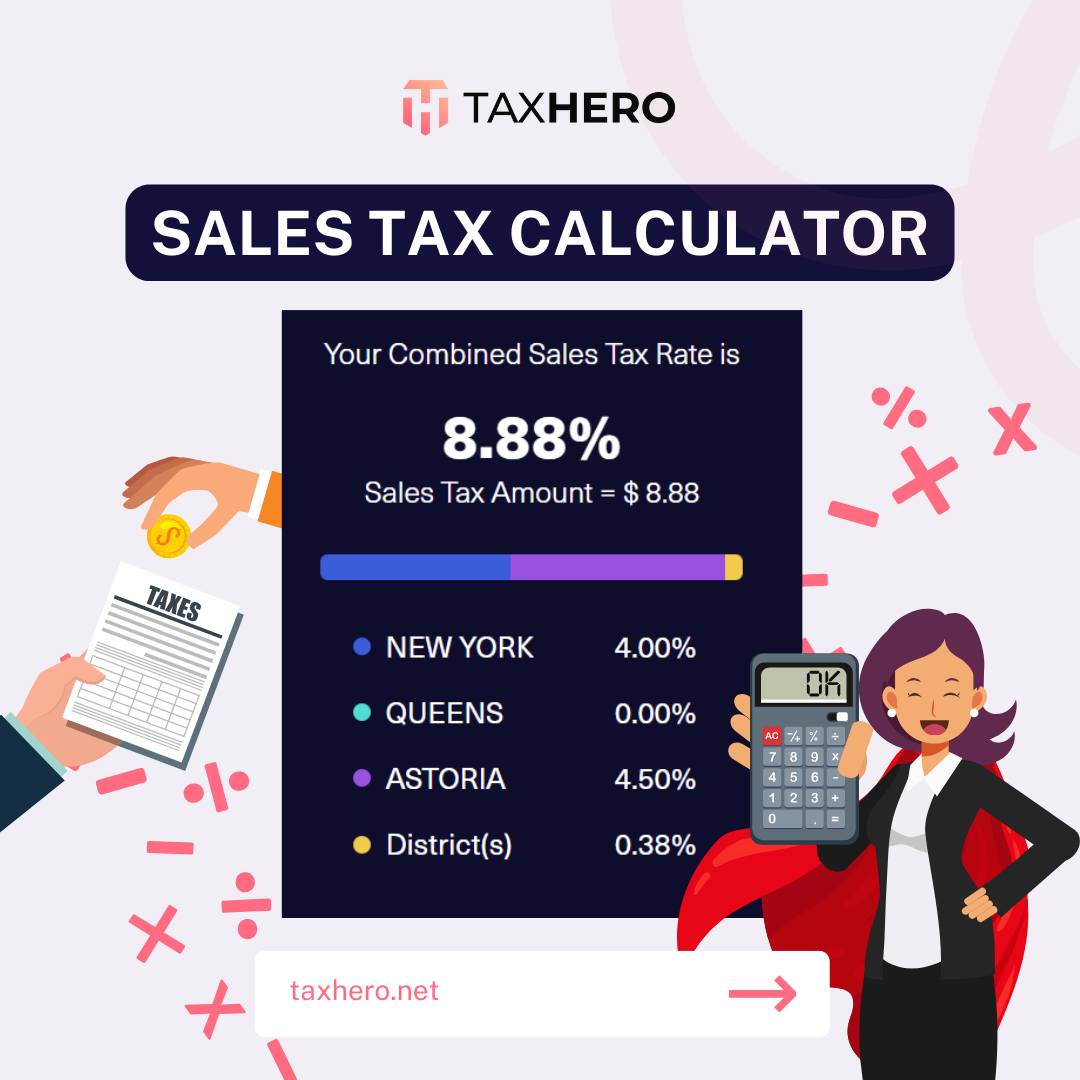

Comparing Chicago’s sales tax with that of other major cities can provide valuable insights into its competitiveness and economic implications. For instance, New York City has a similar sales tax structure, with a combined rate of 8.875%, while Los Angeles has a slightly lower rate of 9.5%.

Such comparisons can help businesses assess the tax landscape when considering expansion or relocation. It also provides consumers with a broader perspective on the cost of living and purchasing power in different cities.

Future Trends and Potential Changes

The sales tax system in Chicago, like any other tax structure, is subject to potential changes and reforms. These changes can be driven by various factors, including economic conditions, political influences, and technological advancements.

One potential trend is the increasing focus on e-commerce and online sales. As more transactions move online, there is a growing discussion around the taxation of digital goods and services. This could impact the sales tax system and its administration, requiring businesses to adapt to new compliance requirements.

Additionally, there may be ongoing debates around tax reform initiatives aimed at simplifying the tax system, addressing tax avoidance strategies, or reallocating tax burdens to promote economic fairness.

Conclusion: A Complex Yet Vital Economic Mechanism

The Chicago sales tax system is a complex mechanism that plays a crucial role in the city’s economic landscape. It impacts businesses, consumers, and the overall fiscal health of the city. Understanding this system is essential for making informed economic decisions and ensuring compliance with tax regulations.

As the city of Chicago continues to evolve and adapt to changing economic conditions, the sales tax system will likely undergo further transformations. Staying abreast of these changes will be vital for businesses and individuals to navigate the economic landscape effectively.

Frequently Asked Questions

What is the purpose of the Chicago sales tax?

+

The Chicago sales tax is a mechanism for the city to generate revenue, which is then used to fund public services and infrastructure. It helps cover the costs of education, public safety, transportation, and other essential services provided by the city government.

How does the sales tax rate compare to other cities in Illinois?

+

Chicago’s sales tax rate is one of the highest in Illinois. Other cities and counties in the state have varying rates, with some being lower and others being slightly higher. It’s important to compare rates when considering business locations or consumer spending patterns.

Are there any special tax incentives or exemptions for certain businesses in Chicago?

+

Yes, the city of Chicago offers various tax incentives and exemptions to encourage specific economic activities. These may include tax breaks for new businesses, job creation incentives, and exemptions for certain types of goods or services. It’s advisable for businesses to consult with tax professionals or the city’s economic development office to explore these opportunities.