Fairfield Tax Collector

Welcome to a comprehensive guide to the Fairfield Tax Collector's Office, a vital administrative entity that plays a crucial role in the local community. This article aims to provide an in-depth analysis of its functions, services, and impact, offering valuable insights to residents and stakeholders alike.

The Role and Responsibilities of the Fairfield Tax Collector

The Tax Collector's Office in Fairfield is a key institution within the local government, responsible for a range of essential financial and administrative tasks. At its core, this office ensures the efficient collection of taxes and fees, which are vital for funding public services and maintaining the infrastructure and development of the city.

One of the primary responsibilities is the management of property taxes. Property owners in Fairfield are required to pay annual taxes, which contribute to the city's budget and support services like public safety, education, and infrastructure maintenance. The Tax Collector's Office handles the assessment, billing, and collection of these taxes, ensuring that property owners fulfill their financial obligations to the city.

Beyond property taxes, the office also administers a range of other fees and assessments. This includes business taxes, vehicle registration fees, and special assessments for services like solid waste management and stormwater drainage. By collecting these various revenues, the Tax Collector's Office plays a critical role in financing the city's operations and maintaining its financial health.

Another crucial aspect of the Tax Collector's role is providing excellent customer service. The office is often the primary point of contact for taxpayers, offering assistance and guidance on tax-related matters. This includes answering inquiries, resolving disputes, and providing information on payment options and due dates. By offering efficient and friendly service, the Tax Collector's Office helps ensure that taxpayers can meet their obligations smoothly and understand their rights and responsibilities.

Key Functions and Services

The Fairfield Tax Collector's Office offers a comprehensive suite of services to facilitate tax payment and compliance. Here's an overview of some of its key functions:

- Tax Assessment and Billing: The office assesses property values and issues tax bills to property owners. This process involves evaluating the fair market value of properties and applying the appropriate tax rates to determine the amount due.

- Tax Payment Options: Taxpayers have several payment options, including online payments, direct debit, credit/debit card payments, and in-person payments at the Tax Collector's office. These options provide flexibility and convenience for taxpayers.

- Tax Collection and Enforcement: The Tax Collector's Office is responsible for collecting taxes in a timely manner. If taxes are not paid, the office may enforce collection through various means, including liens, levies, and seizures. This ensures that the city receives the necessary funds to operate effectively.

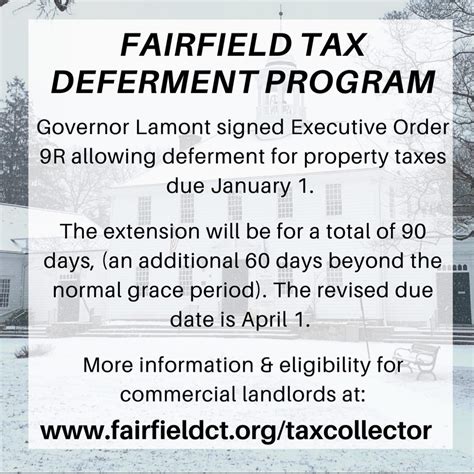

- Tax Relief Programs: To assist taxpayers facing financial difficulties, the office may offer tax relief programs. These can include deferred payment plans, hardship waivers, or other forms of assistance, ensuring that taxpayers are treated fairly and that the city's revenue stream remains stable.

- Online Services: Fairfield's Tax Collector Office provides an online portal where taxpayers can access their account information, view tax bills, make payments, and manage their tax obligations. This digital platform enhances convenience and efficiency for taxpayers.

By offering these services, the Tax Collector's Office ensures that the city's tax system is fair, efficient, and accessible to all taxpayers. This not only facilitates the smooth operation of the city's financial system but also fosters trust and transparency between the government and its citizens.

The Impact and Benefits of Effective Tax Collection

The efficient and effective operation of the Fairfield Tax Collector's Office has a profound impact on the local community and the city's overall financial health. Here are some key benefits that result from a well-functioning tax collection system:

Funding Essential Services

Taxes collected by the Tax Collector's Office are a primary source of revenue for the city. This funding is vital for maintaining and improving critical public services, including education, public safety, healthcare, and infrastructure development. By ensuring a steady stream of tax revenue, the Tax Collector's Office helps the city provide the services that residents rely on daily.

Maintaining Financial Stability

Effective tax collection contributes to the city's financial stability. Timely and efficient tax collection ensures that the city can meet its financial obligations, such as paying employee salaries, maintaining public facilities, and investing in long-term projects. This stability is crucial for the city's economic health and its ability to attract businesses and residents.

Encouraging Civic Responsibility

The Tax Collector's Office plays a role in fostering a sense of civic responsibility among residents. By collecting taxes in a fair and transparent manner, the office encourages taxpayers to fulfill their financial obligations to the community. This sense of responsibility is essential for maintaining a well-functioning society and a vibrant local economy.

Promoting Economic Development

A well-managed tax system can attract businesses and investors to the city. Businesses require a stable and efficient tax environment to operate effectively. The Tax Collector's Office contributes to this stability by providing clear tax guidelines, offering efficient payment options, and ensuring timely collection. This, in turn, can lead to increased investment, job creation, and economic growth for the city.

The Future of Tax Collection in Fairfield

As technology continues to advance, the Tax Collector's Office in Fairfield is adapting to meet the changing needs and expectations of taxpayers. Here's a glimpse into the future of tax collection in the city:

Digital Transformation

The office is embracing digital technologies to enhance its services. This includes further developing its online platform to provide even more comprehensive services. Taxpayers can expect to see improved online payment options, real-time account updates, and more efficient dispute resolution processes.

Data-Driven Decision Making

By leveraging data analytics, the Tax Collector's Office can make more informed decisions. This includes using data to identify trends in tax collection, optimize collection strategies, and improve the overall efficiency of the office. Data-driven decision-making will also help the office identify areas where taxpayer assistance may be needed, ensuring a more equitable tax system.

Enhanced Taxpayer Engagement

The office is committed to improving taxpayer engagement and satisfaction. This involves implementing initiatives to educate taxpayers about their rights and responsibilities, offering more flexible payment plans, and providing personalized support to taxpayers facing financial difficulties. By enhancing taxpayer engagement, the office aims to build trust and improve the overall tax compliance rate.

Partnerships and Collaborations

The Tax Collector's Office is exploring partnerships with local businesses and community organizations to improve tax collection and compliance. These partnerships can help the office reach a wider audience, provide more tailored services, and create a stronger sense of community engagement around tax matters. By working together, the office and its partners can create a more efficient and fair tax system for all.

Frequently Asked Questions (FAQ)

What is the deadline for paying property taxes in Fairfield?

+The deadline for paying property taxes in Fairfield is typically the last business day of November each year. However, it's essential to check with the Tax Collector's Office for any updates or changes to this deadline.

How can I pay my taxes if I don't have access to online banking?

+If you don't have access to online banking, you can still pay your taxes in person at the Tax Collector's office. You can also use other payment methods such as direct debit, credit/debit card, or even cash. The office staff will be happy to assist you in choosing the most suitable payment option.

What happens if I don't pay my taxes on time?

+If you fail to pay your taxes by the due date, you may be subject to penalties and interest charges. The Tax Collector's Office may also initiate collection actions, including liens and levies. It's important to contact the office as soon as possible if you're facing financial difficulties to discuss potential payment arrangements.

Can I appeal my property tax assessment?

+Yes, you have the right to appeal your property tax assessment if you believe it is inaccurate or unfair. The Tax Collector's Office can provide information on the appeal process and the deadlines for filing an appeal. It's important to gather supporting documentation and follow the necessary steps to ensure a successful appeal.

How often are property tax assessments conducted in Fairfield?

+Property tax assessments in Fairfield are typically conducted annually. However, there may be instances where reassessments are triggered by changes in property ownership, improvements to the property, or other factors. It's important to stay informed about any changes to your property assessment and to report any inaccuracies to the Tax Collector's Office.

The Fairfield Tax Collector’s Office stands as a cornerstone of the city’s financial infrastructure, ensuring the efficient collection of taxes and fees to fund essential services and maintain the city’s financial stability. Through its commitment to excellence, the office not only fulfills its administrative duties but also fosters a sense of civic responsibility and contributes to the economic growth and development of the community. As it embraces digital transformation and data-driven decision-making, the office is well-positioned to continue serving the residents of Fairfield with efficiency and integrity, adapting to meet the evolving needs of a modern society.