Alabama State Tax Return Status

Welcome to our comprehensive guide on the Alabama State Tax Return Status. As taxpayers, it is crucial to understand the status of our tax returns and have access to accurate and up-to-date information. In this article, we will delve into the various aspects of the Alabama tax system, explore the steps involved in checking the status of your state tax return, and provide valuable insights to ensure a smooth and efficient process.

Understanding the Alabama State Tax System

Alabama, known as the Heart of Dixie, has a unique tax landscape that plays a significant role in the state’s economy. The Alabama Department of Revenue is responsible for administering and enforcing the state’s tax laws, ensuring compliance, and providing taxpayer services.

Alabama's tax system primarily consists of income taxes, sales and use taxes, and various other taxes such as property taxes, estate taxes, and excise taxes. For individual taxpayers, understanding the state's income tax structure is crucial when filing returns and checking their status.

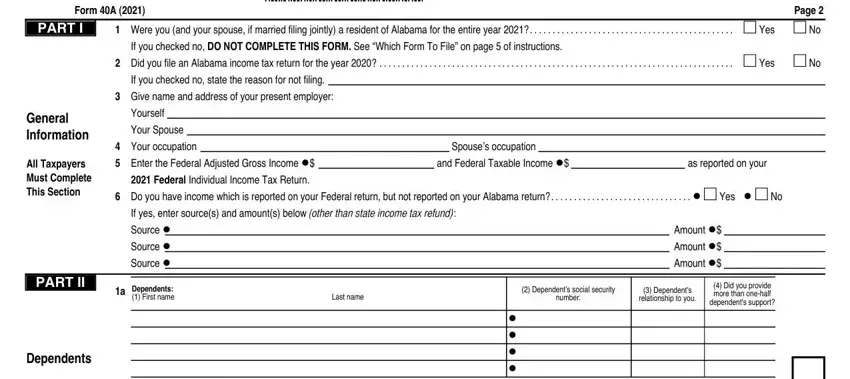

Income Tax Structure

Alabama operates on a graduated income tax system, which means that the tax rate increases as income levels rise. As of 2023, Alabama has six tax brackets with rates ranging from 2% to 5%. The state income tax is applied on top of federal income tax, and taxpayers are required to file both federal and state tax returns.

| Tax Bracket | Tax Rate |

|---|---|

| First $5,000 | 2% |

| $5,001 - $10,000 | 3% |

| $10,001 - $25,000 | 4% |

| $25,001 - $35,000 | 4.5% |

| $35,001 and above | 5% |

Checking Your Alabama State Tax Return Status

Now, let’s dive into the process of checking the status of your Alabama state tax return. The Alabama Department of Revenue provides several convenient options for taxpayers to access their return status information.

Online Options

The most efficient and commonly used method is through the Alabama Department of Revenue’s online services. Taxpayers can create an account on the Alabama Individual Income Tax Electronic Filing System website and log in to access their tax information.

Once logged in, you can view the status of your current and previous tax returns, check the processing timeline, and receive updates on any refunds or additional payments required. The online system provides real-time information, ensuring you stay informed throughout the process.

Telephone Inquiries

For those who prefer a more traditional approach, the Alabama Department of Revenue offers a telephone inquiry service. You can call the Alabama Taxpayer Service Center at (334) 242-1170 or toll-free at (800) 829-4070 to speak with a representative.

When calling, have your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) ready, as well as any relevant tax return information. The representative will assist you in checking the status of your return and provide any necessary updates.

Mail Correspondence

If online or telephone options are not available or preferred, you can also check your Alabama state tax return status through mail correspondence.

Send a written request, including your SSN or ITIN, full name, and mailing address, to the following address:

Alabama Department of Revenue

Individual Income Tax Division

P.O. Box 327350

Montgomery, AL 36132-7350

Allow sufficient time for the department to process your request and respond via mail. This method may take longer compared to online or telephone inquiries.

Processing Times and Refunds

Understanding the processing times and refund procedures is essential when checking your Alabama state tax return status. The Alabama Department of Revenue aims to process tax returns promptly, but various factors can impact the timeline.

Generally, if you file your return electronically and choose direct deposit for your refund, you can expect to receive your refund within 7-10 business days from the date of acceptance. However, if you opt for a paper return or a paper refund check, the processing time may be slightly longer.

Refund Status

To check the status of your Alabama state tax refund, you can use the Where’s My Refund tool on the Alabama Department of Revenue’s website. This tool provides real-time updates on the status of your refund, including whether it has been approved, issued, or is still in the processing stage.

It's important to note that refund processing times can vary, and factors such as errors, missing information, or additional reviews may cause delays. In such cases, the Alabama Department of Revenue will contact you directly to resolve any issues.

Common Issues and Resolutions

While the Alabama state tax system is designed to be user-friendly, taxpayers may encounter certain issues or have specific inquiries during the return status checking process.

Error Messages

If you encounter an error message while checking your return status online, it is essential to carefully review the message and understand the reason for the error. Common error messages include:

- Invalid Login Credentials: Ensure you are using the correct username and password. If you forget your credentials, you can use the "Forgot Password" feature to reset them.

- Return Not Found: This message may appear if your return has not yet been processed or if there is an issue with the information provided. Contact the Alabama Taxpayer Service Center for assistance.

- Technical Issues: In rare cases, technical glitches may occur. Try refreshing the page or using a different web browser. If the issue persists, contact the technical support team for further assistance.

Missing Refund

If you believe you are entitled to a refund but have not received it, first check the status of your return using the methods mentioned above. If your return has been processed and approved, but you still haven’t received your refund, contact the Alabama Department of Revenue to report the issue.

Provide them with your tax return information, including your SSN, filing status, and the amount you expect to receive. The department will investigate the matter and provide further guidance.

Audit and Review

In some cases, the Alabama Department of Revenue may select your return for an audit or further review. If this happens, you will receive a notification via mail or email. It is crucial to respond promptly and provide any requested documentation to ensure a smooth audit process.

The audit process may involve a thorough examination of your tax return, supporting documents, and potentially a meeting with a tax examiner. Cooperating with the department and providing accurate information will help resolve the audit efficiently.

Future Implications and Tax Planning

Understanding the status of your Alabama state tax return is not only important for the current tax year but also has implications for future tax planning.

Carryforward of Losses and Credits

If your Alabama state tax return includes losses or credits that cannot be fully utilized in the current tax year, you may be able to carry them forward to future tax years. This process, known as carryforward, allows you to offset future taxable income or apply the credits to reduce your tax liability.

It is essential to carefully review your tax return and consult a tax professional to ensure you maximize the benefits of carryforward provisions.

Tax Planning Strategies

Checking the status of your Alabama state tax return provides an opportunity to reflect on your tax planning strategies. Consider the following points to optimize your tax situation:

- Review your withholding allowances and make adjustments as needed to avoid overpayment or underpayment of taxes.

- Explore tax-efficient investment options and retirement plans to reduce your taxable income and maximize deductions.

- Stay updated on any changes in Alabama's tax laws and take advantage of any new incentives or credits that may benefit you.

- Consider seeking professional tax advice to ensure you are taking full advantage of all available tax benefits and strategies.

Conclusion

Checking the status of your Alabama state tax return is a crucial step in ensuring a smooth and compliant tax filing process. By understanding the Alabama tax system, utilizing the available resources, and staying informed, you can efficiently manage your tax obligations and take advantage of any refunds or credits you may be entitled to.

Remember, the Alabama Department of Revenue is dedicated to providing taxpayer services and assistance. Don't hesitate to reach out to them if you have any questions or concerns regarding your tax return status. They are here to help and ensure a positive taxpayer experience.

How long does it take for Alabama to process state tax returns?

+The processing time for Alabama state tax returns varies depending on various factors. On average, electronic returns with direct deposit refunds are processed within 7-10 business days from the date of acceptance. Paper returns and refunds may take slightly longer. It’s important to note that processing times can be impacted by factors such as errors, missing information, or additional reviews.

What if I don’t receive my Alabama state tax refund within the expected timeframe?

+If you haven’t received your Alabama state tax refund within the expected timeframe, first check the status of your return using the online tools or by contacting the Alabama Taxpayer Service Center. If your return has been processed and approved, but you still haven’t received your refund, report the issue to the Alabama Department of Revenue. Provide them with your tax return information, and they will investigate and guide you further.

Can I check my Alabama state tax return status without an online account?

+Yes, you have alternative options to check your Alabama state tax return status without an online account. You can call the Alabama Taxpayer Service Center or send a written request via mail. Provide your SSN or ITIN, full name, and mailing address, and the department will assist you in checking the status of your return.

What should I do if I receive an error message while checking my return status online?

+If you encounter an error message while checking your Alabama state tax return status online, carefully review the message to understand the reason for the error. Common error messages include invalid login credentials, return not found, or technical issues. Take appropriate actions, such as resetting your password, contacting the Alabama Taxpayer Service Center, or seeking technical support, to resolve the issue.