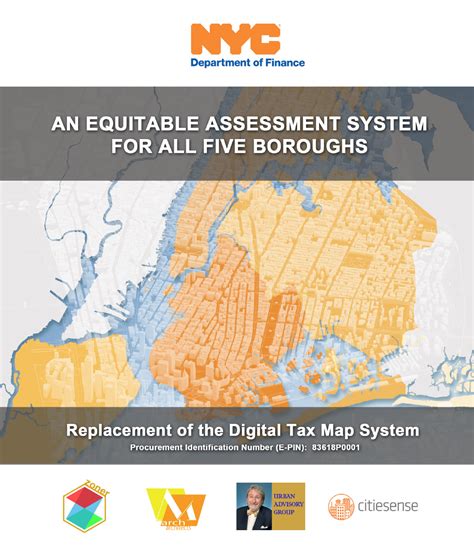

Nyc Digital Tax Map

Welcome to an in-depth exploration of the NYC Digital Tax Map, an innovative tool that has revolutionized the way we understand and navigate the complex world of taxes in New York City. This interactive platform is a game-changer, offering unparalleled insights and accessibility to taxpayers, businesses, and anyone curious about the fiscal landscape of the Big Apple. Join us as we delve into its features, benefits, and the transformative impact it has had on tax administration and public engagement.

Revolutionizing Tax Transparency: The NYC Digital Tax Map

The NYC Digital Tax Map is a cutting-edge initiative by the New York City Department of Finance, aiming to bring unprecedented transparency and accessibility to the city’s tax system. This digital platform, launched in [insert launch date], has quickly become an indispensable resource for taxpayers, businesses, and even researchers, offering a wealth of information and insights at their fingertips.

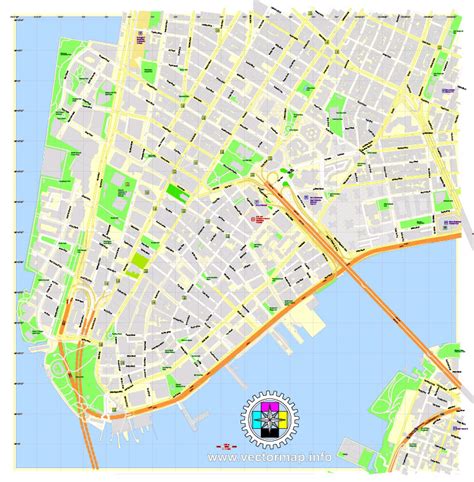

At its core, the Digital Tax Map is an interactive, web-based tool that visually represents tax data across the city. It provides a comprehensive overview of tax rates, assessments, and various tax-related information for every property in New York City. This innovative approach to tax transparency has not only simplified the process of understanding complex tax structures but has also empowered citizens with knowledge, fostering a more informed and engaged taxpayer community.

One of the standout features of the NYC Digital Tax Map is its user-friendly interface. With a simple search function, users can input an address or property ID to access a wealth of information. The map then displays a detailed overview of the property's tax assessment, including its current market value, the assessed value, and the applicable tax rates. This level of detail, previously accessible only through tedious manual searches or specialized knowledge, is now available with just a few clicks.

Key Features and Benefits

- Real-Time Data: The Digital Tax Map provides up-to-date and accurate tax information, ensuring users have the most current data available. This is particularly beneficial for businesses and investors making financial decisions, as it eliminates the guesswork associated with tax rates and assessments.

- Interactive Visualization: By presenting tax data visually on a map, the platform offers a unique perspective. Users can zoom in on specific neighborhoods, compare tax rates across different areas, and even track historical trends, making it an invaluable tool for urban planning, real estate analysis, and community development initiatives.

- Property Comparison: The ability to compare multiple properties on the map is a powerful feature. Whether you’re a homeowner looking to understand your tax liability relative to your neighbors or a business assessing potential locations, this feature provides an objective and data-driven perspective.

- Tax Calculation Tools: Beyond just displaying tax rates, the Digital Tax Map often includes interactive calculators. These tools allow users to input specific property details and receive an estimated tax liability, providing a clear understanding of potential costs before making any decisions.

The NYC Digital Tax Map has been particularly beneficial for small businesses and startups, many of which operate on tight budgets and rely on accurate financial projections. By providing easy access to tax information, the platform helps these businesses make informed decisions about their operations, expansions, and investments in the city.

Impact and Future Implications

The introduction of the NYC Digital Tax Map has had a significant impact on tax administration and public perception. It has streamlined the process of obtaining tax information, reducing the need for manual inquiries and paperwork. This not only saves time and resources for taxpayers but also reduces the administrative burden on the Department of Finance, allowing them to focus on other critical tasks.

From a transparency standpoint, the Digital Tax Map has been a game-changer. It has fostered a new level of trust between taxpayers and the city government by providing an unbiased and accessible platform for tax information. This transparency has also led to increased public awareness and engagement, with citizens becoming more proactive in understanding their tax obligations and rights.

Looking ahead, the NYC Digital Tax Map is set to evolve further. Future updates may include more advanced analytics, integration with other city databases, and even predictive modeling to forecast tax trends. The platform's success has also inspired other municipalities to explore similar initiatives, signaling a potential shift towards more transparent and citizen-centric tax administration nationwide.

In conclusion, the NYC Digital Tax Map is not just a digital tool but a transformative force in tax administration. Its impact extends beyond mere convenience, fostering a new era of transparency, accessibility, and engagement in the complex world of taxation. As it continues to evolve, the Digital Tax Map promises to remain a cornerstone of progressive tax governance in New York City and a model for cities worldwide.

FAQs

How often is the data on the NYC Digital Tax Map updated?

+The data is updated regularly, with most updates occurring quarterly to ensure the information remains current and accurate. Major assessments or tax changes may trigger more frequent updates.

Can I access historical tax data through the Digital Tax Map?

+Absolutely! The platform allows users to explore historical tax data, providing insights into past assessments, tax rates, and property values. This feature is particularly useful for tracking long-term trends.

Is the NYC Digital Tax Map accessible on mobile devices?

+Yes, the Digital Tax Map is designed to be responsive and accessible across various devices, including smartphones and tablets. This ensures users can access tax information on the go, making it a convenient tool for both residents and visitors.

What security measures are in place to protect user data on the Digital Tax Map?

+The NYC Department of Finance takes data security seriously. The Digital Tax Map employs robust encryption protocols and access controls to protect user data. Additionally, the platform complies with strict data privacy regulations to ensure user information remains confidential.