Philadelphia Sugar Tax

The Philadelphia Sugar Tax, officially known as the Philadelphia Beverage Tax (PBT), has been a topic of much debate and discussion since its implementation in 2017. This tax, targeting sugar-sweetened beverages, was introduced as a public health measure aimed at combating obesity and related health issues. In this comprehensive article, we will delve into the details of the Philadelphia Sugar Tax, exploring its impact, effectiveness, and the ongoing conversations surrounding its implementation.

Understanding the Philadelphia Sugar Tax

The Philadelphia Sugar Tax, or PBT, is a sales tax levied on the distribution of sugar-sweetened beverages within the city limits of Philadelphia. The tax applies to a wide range of drinks, including sodas, energy drinks, sports drinks, and sweetened teas and coffees. The primary goal of this tax is to discourage the consumption of sugary drinks, which are often associated with various health concerns such as obesity, diabetes, and tooth decay.

The tax was introduced as a means to generate revenue for the city's budget and to promote healthier lifestyle choices among Philadelphians. By making sugary beverages more expensive, the city aimed to reduce their consumption and encourage residents to opt for healthier alternatives.

Tax Rate and Revenue Generation

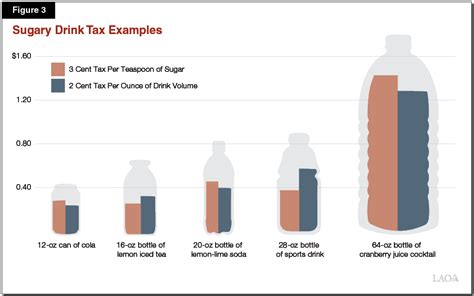

The Philadelphia Sugar Tax is currently set at a rate of 1.5 cents per ounce of the beverage. This means that for every ounce of a sugar-sweetened drink sold or distributed within the city, the distributor must pay this tax. For example, a 12-ounce can of soda would be subject to a tax of 0.18</strong> (12 ounces x 0.015 per ounce). The tax is applied at the wholesale level, making it the responsibility of the distributors and not the individual consumers.

Since its implementation, the tax has generated significant revenue for the city. According to official reports, the Philadelphia Sugar Tax has raised over $150 million in its first few years. This revenue has been allocated to various initiatives, including pre-kindergarten programs, community schools, and the development of parks and recreation centers.

Exemptions and Special Considerations

While the Philadelphia Sugar Tax targets a wide range of sugary beverages, there are certain exemptions and considerations in place to ensure fairness and practicality. Here are some key exemptions:

- Diet and Low-Calorie Drinks: Beverages with no or low caloric content, such as diet sodas and sugar-free drinks, are exempt from the tax.

- Milk and Milk Alternatives: Dairy milk and plant-based milk alternatives, including soy, almond, and oat milk, are also exempt, as they are considered essential nutritional sources.

- Alcoholic Beverages: The tax does not apply to alcoholic drinks, as they are already subject to separate alcohol excise taxes.

- Certain Small Businesses: Small businesses with an annual gross revenue of less than $500,000 from the sale of taxed beverages are exempt, to support local businesses and minimize their administrative burden.

Impact and Effectiveness of the Sugar Tax

The Philadelphia Sugar Tax has sparked a lot of interest and research regarding its impact on public health and consumer behavior. Let’s explore some key findings and analyses.

Reducing Consumption

One of the primary goals of the sugar tax was to reduce the consumption of sugary beverages, and early studies suggest that it has had a positive impact in this regard. Research conducted by the Philadelphia Department of Public Health found that there was a significant decline in the purchase of taxed beverages within the city limits. Specifically, the study reported a 29% reduction in the purchase of sugar-sweetened drinks, indicating that consumers were opting for healthier alternatives or reducing their overall consumption.

Additionally, the tax has led to a shift in consumer preferences, with an increase in the purchase of diet and low-calorie beverages. This shift suggests that consumers are becoming more conscious of their choices and are actively seeking healthier options.

Health Benefits

The reduction in sugary beverage consumption has the potential to bring about significant health benefits for Philadelphians. Sugary drinks are a major contributor to obesity, which is a leading cause of various chronic diseases. By discouraging the consumption of these beverages, the Philadelphia Sugar Tax aims to improve public health outcomes.

Early data suggests that the tax has indeed contributed to lower obesity rates among Philadelphia's youth. A study by the University of Pennsylvania found that the tax had a positive correlation with a reduction in obesity prevalence among adolescents in the city. While more research is needed, these initial findings are promising and indicate that the tax could have long-term health benefits for the community.

Economic Impact

Beyond its health implications, the Philadelphia Sugar Tax has also had an impact on the local economy. While the tax has generated substantial revenue for the city, it has also affected businesses and consumers in various ways.

For businesses, particularly small retailers and restaurants, the tax has added an additional cost to their operations. Some businesses have passed on this cost to consumers, resulting in slightly higher prices for sugary drinks. However, many businesses have also used this opportunity to promote healthier options and diversify their offerings.

Consumers, on the other hand, have had to adjust their purchasing habits. While some have reduced their consumption of taxed beverages, others have chosen to continue buying them despite the increased cost. This has led to a diversification of beverage choices among consumers, with an increased demand for healthier alternatives.

Challenges and Controversies

Despite its potential benefits, the Philadelphia Sugar Tax has faced its fair share of challenges and controversies. Let’s explore some of the key issues surrounding this tax.

Legal Battles

The implementation of the Philadelphia Sugar Tax was not without legal hurdles. Shortly after its introduction, the tax faced legal challenges from the beverage industry, with lawsuits arguing that the tax was unconstitutional and discriminatory. These legal battles dragged on for several years, creating uncertainty for the city and its budget.

However, in a significant victory for the city, the Pennsylvania Supreme Court ultimately upheld the constitutionality of the tax in 2021. This decision paved the way for the tax to continue and for the city to utilize the revenue for its intended purposes.

Job Losses and Economic Impact

Critics of the sugar tax argue that it has led to job losses and negatively impacted the local economy. Some businesses, particularly those heavily reliant on the sale of sugary beverages, have faced challenges due to reduced sales and increased costs. This has resulted in job cuts and economic hardships for certain sectors.

However, proponents of the tax argue that the revenue generated has also created new job opportunities in the healthcare and education sectors. The investment in pre-kindergarten programs and community schools, for example, has the potential to create jobs and improve the overall well-being of the community.

Equity Concerns

Another controversy surrounding the Philadelphia Sugar Tax is its potential impact on low-income communities. Sugary drinks are often more affordable than healthier alternatives, and some argue that the tax disproportionately affects those with limited financial means. This has sparked debates about equity and the potential for the tax to exacerbate existing health disparities.

To address these concerns, the city has implemented initiatives to ensure that the tax does not burden low-income residents excessively. For instance, the revenue generated from the tax has been used to fund programs aimed at promoting healthy eating and providing access to nutritious foods in underserved communities.

Future Implications and Potential Next Steps

As the Philadelphia Sugar Tax continues to generate revenue and shape consumer behavior, it is important to consider its future implications and potential next steps.

Expanding the Tax Base

One potential consideration is expanding the tax base to include other sugary products. While the current tax targets beverages, there are other sugar-laden foods that contribute to health concerns. Some advocates suggest extending the tax to include items like candy, baked goods, and certain processed foods.

By broadening the tax base, the city could generate even more revenue and further encourage healthier dietary choices. However, this approach would require careful consideration to ensure that it does not disproportionately affect low-income households or specific industries.

Investing in Health Promotion

The revenue generated from the Philadelphia Sugar Tax presents an opportunity to invest in health promotion and prevention initiatives. The city could allocate funds to educate the public about the health risks associated with sugary diets and promote healthier alternatives. This could include campaigns targeting youth, as well as initiatives to improve access to nutritious foods and promote physical activity.

Collaborative Efforts

The success of the Philadelphia Sugar Tax relies on collaboration between various stakeholders, including government agencies, healthcare professionals, community organizations, and the private sector. By working together, these entities can develop comprehensive strategies to address health disparities and promote overall well-being.

For instance, partnerships between schools and local businesses could lead to the creation of healthier school meal programs and the promotion of nutritious options in school cafeterias. Collaborative efforts can also focus on addressing food deserts and ensuring that all Philadelphians have access to affordable, healthy food options.

What are the main goals of the Philadelphia Sugar Tax?

+The primary goals of the Philadelphia Sugar Tax are to reduce the consumption of sugary beverages, promote healthier lifestyle choices, and generate revenue for public health initiatives.

How much revenue has the tax generated so far?

+As of recent reports, the Philadelphia Sugar Tax has generated over 150 million in revenue.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>Are there any exemptions to the tax?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>Yes, the tax exempts diet and low-calorie drinks, milk and milk alternatives, and alcoholic beverages. Small businesses with an annual gross revenue of less than 500,000 from taxed beverages are also exempt.

What has been the impact of the tax on public health?

+Early studies suggest that the tax has led to a reduction in the purchase of sugary beverages and a shift towards healthier alternatives. Additionally, it has been correlated with a decrease in obesity rates among youth.

How has the tax affected the local economy?

+The tax has generated revenue for the city, but it has also impacted businesses and consumers. Some businesses have faced challenges, while others have used it as an opportunity to promote healthier options. Consumers have adjusted their purchasing habits, leading to a diversification of beverage choices.