San Francisco City Tax Rate

Understanding the tax landscape is crucial for individuals and businesses alike, especially in bustling cities like San Francisco. The city's tax structure, encompassing various rates and regulations, significantly impacts residents' and companies' financial obligations. This article aims to provide an in-depth exploration of San Francisco's city tax rate, shedding light on its intricacies and implications.

The San Francisco City Tax Rate: An Overview

San Francisco, renowned for its vibrant culture, tech hub status, and picturesque landmarks, boasts a dynamic tax system. The city’s tax rate is a crucial factor influencing the financial landscape, affecting everything from personal finances to business operations.

The San Francisco city tax rate encompasses a range of taxes, each with its own purpose and rate. These taxes are designed to fund essential city services, infrastructure development, and social programs. Understanding these rates is essential for residents and businesses to navigate their financial responsibilities effectively.

Income Tax: A Key Component

One of the most significant taxes levied by the city is the income tax. San Francisco imposes a local income tax on both residents and non-residents earning income within city limits. This tax contributes significantly to the city’s revenue stream and is essential for funding public services.

| Tax Bracket | Tax Rate |

|---|---|

| First $12,960 | 1.5% |

| $12,960 - $25,920 | 2.0% |

| $25,920 - $38,880 | 2.5% |

| $38,880 - $51,840 | 3.0% |

| Over $51,840 | 3.5% |

The income tax rates are progressive, meaning higher earners pay a larger percentage of their income as tax. This system aims to promote fairness and ensure a sustainable revenue stream for the city. The rates are periodically adjusted to account for inflation and changing economic conditions.

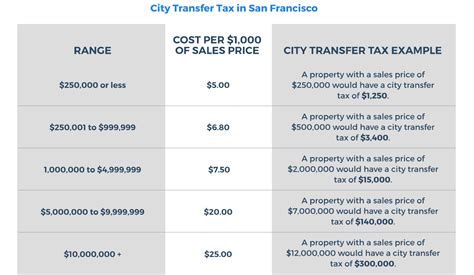

Property Taxes: A Key Funding Source

San Francisco, like many other cities, relies heavily on property taxes to fund its operations. Property taxes are levied on both residential and commercial properties based on their assessed value. The city’s Property Tax Office assesses properties annually, determining their taxable value.

The property tax rate in San Francisco is set by the city's Board of Supervisors and is applied uniformly across the city. This rate is a crucial factor in the city's fiscal planning, as it significantly contributes to funding public services and infrastructure projects.

While the property tax rate is uniform, the actual tax liability for each property owner can vary widely due to differences in property values. Higher-value properties generally incur higher tax liabilities, reflecting the city's commitment to a fair and equitable tax system.

| Property Type | Tax Rate |

|---|---|

| Residential Properties | 1.1478% |

| Commercial Properties | 1.5% |

It's important to note that San Francisco also offers certain property tax exemptions and relief programs, particularly for low-income homeowners and veterans. These initiatives aim to alleviate the tax burden on specific segments of the population, promoting social equity and financial stability.

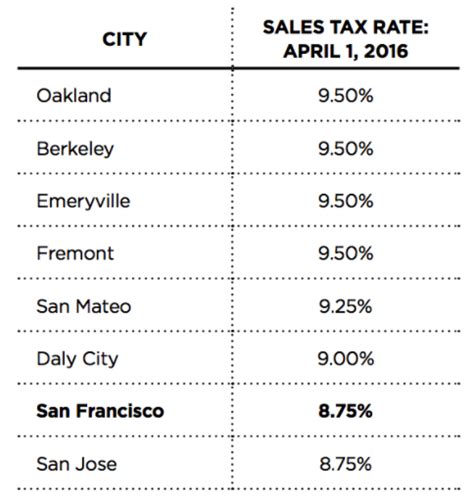

Sales and Use Taxes: Impacting Daily Life

San Francisco also imposes sales and use taxes on goods and services purchased within the city limits. These taxes are a significant source of revenue for the city and play a crucial role in funding public projects and services.

The sales tax rate in San Francisco is composed of both state and local components. The state sales tax rate is 7.25%, while the city's local sales tax rate varies based on the specific jurisdiction within San Francisco. This rate is generally around 1.25%, bringing the total sales tax rate to approximately 8.5%.

| Tax Type | Tax Rate |

|---|---|

| State Sales Tax | 7.25% |

| Local Sales Tax | 1.25% |

| Total Sales Tax | 8.5% |

The use tax, often overlooked, is another critical component of San Francisco's tax system. Use tax is levied on goods purchased from out-of-state vendors and brought into San Francisco for use. This tax ensures that residents pay taxes on goods they acquire, regardless of where the purchase is made, promoting fairness in the tax system.

The use tax rate in San Francisco aligns with the sales tax rate, ensuring consistency in taxation. This rate is applied to the purchase price of the goods, and it's the responsibility of the buyer to remit the use tax to the city.

Business Taxes: Supporting Economic Growth

San Francisco, known for its thriving business environment, levies various taxes on businesses operating within the city. These taxes are designed to support economic growth, fund public services, and promote social equity.

One of the key business taxes is the Gross Receipts Tax. This tax is levied on the gross receipts of businesses, regardless of their profit margins. The rate is determined based on the business's gross receipts, with higher-earning businesses paying a higher percentage.

| Gross Receipts Range | Tax Rate |

|---|---|

| $1,000,000 - $5,000,000 | 0.6% |

| $5,000,000 - $10,000,000 | 0.9% |

| $10,000,000 - $20,000,000 | 1.1% |

| $20,000,000 - $50,000,000 | 1.3% |

| Over $50,000,000 | 1.5% |

The Gross Receipts Tax is an essential revenue stream for the city, particularly in the tech and innovation sectors that thrive in San Francisco. It ensures that businesses contribute proportionally to the city's finances, supporting the local economy and community development.

Additionally, San Francisco imposes a Payroll Expense Tax on businesses based on their payroll expenses. This tax is another crucial source of revenue for the city, helping fund essential services and infrastructure projects. The rate is determined based on the business's payroll expenses, with larger businesses contributing a higher percentage.

Impact and Implications of San Francisco’s Tax Rates

San Francisco’s tax rates have significant implications for both residents and businesses. For individuals, the progressive income tax structure ensures that higher earners contribute a larger share, promoting fairness and social equity. Property taxes, while essential for funding city operations, can pose a challenge for homeowners, especially in a city with a high cost of living.

Businesses, on the other hand, face a complex tax landscape with multiple taxes to navigate. The Gross Receipts Tax and Payroll Expense Tax, while contributing significantly to the city's revenue, can impact businesses' financial planning and competitiveness. However, these taxes also support the city's thriving business environment and fund essential services that benefit the business community.

Overall, San Francisco's tax rates are a crucial aspect of the city's financial ecosystem. They fund vital public services, infrastructure projects, and social programs, shaping the city's vibrant and dynamic character. Understanding these rates and their implications is essential for residents and businesses to navigate their financial obligations effectively and contribute to the city's continued growth and prosperity.

FAQ

How do San Francisco’s tax rates compare to other major cities in California?

+San Francisco’s tax rates are generally higher compared to other major cities in California. For instance, the city’s sales tax rate is higher than that of Los Angeles or San Diego. Similarly, San Francisco’s property tax rate is higher than the state average. These differences reflect the city’s unique financial needs and its commitment to funding essential services and infrastructure.

Are there any tax incentives or relief programs for businesses in San Francisco?

+Yes, San Francisco offers various tax incentives and relief programs to support businesses, particularly those in specific sectors or with a social impact focus. These initiatives aim to promote economic growth, job creation, and social equity. Businesses can explore these programs to reduce their tax burden and contribute to the city’s vibrant business ecosystem.

How often are San Francisco’s tax rates reviewed and adjusted?

+San Francisco’s tax rates are reviewed and adjusted periodically to align with economic conditions, inflation, and the city’s financial needs. The city’s Board of Supervisors, in consultation with financial experts, conducts these reviews to ensure the tax system remains fair, sustainable, and responsive to changing circumstances.

What is the impact of San Francisco’s tax rates on the city’s budget and financial stability?

+San Francisco’s tax rates play a critical role in the city’s budget and financial stability. They provide a significant revenue stream to fund essential services, infrastructure projects, and social programs. The city carefully balances its tax rates to ensure financial sustainability while promoting social equity and economic growth.