Charleston Property Tax

Welcome to a comprehensive guide on the topic of Charleston property taxes. In this article, we will delve into the intricacies of property taxation in the vibrant city of Charleston, South Carolina. Understanding the property tax landscape is crucial for homeowners, investors, and anyone interested in the real estate market. Let's explore the key aspects, rates, and strategies related to Charleston property taxes.

Unraveling the Complexity of Charleston Property Taxes

Charleston, with its rich history and thriving economy, presents a unique tax environment for property owners. The city’s property tax system, like many others, serves as a primary source of revenue for local government operations and services. However, the specific rates and regulations can often be confusing for those unfamiliar with the process.

Property taxes in Charleston are determined by a combination of factors, including the assessed value of the property, the tax rate set by the local government, and any applicable exemptions or deductions. These taxes are essential for funding various public services, such as education, infrastructure development, and public safety initiatives.

Understanding Property Assessment

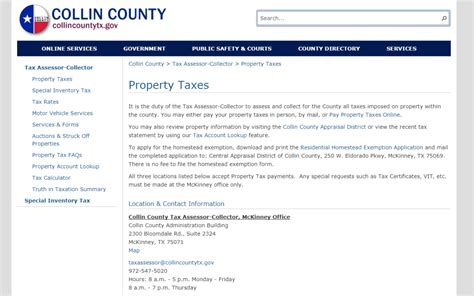

The first step in comprehending Charleston property taxes is understanding the assessment process. The Charleston County Assessor’s Office is responsible for determining the fair market value of each property within the county. This value is then used as a basis for calculating the property tax liability.

Assessors consider several factors when determining the value of a property, including its location, size, age, condition, and recent sales data of similar properties in the area. It’s important for property owners to ensure that their assessments are accurate, as this directly impacts the tax bill they receive.

| Assessment Year | Average Assessment Ratio |

|---|---|

| 2023 | 95% |

| 2022 | 93% |

| 2021 | 91% |

The assessment ratio, as shown in the table above, represents the percentage of the property's fair market value that is used for tax purposes. It is important to note that this ratio can vary from year to year and is influenced by various economic factors.

Tax Rates and Calculations

Once the assessed value of a property is determined, the tax rate comes into play. The tax rate is set by the local government and is applied to the assessed value to calculate the property tax liability. Charleston County has a millage rate structure, where the tax rate is expressed in mills (one mill equals one-tenth of a cent) per dollar of assessed value.

The tax rate consists of two components: the county rate and the municipality rate. Each municipality within Charleston County has its own tax rate, which can vary significantly. For instance, the city of Charleston's tax rate may differ from that of Mount Pleasant or James Island.

| Municipality | Tax Rate (Mills) |

|---|---|

| City of Charleston | 310 |

| Mount Pleasant | 280 |

| James Island | 340 |

To calculate the property tax, the assessed value is multiplied by the assessment ratio and then by the applicable tax rate. For example, if a property in Charleston has an assessed value of $500,000 and the assessment ratio is 95%, the taxable value would be $475,000 ($500,000 x 95%). Applying the city's tax rate of 310 mills, the property tax liability would be $147,250 ($475,000 x 0.310).

Exemptions and Deductions

Charleston offers various exemptions and deductions to reduce the tax burden on certain property owners. These incentives aim to support specific groups, such as senior citizens, veterans, and homeowners with limited incomes.

- Homestead Exemption: Property owners who use their home as their primary residence may be eligible for a homestead exemption. This exemption reduces the assessed value of the property for tax purposes, resulting in lower taxes.

- Senior Citizen Exemption: Residents aged 65 and older may qualify for a senior citizen exemption, which provides a reduction in the assessed value based on certain criteria.

- Veteran's Exemption: Veterans who meet specific requirements can receive an exemption on a portion of their property's assessed value, providing tax relief for their service.

It is important for property owners to research and understand the eligibility criteria for these exemptions and deductions. Consulting with a tax professional or the local assessor's office can help ensure that all applicable benefits are claimed.

Strategies for Managing Charleston Property Taxes

Navigating the complexities of Charleston property taxes can be challenging, but there are strategies that property owners can employ to manage their tax obligations effectively.

Stay Informed and Engage with the Assessor’s Office

One of the most effective ways to stay on top of property taxes is to stay informed about any changes in tax rates, assessment practices, and available exemptions. Regularly reviewing the assessor’s website, attending public meetings, and subscribing to relevant newsletters can provide valuable insights.

Engaging with the Charleston County Assessor's Office is crucial for addressing any concerns or disputes regarding property assessments. Property owners have the right to appeal their assessed values if they believe they are inaccurate or unfair. Understanding the appeal process and gathering supporting evidence can be instrumental in ensuring a fair assessment.

Consider Tax-Efficient Property Upgrades

While property improvements can enhance the value and desirability of a home, they may also impact the assessed value and, consequently, the property taxes. However, certain upgrades can be more tax-efficient than others.

For instance, energy-efficient upgrades such as solar panels, insulation, or energy-efficient appliances can not only reduce utility costs but may also qualify for tax credits or incentives. Additionally, improvements that increase the functional value of the property, such as adding a garage or renovating the kitchen, may have a lower impact on the assessed value compared to cosmetic upgrades.

Explore Rental Property Strategies

If you own rental properties in Charleston, managing property taxes becomes even more crucial. Considering strategies to optimize rental income and minimize tax liabilities can be beneficial.

- Proper Record-Keeping: Maintaining detailed records of rental income, expenses, and improvements is essential for tax purposes. Accurate record-keeping simplifies the process of claiming deductions and ensures compliance with tax regulations.

- Depreciation Benefits: Rental property owners can take advantage of depreciation deductions, which allow them to recover a portion of the property's cost over time. Consulting with a tax professional can help maximize these deductions and reduce tax obligations.

- Tax-Efficient Refinancing: Refinancing rental properties can provide opportunities to reduce interest rates, lower monthly payments, and potentially access cash for improvements or other investments. It's important to consider the tax implications of refinancing and consult with financial advisors.

Future Implications and Trends

As Charleston continues to experience economic growth and development, the property tax landscape is likely to evolve. Understanding the potential future implications can help property owners make informed decisions and plan effectively.

Economic Growth and Tax Revenues

Charleston’s thriving economy and increasing demand for real estate are expected to drive property values upwards. As property values rise, the tax base expands, leading to increased tax revenues for the local government. This can result in improved public services and infrastructure but may also impact individual property tax obligations.

Property owners should stay updated on economic trends and real estate market conditions to anticipate potential changes in property values and, consequently, their tax liabilities.

Potential Tax Reforms and Incentives

Local governments and state authorities may introduce tax reforms or incentives to attract businesses, promote economic development, or support specific communities. These initiatives can include tax breaks, grants, or reduced tax rates for certain industries or properties.

Staying informed about potential tax reforms and incentives can help property owners take advantage of opportunities to reduce their tax burden or contribute to local economic growth.

Technological Advances in Property Assessment

Advancements in technology are transforming the property assessment process. Assessor’s offices are increasingly adopting digital tools and data analytics to enhance the accuracy and efficiency of assessments. This can lead to more precise valuations and potentially reduce the risk of inaccurate assessments.

Property owners should be aware of these technological advancements and understand how they may impact the assessment process in Charleston. Staying engaged with the assessor's office and providing accurate information can help ensure fair and accurate assessments.

How often are property assessments conducted in Charleston?

+Property assessments in Charleston are typically conducted on a biennial basis, meaning they occur every two years. However, the Charleston County Assessor's Office may conduct reassessments or special assessments in certain circumstances, such as significant property improvements or changes in market conditions.

Can I appeal my property assessment if I believe it is inaccurate?

+Yes, property owners have the right to appeal their assessments if they believe the value determined by the assessor's office is incorrect or unfair. The appeal process involves submitting documentation and evidence to support your claim. It is advisable to consult the Charleston County Assessor's Office for specific guidelines and deadlines.

Are there any tax breaks or incentives for homeowners in Charleston?

+Charleston offers various tax breaks and incentives to support homeowners. These include the Homestead Exemption, Senior Citizen Exemption, and Veteran's Exemption, which provide reductions in the assessed value of the property for tax purposes. It's important to research and understand the eligibility criteria for these exemptions.

How can I estimate my property tax liability in Charleston?

+Estimating your property tax liability involves multiplying the assessed value of your property by the applicable tax rate. You can obtain the assessed value from your property tax bill or the Charleston County Assessor's Office. The tax rate is determined by the local government and can be found on their official website or by contacting the municipality's tax office.

What are the consequences of not paying property taxes in Charleston?

+Failure to pay property taxes in Charleston can result in significant penalties and legal consequences. The local government may impose late payment fees, interest charges, and even initiate legal proceedings to collect the unpaid taxes. In severe cases, the property may be subject to a tax sale or foreclosure.

Understanding Charleston property taxes is essential for property owners, investors, and anyone interested in the local real estate market. By comprehending the assessment process, tax rates, and available exemptions, individuals can effectively manage their tax obligations and make informed decisions. Stay informed, engage with the assessor’s office, and explore tax-efficient strategies to navigate the complexities of Charleston property taxes successfully.