Sports Betting Tax Calculator

The world of sports betting has witnessed significant growth and evolution, attracting not only avid sports enthusiasts but also those interested in the financial aspects of the industry. As betting activities become more widespread, understanding the financial implications, particularly tax obligations, is crucial. This comprehensive guide aims to shed light on the often complex topic of sports betting taxes, providing a detailed breakdown of tax rates, deductions, and strategies to help bettors navigate this aspect of the betting landscape.

Understanding the Basics of Sports Betting Taxes

Sports betting taxes are a critical aspect of responsible betting, ensuring that bettors understand their financial obligations and make informed decisions. These taxes are levied on the winnings from various betting activities, and while they can vary based on jurisdiction and betting type, they are an integral part of the betting ecosystem.

The first step in navigating sports betting taxes is understanding the different types of betting taxes. These can be categorized into income tax and gambling tax, each with its unique characteristics and implications. Income tax is applied to the total winnings, treating them as regular income, while gambling tax is a specific levy on gambling activities, often calculated as a percentage of the stake or the winnings.

Income Tax on Sports Betting Winnings

Income tax on sports betting winnings is a common practice in many jurisdictions. It is treated similarly to any other income, with bettors required to declare their winnings on their annual tax returns. The tax rate can vary significantly, often depending on the individual’s overall income and the country’s tax laws. For instance, in the United States, the tax rate can range from 10% to 37% based on the taxable income bracket.

To illustrate, let's consider a bettor who wins $50,000 from sports betting in a year. If this individual's total taxable income, including the betting winnings, falls into the 24% tax bracket, they would owe approximately $12,000 in income tax on their betting winnings alone.

| Income Bracket | Tax Rate | Taxable Income Range |

|---|---|---|

| 10% | $0 - $9,950 | |

| 12% | $9,951 - $40,525 | |

| 22% | $40,526 - $86,375 | |

| 24% | $86,376 - $164,925 | |

| ... | ... | |

| 37% | $523,601 and above |

Gambling Taxes: A Distinctive Approach

Gambling taxes, on the other hand, are often levied as a flat rate or a percentage of the stake or winnings. These taxes are usually collected by the betting operator and remitted to the government, meaning bettors may not have to declare these taxes separately. However, it’s crucial to note that some jurisdictions require bettors to report these taxes as well, particularly if the winnings are substantial.

For instance, in the United Kingdom, a 15% Remote Gaming Duty (RGD) is applied to online gambling operators, including sports betting. This tax is calculated based on the gross revenue of the operator, which includes the total stakes minus payouts. While bettors don't pay this tax directly, it's essential to understand that the tax burden is often passed on to bettors through reduced odds or other means.

Tax Strategies for Maximizing Your Winnings

Understanding the tax implications is only the first step; the next crucial phase is devising strategies to maximize your winnings while adhering to tax obligations. Here are some expert tips and strategies to navigate the complex world of sports betting taxes.

Optimizing Your Tax Bracket

One of the most effective strategies is to optimize your tax bracket. This involves understanding your total taxable income and structuring your betting activities to ensure you fall into the lowest possible tax bracket. For instance, if you anticipate significant winnings from sports betting, you might consider spreading your bets across multiple tax years to avoid a sudden spike in your taxable income.

Let's say you're in the 22% tax bracket and anticipate a substantial win of $100,000 from sports betting. If you plan your bets strategically, you could aim to win this amount over two years, ensuring you stay in the 22% bracket for both years. This simple strategy can save you thousands in taxes, as you'd pay a lower rate on your winnings compared to a sudden spike in income in one year.

Maximizing Deductions and Credits

Another strategy involves maximizing deductions and credits to reduce your taxable income. Bettors can often deduct certain expenses related to their betting activities, such as entry fees, travel costs to sporting events, or even a portion of their home office expenses if they regularly work on betting strategies from home. These deductions can significantly reduce your taxable income, resulting in lower taxes owed.

For instance, if you have $10,000 in betting-related expenses, and your taxable income before deductions is $100,000, you can reduce your taxable income to $90,000. This reduction can result in substantial savings, especially if you're in a higher tax bracket.

Strategic Betting and Portfolio Diversification

Diversifying your betting portfolio can also be a strategic tax move. By spreading your bets across different sports, leagues, and betting types, you can manage your risk and potentially reduce your taxable income. This strategy involves understanding the tax implications of each bet and ensuring a balanced approach to minimize potential losses and maximize tax efficiency.

For example, if you primarily bet on high-odds, low-probability events, you might consider diversifying your portfolio to include more moderate-odds, higher-probability bets. This approach can help stabilize your winnings and reduce the volatility of your taxable income, which can be beneficial from a tax perspective.

Advanced Tax Strategies for Seasoned Bettors

For seasoned bettors, advanced tax strategies can further enhance their winnings and minimize tax obligations. These strategies involve a deeper understanding of tax laws and a more nuanced approach to betting.

Utilizing Tax-Efficient Betting Strategies

Tax-efficient betting strategies involve a meticulous approach to betting, considering the tax implications of each bet. This strategy often involves a detailed analysis of odds, potential winnings, and the associated tax obligations. By understanding the tax landscape, bettors can make informed decisions about which bets to place and when to place them, optimizing their returns and minimizing taxes.

For instance, if you're aware of a significant tax event, such as a change in tax laws or a substantial increase in your taxable income, you might consider timing your bets to maximize your winnings during this period. This strategic approach can help you optimize your tax obligations and ensure you're taking advantage of the most favorable tax conditions.

Exploring Tax Havens and Offshore Betting

For those looking to explore more advanced tax strategies, considering offshore betting and tax havens can be an option. These jurisdictions often offer more favorable tax conditions, allowing bettors to minimize their tax obligations. However, it’s crucial to approach this strategy with caution, as it can be complex and may not be suitable for all bettors.

For example, certain jurisdictions, such as the Isle of Man or Gibraltar, offer favorable tax conditions for gambling operators, which can translate to better odds and reduced tax obligations for bettors. However, it's essential to ensure you understand the legal and regulatory landscape of these jurisdictions before considering this strategy.

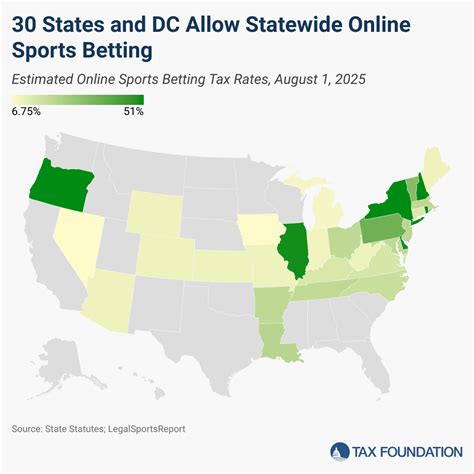

The Future of Sports Betting Taxes

As the sports betting industry continues to evolve, the landscape of sports betting taxes is also likely to change. With the increasing popularity of sports betting and the potential for substantial tax revenues, governments are paying closer attention to this sector. This could lead to more stringent tax regulations and potentially higher tax rates in the future.

One of the key trends to watch is the potential for a shift towards a more uniform tax structure for sports betting. Currently, tax rates and regulations vary widely across jurisdictions, but there is a growing movement towards standardization. This could simplify the tax landscape for bettors but may also result in higher taxes in some regions.

Additionally, the rise of blockchain technology and cryptocurrencies in the betting industry could have significant implications for sports betting taxes. The anonymous and decentralized nature of these technologies could present challenges for tax authorities, potentially leading to new regulations and tax structures.

Conclusion: Navigating the Complex World of Sports Betting Taxes

Understanding and navigating the complex world of sports betting taxes is a crucial aspect of responsible betting. From income taxes to gambling taxes, bettors must be aware of their financial obligations and employ strategic approaches to maximize their winnings. By optimizing tax brackets, maximizing deductions, and employing strategic betting portfolios, bettors can enhance their returns and minimize tax obligations.

As the sports betting industry continues to evolve, so too will the landscape of sports betting taxes. It's essential for bettors to stay informed and adapt their strategies accordingly. With the right knowledge and approach, bettors can enjoy the thrill of sports betting while ensuring they are compliant with tax regulations and optimizing their financial outcomes.

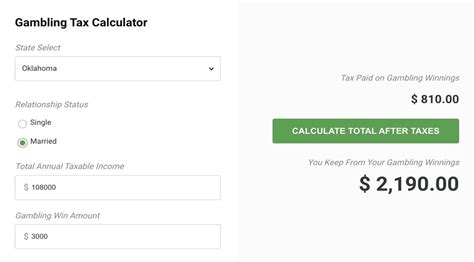

How do I calculate my sports betting taxes?

+Calculating sports betting taxes involves determining the applicable tax rate based on your jurisdiction and then applying it to your winnings. For income tax, this involves adding your betting winnings to your total taxable income and calculating the tax based on your income bracket. For gambling taxes, the calculation depends on the specific tax structure in your region, which could be a flat rate or a percentage of the stake or winnings.

Can I deduct my sports betting losses from my taxes?

+In some jurisdictions, you may be able to deduct your sports betting losses from your taxable income, reducing the amount of tax you owe. However, this is not universally applicable, and the rules can vary significantly based on your location. It’s essential to consult a tax professional to understand the specific rules in your region.

What are the potential risks of not paying sports betting taxes?

+Failing to pay your sports betting taxes can lead to significant penalties and legal consequences. Tax authorities take non-compliance seriously, and you could face fines, interest charges, and even criminal charges in severe cases. It’s crucial to declare your winnings accurately and pay the applicable taxes to avoid these risks.

Are there any strategies to minimize my sports betting tax obligations?

+Yes, there are several strategies to minimize your sports betting tax obligations. These include optimizing your tax bracket by spreading your bets across multiple years, maximizing deductions for betting-related expenses, diversifying your betting portfolio to stabilize winnings, and exploring tax-efficient betting strategies. Additionally, understanding the tax implications of different bet types and timing your bets strategically can also help minimize tax obligations.

What is the future outlook for sports betting taxes?

+The future of sports betting taxes is likely to involve increased regulation and standardization. Governments are paying closer attention to the sports betting industry and may introduce new tax structures or increase existing tax rates. Additionally, the rise of blockchain and cryptocurrencies in the betting industry could present new challenges for tax authorities, potentially leading to further regulatory changes.