Pa Sales Tax License

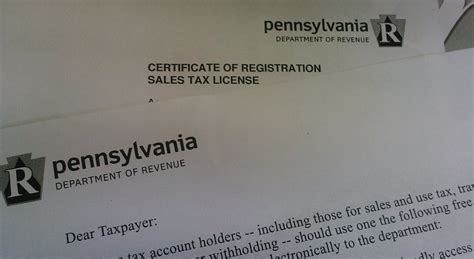

The Pennsylvania Sales Tax License, officially known as the Sales and Use Tax Certificate of Registration, is a vital document for businesses operating within the state of Pennsylvania. This license enables businesses to collect and remit sales tax on behalf of the Pennsylvania Department of Revenue, ensuring compliance with state tax laws and regulations. In this comprehensive guide, we will delve into the intricacies of obtaining and managing a Pa Sales Tax License, providing valuable insights for businesses looking to navigate the state's tax landscape successfully.

Understanding the Pa Sales Tax License

The Pa Sales Tax License is a legal requirement for any business that sells taxable goods or services within the state of Pennsylvania. It serves as a form of registration, authorizing the business to collect sales tax from customers and subsequently remit it to the state. The license ensures that businesses contribute their fair share to the state’s revenue, supporting various public services and infrastructure development.

The Pennsylvania Department of Revenue is the governing body responsible for issuing and regulating Sales Tax Licenses. They provide a comprehensive framework of rules and guidelines that businesses must adhere to, encompassing registration, tax collection, and reporting processes.

Who Needs a Pa Sales Tax License?

Any business entity engaged in selling taxable goods or services to customers in Pennsylvania is required to obtain a Sales Tax License. This includes, but is not limited to:

- Retail stores

- Online retailers

- Wholesale distributors

- Service providers

- E-commerce platforms

- Marketplaces

Even if a business operates primarily outside of Pennsylvania but has a physical presence or conducts transactions within the state, it may be subject to the sales tax laws and require a license.

Taxable Goods and Services

Pennsylvania imposes sales tax on a wide range of goods and services, including:

- Clothing and apparel

- Electronics

- Automotive products

- Home improvement items

- Restaurant meals

- Professional services (e.g., legal, accounting)

- And many more

The state maintains a comprehensive list of taxable items, which businesses can refer to for accurate tax collection and compliance. It is essential for businesses to understand the specific taxable items they offer to ensure proper licensing and tax reporting.

Applying for the Pa Sales Tax License

The application process for the Pa Sales Tax License is straightforward and can be completed online through the Pennsylvania Department of Revenue’s official website. Here’s a step-by-step guide to obtaining your license:

Step 1: Determine Eligibility

Before applying, businesses should assess their eligibility based on their operations and sales within Pennsylvania. Factors such as the nature of the business, the location of customers, and the type of goods or services sold are crucial in determining the need for a Sales Tax License.

Step 2: Gather Required Information

To complete the application, businesses will need to provide specific information, including:

- Business name, address, and contact details

- Federal Employer Identification Number (FEIN) or Social Security Number (SSN)

- Business structure (sole proprietorship, partnership, corporation, etc.)

- Estimated annual sales volume

- Date of first sale in Pennsylvania

- Information on any existing business licenses or permits

It is essential to have accurate and up-to-date information ready to ensure a smooth application process.

Step 3: Complete the Online Application

The Pennsylvania Department of Revenue provides an online application form that businesses can fill out securely. The form guides applicants through the necessary steps, providing clear instructions and prompts for required information.

Step 4: Submit Supporting Documents

In addition to the application form, businesses may need to submit supporting documents, such as:

- Articles of Incorporation or Business Registration

- Partnership or LLC agreements

- Proof of business location (lease agreement, utility bill, etc.)

- Any other relevant documentation requested by the Department of Revenue

Step 5: Pay the Application Fee

A non-refundable application fee is required to process the Pa Sales Tax License application. The fee amount is subject to change, so it is advisable to check the official website for the most current fee structure.

Step 6: Await Processing and Approval

Once the application and supporting documents are submitted, the Pennsylvania Department of Revenue will review the information. Processing times may vary, but businesses can typically expect a response within a few weeks. If the application is approved, the Department will issue the Sales Tax License, allowing the business to commence tax collection and reporting.

Managing the Pa Sales Tax License

Obtaining the Pa Sales Tax License is just the first step. Businesses must actively manage their tax obligations to ensure ongoing compliance. Here’s a look at some key aspects of license management:

Tax Collection

Businesses with a Sales Tax License are responsible for collecting the appropriate tax rate from customers on taxable goods and services. The tax rate may vary depending on the location of the sale, with different municipalities and counties having their own tax rates. It is crucial for businesses to stay updated on these rates to avoid under- or over-charging customers.

Tax Remittance

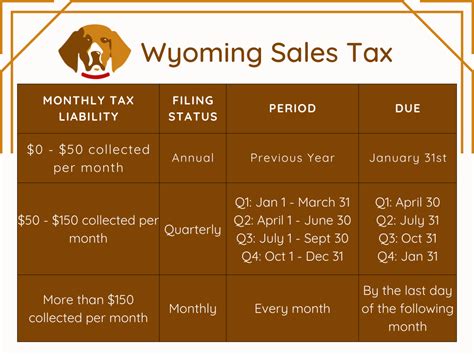

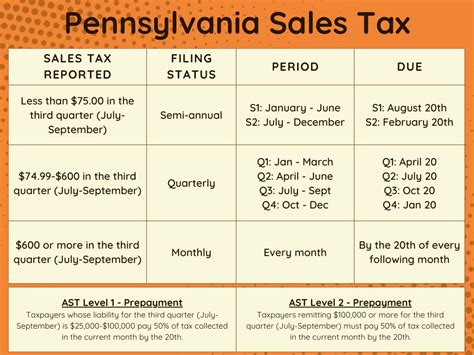

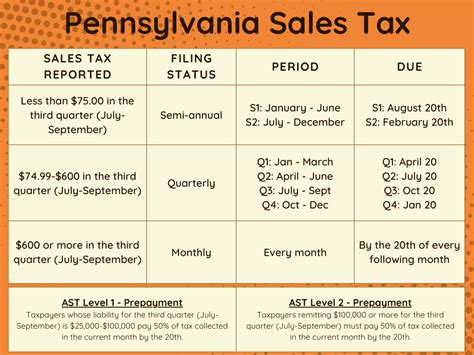

Regular tax remittance is a critical aspect of managing the Pa Sales Tax License. Businesses must remit the collected sales tax to the Pennsylvania Department of Revenue on a timely basis. The frequency of remittance depends on the business’s estimated tax liability, with options for monthly, quarterly, or annual filing.

To ensure accurate remittance, businesses should maintain detailed records of taxable sales, including the date, amount, and location of each transaction. This information is essential for preparing tax returns and demonstrating compliance with state regulations.

Tax Returns and Reporting

In addition to tax remittance, businesses must file tax returns with the Pennsylvania Department of Revenue. These returns provide a detailed account of taxable sales, tax collected, and other relevant information. The Department offers various filing methods, including online filing through their secure portal.

Tax returns are typically due on a quarterly basis, with specific deadlines set by the Department. Late filing or non-compliance can result in penalties and interest charges, so it is crucial for businesses to stay organized and meet these deadlines.

Record-Keeping and Audits

Proper record-keeping is essential for managing the Pa Sales Tax License effectively. Businesses should maintain accurate and complete records of all taxable sales, including invoices, receipts, and any supporting documentation. These records should be readily accessible for at least four years to comply with state regulations.

The Pennsylvania Department of Revenue may conduct audits to ensure businesses are complying with sales tax laws. During an audit, businesses must provide detailed records and cooperate fully with the auditors. Proper record-keeping and compliance with tax regulations can help businesses navigate audits successfully.

Renewal and Updates

The Pa Sales Tax License is typically valid for a specific period, after which it needs to be renewed. The renewal process is similar to the initial application, with businesses updating their information and paying any applicable fees. It is important to stay informed about renewal deadlines to avoid any lapses in license validity.

Additionally, businesses should promptly notify the Department of Revenue of any changes to their business structure, ownership, or location. These updates ensure that the Department has accurate information for tax administration purposes.

Benefits and Considerations

Obtaining and managing a Pa Sales Tax License offers several benefits to businesses operating in Pennsylvania:

Compliance and Legal Protection

By obtaining a Sales Tax License and adhering to the state’s tax laws, businesses protect themselves from legal repercussions. Non-compliance with sales tax regulations can lead to penalties, interest charges, and even legal action. A valid license demonstrates a commitment to transparency and accountability, fostering trust with customers and stakeholders.

Enhanced Business Reputation

Businesses that actively manage their tax obligations and maintain compliance with state regulations are viewed favorably by customers, partners, and investors. A positive reputation for tax compliance can enhance a business’s credibility and attract potential business opportunities.

Access to Tax Incentives

The Pennsylvania Department of Revenue offers various tax incentives and programs to support businesses. By obtaining a Sales Tax License and demonstrating compliance, businesses may become eligible for tax credits, deductions, or other incentives that can reduce their tax liability.

Simplified Tax Administration

Managing sales tax obligations through a dedicated license streamlines the tax administration process. Businesses can focus on their core operations while ensuring accurate tax collection and reporting, avoiding potential complexities and errors associated with manual calculations and filing.

Future Implications and Updates

The landscape of sales tax regulations is dynamic, with frequent updates and changes. Businesses operating in Pennsylvania should stay informed about any amendments to tax laws, rates, or reporting requirements. The Pennsylvania Department of Revenue provides resources and updates through their official website, ensuring businesses have access to the latest information.

Additionally, businesses should consider the impact of e-commerce and online sales on their tax obligations. With the growing popularity of online shopping, the state may introduce specific regulations or guidelines for online retailers. Staying abreast of these developments is crucial for maintaining compliance and avoiding potential penalties.

Conclusion

Obtaining and managing a Pa Sales Tax License is a crucial aspect of doing business in Pennsylvania. By understanding the requirements, navigating the application process, and actively managing tax obligations, businesses can ensure compliance with state tax laws. This comprehensive guide has provided a detailed overview of the process, offering valuable insights for businesses looking to establish and maintain their tax compliance in Pennsylvania.

Frequently Asked Questions

How often do I need to renew my Pa Sales Tax License?

+

The Pa Sales Tax License typically needs to be renewed every three years. However, it is essential to stay updated with the Pennsylvania Department of Revenue’s guidelines, as renewal requirements may vary based on business activities and tax obligations.

Can I apply for a Pa Sales Tax License if my business is located outside Pennsylvania but sells products online to customers in the state?

+

Yes, if your business conducts transactions with customers in Pennsylvania, you are required to obtain a Pa Sales Tax License, regardless of your physical location. This includes online retailers and e-commerce platforms.

What happens if I fail to remit sales tax on time?

+

Late remittance of sales tax can result in penalties and interest charges. The Pennsylvania Department of Revenue may impose penalties based on the amount owed and the duration of the delay. It is crucial to stay on top of your tax obligations to avoid these penalties.

Are there any tax exemptions or reduced tax rates for specific industries or products in Pennsylvania?

+

Yes, Pennsylvania offers various tax exemptions and reduced tax rates for certain industries and products. These exemptions may apply to agricultural products, certain types of machinery, and specific services. It is advisable to consult the Department of Revenue’s guidelines or seek professional advice to determine if your business qualifies for any exemptions.

Can I apply for a Pa Sales Tax License if I’m a sole proprietor operating under my own name without a business entity?

+

Yes, sole proprietors operating under their own names are required to obtain a Pa Sales Tax License if they engage in taxable sales within the state. The application process is similar for sole proprietors, but they may need to provide additional documentation to verify their business activities.