Luxury Tax Nba

In the world of the National Basketball Association (NBA), the luxury tax is a crucial component of the league's financial framework, designed to deter teams from excessive spending on player salaries and maintain a level playing field. The luxury tax system, introduced in the 1980s, has evolved significantly over the years, impacting team strategies, player dynamics, and the overall economic landscape of the league.

This comprehensive guide delves into the intricacies of the NBA luxury tax, exploring its historical context, current regulations, and the profound implications it holds for teams, players, and the league's competitive balance.

A Historical Perspective: The Evolution of the NBA Luxury Tax

The origins of the NBA luxury tax can be traced back to the 1980s, a period marked by the rise of superstar salaries and the growing disparity between wealthy and less financially stable franchises. To address these issues and promote competitive parity, the NBA introduced the luxury tax system as a mechanism to curb excessive spending and redistribute revenue among teams.

Initially, the luxury tax was a relatively straightforward concept. Teams that exceeded a predetermined salary cap threshold were penalized with a tax based on the amount they went over the cap. This initial design, however, proved to be less effective than anticipated, as several teams, particularly those with deep-pocketed owners, were willing to pay the tax to maintain their competitive advantage.

Over the years, the NBA has refined and adapted the luxury tax system to achieve a more balanced approach. Key milestones in this evolution include the implementation of the repeater tax in the 1990s, which increased the tax rate for teams that repeatedly exceeded the luxury tax threshold, and the introduction of the soft cap in the 2000s, allowing teams to exceed the salary cap under certain circumstances without incurring a tax penalty.

The most recent and significant overhaul of the luxury tax system occurred with the 2011 NBA lockout, which led to a new collective bargaining agreement (CBA). This agreement introduced a more progressive tax structure, with escalating tax rates for teams exceeding the luxury tax threshold. It also included provisions for revenue sharing and luxury tax distributions, further enhancing the system's impact on competitive balance.

The Mechanics of the NBA Luxury Tax

At its core, the NBA luxury tax is a penalty imposed on teams that exceed a predetermined salary cap threshold. This threshold, known as the luxury tax line or apron, is set above the league’s salary cap and varies from season to season based on the league’s revenue projections.

Teams that exceed the luxury tax line are required to pay a tax based on the amount they go over the threshold. The tax rate is progressive, meaning the rate increases as the team's salary expenditures rise. This progressive structure is designed to deter teams from significantly exceeding the luxury tax line and encourage a more balanced distribution of resources.

For instance, in the 2021-2022 season, the luxury tax line was set at $138.9 million. Teams that exceeded this threshold paid a tax rate of $1.50 for every dollar they went over the line, up to $5.1 million. Beyond this threshold, the tax rate escalated to $1.75 for each additional dollar, and so on, with the rates continuing to increase as the team's salary expenditures rose.

The Repeater Tax

The repeater tax is a critical component of the NBA’s luxury tax system, designed to discourage teams from repeatedly exceeding the luxury tax threshold. Teams that exceed the luxury tax line in multiple consecutive seasons are subject to a higher tax rate, known as the repeater tax.

The repeater tax rate is typically higher than the standard luxury tax rate, often double or more. This additional penalty is intended to deter teams from consistently operating in the luxury tax territory and encourage them to find more sustainable financial strategies.

For example, a team that exceeds the luxury tax line for the first time may pay a standard tax rate of $1.50 per dollar over the threshold. However, if the same team exceeds the luxury tax line again in the following season, they may be subject to a repeater tax rate of $3.00 per dollar, a significant increase designed to deter repeat offenders.

Revenue Sharing and Luxury Tax Distributions

One of the key objectives of the NBA luxury tax system is to promote competitive balance and ensure that even the least financially stable teams can compete effectively. To achieve this, the league employs a system of revenue sharing and luxury tax distributions.

Revenue sharing involves the redistribution of a portion of the league's revenue to teams that operate below the luxury tax threshold. This revenue is typically generated from league-wide income streams, such as national television deals, merchandise sales, and sponsorship agreements. By sharing this revenue, the NBA ensures that even small-market teams can afford to retain talent and compete with larger, wealthier franchises.

In addition to revenue sharing, the NBA also utilizes luxury tax distributions. Teams that pay the luxury tax contribute a portion of their tax payments to a pool, which is then distributed to teams that operate below the luxury tax line. This distribution system provides an additional financial boost to smaller-market teams, helping them maintain competitive rosters and attract free agents.

| Season | Luxury Tax Line | Standard Tax Rate | Repeater Tax Rate |

|---|---|---|---|

| 2021-2022 | $138.9 million | $1.50 per dollar over | Double or more |

| 2020-2021 | $132.6 million | $1.50 per dollar over | Double or more |

| 2019-2020 | $132.6 million | $1.50 per dollar over | Double or more |

Impact on Team Strategies and Player Dynamics

The NBA luxury tax system has a profound impact on team strategies and player dynamics, influencing everything from roster construction to free agency negotiations.

Teams operating under the luxury tax line have a financial incentive to build competitive rosters without exceeding the threshold. This often involves strategic roster management, including the use of cost-effective players, creative contract structures, and careful cap management. Teams may also employ strategies such as sign-and-trade deals or acquiring players via trade exceptions to minimize their luxury tax burden.

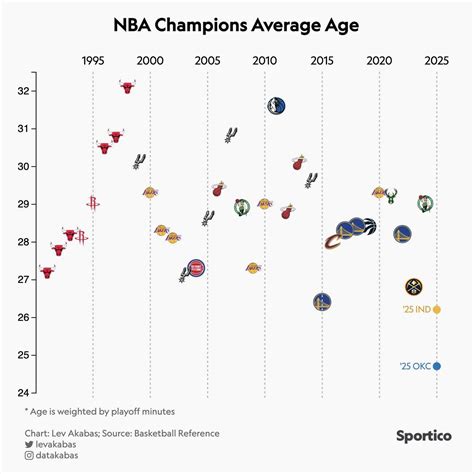

For teams that consistently operate in the luxury tax territory, the financial burden can be significant. These teams may be forced to make difficult decisions, such as trading away star players or restructuring contracts, to reduce their tax liability. In some cases, teams may even choose to dismantle their championship-contending rosters to avoid the luxury tax, as seen with the 2011 Dallas Mavericks, who disbanded their title-winning team to avoid the luxury tax following their championship season.

The luxury tax also plays a crucial role in free agency, influencing player movement and contract negotiations. Players may be more inclined to sign with teams that are not in the luxury tax territory, as these teams have more financial flexibility to offer lucrative contracts. Conversely, players on luxury tax teams may have to accept lower salaries to maintain roster stability.

Case Study: The Golden State Warriors and the Luxury Tax

The Golden State Warriors provide a compelling case study of the impact of the NBA luxury tax on team strategies and player dynamics. During their dynasty years from 2014 to 2019, the Warriors consistently operated in the luxury tax territory, paying significant tax penalties to maintain their star-studded roster.

Despite the financial burden, the Warriors' front office was adept at managing the luxury tax, employing a range of strategies to minimize their tax liability. This included the use of cost-effective role players, creative contract structures, and strategic roster moves. For instance, the Warriors used the mid-level exception to sign players like Shaun Livingston and Andre Iguodala, who played crucial roles in their championship runs, without incurring additional luxury tax penalties.

However, as the Warriors' tax bill continued to rise, they were forced to make difficult decisions. In 2019, with the luxury tax bill approaching $40 million, the Warriors traded away several key players, including Andre Iguodala and Shaun Livingston, to reduce their tax liability. This decision, while necessary from a financial perspective, had a significant impact on the team's dynamics and ultimately contributed to the end of their dynasty.

Competitive Balance and the NBA Luxury Tax

A primary objective of the NBA luxury tax system is to promote competitive balance, ensuring that all teams, regardless of their financial resources, have a chance to compete for the championship. The system is designed to deter teams from hoarding talent and creating a significant advantage over their competitors.

By imposing a financial penalty on teams that exceed the luxury tax threshold, the NBA discourages the concentration of talent in a few wealthy franchises. This, in turn, encourages teams to distribute their resources more evenly, leading to a more balanced league. The revenue sharing and luxury tax distributions further enhance this effect, providing financial support to smaller-market teams and helping them compete with larger franchises.

While the luxury tax system has been successful in promoting competitive balance to some extent, it is not without its critics. Some argue that the system does not go far enough, as wealthy teams can still afford to pay the luxury tax and maintain a significant competitive advantage. Others suggest that the system disproportionately benefits small-market teams, at the expense of large-market teams that operate responsibly within the luxury tax threshold.

The Impact on Small-Market Teams

Small-market teams, in particular, benefit significantly from the NBA luxury tax system. These teams, which often have limited financial resources, rely on the revenue sharing and luxury tax distributions to compete effectively with larger, wealthier franchises.

Revenue sharing provides small-market teams with a steady stream of income, allowing them to retain talent and attract free agents. This financial support helps these teams build competitive rosters and maintain a level of parity with their larger-market counterparts. Luxury tax distributions further enhance this effect, providing an additional financial boost to small-market teams that operate below the luxury tax line.

For example, the Oklahoma City Thunder, a small-market team, has consistently benefited from the NBA's revenue sharing and luxury tax distributions. Despite having a limited local market, the Thunder has been able to compete with larger-market teams, reaching the NBA Finals in 2012 and consistently fielding competitive rosters. This success is largely attributable to the financial support provided by the league's revenue sharing and luxury tax systems.

Future Implications and Potential Reforms

The NBA luxury tax system is a dynamic and evolving component of the league’s financial framework. As the league continues to grow and adapt, the luxury tax system will likely undergo further refinements and reforms to address emerging challenges and maintain competitive balance.

One potential area of reform is the progressive nature of the tax structure. While the current system discourages teams from significantly exceeding the luxury tax line, some argue that the tax rates could be further escalated to deter excessive spending. This could involve increasing the repeater tax rates or introducing additional tax tiers to further penalize teams that consistently operate in the luxury tax territory.

Another potential area of focus is the balance between small-market and large-market teams. While the luxury tax system provides significant support to small-market teams, some argue that it may be too favorable, incentivizing large-market teams to operate responsibly within the luxury tax threshold rather than pursuing championship-contending rosters. Finding the right balance between these competing interests will be a key challenge for the NBA in the coming years.

Additionally, the NBA may need to consider the impact of the luxury tax system on player movement and free agency. As the system currently stands, players may be more inclined to sign with teams that are not in the luxury tax territory, potentially leading to a concentration of talent on a few select teams. The league may need to find ways to encourage player movement and prevent the formation of superteams, while still maintaining a level playing field.

Conclusion

The NBA luxury tax system is a critical component of the league’s financial framework, designed to promote competitive balance and deter excessive spending. Through a combination of progressive tax rates, revenue sharing, and luxury tax distributions, the system has had a profound impact on team strategies, player dynamics, and the overall competitive landscape of the league.

While the luxury tax system has been successful in achieving its objectives, ongoing refinements and reforms will be necessary to address emerging challenges and maintain the league's competitive integrity. As the NBA continues to evolve, the luxury tax system will remain a key focus, ensuring that the league remains financially sustainable and competitively balanced for years to come.

Frequently Asked Questions

What is the purpose of the NBA luxury tax system?

+

The NBA luxury tax system is designed to promote competitive balance and deter excessive spending on player salaries. It penalizes teams that exceed a predetermined salary cap threshold, known as the luxury tax line, with a progressive tax rate based on the amount they go over the threshold.

How does the luxury tax system impact team strategies and player dynamics?

+

The luxury tax system influences team strategies by encouraging financial responsibility and strategic roster management. Teams operating under the luxury tax line have an incentive to build competitive rosters without exceeding the threshold, often employing cost-effective players and creative contract structures. For teams in the luxury tax territory, the financial burden can lead to difficult decisions, such as trading away star players or restructuring contracts.

How does the luxury tax system promote competitive balance?

+

The luxury tax system promotes competitive balance by discouraging teams from hoarding talent and creating a significant advantage over their competitors. By imposing a financial penalty on teams that exceed the luxury tax threshold, the NBA discourages the concentration of talent in a few wealthy franchises, encouraging a more balanced distribution of resources.

What is the repeater tax, and how does it work?

+

The repeater tax is a component of the NBA luxury tax system designed to discourage teams from repeatedly exceeding the luxury tax threshold. Teams that exceed the luxury tax line in multiple consecutive seasons are subject to a higher tax rate, known as the repeater tax rate. The repeater tax rate is typically double or more than the standard luxury tax rate, providing an additional penalty for repeat offenders.

How does the luxury tax system benefit small-market teams?

+

Small-market teams benefit significantly from the NBA luxury tax system through revenue sharing and luxury tax distributions. Revenue sharing provides a steady stream of income, allowing small-market teams to retain talent and attract free agents. Luxury tax distributions further enhance this effect, providing an additional financial boost to small-market teams that operate below the luxury tax line.