Sales Tax Rate For New York

Sales tax in the United States is a complex and diverse system, varying greatly from state to state. Understanding the sales tax rates and regulations is crucial for both businesses and consumers, as it directly impacts the cost of goods and services. This article delves into the intricacies of sales tax in New York, exploring its rates, applicability, and unique features.

The Sales Tax Landscape in New York

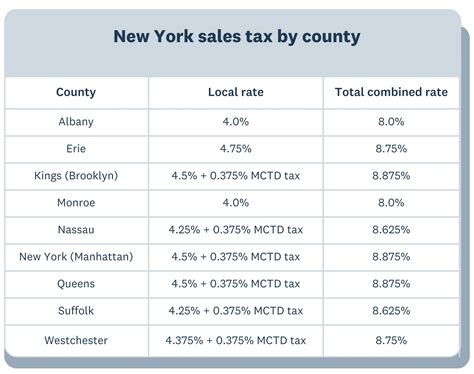

New York, known for its vibrant economy and diverse industries, has a sales tax system that reflects its economic complexity. The state sales tax is a critical revenue source for New York, contributing significantly to its budget. As of [current date], the state sales tax rate stands at 4%, which is applicable to most retail sales and certain services.

However, the sales tax landscape in New York is not uniform. The state allows local governments to impose additional sales taxes, creating a multi-layered tax structure. This results in a patchwork of rates across the state, with some localities having higher combined sales tax rates than others.

New York City’s Sales Tax

New York City, being the economic hub of the state, has its own set of sales tax regulations. The city imposes an additional sales tax of 4.5%, bringing the total sales tax rate within the city limits to 8.875% (including the state sales tax). This rate is applicable to a wide range of goods and services, making New York City one of the highest sales tax areas in the country.

| Sales Tax Rate | Location |

|---|---|

| 4.5% | New York City |

| 1.25% | Nassau County |

| 1% | Suffolk County |

| 0.5% | Dutchess County |

| 4% | Statewide (excluding localities) |

Variations Across the State

Outside of New York City, the sales tax rates can vary significantly. Counties and cities often impose their own sales taxes, creating a diverse tax environment. For instance, Nassau County has an additional sales tax of 1.25%, while Suffolk County adds 1% to the state rate. These variations can make it challenging for businesses to navigate the sales tax landscape, especially when operating in multiple locations within the state.

Sales Tax Exemptions and Special Cases

New York, like many other states, provides certain exemptions and special provisions within its sales tax system. These exemptions are designed to support specific industries, promote certain activities, or provide relief to certain consumer groups.

Food and Beverage Exemptions

One notable exemption in New York’s sales tax system is the treatment of food and beverages. Prepared food and restaurant meals are generally subject to sales tax, but groceries and unprepared food items are exempt. This distinction can impact businesses in the food industry, as they must carefully classify their products to ensure compliance.

Clothing and Shoe Exemptions

Another unique aspect of New York’s sales tax is the exemption on clothing and footwear. Clothing and shoes costing less than $110 per item are exempt from sales tax, providing a significant benefit to consumers and a competitive advantage for retailers. This exemption, however, has its complexities, as it doesn’t apply to accessories or certain types of clothing.

Pharmaceuticals and Medical Devices

Pharmaceuticals and medical devices are generally exempt from sales tax in New York. This exemption is a significant relief for consumers, especially those with chronic health conditions or high medical expenses. It also encourages the development and distribution of medical products within the state.

Compliance and Administration

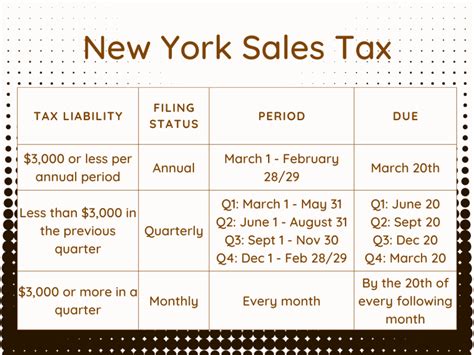

Ensuring compliance with New York’s sales tax regulations is a complex task for businesses. The multi-layered tax structure and varying exemptions require meticulous record-keeping and reporting. Businesses must stay updated with the latest regulations and tax rate changes to avoid penalties and maintain compliance.

New York's Department of Taxation and Finance provides resources and guidance to help businesses navigate the sales tax landscape. They offer tools for tax registration, filing, and payment, ensuring a streamlined process for tax compliance. However, given the complexity of the system, many businesses opt for professional tax services to manage their sales tax obligations effectively.

Future Outlook and Potential Changes

The sales tax landscape in New York is dynamic and subject to change. As the state’s economic priorities evolve, so might its tax policies. There have been ongoing discussions about potential reforms, including the simplification of the sales tax system and the exploration of alternative revenue sources.

One potential area of change is the treatment of online sales. With the growth of e-commerce, the collection of sales tax on online purchases has become a critical issue. New York, like many other states, is working to ensure that online retailers collect and remit sales tax, ensuring a level playing field for brick-and-mortar stores.

Additionally, the state might consider adjusting its sales tax rates or exploring other tax structures to support specific economic goals. For instance, there have been proposals to introduce a value-added tax (VAT) system, which could provide a more stable revenue stream and simplify tax administration.

Conclusion: Navigating New York’s Sales Tax

Understanding and navigating New York’s sales tax system is crucial for businesses and consumers alike. The state’s diverse tax landscape, with its varying rates and exemptions, presents both challenges and opportunities. For businesses, effective tax management can be a competitive advantage, while for consumers, a clear understanding of sales tax can lead to better financial decisions.

As New York continues to evolve economically, its sales tax system will likely undergo changes to adapt to new realities. Staying informed about these changes is essential for all stakeholders to ensure compliance and take advantage of any new opportunities that may arise.

What is the current sales tax rate in New York City?

+The total sales tax rate in New York City is 8.875%, which includes both the state and local sales taxes.

Are there any sales tax holidays in New York?

+Yes, New York occasionally has sales tax holidays, typically for back-to-school shopping and certain energy-efficient products. These holidays offer a temporary reduction or exemption from sales tax on specific items.

How does New York handle sales tax for online purchases?

+New York requires online retailers with a physical presence or significant economic activity in the state to collect and remit sales tax. This ensures that online purchases are subject to the same tax rates as in-store purchases.