Does Mn Have A State Income Tax

In the United States, the taxation landscape varies from state to state, with each jurisdiction implementing its own set of tax policies. One crucial aspect that differentiates states is the presence or absence of a state income tax. Minnesota, often referred to as the "Land of 10,000 Lakes," has a long-standing tradition of imposing a state income tax, which plays a significant role in funding various public services and initiatives within the state.

Minnesota’s State Income Tax: An Overview

Minnesota, like many other states, levies an income tax on its residents and certain nonresidents. This tax is a critical component of the state’s revenue stream, accounting for a substantial portion of the funds that support essential services and infrastructure. The state income tax is a progressive tax system, meaning that higher earners pay a higher tax rate compared to lower-income individuals.

The tax rates in Minnesota are structured into multiple brackets, ensuring that taxpayers contribute proportionally to their ability to pay. As of the most recent tax year, these brackets and their corresponding rates are as follows:

| Income Bracket (Single Filers) | Income Bracket (Married Filing Jointly) | Tax Rate |

|---|---|---|

| $0 - $12,250 | $0 - $24,500 | 5.35% |

| $12,251 - $31,500 | $24,501 - $63,000 | 7.05% |

| $31,501 - $165,000 | $63,001 - $225,000 | 7.85% |

| $165,001 and above | $225,001 and above | 9.85% |

These rates are subject to change periodically, so it is advisable to refer to the official Minnesota Department of Revenue website for the most up-to-date information. The state also offers various tax credits and deductions to ease the tax burden on specific groups, such as the Working Family Credit and the Property Tax Refund program.

Historical Context and Impact

The state income tax in Minnesota has a rich history, dating back to the early 20th century. Its implementation and evolution have had a profound impact on the state’s economic landscape and public services. The revenue generated from this tax has been instrumental in funding education, healthcare, infrastructure development, and a range of social programs that benefit Minnesotans.

Over the years, the state income tax has been a subject of debate and policy discussions, with some advocating for tax reforms to stimulate economic growth and attract businesses, while others emphasize the importance of maintaining a robust tax base to support vital public services. The delicate balance between these perspectives continues to shape the state's fiscal policies.

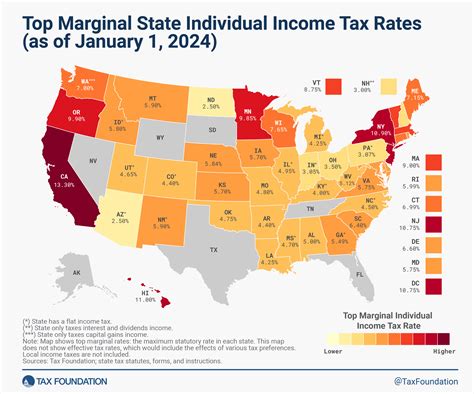

Comparison with Other States

When compared to other states, Minnesota’s income tax system falls within the moderate to high range. Some states, like Florida and Texas, have no income tax, while others, like California and New York, have higher tax rates and more complex systems. Minnesota’s progressive tax structure aims to strike a balance, ensuring fairness while also providing sufficient revenue for state operations.

The Practical Implications for Residents and Businesses

For individuals and businesses operating in Minnesota, understanding the state income tax is crucial for financial planning and compliance. Residents must file state tax returns annually, declaring their income and calculating their tax liability. Businesses, depending on their structure and income, may also be subject to state income tax, in addition to other business-related taxes.

The state's tax policies can influence various aspects of life and business operations. For instance, the tax burden can impact an individual's take-home pay and overall financial health. For businesses, the tax climate can be a significant factor in decision-making processes, such as expansion plans, investment strategies, and employee compensation.

Navigating the Tax Landscape

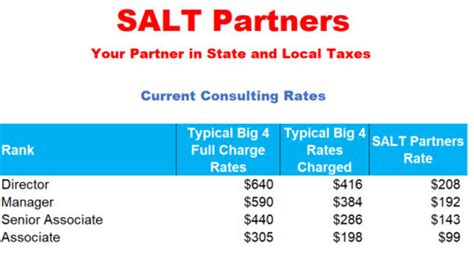

To navigate the complexities of Minnesota’s state income tax, individuals and businesses often seek professional guidance. Tax professionals, such as certified public accountants (CPAs) and tax attorneys, play a vital role in ensuring compliance, optimizing tax strategies, and providing tailored advice based on individual or business circumstances.

These experts stay abreast of the ever-changing tax laws and regulations, helping taxpayers make informed decisions and avoid potential pitfalls. They assist with tax return preparation, tax planning, and even representing clients in case of audits or disputes with the state revenue department.

Future Prospects and Considerations

As with any tax system, Minnesota’s state income tax is subject to ongoing review and potential reforms. The state government regularly assesses the effectiveness and fairness of the tax structure, taking into account economic trends, demographic shifts, and public sentiment. This continuous evaluation ensures that the tax system remains adaptable and responsive to the needs of the state and its residents.

In the coming years, discussions surrounding tax policy may focus on issues such as tax simplification, the impact of remote work on tax residency, and the potential for tax incentives to promote economic growth and innovation. These considerations will shape the future of Minnesota's state income tax, ensuring its continued relevance and effectiveness in funding the state's priorities.

Are there any tax credits or deductions available in Minnesota?

+Yes, Minnesota offers a range of tax credits and deductions to alleviate the tax burden on specific groups. These include the Working Family Credit, Property Tax Refund, and various education-related deductions. It is advisable to consult the Minnesota Department of Revenue website for a comprehensive list of available credits and deductions.

How does Minnesota’s state income tax compare to federal income tax?

+Minnesota’s state income tax is separate from federal income tax, which is levied by the Internal Revenue Service (IRS). While both systems have similarities, such as progressive tax rates, they have different brackets, deductions, and tax codes. It’s important to file both state and federal tax returns separately and accurately.

Are there any special considerations for remote workers in Minnesota regarding state income tax?

+Yes, the rise of remote work has led to complexities in determining tax residency. Minnesota, like many states, considers factors such as the number of days worked within the state and the employee’s physical presence to determine tax liability. It’s crucial for remote workers to understand these rules and consult tax professionals for guidance.