Mclean County Property Tax

Mclean County, located in the heart of Illinois, is renowned for its rich agricultural heritage and thriving communities. Property taxes are an essential component of the county's revenue system, contributing significantly to the development and maintenance of vital public services and infrastructure. This article delves into the intricacies of Mclean County's property tax system, exploring its rates, assessment processes, and the impact it has on residents and businesses.

Understanding Mclean County’s Property Tax Structure

Mclean County’s property tax system operates under a uniform framework, ensuring fairness and consistency across the county. The tax rate is determined by a combination of factors, including the assessed value of the property and the tax levy set by various taxing districts within the county. These districts include the county government, local municipalities, school districts, and special purpose districts such as fire protection districts.

The tax levy is a crucial determinant of the property tax rate. Each taxing district proposes a levy based on its budget requirements, which are then approved by the Mclean County Board. The total tax levy for the county is the sum of these individual levies. The assessed value of a property, on the other hand, is determined by the Mclean County Assessor's Office through a systematic assessment process.

The Role of the Mclean County Assessor

The Mclean County Assessor’s Office plays a pivotal role in the property tax system. It is responsible for assessing the fair market value of all properties within the county, ensuring that the assessments are accurate and equitable. The assessment process involves analyzing recent sales of comparable properties, considering factors such as location, size, age, and condition.

The Assessor's Office conducts reassessments every four years, as mandated by Illinois law. During these reassessments, properties are evaluated to determine if their values have changed since the last assessment. If a property's value has increased, its tax liability will also increase, assuming the tax rate remains constant. Conversely, if a property's value decreases, its tax liability will decrease.

To ensure transparency and fairness, the Assessor's Office provides property owners with the opportunity to review and appeal their assessments. Property owners can request a review if they believe their property's assessed value is inaccurate. If the review does not resolve the issue, property owners can file a formal appeal with the Mclean County Board of Review.

Property Tax Rates and Calculations

The property tax rate in Mclean County is expressed as a percentage of the assessed value of a property. The rate is calculated by dividing the total tax levy by the total assessed value of all properties within the county. This rate is then applied to the assessed value of each individual property to determine its tax liability.

| Year | Total Tax Levy | Total Assessed Value | Property Tax Rate |

|---|---|---|---|

| 2022 | $120,000,000 | $5,000,000,000 | 2.4% |

| 2021 | $115,000,000 | $4,800,000,000 | 2.4% |

| 2020 | $110,000,000 | $4,600,000,000 | 2.4% |

For example, if a property has an assessed value of $200,000 and the county's tax rate is 2.4%, the property tax liability would be calculated as follows:

Property Tax Liability = Assessed Value x Tax Rate

Property Tax Liability = $200,000 x 0.024 = $4,800

Impact on Residents and Businesses

Property taxes in Mclean County have a significant impact on both residents and businesses. For homeowners, property taxes are a substantial expense that can influence their financial planning and decision-making. The tax liability can vary widely based on the assessed value of the property and the tax rate.

Businesses, particularly those with large commercial properties, also face significant property tax obligations. These taxes can affect a company's profitability and investment decisions. However, Mclean County offers various incentives and tax relief programs to attract and support businesses, helping to mitigate the impact of property taxes.

Property Tax Exemptions and Relief

Mclean County recognizes the financial burden that property taxes can impose on certain segments of the population and, therefore, provides a range of exemptions and relief programs. These initiatives aim to provide relief to seniors, veterans, and individuals with disabilities, as well as promote economic development and support local agriculture.

One notable exemption is the Homestead Exemption, which reduces the assessed value of a homeowner's primary residence by a set amount. This exemption is available to homeowners who meet specific residency and income criteria. Additionally, the county offers a Senior Citizens Exemption, which provides a further reduction in assessed value for homeowners aged 65 and older.

For businesses, Mclean County offers a variety of incentives, including tax abatement programs and enterprise zones. These initiatives aim to attract new businesses, support existing ones, and foster economic growth. By offering tax breaks and incentives, the county encourages investment and job creation, ultimately benefiting the entire community.

Future Outlook and Potential Changes

As Mclean County continues to evolve and adapt to changing economic and demographic conditions, the property tax system may also undergo modifications. The county’s leadership and policymakers regularly review the tax system to ensure it remains fair, efficient, and aligned with the community’s needs.

One potential area of change is the reassessment process. While the current four-year cycle ensures regular updates to property values, some counties in Illinois have implemented annual or more frequent reassessments. This could provide a more accurate reflection of property values and ensure that tax liabilities are based on up-to-date assessments.

Additionally, as the county's population and economic landscape change, the distribution of tax levies among taxing districts may need adjustment. This could involve a review of the tax rates and the services provided by each district to ensure that the tax burden is fairly distributed.

Frequently Asked Questions

How often are property taxes assessed in Mclean County?

+Property taxes in Mclean County are assessed every four years. This cycle ensures that property values are regularly updated to reflect market conditions.

Can property owners appeal their assessments?

+Yes, property owners have the right to appeal their assessments if they believe the assessed value is inaccurate. The appeal process involves a review by the Assessor’s Office and, if necessary, a formal hearing with the Mclean County Board of Review.

What are the eligibility criteria for the Homestead Exemption?

+To be eligible for the Homestead Exemption, homeowners must reside in Mclean County, occupy the property as their primary residence, and meet specific income criteria. The exact income limits are determined annually by the county.

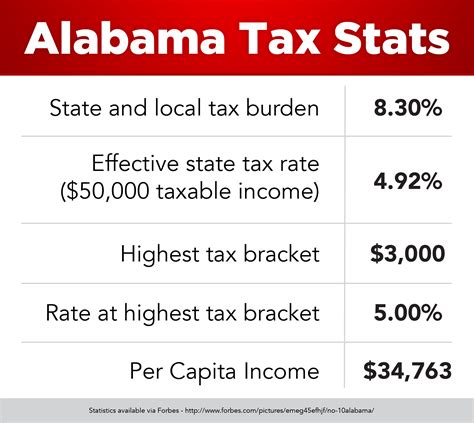

How do property tax rates compare between Mclean County and other Illinois counties?

+Property tax rates can vary significantly between Illinois counties. Mclean County’s rates are relatively competitive, but it’s essential to compare the rates with those of other counties to make an informed decision.

Are there any plans to change the property tax system in Mclean County in the near future?

+While there are no immediate plans for significant changes, the county leadership regularly reviews the tax system. Potential changes could include more frequent reassessments or adjustments to tax levy distributions.